Annuity Insurance Market Research, 2032

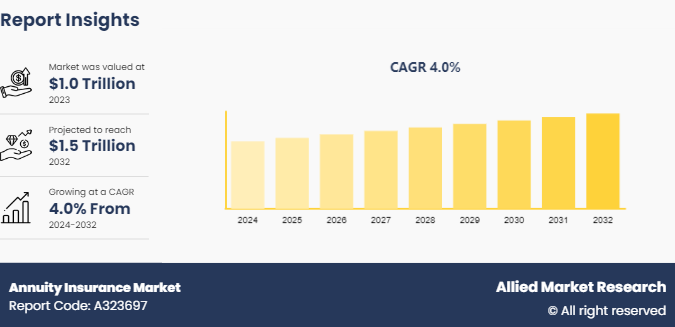

The annuity insurance market was valued at $1.0 trillion in 2023 and is estimated to reach $1.5 trillion by 2032, exhibiting a CAGR of 4.0% from 2024 to 2032.

Market Introduction and Definition

An annuity is a long-term insurance contract between an individual and a life insurer that provides the buyer with a regular series of payments in return for a lump-sum payment. Annuities serve the purpose of delivering a regular stream of income when an individual is either faced with unemployment or has retired. It is well-suited for individuals who require a steady, guaranteed retirement income and are willing to trade a large lump sum into a regular cash flow.

Furthermore, annuity insurance usually plays a pivotal role in retirement planning and income security, particularly in retirement income, pension supplement, tax-deferred growth, estate planning, and asset protection. These benefits contribute to the continued existence and significance of the annuity insurance market in offering financial security for retirees and individuals planning for their future.

Key Takeaways

- The annuity insurance market outlook covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2023-2032.

- More than 1, 500 product literature, industry releases, annual reports, and other such documents of major annuity insurance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Industry Trends

- In January 2024, the Life Insurance Corporation of India (LIC) unveiled Jeevan Dhara II, a new annuity plan. This non-participating, non-linked, individual savings, deferred annuity scheme is proposed by LIC to ensure a guaranteed and secure financial future for individuals. As per the scheme document provided by LIC, policyholders have the option to improve their annuity by making additional premium payments during the deferment period.

- In March 2024, Reinsurance Group of America, Incorporated, a leading global life and health reinsurer, announced an agreement with Japan Post Insurance Company (Kampo) for an RGA affiliate to reinsure a nearly 700 billion JPY in-force block of individual life annuities through coinsurance. The transaction is considered a landmark transaction in the longevity space with one of Japan’s leading providers of life annuities.

- In December 2023, the Brazilian Patent Office set new rules regarding the payment and settlement of annuities to allow applicants and patent owners to advance annuity payments. Besides, the official annuity system is now likely to take advantage of any annuity payment for automatically settling any annuity yet to be paid.

Key Market Dynamics

The global annuity insurance market is growing due to several factors such as retirement planning challenges, regulatory support and incentives, volatility in financial markets, and increased annuity insurance market awareness and education about income strategies. However, the high cost of annuities, longevity risk management, and liquidity constraints restrain the development of the market. In addition, the surge in a trend toward financial wellness programs and ongoing strategies for innovative investments in developing countries will provide ample opportunities for the market's development during the forecast period.

Annuity insurance persists in low-interest-rate environments prompting investors to seek alternative sources of income with higher yields. Annuities, particularly fixed and indexed annuities, provide competitive interest rates tied to market indexes, making them engaging to investors searching for higher returns in a low-yield environment. Thus, annuities have become increasingly important to increase their appeal among risk-averse investors seeking safety and principal protection. In addition, favorable regulatory environments and initiatives promoting retirement savings drive growth in the annuity insurance market size. Regulatory reforms that encourage retirement planning, offer tax incentives for annuity contributions, or promote consumer protections stimulate demand for annuity products.

PESTLE Overview

Although the growth of the annuity insurance market has been more rapid in recent years, the industry is influenced by a range of political, socioeconomic, and legal factors. Government regulations, including insurance laws and financial regulations, positively shape the annuity insurance market. Also, the rapid changes to governmental social security programs may supplement the retirement income among individuals, creating a positive outlook for the annuity insurance sector. The growing pool of individuals requiring retirement income solutions and the surge in trends toward retirement savings may expand the demand potential for annuities among the wider consumer base in annuity insurance market portfolio. However, monetary policies, central bank actions, and prevailing interest rates may affect annuity pricing and investment returns, causing a reasonable reduction in insurer profitability and impacting annuity product competitiveness. Further, legal requirements governing annuity contracts, including contract terms, disclosures, and beneficiary designations, impact product design and sales practices, which lead to a considerable challenge to the growth of the annuity insurance market. On the contrary, Fintech innovation and digitalization trends may propel the technological landscape of the annuity insurance industry across a wider geographical scale in annuity insurance market sector.

Market Segmentation

The annuity insurance market is segmented into type, application, distribution channel, and region. On the basis of type, the market is divided into fixed annuity insurance, variable annuity insurance, indexed annuity insurance, and others. As per the application, the market is bifurcated into financial, manufacturing, industrial, travel & hospitality, and others. On the basis of distribution channel, the market is categorized into insurance agencies & brokers, banks, and others annuity insurance market providers. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The U.S. has been one of the leading countries in the annuity insurance market, primarily due to its well-developed financial industry and retirement planning culture. The robust retirement planning culture in the U.S. promotes entities to invest in annuities as a means of securing a steady income stream during retirement. Additionally, the regulatory environment and tax incentives for retirement savings in the U.S. further support the growth of the annuity insurance market. For instance, in February 2020, the National Association of Insurance Commissioners (NAIC) adopted revisions to Model #275 in the U.S., requiring agents and insurers to act in customers' best interests while making recommendations for annuity sales. The revisions often require agents and carriers to act with reasonable diligence, care, & skill and put the consumer's interest ahead of their own. The revisions also include improvements to the model's supervision system to help with compliance.

- In February 2024, WTW, a leading advisory, broking, and solutions firm across the globe, in collaboration with RBC Insurance, Sun Life and Desjardins Group, proclaimed a group annuity buy-out transaction of CA$923 million for more than 2, 700 members of the Ford of Canada Retirement Pension Plan Number 3 who retired on or prior to June 1, 2021. This transaction is part of a raising trend in the private sector, where plan benefactors may protect pension benefits for plan members and mitigate the risk for the companies.

- In April 2024, the Insurance Regulatory and Development Authority of India (IRDAI) introduced a new rule allowing insurance companies to provide variable annuity plans with a minimum guaranteed annuity amount. This option is accessible under both individual and group defined annuity products, depending on publicly available benchmarks.

Competitive Landscape

The major players operating in the annuity insurance market growth include Allianz, Assicurazioni Generali S.p.A., Equitable Holdings, Inc., Lincoln Financial Group, MetLife Services and Solutions, LLC, Munich Re, Nationwide Mutual Insurance Company, New York Life Insurance Company, Pacific Life Insurance Company, and Zurich. Other players in the annuity insurance market include American International Group, Inc., Jackson National Life Insurance Company, MassMutual, Prudential Financial, Inc., and so on.

Recent Key Strategies and Developments

- In March 2024, Allianz Life Insurance Company of North America (Allianz Life) unveiled its latest accumulation-focused product, Allianz Accumulation Advantage+ Annuity. Allianz Accumulation Advantage+ is a fixed index annuity (FIA) that integrates robust accumulation potential with a premium bonus, signature Allianz innovations, and flexible design. Allianz has also recently added a new FIA with a shorter, seven-year withdrawal charge period, Allianz Accumulation Advantage 7 Annuity, to its current suite of products. The latest addition of FIAs delivers protection of principal and growth potential to facilitate individuals' move toward their ideal retirement plans.

- In July 2023, Nationwide launched Nationwide Defender Annuity, a new registered index-linked annuity (RILA) that provides tailored growth potential and investment protection to fit the needs of investors in today’s volatile market. Along with delivering growth potential, Nationwide Defender offers buffer protection counter to a certain percentage of market losses, making it easier for investors to secure their investments in volatile markets. This new product also aligns with Nationwide’s mission to protect individuals, businesses, and futures with extraordinary care.

Report Coverage & Deliverables

The annuity insurance market report offers an in-depth analysis of industry trends, regulatory frameworks, and key drivers influencing market growth. It covers various insurance types, policy structures, and distribution channels. The deliverables include quantitative data on market size, growth forecasts, and a comprehensive competitive analysis. The report also covers the impact of demographic changes, interest rate fluctuations, and consumer behavior on the annuity insurance market.

Insurance Type Insights

Annuity insurance typically falls into the following categories:

Fixed Annuities: These insurance offers a guaranteed payout over a specified period, providing stability in income post-retirement.

Variable Annuities: Payments fluctuate based on the performance of underlying investments, making them more flexible but riskier.

Indexed Annuities: A hybrid, where payments are linked to a specific index, like the S&P 500, offering both growth potential and security.

Immediate Annuities: Start payouts immediately after a lump sum payment is made, often used for immediate income needs. These types cater to varying risk appetites and retirement planning needs, driving growth in the market as financial security becomes a priority for aging populations.

Coverage Insights

The annuity insurance market share is expanding as more individuals seek long-term financial planning solutions. The demand for retirement income security has significantly increased due to growing life expectancies and the declining reliability of traditional pension systems. Fixed annuities dominate the market share, particularly among risk-averse investors, while variable and indexed annuities are gaining popularity as interest rates fluctuate. The market is also influenced by regulatory changes and tax incentives, which vary by region.

End User Insights

The annuity insurance market growth is driven by:

Retirees and Pre-retirees: A key demographic, as individuals seek guaranteed income streams to supplement retirement funds.

High-Net-Worth Individuals: Often opt for variable and indexed annuities for wealth management and tax planning. The market is growing as individuals prioritize secure retirement plans amidst economic uncertainties. Shifts in government policies, promoting private retirement savings, are encouraging more individuals to invest in annuity products.

Regional Insights

North America holds the largest market share due to its aging population, strong financial markets, and well-established insurance industry. The U.S. is a key player, with tax benefits and retirement-focused products driving demand.

Asia-Pacific is experiencing rapid growth, driven by rising disposable incomes, increasing financial literacy, and government initiatives promoting retirement savings.

Key Companies & Market Share Insights

Major companies dominating the annuity insurance market include Allianz SE, AXA, and MetLife are key players globally, offering a wide range of annuity products. These companies drive annuity insurance market value by offering customized annuity solutions, innovative product features, and robust financial advisory services, helping them maintain or expand their market positions.

Key Sources Referred

- National Association for Fixed Annuities (NAFA)

- Insured Retirement Institute (IRI)

- American Academy of Actuaries (AAA)

- American Council of Life Insurers (ACLI)

- National Association of Insurance Commissioners (NAIC)

- Teachers Insurance and Annuity Association of America (TIAA)

- National Organization of Life and Health Insurance Guaranty Associations (NOLHGA)

- World Economic Forum (WEF)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the annuity insurance market share, segments, current trends, estimations, and dynamics of the annuity insurance market analysis from 2023 to 2032 to identify the prevailing annuity insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the annuity insurance market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global annuity insurance market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global annuity insurance market trends, key players, market segments, application areas, and market growth strategies.

Annuity Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.5 Trillion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | MassMutual, Assicurazioni Generali S.p.A., American International Group, Inc., Nationwide Mutual Insurance Company, New York Life Insurance Company, MetLife Services and Solutions, LLC., Jackson National Life Insurance Company, Allianz, Equitable Holdings, Inc., Prudential Financial, Inc., Pacific Life Insurance Company, Zurich, Lincoln Financial Group, Munich Re |

The annuity insurance market was valued at $1,041.62 billion in 2023 and is estimated to reach $1,480.27 billion by 2032, exhibiting a CAGR of 4.2% from 2023 to 2032.

The global annuity insurance market is growing due to several factors such as retirement planning challenges, regulatory support and incentives, volatility in financial markets, and increased awareness and education about income strategies.

Based on distribution channel, insurance agencies & brokers is expected to register highest share in the global annuity insurance market.

Region-wise, North America is expected to dominate the annuity insurance market during the forecast period.

The major players operating in the annuity insurance market include Allianz, Assicurazioni Generali S.p.A., Equitable Holdings, Inc., Lincoln Financial Group, MetLife Services and Solutions, LLC, Munich Re, Nationwide Mutual Insurance Company, New York Life Insurance Company, Pacific Life Insurance Company, and Zurich.

Loading Table Of Content...