Animal Milk Replacer Market Research, 2035

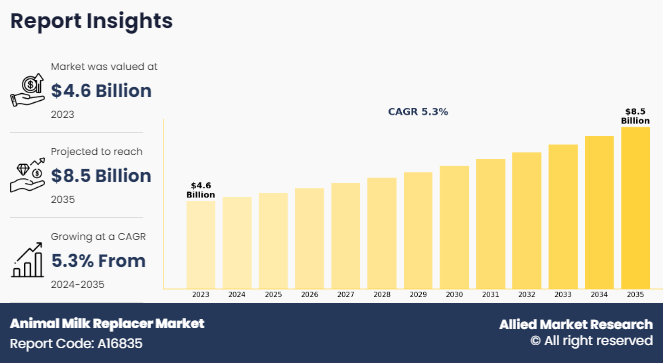

The global animal milk replacer market size was valued at $4.6 billion in 2023, and is projected to reach $8.5 billion by 2035, growing at a CAGR of 5.3% from 2024 to 2035. The global animal milk replacer market growth is driven by factors such as rise in demand for specialty milk products, increase in adoption of precision nutrition techniques in livestock farming, and surge in focus on animal welfare & health. Moreover, technological advancements in milk replacers and expansion of dairy industries in emerging economies further contribute to market expansion.

Animal milk replacers are utilized by animal owners to provide younger ones with necessary nutrition when mother's milk is unavailable. It provides liquid nutrition with nutritional properties comparable to mother's milk and is provided to young domestic animals and pets such as calf, puppies, kitten, and others. Milk replacers are created from a range of ingredients including skim milk powder, vegetable or animal fat, butter milk powder, whey protein, soy lecithin and vitamin-mineral premix that approximate the qualities and nutritional benefits of animal milk.

Key Takeaways

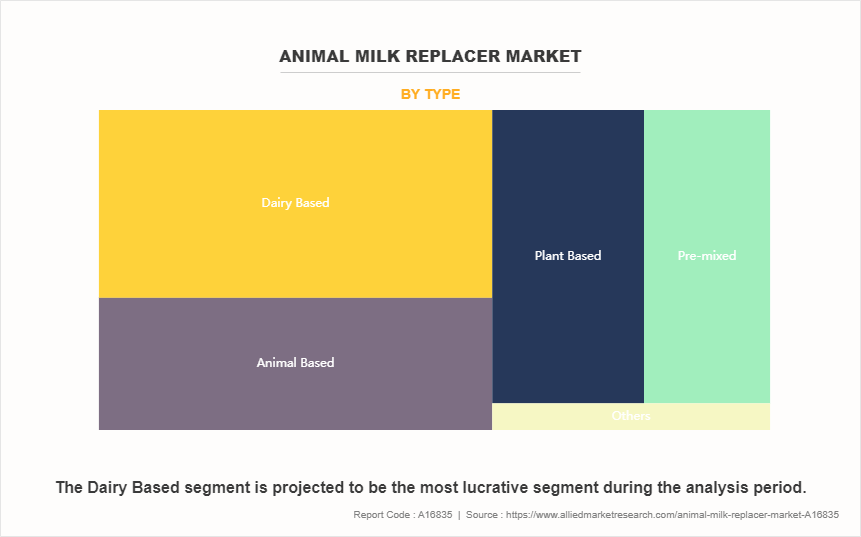

By type, the dairy based segment was the highest revenue contributor to the market in 2023.

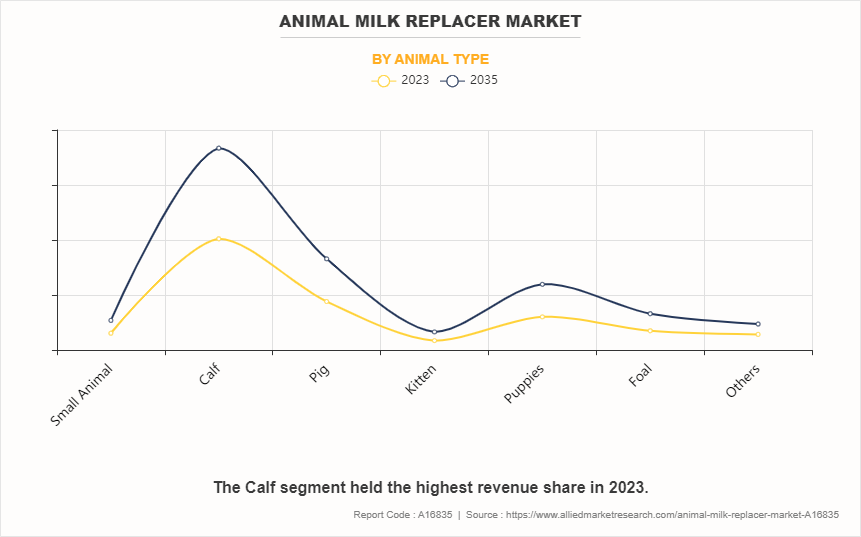

By animal type, the calf segment was the largest segment in the global animal milk replacer market during the forecast period.

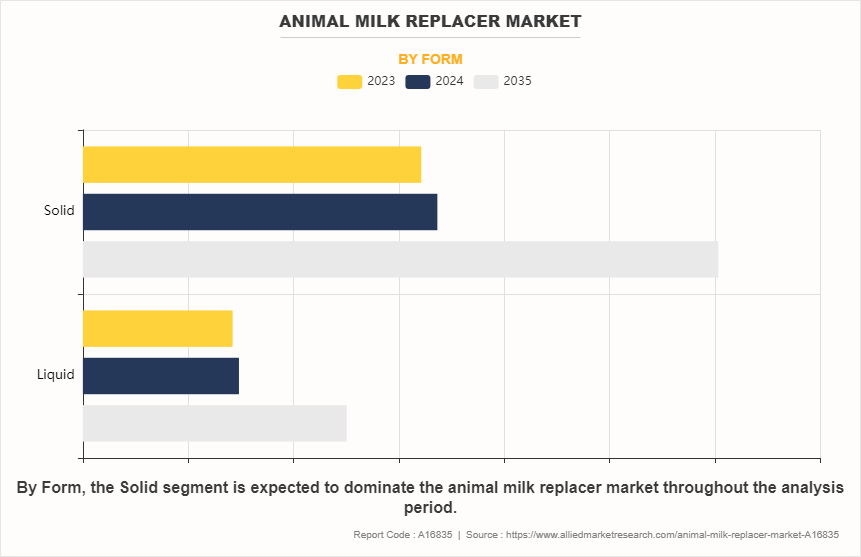

By form, the solid segment dominated the global animal milk replacer market in 2023.

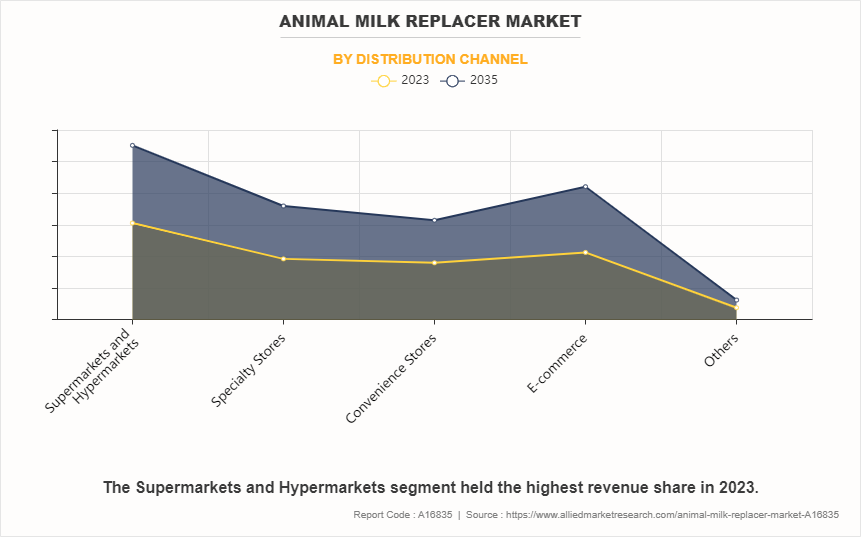

Depending on distribution channel, the supermarkets/hypermarkets segment was the largest segment in 2023.

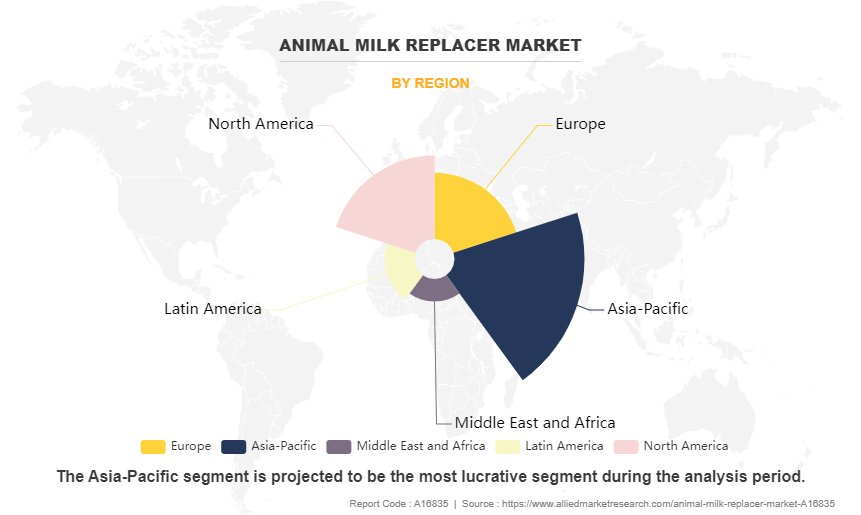

Region-wise, Europe was the highest revenue contributor in 2023.

Market Dynamics

The animal milk replacer industry has experienced rapid growth, as the milk producers have started replacing the traditional animal feed with nutritionally balanced compound feed in terms of milk and other food, as they have realized the tangible benefits of nutritional feed for yield improvement. Livestock production, especially in Asia-Pacific, has been growing faster than any other agricultural sub-sector, owing to substantial growth of pig, livestock, and poultry industries, as the livestock industry is the most crucial part of agricultural development. Livestock products contribute around 40% of the total agricultural output in global sales.

Furthermore, there has been an increase in the consumption of animal products owing to population growth and increased living standards of people. Moreover, the rise in concerns among people over their baby animals has encouraged them to buy animal milk replacers. Thus, an increase in awareness among customers is expected to boost the animal milk replacer market growth during the forecast period.

In addition, the use of milk replacers minimizes the possibility of disease transmission from parent animal to newborn, which is anticipated to boost the animal milk replacer market demand in the coming years. The transition from pet ownership to parenting has been a critical and defining development in the pet care business, particularly in industrialized nations. A pet is owned by one-third of all households in industrialized countries. Pet owners traditionally gave leftovers and scraps from family dinners to their pets. However, pet owners have now become more aware about pet food and supplements that are designed to promote the health of these animals. Furthermore, there has been a surge in pet adoption owing to several advantages linked with them, such as increased possibilities for exercise and decrease in stress. According to research conducted by the American Veterinary Medical Foundation (AVMF), 9 out of 10 Americans who own pets consider them to be members of their family.

Even though the market has expanded rapidly, there are certain factors that hinder the animal milk replacer market share expansion. Rise in regulatory constraints in pet food and animal feed industry has impacted the animal milk replacer market and pet supplement industry negatively in recent years. For instance, in the U.S., pet food is highly regulated by the U.S. FDA to meet both federal and state requirements. The U.S. FDA imposed laws on both finished pet supplements and their application. An ingredient cannot be used in pet food supplement until it has been accepted by the FDA and Association of American Feed Officials (AAFCO). These organizations develop model bills and legislation for pet supplements, which include functional animal milk replacers (solid and liquid).

The Food Safety Modernization Act of 2010 (FSMA) introduced guidelines related to certification, sterilization, hygiene, and labeling of application for pet supplement manufacturers in the U.S. Furthermore, owing to lack of a universal regulatory structure, global trading has become difficult. Huge investments are made in manufacturing feed additives and different regulations lead to severe losses for animal milk replacer manufacturers. Therefore, it becomes expensive to frequently update technologies and facilities in accordance with changing guidelines. Thus, the aforementioned factors are expected to hamper the market during the animal milk replacer market forecast period.

Moreover, the concept of pet ownership has experienced a boom in developing nations such as India, Bangladesh, and Iran, which has created numerous growth opportunities in the animal milk replacer market. With rapid increase in personal disposable income, people in such nations are able to own pets such as puppies, kittens, and small animals. They prefer to provide quality food and nutrition for their pets. In addition, the Southeast Asia pet food market is growing tremendously, owing to increase in pet population. In addition, The Times of India published a press release in December 2021 that there are immense possibilities of increasing calf population using IVF (in vitro fertilization) technology over the coming years.

Thus, the manufacturers of calf milk replacers are intensively focusing on new innovations in the developing market, which in turn is expected to create a huge opportunity in the animal milk replacer market.

Segmental Overview

The animal milk replacer market is segmented on the basis of type, animal type, form, distribution channel, and region. On the basis of type, the market is categorized into dairy based, plant based, animal based, pre-mixed, and others. On the basis of animal type, it is segregated into small animals, calf, pig, kitten, puppies, foal, and others. On the basis of form, it is bifurcated into liquid and solid. On the basis of distribution channel, it is divided into supermarkets & hypermarkets, specialty stores, convenience stores, e-commerce, and others. On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, the UK, Russia, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Malaysia, Indonesia, and rest of Asia-Pacific), Latin America (Brazil, Argentina, Colombia, and rest of Latin America), and Middle East and Africa (GCC, South Africa, and Rest of MEA).

By Type

By type, the dairy based segment dominated the global animal milk replacer market in 2023 and is anticipated to maintain its dominance during the forecast period. Dairy-based animal milk replacers are in high demand due to their nutritional similarity to natural milk, providing essential nutrients like protein, calcium, and vitamins crucial for growth and development, particularly in young animals. This segment offers a convenient alternative for farmers facing challenges such as milk shortages, high costs, or health concerns in livestock. In addition, dairy-based replacers often match with the taste and texture of real milk, making them more palatable for animals and easier to incorporate into their diets. With rise in need for sustainable and efficient animal husbandry practices, dairy-based replacers serve as a vital component in supporting livestock rearing while meeting nutritional requirements effectively.

By Animal Type

By animal type, the calf segment dominated the global animal milk replacer market in 2023 and is anticipated to maintain its dominance during the forecast period. Breeding calf is considered as a part of modern rural lifestyle. The major reason for the growth of this segment is associated with the requirement of high nutritional quality milk and meat with favorable price. Thus, the buyers have become attentive regarding their calf health and diet. The manufacturers of cattle feed and domestic animals feed focus on new product launches that cater to the demand for animal nutritional products in the market. Animal milk replacers have gained huge popularity as such replacers are low in cost when compared with the original mother milk with moreover same nutritional properties.

By Form

By form, the solid segment dominated the global animal milk replacer market in 2023 and is anticipated to maintain its dominance during the forecast period. Solid milk replacers are easy to store and have a longer shelf life. The buyers who do not get time for shopping for pet care or animal food products purchase solid milk replacers for their pet and domestic animals in bulk quantity. Solid and powdered animal milk replacers formula lasts longer since the unused powder can be frozen for six months. The solid milk replacer holds a major share in the market, owing to which the manufacturers are intensively focusing on innovative consumer packs and small packs of solid milk replacer in the market.

By Distribution Channel

By distribution channel, the supermarkets & hypermarkets segment dominated the global animal milk replacer market in 2023 and is anticipated to maintain its dominance during the forecast period. Supermarket/hypermarket has gained high popularity owing to the availability of a broad range of consumer goods such as pet food and animal feed under a single roof. The animal feed business includes several types of products to offer, and supermarket/hypermarket meets buyers‐™ expectation by availing these different products under exclusive sections in the store. Moreover, rapid urbanization, rise in working class population, and competitive pricing boost the popularity of supermarkets in developed and developing regions.

Furthermore, these stores offer a variety of brands in a product category, including solid milk replacer, functional cat milk replacer, and fortified calf milk replacer, thus offering more buying options for customers. Furthermore, the presence of store associates for helping buyers to choose the right animal milk replacer and provide product knowledge further attract customers in the market to purchase the required milk replacer products.

By Region

Region-wise, Asia-Pacific is anticipated to dominate the market with the largest share during the forecast period. The livestock sector is one of the major areas for agricultural economy and regional farming throughout Asia-Pacific. The animal feed industry and functional pet food industry have been booming in the region for the past couple of years. This is majorly attributed to rise in adoption of cross breed pets & domestic animals such as calf, pig, & unusual or wild animals and growth in awareness regarding health issues in animals.

Increase in popularity and adoption rate of unusual or wild animals as pets are expected to increase the demand for animal milk replacer in Asia-Pacific region, which in turn make way for a huge opportunity for feed manufacturers by offering innovative milk replacers in the market. Unusual or wild animals include flying squirrels, hedgehog, fennec fox, skunk, savannah cat, tiger, wallabies, and genets. France, the UK, Germany, and Italy have witnessed highest pet and domestic animals‐™ ownership; thus, the region holds significant demand for animal milk replacers. Furthermore, rise in trend of pet animal humanization is expected to boost the regional industry size by 2025.

Competitive Analysis

The key players profiled in this report include Alltech, Beaphar, Cargill, Inc., FrieslandCampina N.V., Koninklijke DSM N.V., Liprovit B.V., Manna Pro Products, LLC, and Nutreco. The players operating in the global animal milk replacer market have adopted various developmental strategies to expand their milk replacer market share, increase profitability, and remain competitive in the market. For instance, in September 2021, Manna pro products acquired Dinovite. Dinovite is an online seller of natural pet products.

Recent Developments in Animal Milk Replacer industry

In October 2021, BASF and Cargill expanded their partnership in the animal nutrition business, which resulted in increased R&D capabilities and expansion into new markets beyond the partners' existing feed enzymes distribution agreements.

In April 2021, Manna pro products acquired ZuPreem. Manna Pro is a manufacturer and distributor of food for companion birds, small animal pets and animals in zoos.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the animal milk replacer market analysis from 2023 to 2035 to identify the prevailing animal milk replacer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the animal milk replacer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global animal milk replacer market trends, key players, market segments, application areas, and market growth strategies.

Animal Milk Replacer Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 289 |

| By Type |

|

| By Animal Type |

|

| By Form |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Nutreco, Cargill, Incorporated, Hubbard Feeds Inc., Beaphar, Glanbia PLC, Liprovit B.V., Koninklijke DSM N.V., Royal FrieslandCampina N.V., Alltech, MANNA PRO PRODUCTS, LLC |

Analyst Review

According to the insights of CXOs of leading companies, the global animal milk replacer market is expected to offer remunerative business opportunities in developing economies such as India and China. This is attributed to the increase in adoption of animals for farming and as pets at home. Awareness regarding various pet care and nutritional products such as functional food, supplements, medicines, and nutraceuticals, has increased among people worldwide.

Thus, sales and distribution of animal milk replacers are expected to grow during the forecast period. Internet sales have been presenting continuous growth over the years. The availability of info-centric health products, such as nutritional food and drinks for animals, as per consumers’ demand has gained even more popularity than before, owing to rapid increase in pet humanization.

CXOs have highlighted that Asia-Pacific is one of the most important and high potential regions for the animal milk replacer industry. The functional pet food market associated with animal milk replacer market in Asia-Pacific is largely driven by rapid urbanization and connectivity programs and the trend is anticipated to grow over the coming years.

The global animal milk replacer market was valued at $4,632.8 million in 2023, and is projected to reach $8,535.3 million by 2035, registering a CAGR of 5.3% from 2024 to 2035.

The base year calculated in the animal milk replacer market report is 2023.

The forecast period in the animal milk replacer market report is 2024 to 2035.

The dairy based animal milk replacer segment is the most influential segment in the animal milk replacer market report.

The top companies analyzed for the global animal milk replacer market report are Alltech, Beaphar, Cargill, Inc., FrieslandCampina N.V., Glanbia Plc, Hubbard Feeds Inc., Lactalis, Koninklijke DSM N.V., Liprovit B.V., Manna Pro Products, LLC, and Nutreco.

The company profile has been selected on the basis of revenue, product offerings, and market penetration.

Asia-Pacific holds the maximum market share of the animal milk replacer market.

The market value of the animal milk replacer market in 2023 was $4,632.8 million.

Loading Table Of Content...

Loading Research Methodology...