Anesthesia Video Laryngoscope Market Research, 2033

The global anesthesia video laryngoscope market size was valued at $0.4 billion in 2023, and is projected to reach $1.0 billion by 2033, growing at a CAGR of 9.4% from 2024 to 2033. One of the primary drivers of the Anesthesia Video Laryngoscope market growth is the increasing demand for advanced medical devices that enhance patient safety and improve clinical outcomes. Traditional laryngoscopy techniques often result in complications such as esophageal intubation or dental trauma due to limited visibility.

Market Introduction and Definition

An anesthesia video laryngoscope is an advanced medical device used to facilitate endotracheal intubation by providing a clear, magnified view of the larynx and vocal cords. It combines traditional laryngoscopy with a video camera and display screen, allowing anesthesiologists to visualize the airway more effectively. This enhanced visualization improves the accuracy and success rate of intubation, particularly in patients with difficult airways. Video laryngoscopes are essential in operating rooms, emergency departments, and intensive care units, contributing to safer and more efficient airway management by reducing complications associated with blind or difficult intubations.

Key Takeaways

- The anesthesia video laryngoscope market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected 2024-2033 anesthesia video laryngoscope market forecast period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major anesthesia video laryngoscope industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The Video laryngoscopes provide a clear view of the glottis and surrounding structures, facilitating more accurate and safer intubation. This improved visualization significantly reduces the risk of complications, making video laryngoscopes a preferred choice among anesthesiologists. Additionally, the rising number of surgical procedures globally due to an aging population and the prevalence of chronic diseases further fuels the demand for these advanced devices, as they enhance the efficiency and safety of airway management during surgeries.

However, despite the clear advantages, the high cost of video laryngoscopes poses a significant restraint to market growth. Advanced video laryngoscopes with sophisticated imaging and recording capabilities are considerably more expensive than traditional laryngoscopes. This price difference can be a major barrier for smaller healthcare facilities and developing regions with limited budgets for medical equipment. Furthermore, the cost of training healthcare professionals to effectively use these advanced devices adds to the overall expenditure. The financial burden associated with purchasing and maintaining video laryngoscopes can limit their widespread adoption, particularly in resource-constrained settings, thereby hindering market expansion.

Furthermore, a significant opportunity in the anesthesia video laryngoscope market lies in the technological advancements and the integration of artificial intelligence (AI) and machine learning (ML) algorithms. Innovations such as real-time image enhancement, automated detection of anatomical landmarks, and AI-guided intubation can further improve the accuracy and efficiency of video laryngoscopes. These technological enhancements can make the devices even more user-friendly and reduce the learning curve for medical practitioners. Additionally, the growing emphasis on telemedicine and remote healthcare services provides an avenue for video laryngoscopes to be used in tele-intubation procedures, allowing specialists to guide less experienced practitioners in remote or emergency settings. As healthcare providers continue to seek ways to enhance patient care and operational efficiency, the integration of cutting-edge technology in video laryngoscopes presents a promising opportunity for market growth.

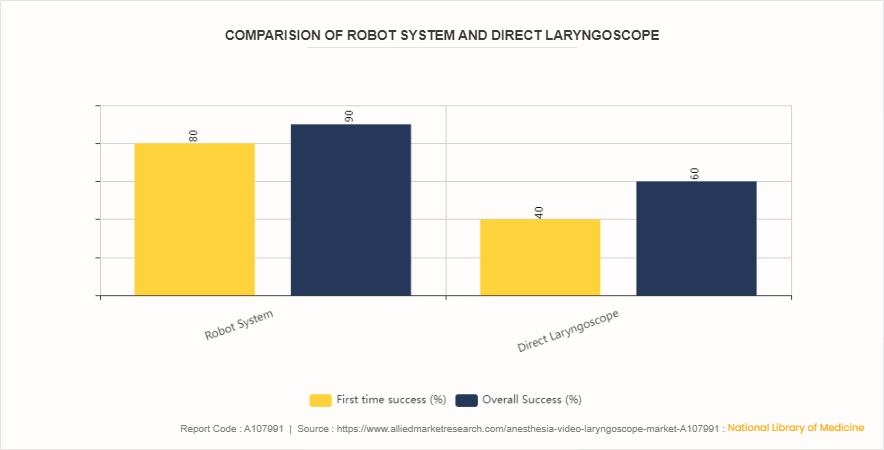

Comparison of Robot System and Direct Laryngoscope for Anesthesia Video Laryngoscope Market

According to an article published in National Library of Medicine, July 2023. The data shows a significant difference in the success rates between robot systems and direct laryngoscopes used in anesthesia procedures. For first-time success, the robot system achieves an 80% success rate compared to 40% for the direct laryngoscope. Overall success rates also favor the robot system, with a 90% success rate compared to 60% for the direct laryngoscope.

This indicates that robot systems offer higher efficiency and reliability in securing airways during anesthesia, contributing to their growing preference in medical practices. The advanced technology and precision of robot systems likely contribute to these higher success rates, making them a valuable tool in anesthesia and surgical settings.

Market Segmentation

The anesthesia video laryngoscope industry is segmented into type, usability, end user and region. On the basis of type, the market is categorized into rigid and flexible. On the basis of usability, the market is segmented into reusable and disposable. On the basis of end user, the market is segmented into hospitals, clinics, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The anesthesia video laryngoscope market share is experiencing significant growth across various regions. North America holds the largest market share due to advanced healthcare infrastructure, high adoption rates of new technologies, and substantial healthcare expenditure. Europe follows closely, driven by increasing surgical procedures and growing awareness of advanced intubation techniques. The Asia-Pacific region is expected to witness the highest growth rate, attributed to the rising healthcare investments, improving medical facilities, and increasing prevalence of chronic diseases necessitating surgical interventions.

- In November 2021, Ambu was awarded with a contract in the category of Video Laryngoscopes with Vizient Inc., the largest healthcare performance improvement company in the U.S. representing more than half of the hospitals and health systems in the U.S and serving 97 percent of the nation’s academic medical centers

Industry Trends

- In April 2022, OMNIVISION, a leading global developer of semiconductor solutions, including advanced digital imaging, analog and touch and display technology, launched new laryngoscope reference designs that include a range of OMNIVISION products that help improve patient care by providing crisp, clear images for single-use video laryngoscopes.

- In January 2023, Timesco Healthcare Ltd, a medical equipment manufacturer, announced the launch of their ground-breaking new video laryngoscope to support intubation in patients with difficult airways at Arab Health 2023

Competitive Landscape

The major players operating in the anesthesia video laryngoscope market size include Advin Health Care, Vyaire Medical, Inc, Prodol Meditec, Infinium Medical, Inc., Medtronic, SourceMark, LLC, VDO Medical (Shanghai) Co., Ltd (VDO) , Intersurgical Ltd, Olympus Corporation, Roper Technologies, Inc.

Other players in the Anesthesia Video Laryngoscope market include Karl Storz Se & Co. KG, Shenzhen HugeMed Medical Technology Development Co., Ltd, Nihon Kohden Corporation, and so on.

Recent Key Strategies and Developments

- In May 2021, Olympus Corporation announced the FDA 510 (k) clearance of its airway mobile scopes, the MAF-TM2, MAF-GM2, and MAF-DM2, enabling providers to perform a variety of upper and lower airway management procedures. anesthesiologists, pulmonologists and critical care and intensive care providers will appreciate the anytime/anywhere advantages, the digital capture capability, and the compact design of the MAF versions.

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- National Health Mission (NHM)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- Mental Health Foundation

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anesthesia video laryngoscope market analysis from 2024 to 2033 to identify the prevailing anesthesia video laryngoscope market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anesthesia video laryngoscope industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global anesthesia video laryngoscope market trends, key players, market segments, application areas, and market growth strategies.

Anesthesia Video Laryngoscope Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.0 Billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Type |

|

| By Usability |

|

| By End User |

|

| By Region |

|

| Key Market Players | Prodol Meditec, Intersurgical Ltd., VDO Medical (Shanghai) Co., Ltd (VDO), Infinium Medical, Inc., Roper Technologies, Inc., Advin Health Care, SourceMark, LLC, Olympus Corporation, Vyaire Medical, Inc, Medtronic Plc |

The total market value of anesthesia video laryngoscope market is $0.4 billion in 2023.

The forecast period for anesthesia video laryngoscope market is 2024 to 2033

The market value of anesthesia video laryngoscope marketin 2033 is $1.0 billion

The base year is 2023 in anesthesia video laryngoscope market.

Top companies such as Advin Health Care, Vyaire Medical, Inc, Prodol Meditec, Infinium Medical, Inc., held a high market position in 2023. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LAMEA.

The Rigid anesthesia video laryngoscopessegment is the most influencing segment in anesthesia video laryngoscope market

Loading Table Of Content...