Amyl Acetate Market Research, 2033

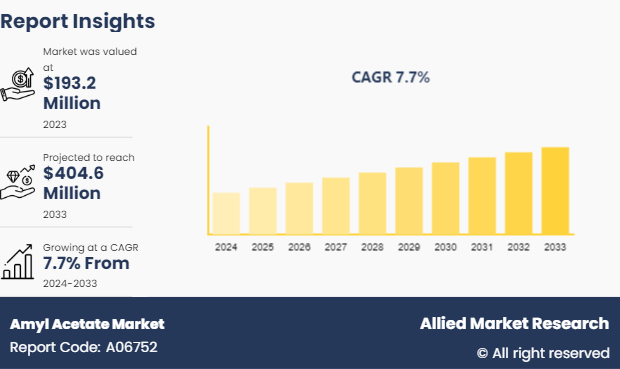

The global amyl acetate market was valued at $193.2 million in 2023, and is projected to reach $404.6 million by 2033, growing at a CAGR of 7.7% from 2024 to 2033.

Introduction

Amyl acetate, also known as pentyl acetate, is an ester with a chemical formula C₅H₁₁OCOCH₃. It exists in two primary forms isoamyl acetate, which imparts a strong banana-like fragrance, and n-amyl acetate, known for its milder fruity aroma.

These compounds find extensive use across several industries. In the food sector, isoamyl acetate serves as a flavor enhancer, contributing to the fruity taste of products like banana-flavored candies and beverages. Both isoamyl acetate and n-amyl acetate are crucial in the fragrance industry, where they add natural fruity notes to perfumes and personal care products. In addition, n-amyl acetate acts as a versatile solvent in industrial applications, including coatings, paints, and cleaning solutions, owing to its ability to dissolve various substances effectively. Moreover, these compounds play roles in chemical synthesis, serving as precursors for pharmaceuticals and other chemicals.

Key Takeaways

- The amyl acetate market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literature, industry releases, annual reports, and other documents of major valine industry participants, authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

Market Dynamics

The amyl acetate market is primarily driven by several key factors, including the increasing demand for natural flavors and fragrances. Consumers are increasingly seeking products with natural ingredients, leading to higher utilization of amyl acetate, known for its fruity aroma, in the food and beverage industry. This food and beverage industry growth further propels the market, as amyl acetate is a preferred flavoring agent in products like candies, beverages, and baked goods, enhancing their appeal and taste. In addition, the expanding cosmetics and personal care sector significantly contributes to market dynamics. Amyl acetate's pleasant scent makes it a valuable ingredient in perfumes, lotions, and other personal care products, catering to the rise in consumer preference for naturally scented items. These factors collectively drive the demand for amyl acetate, ensuring its sustained growth and application across various industries focused on natural and appealing products.

The amyl acetate market faces several restraints that hinder its growth potential. One significant challenge is the fluctuating prices of raw materials, which impact production costs and profitability for manufacturers. These price variations create an unpredictable economic environment, making it difficult for companies to plan and budget effectively. In addition, environmental and regulatory concerns pose substantial hurdles. Stringent regulations related to volatile organic compounds (VOCs) and emissions can lead to increased compliance costs and operational constraints. These regulations are essential for environmental protection but can limit market expansion. Furthermore, potential health hazards associated with improper handling of amyl acetate present safety risks. The compound's flammability and potential as an irritant necessitate strict safety protocols, adding to operational complexities and costs. These factors collectively restrain the market, challenging producers to navigate economic uncertainties, adhere to regulatory standards, and ensure safe handling practices to sustain market growth.

The amyl acetate market is poised for significant growth, driven by emerging opportunities in several key areas. One of the primary opportunities is the rise in preference for bio-based solvents. As industries shift towards more sustainable and environment-friendly practices, amyl acetate, derived from natural sources, is gaining traction as a green alternative to traditional, petroleum-based solvents. This trend is particularly evident in sectors such as coatings, adhesives, and cleaning products, where eco-friendly solutions are increasingly in demand. Additionally, the growing applications in emerging markets present a substantial opportunity for the amyl acetate market. Rapid industrialization and urbanization in regions like Asia-Pacific and Latin America are driving the demand for flavors, fragrances, and industrial solvents. These markets are expanding their production capacities and consumer bases, creating fertile ground for the adoption of amyl acetate in various applications. Together, these factors are set to propel the growth and diversification of the amyl acetate market during the forecast period.

Segment Overview

The amyl acetate market is segmented into type, application, and region. By type, the market is bifurcated into natural and synthetic. By application, the market is divided into paints and coatings, flavors and fragrances, cleaning, leather polishes, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

Key market players in the amyl acetate market include Eastman Chemical Company, Dow Chemical Company, BASF SE, Solvay, Sasol Limited, INEOS Group, OQ Chemicals GmbH, Merck KGaA, Celanese Corporation, and ShanDong Fine Chemical Co., Ltd.

Key Regulations

In the U.S., amyl acetate is regulated under several key federal statutes. The Toxic Substances Control Act (TSCA) mandates that amyl acetate be listed on the TSCA inventory, and its production and use are subject to strict reporting and record-keeping requirements. The Occupational Safety and Health Administration (OSHA) sets permissible exposure limits (PELs) for amyl acetate to ensure workplace safety. Additionally, the Environmental Protection Agency (EPA) regulates the emissions and disposal of amyl acetate under the Clean Air Act (CAA) and the Resource Conservation and Recovery Act (RCRA) , addressing both environmental and public health concerns.

In the European Union, amyl acetate is primarily regulated under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation, which requires manufacturers and importers to register the chemical with the European Chemicals Agency (ECHA) and comply with stringent safety data requirements. The Classification, Labelling and Packaging (CLP) Regulation ensures that amyl acetate is correctly classified, labeled, and packaged according to its hazards. Additionally, individual EU member states set specific Occupational Exposure Limits (OELs) to manage workplace exposure to amyl acetate, ensuring the safety of workers.

In the Asia-Pacific, China regulates amyl acetate under the Regulations on Safe Management of Hazardous Chemicals, which oversee the production, storage, use, and disposal of hazardous chemicals. The national standard GB/T 17519-2013 provides guidelines for the safety data sheet (SDS) for hazardous chemicals, including amyl acetate. Furthermore, China’s National Standards for Workplace Safety set occupational exposure limits and safety guidelines to protect workers handling amyl acetate, ensuring both environmental and human health safety.

In India, the Manufacture, Storage, and Import of Hazardous Chemical Rules (MSIHC Rules) govern the handling and storage of amyl acetate, including provisions for safety and emergency preparedness. The Bureau of Indian Standards (BIS) provides standards for the safe handling, labeling, and packaging of chemicals such as amyl acetate. The Factories Act imposes requirements for worker safety, including permissible exposure limits and safety measures in industrial settings, ensuring comprehensive regulatory oversight for the safe use of amyl acetate.

Japan regulates amyl acetate through the Chemical Substances Control Law (CSCL) , which oversees the production and import of chemicals to prevent environmental pollution. The Industrial Safety and Health Law (ISHL) sets exposure limits and mandates safety measures for handling amyl acetate in workplaces. Additionally, the Poisonous and Deleterious Substances Control Law requires proper labeling, storage, and handling of hazardous chemicals, ensuring that amyl acetate is managed safely throughout its lifecycle.

In LAMEA, the National Environment Council (CONAMA) regulations oversee the environmental impact of amyl acetate in Brazil, particularly concerning its use and disposal. Norma Regulamentadora (NR) 15 sets occupational exposure limits for hazardous chemicals in the workplace, ensuring the safety of workers. The Agência Nacional de Vigilância Sanitária (ANVISA) regulates the safety standards and labeling requirements for chemicals used in consumer products, ensuring that amyl acetate is managed safely and effectively within the country.

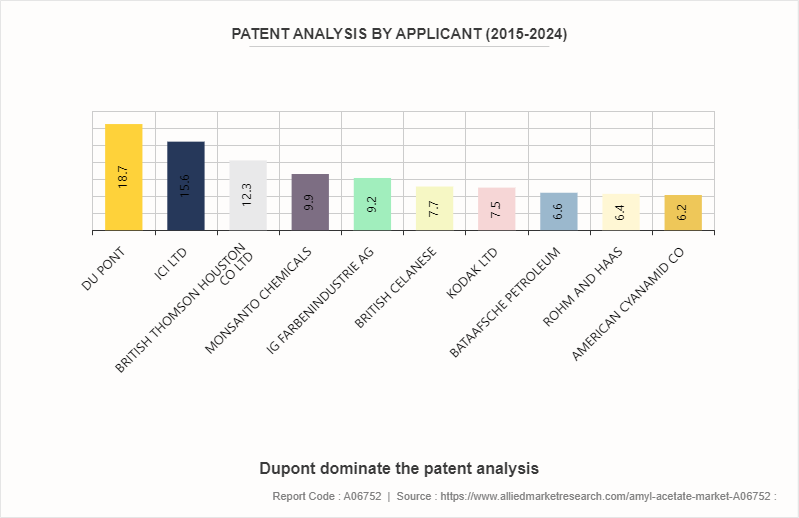

Between 2015 and 2024, the amyl acetate market witnessed significant patent activity, with Du Pont leading the field, accounting for 18.7% of patents (85 patents) . ICI Ltd followed with 15.6% (71 patents) , and British Thomson Houston Co Ltd held 12.3% (56 patents) . Other notable contributors included Monsanto Chemicals with 9.9% (45 patents) and IG Farbenindustrie AG with 9.2% (42 patents) . British Celanese, Kodak Ltd, Bataafsche Petroleum, Rohm and Haas, and American Cyanamid Co also played substantial roles, collectively contributing to 30.5% of the patents (155 patents) . This patent activity suggests robust research and development efforts within the amyl acetate market, indicating a focus on innovation in applications such as flavors, fragrances, and solvents. Future trends likely include the development of more sustainable and efficient production methods, expansion into new industrial applications, and enhanced formulations to meet environmental regulations and consumer preferences for eco-friendly products.

Industry Trends

- In the fragrance and perfume industry, there is a growing demand for natural and sustainable ingredients in fragrances. Amyl acetate, with its fruity and natural aroma, is increasingly sought after as consumers and manufacturers prioritize eco-friendly and organic formulations.

- In the food and beverage industry, there is an increasing trend towards natural flavors and ingredients in food products. Amyl acetate, particularly isoamyl acetate known for its banana-like flavor, is used to enhance the taste of natural fruit-flavored products without the need for artificial additives.

- In the paints and coatings industry with stricter regulations on volatile organic compounds (VOCs) , there is a shift towards using safer and more environmentally friendly solvents. Amyl acetate, as a solvent with low toxicity and good solvency power, is gaining popularity in water-based and eco-friendly paint formulations.

- In the pharmaceutical industry, there is ongoing research into novel drug delivery systems and formulations. Amyl acetate's role as a solvent and its compatibility with various active pharmaceutical ingredients (APIs) make it a promising candidate for developing new pharmaceutical formulations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the amyl acetate market analysis from 2024 to 2033 to identify the prevailing amyl acetate market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the amyl acetate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global amyl acetate market trends, key players, market segments, application areas, and market growth strategies.

Amyl Acetate Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 404.6 Million |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Eastman Chemical Company, Sasol Limited, Solvay, Merck KGaA, ShanDong Fine Chemical Co., Ltd., OQ Chemicals GmbH, INEOS Group, Celanese Corporation, Dow Inc., BASF SE |

| Other Key Market Players | BASF SE, Chemoxy International Ltd, Dow |

$193.4 million is the estimated industry size of Amyl Acetate in 2023.

Rising preference for bio-based solvents, innovations in flavor and fragrance formulations, growing applications in emerging markets are the upcoming trends of Amyl Acetate Market in the globe.

Flavors and Fragrances is the leading application of Amyl Acetate Market.

North America is the largest regional market for Amyl Acetate.

Eastman Chemical Company, Dow Chemical Company, BASF SE, Solvay, Sasol Limited are the top companies to hold the market share in Amyl Acetate

Loading Table Of Content...