Anti-Corrosive Packaging Market Research, 2031

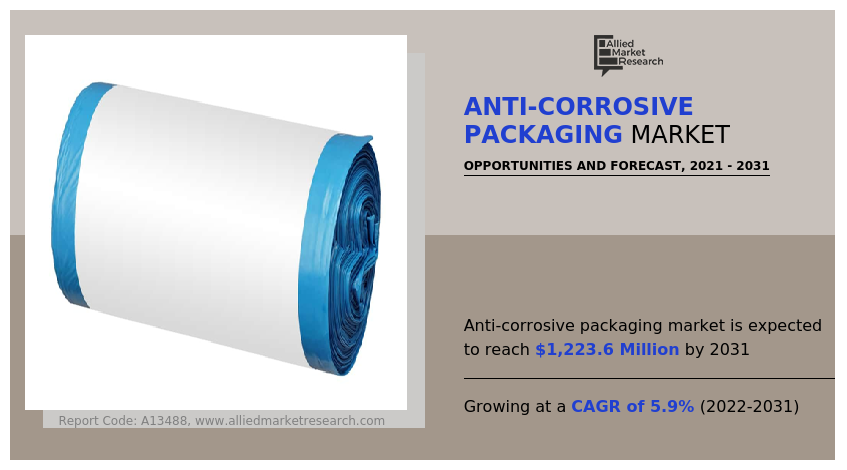

The global anti-corrosive packaging market size was valued at $683.3 million in 2021, and is projected to reach $1223.6 million by 2031, growing at a CAGR of 5.9% from 2022 to 2031.

Corrosion is a chemical or electrochemical reaction between the metal and environment. Anti-corrosive packaging provides long-term protection to metal products that are stored or are to be transported to prevent them from corrosion. Anti-corrosive packaging benefits companies who export across sea or moisture prone areas. This packaging solution are flexible, low-cost, effective and can be used for various metal and non-metal products.

Market Dynamics

Corrosion can have devastating effects on equipment and structures, leading to unplanned maintenance costs, shortened equipment life spans. Anti-corrosive packaging is an upcoming trend specially in the manufacturing sector. Moreover, there is increasing demand for anti-corrosive packaging material among several industries such as automotive, electrical & electronics, consumer goods and industrial goods. This rising demand has led to serious competition among the packaging companies as they are coming up with latest improvements in the market. Moreover, the expansion of shipping and logistics of metal products is creating greater demand for anti-corrosive packaging products.

Increase in automotive and industrial goods in developing economies such as China, India, and the U.S., has led to development of the manufacturing, and industrial sectors, thus increasing the demand for anti-corrosive packaging. The anti-corrosive packaging market indicates good potential with the growing steel production throughout the world. Anti-corrosive packaging is designed to address many challenges encountered in long-term protection of metal products so that they remain corrosion-free. For instance, under the Union Budget 2022-23, the Indian government allocated $6.2 million to the Ministry of Steel for boosting the production of steel. Such factors will fuel the anti-corrosive packaging market for industrial sectors.

Anti-corrosive packaging plays a vital role in automotive industry. Crucial parts such as brake and suspension components can be susceptible to corrosion, and as these are critical to safety on the road, manufacturers and suppliers continue to develop sophisticated corrosion prevention technologies. Moreover, key players in the market are introducing new range of anti-corrosive packaging products for various industries. For instance, in November 2021, Jotun launched Jotacote universal S120 epoxy, this chemical bond is 10 times stronger than the typical hydrogen bond and has qualities of corrosion protection and durability.

By Material Type

The Polyethylene (PE) segment was the highest revenue contributor in 2021.

On the basis of material type, the Polyethylene (PE) segment has registered the highest anti-corrosive packaging market share in terms of revenue in 2021. Polyethylene protects both accessible and inaccessible metal surfaces from attack by corrosion accelerating agents such as moisture, salt air, airborne acids and contaminants. It provides clean protection that produces no residue or aroma and has zero effect upon the electrical or mechanical properties of the product.

By Application

The Automotive segment dominated the market in 2021.

On the basis of application, the automotive segment has generated the highest revenue in 2021. Anti-corrosive packaging plays a vital role in automotive industry. Crucial parts such as brake and suspension components can be susceptible to corrosion, and as these are critical to safety on the road, manufacturers and suppliers continue to develop sophisticated corrosion prevention technologies. Moreover, key players in the market are introducing new range of anti-corrosive packaging products for various industries. For instance, in November 2021, Jotun launched Jotacote universal S120 epoxy, this chemical bond is 10 times stronger than the typical hydrogen bond and it has qualities of corrosion protection and durability.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many products in the anti-corrosive packaging market, owing to lockdowns. Furthermore, the number of COVID-19 cases is expected to reduce in the future with the introduction of the vaccine for COVID-19 in the market. This has led to reopening of anti-corrosive packaging companies at their full-scale capacities. This is expected to help the market recover by the end of 2022. After COVID-19 infection cases begin to decline, anti-corrosive packaging manufacturers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

By Region

Asia-Pacific garnered the largest market share in the global anti-corrosive packaging market in 2021.

Asia-Pacific dominated the market in 2021, accounting for the highest share, and is anticipated to maintain this trend throughout the anti-corrosive packaging market forecast period. This is attributed to increase in manufacturing industries such as automotive, electrical & electronics aviation, and metal in countries such as India, China, and Japan. Moreover, increase in infrastructure activities in this region are creating demand for anti-corrosive packaging. Thus, all such factors are expected to drive the anti-corrosive packaging market growth in Asia-Pacific.

The anti-corrosive packaging market is segmented into Material Type, Product Type and Application. By material type, the market is categorized into Polyethylene (PE), Polyvinyl Chloride (PVC) and others. Depending on product type, it is fragmented into bags, foils and others. On the basis of application, it is categorized into automotive, electrical & electronics, consumer goods, industrial goods, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competition Analysis

Key companies profiled in the anti-corrosive packaging industry report include 3M Company, AGM Container, Inc., Armor Protective Packaging, Chugoku Marine Paints, Ltd., Daubert Cromwell, Gulmohar Pack-Tech India Pvt. Ltd., Hempel, Intertape Polymer Group Inc., Jotun, Kansai Paints Co., Ltd., Metpro Group, Nefab Group, Nitto Denko Corporation, PPG Industries Inc., Safepack Incorporates, Smurfit Kappa Group Plc., and Trenton Corporation.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anti-corrosive packaging market analysis from 2021 to 2031 to identify the prevailing anti-corrosive packaging market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anti-corrosive packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global anti-corrosive packaging market trends, key players, market segments, application areas, and market growth strategies.

Anti-Corrosive Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1223.6 million |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Product Type |

|

| By Material Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Cortec Corporation, Daubert Cromwell, CHUGOKU MARINE PAINTS, LTD., Gulmohar Pack-Tech India Pvt. Ltd., Nitto Denko Corporation, Kansai Paints Co. Ltd., PPG Industries Inc., AGM Container Inc., Nefab Group, Hempel A/S, Intertape Polymer Group Inc., Trenton Corporation, Armor Protective Packaging, Metpro Group, Jotun, Smurfit Kappa Group Plc, SAFEPACK Incorporates |

Analyst Review

The anti-corrosive packaging market has witnessed significant growth in the past few years, owing to increase in industrial goods, electrical & electronics and steel & metal industries. Moreover, increase in demand for automotive and consumer goods is increasing the demand for anti-corrosive packaging and thus, fueling the market growth. In addition, growth in shipping and logistics activities for metal products has created a demand for advanced corrosion protection packaging as the transportation of goods in shipping containers exposes them to extreme salinity, humidity and temperature conditions. The only way to control oxidation is to use corrosion-resistant packaging to isolate the product from this destructive environment, increasing the demand for anti-corrosive packaging in the market.

Furthermore, various key players in the global market are implementing strategic moves to strengthen its market position. For instance, in August 2021, Kansai Paints Co. Ltd. acquired SIPCO, Saudi Arabia’s anti corrosion and architectural coating company. This acquisition will give Kansai a boost in Middle East region. As a result, such factors provide lucrative growth in the anti-corrosive packaging market.

The global anti-corrosive packaging market size was valued at $6,83,258.2 thousand in 2021.

The global anti-corrosive packaging market size is projected to reach $12,23,555.6 thousand by 2031.

Asia-Pacific is the largest regional market for Anti-Corrosive Packaging.

The automotive segment is the leading application of Anti-Corrosive Packaging Market

Growth of manufacturing, marine and logistic industries and rise of automatic technology in packaging at manufacturing plants are the upcoming trends of Anti-Corrosive Packaging Market in the world.

On the basis of application, it is categorized into automotive, electrical & electronics, consumer goods, industrial goods, and others.

The product launch is key growth strategy of anti-corrosive packaging industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...

Loading Research Methodology...