Anti-Block Additives Market Research, 2033

The global anti-block additives market was valued at $1.9 billion in 2023, and is projected to reach $3.1 billion by 2033, growing at a CAGR of 5% from 2024 to 2033.

Market Introduction and Definition

Anti-block additives are substances added to polymers, such as plastics and films, to prevent them from sticking together or to other surfaces during processing, storage, or use. These additives work by modifying the surface properties of the polymer, typically reducing the coefficient of friction between surfaces, thereby preventing adhesion. The primary function of anti-block additives is to improve the handling and usability of polymer materials. In manufacturing processes such as extrusion, molding, and packaging, polymers tend to adhere to processing equipment or to themselves, causing operational inefficiencies, defects in products, or difficulty in separating stacked materials. Anti-block additives create a micro-roughened surface on the polymer, which reduces the contact area and thus the adhesion between layers or between the polymer and processing equipment. Commonly used anti-block additives include inorganic materials like silica, talc, and diatomaceous earth, as well as synthetic materials such as polyethylene and fluoropolymers. The choice of additive depends on the specific requirements of the polymer and the intended application. For example, in food packaging films, where clarity is crucial, fine particles like silica are preferred due to their minimal impact on optical properties.

Key Takeaways:

Over 1, 500 product literatures, industry releases, annual reports, and various documents from major anti-block additives market participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

The anti-block additives market study covers 20 countries. The research includes a segment analysis of each country in terms of value and volume for the projected period.

The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and anti-block additives market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Anti-block additives market news and key industry trends are also included in the report.

Market Dynamics?

The market for anti-block additives is driven by several key factors that influence their widespread adoption across various industries, particularly in the plastics and packaging sectors. One significant driver is the increasing demand for improved packaging solutions across the food and beverage, pharmaceutical, and consumer goods industries. Anti-block additives play a crucial role in enhancing the functionality of plastic films and packaging materials by reducing friction between layers, thereby preventing blocking and improving the handling and usability of packaged products.

As per World Packaging Organization, the global fresh food packaging market is expected to increase from $79.8 billion in 2020 to $95.2 billion in 2025, with a 3.5% CAGR. Packaging is essential for maintaining product freshness, preventing damage, and serving as an effective marketing tool. The fresh food packaging market has grown with the overall food packaging sector. Thus, growth of fresh food packaging industry is expected to drive the demand for anti-block additives in coming years.

Moreover, regulatory requirements concerning food safety and product quality have further propelled the demand for anti-block additives. Stringent regulations in regions like North America, Europe, and Asia-Pacific ensure that additives used in food contact materials do not migrate into food in harmful amounts and comply with safety standards. As a result, there is a continuous focus on developing additives that meet these regulatory requirements while maintaining high performance and safety standards. Another significant driver is the expanding applications of plastics in industries such as automotive, electronics, and construction. These industries utilize anti-block additives to improve the processing and performance of plastic materials in various applications, including molded parts, films, and coatings. As global manufacturing activities continue to grow, the demand for anti-block additives is expected to rise, driven by the need for efficient and sustainable packaging solutions and enhanced product performance across diverse industrial sectors.

One significant restraint in the market is the increasing scrutiny and regulatory compliance requirements for additives used in food contact materials. Regulatory bodies worldwide, such as the FDA in the U.S. and the European Food Safety Authority (EFSA) in the EU, impose strict guidelines to ensure that additives do not pose health risks or contaminate food products. Meeting these regulatory standards requires substantial investments in research and development, as well as rigorous testing protocols, which can be a barrier to entry for smaller manufacturers. However, these challenges also present opportunities for innovation and market expansion. One such opportunity lies in the development of bio-based and biodegradable anti-block additives. Companies investing in research and development in this area can capitalize on the growing consumer preference for sustainable and environmentally friendly products. Innovations in nanotechnology and surface modification techniques also offer opportunities to enhance the performance of anti-block additives, leading to improved functionality and broader application possibilities.

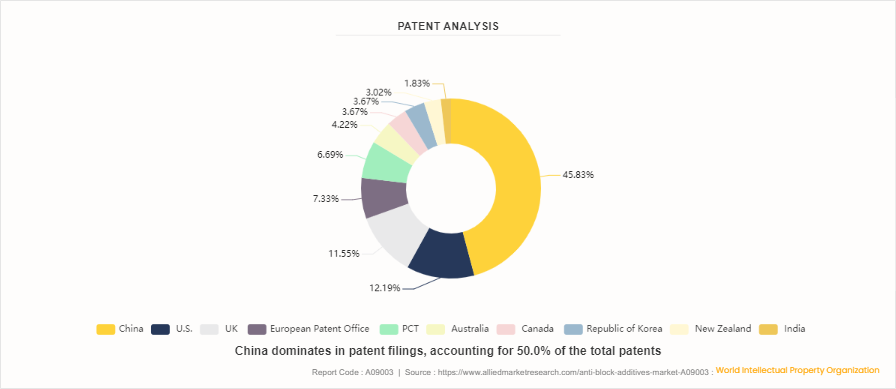

Patent Analysis

Market Segmentation?

The anti-block additives market is segmented on the basis of category, polymer type, application, and region. By category, the market is classified into organic and inorganic. By polymer type, the market is classified into polyolefin, polypropylene, polyethylene, polystyrene, polyamide, and others. By application, the market is classified into food packaging, agricultural films, and others. Region-wise the anti-block additives market share is studied across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

Key players in the anti-block additives market include Cargill Corporation, Tosaf, Inc., Avient Corporation, Lawrence Industries, Inc., Kompuestos, Biesterfeld AG, W. R. Grace and Company, Ampacet Corporation, Honeywell International Inc., and Bajaj Plast Pvt. Ltd.

Key Company Overview

Cargill Corporation specializes in food, agriculture, financial, and industrial products and services. Founded in 1865 and headquartered in Wayzata, Minnesota, Cargill operates in over 70 countries. It provides a variety of essential saturated amides and secondary bis-amides that help polyolefin films resist blockage. ? These additions are especially beneficial when combined with standard inorganic anti-blocking additives, which can have a synergistic effect. ?Optislip additives increase blocking when used with inorganic materials. Optislip BR is the most effective, creating a continuous non-sticking layer. This enables for the use of lower doses of inorganic anti-blocking agents, which improves clarity. ?Optislip BR can be used with Optislip ER without raising the total amide content, providing combined slip and anti-block capabilities.

Biesterfeld AG specializes in the production of chemicals and plastics and is headquartered in Hamburg, Germany. It operates in over 40 countries and focuses on providing high-quality products and comprehensive services to various industries, including plastics, rubber, food, pharmaceuticals, and personal care. The company offers Innoslip?amide waxes from PATHWEL.?Amide waxes, such as Erucamide or Oleamide, have long been the most well-known standard lubricants in polymer processing, and they are widely used as slip and antiblock additives throughout the service life of plastics.

Kompuestos is a prominent European manufacturer of masterbatches and compounds, based in Barcelona, Spain. Founded in 1986, the company specializes in producing high-quality, innovative solutions for the plastics industry, focusing on sustainability and performance. Kompuestos uses a variety of inorganic anti-blocking additives that have exceptional temperature resistance, focusing on those that are most suited for producing clear films.?The?Kompuestos' anti-blocking additives ?reduce the blocking effect, which facilitates winding and makes it simpler and more pleasant to separate plastic film layers. The company?employs?non-migratory additives. The action is permanent and does not change with temperature or time after extrusion. They can also be combined with slip additives for a slip-antiblock effect.

Regional/Country Industry Outlook

The U.S. holds a dominant position in the North American anti-block additives market, owing to its large manufacturing sector and substantial demand across various industries. The packaging industry is a major consumer of anti-block additives in the U.S., driven by the need for efficient and high-performance packaging solutions in food, pharmaceuticals, and consumer goods. The FDA regulates additives used in food contact materials, ensuring they meet stringent safety standards. This regulatory environment encourages innovation in safer and more effective additives. Technological advancements in additive manufacturing are prevalent in the U.S., leading to the development of additives with enhanced properties such as improved transparency and reduced haze. These advancements cater to the demand for high-quality packaging materials while complying with regulatory requirements.

Moreover, the automotive industry in the U.S. also contributes to the demand for anti-block additives, particularly in applications such as interior components and exterior films. The market benefits from a robust research and development infrastructure, fostering innovation in sustainable and bio-based additives to address environmental concerns. The automotive industry in the U.S. adheres to stringent regulatory standards set by agencies such as the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) . Additives used in automotive applications, including anti-block additives, must comply with these regulations to ensure safety, performance, and environmental sustainability.

Public Policies

Food Contact Regulations: In many regions, including the European Union (EU) , U.S., and other countries, anti-block additives used in food packaging materials must comply with specific regulations. These regulations ensure that additives do not migrate into food in harmful amounts and do not pose health risks to consumers.

Food and Drug Administration (FDA) Regulations: In the U.S., the FDA regulates substances intended for use as components of food contact materials under the Food Contact Notification (FCN) program or through the Generally Recognized as Safe (GRAS) determination process. Additives used in food packaging must be evaluated for safety before they can be marketed.

EU Regulations: In the EU, the use of additives in food contact materials is governed by the Regulation (EC) No 1935/2004, which requires that materials and articles intended to come into contact with food are safe and do not transfer their constituents into food in quantities that could endanger human health or bring about an unacceptable change in the composition of the food or a deterioration in its organoleptic characteristics.

?Key Sources Referred

Society of Plastics Engineers (SPE)

American Chemical Society (ACS)

American Coatings Association - Additives Technical Committee (ATC)

Canadian Plastics Industry Association (CPIA)

British Plastics Federation (BPF)

European Chemical Industry Council (CEFIC)

Society of Chemical Manufacturers and Affiliates (SOCMA)

Flexible Packaging Association (FPA)

The Association of Plastics Recyclers (APR)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anti-block additives market analysis from 2024 to 2033 to identify the prevailing anti-block additives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anti-block additives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global anti-block additives market trends, key players, market segments, application areas, and market growth strategies.

Anti-Block Additives Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.1 Billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Category |

|

| By Polymer Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Lawrence Industries, Inc., Bajaj Plast Pvt. Ltd., Kompuestos, Avient Corporation, Ampacet Corporation, Biesterfeld AG, Cargill Corporation, Tosaf, Inc., Honeywell International Inc., W. R. Grace and Company |

Loading Table Of Content...