Anti-Snoring Devices Market Research, 2032

The global anti-snoring devices market size was valued at $$233.9 million in 2022, and is projected to reach $511.4 million by 2032, growing at a CAGR of 8.1% from 2023 to 2032. Anti-snoring devices are specifically designed to address the issue of snoring by targeting its root causes. Snoring occurs when airflow is obstructed, leading to vibrations in the throat tissues during sleep. Various types of anti-snoring devices, such as mandibular advancement devices, tongue stabilizing devices, nasal dilators/strips, CPAP machines, and positional therapy devices, are used to reduce or eliminate snoring. These devices work by repositioning the jaw, keeping the tongue forward, opening nasal passages, providing continuous air pressure, or encouraging side sleeping. The aim of these devices is to enhance the quality of sleep for both the snorer and their sleep partner by minimizing the vibrations and disruptive noises associated with snoring.

Market dynamics

Anti-snoring devices market size is driven by rise in awareness among individuals about the impact of snoring on sleep quality and overall health is the key factor driving the growth of the anti-snoring devices market. Various public health campaigns have been launched to raise awareness about snoring and its potential health risks. These campaigns aim to educate the general public about the importance of addressing snoring as a significant sleep-related issue. For instance, organizations such as the American Academy of Sleep Medicine (AASM) and the British Snoring & Sleep Apnea Association (BSSAA) have conducted awareness campaigns through online resources, social media campaigns, and community events. In addition, the National Stop Snoring Week is an awareness campaign dedicated to educating the public about snoring and its impact on sleep health. This campaign is run in the UK every year and serves as a platform to raise awareness, provide information, and encourage individuals to seek solutions for snoring issues.

Furthermore, rise in prevalence of snoring and sleep disorders, such as obstructive sleep apnea (OSA), is also driving the growth of the anti-snoring devices market. Obstructive sleep apnea (OSA) is a common sleep disorder that is characterized by repeated episodes of partial blockage of the upper airway during sleep, leading to snoring and disrupted breathing. For instance, in May 2023, Sleep Foundation estimated that about 50 million to 70 million people in the U.S. are suffering from sleep disorders. Thus, as the prevalence of sleep apnea increases, there is a greater demand for effective anti-snoring devices, such as continuous positive airway pressure (CPAP) machines and mandibular advancement devices (MADs) for managing OSA and reducing snoring.

Furthermore, emergence of advanced anti-snoring devices with enhanced functionality propels the market growth. In addition, user-friendly features in anti-snoring devices such as easy-to-use, adjustment mechanisms, or minimal assembly, make them more accessible to users, which, in turn, contribute toward the market growth.

The growth of the anti-snoring devices market is expected to be driven by developed countries such as the U.S., Canada, and Germany, due to increase in prevalence of snoring in these countries, adoption of advanced anti-snoring devices, and easy accessibility of these devices. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to emergence of new medical devices, rise in demand for enhanced healthcare services, and an increase in geriatric population which are more susceptible to snoring.

However, side effects associated with oral anti-snoring devices such as temporomandibular disturbances, teeth pain, and excessive salivation restrain the market growth. For instance, some individuals may experience jaw pain, soreness, or clicking in the jaw joint due to mandibular advancement devices. In addition, limited efficacy, compliance and comfort issues associated with anti-snoring devices negatively impact the anti-snoring devices market growth. Furthermore, availability and preference for alternative treatment options such as surgical interventions and oral medications limit the adoption of anti-snoring devices and restrains the market growth.

The COVID-19 pandemic has led to a rise in demand for anti-snoring devices due to easy availability of these devices through online pharmacy and other platforms. Furthermore, sales of over-the-counter nasal dilators, nasal strips, and tongue stabilizing devices increased during the pandemic as these are non-invasive and self-manageable solutions for snoring. On the other hand, financial constraints for individuals and households have impacted the purchasing power and willingness to invest in non-essential products, including anti-snoring devices. This has led to decrease in sale of anti-snoring devices during the pandemic.

Segmental Overview

The anti-snoring devices market share is segmented into product and end user. and region. On the basis of product, the market is classified into mouthguard, nasal devices, EPAP devices, and others. Others include sleeping aids, mask, chin strip, and other accessories. As per end user, the market is bifurcated into homecare and others. Others include hospital & clinic and sleep laboratory. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

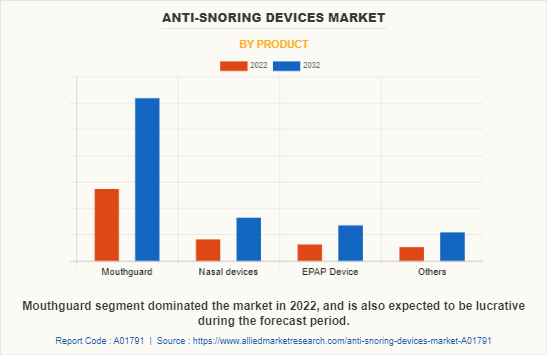

By Product

By product, the anti-snoring devices market share is segmented into mouthguard, nasal devices, EPAP devices, and others. The mouthguard segment dominated the global market in 2022 and is expected to remain dominant throughout the anti-snoring devices market forecast period. This is attributed to high effectiveness of mandibular advancement devices (MADs) in reducing snoring. Furthermore, mouthguards are non-intrusive and easy to use as compared to other types of anti-snoring devices. In addition, mouthguards are more affordable alternatives to other anti-snoring devices such as CPAP machines which has led to rise in demand for mouthguards.

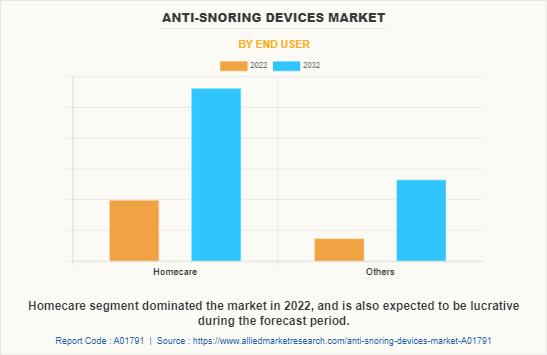

By End User

By end user, the anti-snoring devices market is bifurcated into homecare and others. The homecare segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period, owing to rise in number of people seeking snoring relief based from home due to convenience and comfort. Furthermore, advancements in technology has led to the development of user-friendly and effective homecare devices. These devices are user-friendly and easy to operate, allowing individuals to manage their snoring condition independently.

By Region

The anti-snoring devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the anti-snoring devices market in 2022 and is expected to maintain its dominance during the forecast period.

North America is a highly developed region with advanced healthcare systems. The region has a large aging population and a high prevalence of snoring, which has led to an increased demand for anti-snoring devices. This increased demand is driving the growth of anti-snoring devices market. Furthermore, North America is a hub for technological advancements and innovations in the healthcare industry. The region is home to many leading medical device companies that are investing heavily in research and development to develop new and advanced anti-snoring devices. Thus, presence of anti-snoring devices industry, such as ResMed Inc., The Pure Sleep Company, Airway Management, Inc, and ZQuiet, boost the growth of the anti-snoring devices market.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributed to rise in use of anti-snoring devices due to increase in snoring population. In addition, surge in prevalence of obesity, lifestyle changes, and increase in smoking population further contribute to snoring in this region. Furthermore, rising healthcare expenditure in countries like China and India has led to increased investment in healthcare infrastructure and medical devices, creating a significant demand for anti-snoring devices.

Competition Aanlysis

Competitive analysis and profiles of the major players in the anti-snoring devices market include SomnoMed, ResMed Inc., Koninklijke Philips N.V., VVFLY Snore Circle, ZQuiet, The Pure Sleep Company, Apnea Sciences, Airway Management, Inc., Rhinomed, and DentCare Dental Lab Pvt. Ltd. There are some important anti-snoring devices industry in the market such as Theravent, GlaxoSmithKline plc, and PureSleep. Major players have adopted product launch as a key developmental strategy to improve their product portfolio and gain a strong foothold in the anti-snoring devices market.

Recent Agreement in the Anti-snoring Devices Market

In April 2020, Apnea Sciences, a medical device company, has introduced its latest product, SnoreRX Plus, for the treatment of snoring. The launch of SnoreRX Plus is expected to significantly strengthen the company's position in the competitive anti-snoring devices market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anti-snoring devices market analysis from 2022 to 2032 to identify the prevailing anti-snoring devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anti-snoring devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global anti-snoring devices market trends, key players, market segments, application areas, and market growth strategies.

Anti-Snoring Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 511.4 million |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 243 |

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | ResMed Inc., Airway Management, Inc, Rhinomed, Apnea Sciences, Pure Sleep, LLC, VVFLY Snore Circle, Koninklijke Philips N.V., DentCare Dental Lab Pvt. Ltd, ZQuiet, SomnoMed |

Analyst Review

Anti-snoring devices are used to reduce the snoring. These devices are designed to provide improved airflow during sleep and minimize the vibration of the tissues in the throat that cause snoring. Development of advanced and non-invasive anti-snoring devices, increase in awareness about potential health risks associated with snoring through launch of campaigns and organization, and rise in adoption of anti-snoring devices boost the growth of the market.

Furthermore, increase in product launch by the market key players and new campaigns are expected to create opportunities for the market growth. For instance, in April 2020, Apnea Sciences, a medical device company, launched SnoreRX Plus, an anti-snoring device. The introduction of SnoreRX Plus is expected to strengthen the company's position in the anti-snoring devices market. Furthermore, various organizations such as World Sleep Society, American Sleep Apnea Association, and National Sleep Foundation (NSF) provide educational resources and campaigns to raise awareness about various sleep disorders, including snoring.

The top companies that hold the market share in anti-snoring devices market are SomnoMed, ResMed Inc., Koninklijke Philips N.V., VVFLY Snore Circle, ZQuiet, The Pure Sleep Company, Apnea Sciences, Airway Management, Inc., Rhinomed, and DentCare Dental Lab Pvt. Ltd

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to rise in use of anti-snoring devices due to increase in snoring population

The key trends in the anti-snoring devices market are due to Increase in number of people suffering from snoring, and rise in awareness among individuals about the health risks associated with snoring

The base year for the report is 2022.

North America is the largest regional market for anti-snoring devices Market

The total market value of anti-snoring devices Market market is $233.9 million in 2022 .

The forecast period in the report is from 2023 to 2032

Major restraints in the anti-snoring devices Market are discomfort and inconvenience associated with anti-snoring devices

Loading Table Of Content...

Loading Research Methodology...