Antimicrobial Packaging Market Research - 2031

The Global Antimicrobial Packaging Market Size was valued at $10.3 billion in 2021, and is projected to reach $17.9 billion by 2031, growing at a CAGR of 5.6% from 2022 to 2031.

Market Introduction and Definition

Antimicrobial packaging is specifically designed packaging medium which helps in eliminating the possibility of growth of bacteria & germs. By inhibiting the pathogenic growth, it extends the shelf life of the product.

Market Dynamics

There is a rise in the demand for packaged food, owing to the surge in disposable income of people worldwide. This boosts the product demand in the antimicrobial packaging market. Furthermore, packaged food has always been a major health concern, and for the same reason, government bodies across the world established many regulations. Food processing industries invest heavily in the development of healthier packaging methods to meet these statutory requirements. This, in turn, increases the demand for antimicrobial packaging. Further, the healthcare industry is one of the major end-users of antimicrobial packaging. Moreover, consumers are becoming very keen on hygiene and packaging other product related to food, grooming solutions, and medicines. In addition, the healthcare industry has grown significantly in recent years, thereby driving the demand during the antimicrobial packaging market forecast period. Such instances support the antimicrobial packaging market overview.

The developments in the chemical and pharmaceutical industries fuel market expansion in countries like China, India, South Africa, and others. R&D and advances in drug formulation are the two biggest market drivers for clinical trial packaging globally. For instance, March 2022, BERRY GLOBAL, which offers innovative packaging and PYLOTE, a provider of industrial mineral chemistry, announced strategic partnership for innovative antimicrobial packaging solutions which are cleaner and safer for consumers and patients. They have launched multidose ophthalmic dropper with antimicrobial protection properties. This dropper kills germs and microorganisms and can be used for personal or medical applications. All such instances are anticipated to augment the growth of the antimicrobial packaging industry.

However, the fluctuation in the cost of raw materials used in the manufacturing of antimicrobial packaging is one of the restraining factors hindering the growth of the market. Manufacturer profitability, particularly those of small and medium-sized enterprises is impacted by the procedure's complexity and cost (SME). Market participants are turning to product post-consumption recycling due to stringent environmental regulations. In an effort to address the issue, market players are experimenting with novel methods, such as using truly biodegradable alternatives like biopolymers.

The demand for antimicrobial packaging decreased in 2020, owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic has shutdown the production of antimicrobial packaging for the end-user, mainly owing to prolonged lockdowns in major global countries. This has hampered the growth of the antimicrobial packaging market significantly during the pandemic. The major demand for antimicrobial packaging was previously noticed from giant manufacturing countries including China, U.S., Germany, Italy, and the UK which was badly affected by the spread of coronavirus, thereby halting demand for antimicrobial packaging. This is expected to lead to re-initiation of manufacturing industry at their full-scale capacities, which is likely to help the antimicrobial packaging market to recover by end of 2022.

Contrarily, technological developments in antimicrobial packaging products such as advancements in biopolymers, and biodegradable packaging materials is expected to boost the microbial resistivity of the packaging. For instance, December 2020 DS Smith and Touchguard partnered to develop a range of cardboard packaging with antimicrobial properties for the e-commerce industry. It is projected to protect consumers from harmful bacteria. This is anticipated drive the antimicrobial packaging market opportunity during the forecast period.

Segmental Overview

The antimicrobial packaging market is segmented on the basis of material, technology, type, and region.

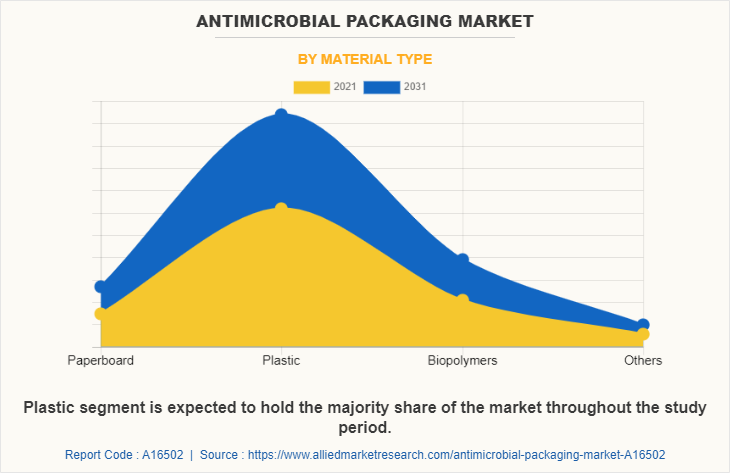

By material, the market is classifed into paperboard, plastic, biopolymer, and others.

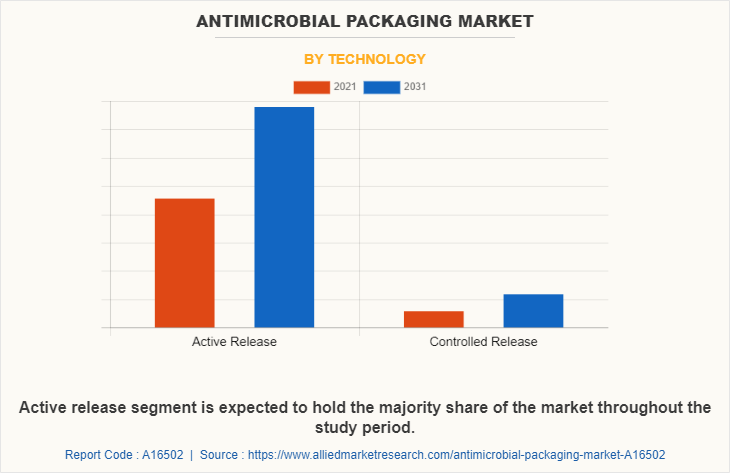

By technology, the market is bifurcated into active release and controlled release.

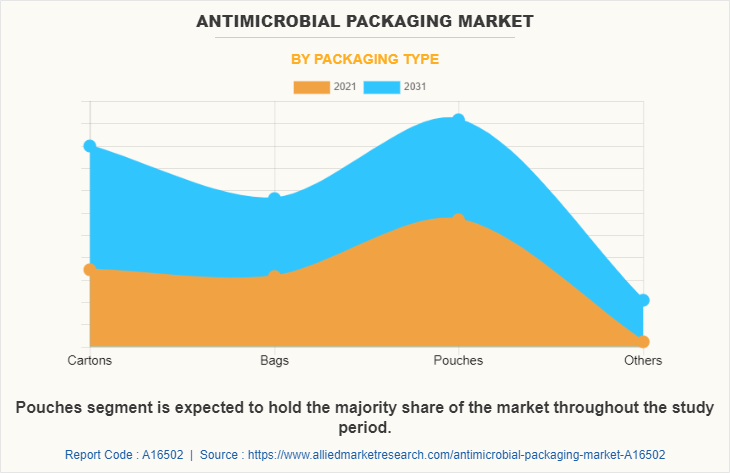

By type, the market is divided into carton, bags, pouches, and others.

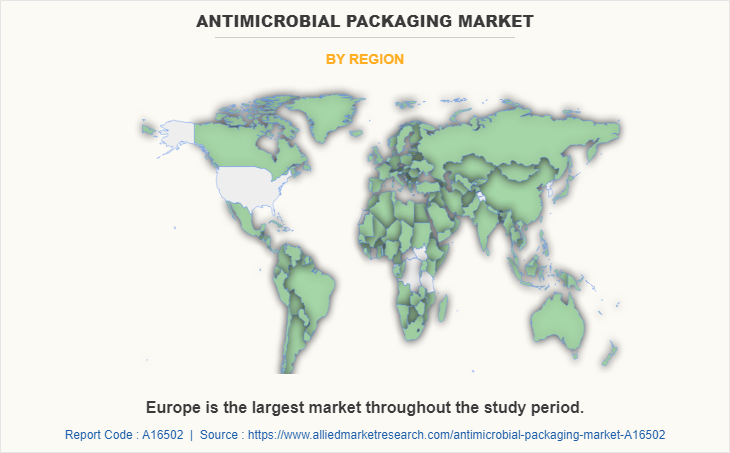

By region: The antimicrobial packaging market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Europe held the highest revenue in antimicrobial packaging market share. And Asia-Pacific is expected to exhibit the highest CAGR during the forecast period.

By Material:

The antimicrobial packaging market is categorized into paperboard, plastic, biopolymer, and others. Paperboard material used for antimicrobial packaging is effective in providing distinct environmental sustainability credentials. Various coatings are used for paperboard antimicrobial packaging. Moreover, plastic antimicrobial packaging consists of a container or any other single-use packaging product that is mostly used for secondary packaging of food & beverage products.

Plastic consists of synthetic polymer material which contains active antimicrobial ingredient that resists microbial growth. Biopolymer is resistant to microorganism and germs by shielding product through active antimicrobial, making them useful in different applications, such as packaging materials, emulsions, edible films, in the drug transport materials, and food industry. The others segment in by materials includes metals, and glass. Plastic is expected to exhibit the largest revenue contributor during the forecast period. Paperboard is expected to exhibit the highest CAGR share in the valve material segment in the antimicrobial packaging market during the forecast period.

By Technology:

The antimicrobial packaging market is classified into active release and controlled release. The active released antimicrobial packaging increases shelf life of products by purposefully releasing or absorbing substances from food packaging. This technology outperforms traditional food packaging in stopping the degradative reactions of microbial growth, lipid oxidation, and moisture loss and gain. The term-controlled release antimicrobial packaging refers to a new class of packaging materials that can increase the shelf life of a wide range of food by releasing active ingredients like antioxidants and antimicrobials at controlled rates. The active release segment is expected to be the largest revenue contributor during the forecast period, and the controlled release segment is expected to exhibit the highest CAGR share in the technology segment in the antimicrobial packaging market during the forecast period.

By Type:

The antimicrobial packaging market is divided into carton, bags, pouches, and others. Carton is made up of paperboard that is printed, laminated, cut, folded, and glued. These cartons have an antimicrobial coating to protect the product packed inside the carton. Bags are poly packaging film converted into pouches made with addition of antimicrobial polymer. Pouches are fused with biopolymers or synthetic polymer to protect packed products such as food or beverage and extend.

The other product type included in the antimicrobial packaging market are trays, and cups & lids. Carton is expected to exhibit the largest revenue share in the type segment in the antimicrobial packaging market during the forecast period. The pouches segment is expected to exhibit the largest CAGR during the forecast period.

Region Wise,

The antimicrobial packaging market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Competition Analysis

The major players profiled in the antimicrobial packaging market include Avient Corporation, BASF SE, BioCote Limited, Dow, Dunmore, Klockner Pentaplast, Microban International, Mondi, Sciessent, and Takex labo Co.,Ltd.

Major companies in the market have adopted acquisition and product launch as their key developmental strategies to offer better products and services to customers in the antimicrobial packaging market.

Some examples of acquisition and partnership in the market

In August 2022, Mondi plc acquired Duino mill near Trieste (Italy) from the Burgo Group which total consideration of €40 million in order to expands its packaging unit. The mill currently operates one paper machine producing lightweight coated mechanical paper. Mondi plans to convert this paper machine to produce around 420,000 tonnes per annum of high-quality recycled containerboard for an estimated investment of around €200 million.

In June 2022, Confoil and BASF collaborated to develop a certified compostable dual ovenable paper tray for packaging ready-to-eat meals. This will strengthen the product portfolio of the company and increase its customer base.

In May 2020, Cartro, has collobirated with Mondi Ltd., one of the major market competitors, partnered. by meamns of Their collobortation may have enhanced the market value for anti-microbial packaging because they were successful in developing eco-friendly packaging for both fresh and regional goods.

In September 2022, Mondi has collaborated with Austrian bacon producer Handl Tyrol in order to provide a new mono-material polypropylene (PP) high barrier packaging solution for bacon. In addition, The eye-catching ‘wood effect’ film ensures safe vacuum packaging and offers excellent protection to prevent food waste..

In December 2022, BASF has collaborated to StePac to create contact-sensitive packaging solution for the preservation of fresh produce, making use of BASF’s ChemCycling technology to facilitate the production of Ultramid Ccyled polyamide 6 for StePac’s Xgo Circular series.

In December 2020 Touchguard and DS Smith have partnered to develop range of cardboard packaging with antimicrobial properties for e-commerce industry. Thus, all such factors collectively are expected to drive the growth of the company and expand its customer base by strengthening the product portfolio.

The product launch in the market

In May 2021, Avient has launches GLS thermoplastic elastomers with antimicrobial technology that protects against microbial growth. In addition, tested in accordance with JIS Z2801 and ASTM G21-15 standards, these additives protect molded plastic parts by inhibiting bacterial growth (99.9 percent or more) and resisting fungal and mold growth..

In June 2022, Avient Corporation, a premier provider of specialized and sustainable material solutions and services has launched its breakthrough PCR Color Prediction Service for polyolefins and polyethylene terephthalate (PET) resins, and the company’s new polyolefin antioxidants, Cesa Nox A4R Additives for Recycling.

In February 2021, Toppan Company developed film called “Virusweeper” for packaging with antibacterial and antiviral functions. Such instances are anticipated to boost growth of the antimicrobial packaging market.

In August 2020, Parkside Company and Touchguard Company collaborated to launch “Coating” for packaging solutions with an antimicrobial coating that protects against harmful bacteria. This will enhance and strengthen the product portfolio for the customer.

In June 2020, Designsake company has launched new coating with antimicrobial properties called “Matter” which kills/reduces harmful bacteria by 99.99%. The matter consist of a barrier made of silver ion technology. The company is taking lots of efforts to fulfill rising demand of customers by making innovations in the antimicrobial coating. Such instances are expected to drive the growth of the company.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the antimicrobial packaging market outlook, segments, current trends, estimations, and dynamics of the antimicrobial packaging market analysis from 2021 to 2031 to identify the prevailing antimicrobial packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the antimicrobial packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global antimicrobial packaging market trends, key players, market segments, application areas, and antimicrobial packaging market growth strategies.

Antimicrobial Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 17.9 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 210 |

| By Material Type |

|

| By Technology |

|

| By Packaging Type |

|

| By Region |

|

| Key Market Players | Microban International, Takex labo Co.,Ltd, DUNMORE, BioCote Limited, Sciessent LLC, Avient Corporation, Mondi plc, BASF SE, Klckner Pentaplast Group, Dow |

Analyst Review

The antimicrobial packaging market witnessed a huge demand in Europe. The highest share of the Europe market is attributed to increasing demand for antimicrobial packaging in the chemical, pharmaceutical and food and beverage sector.

Antimicrobial packaging consist of biopolymer or synthetic polymer which is particular designed for packaging material such as cardboard, plastic or paperboard. This antimicrobial coating helps in eliminating the possibility of growth of bacteria & germs. By inhibiting the pathogenic growth, it extends the shelf life of the product. Consumers' growing awareness of health-related issues is contributing to the growth of the antimicrobial packaging sector. Antimicrobial agents like bacteriocins are used in food packaging sheets to stop food from going bad. Another major factor driving the market is rising healthcare and pharmaceutical industries which are fueling market expansion in countries with economies like China, India, South Africa, and others. Moreover, stringent environmental regulations and high raw material prices is hindering markets growth. Price volatility results from the need to produce antimicrobial packaging elements for food packaging using petroleum-based ingredients. Manufacturer profitability, particularly those of small and medium-sized enterprises (SME) are impacted by the procedure's complexity and cost. In addition, rising innovations in antimicrobial packaging such as intelligent antimicrobial coatings are one of the new concepts in food packaging. Such R&D is expected to create new opportunities for the market growth.

The major players profiled in the antimicrobial packaging market include Avient Corporation, BASF SE, BioCote Limited, Dow, Dunmore, Klockner Pentaplast, Microban International, Mondi, Sciessent, and Takex labo Co.,Ltd.

The global antimicrobial packaging market was valued at $10,255.4 million in 2021, and is projected to reach $17,916.1 million by 2031, registering a CAGR of 5.6% from 2022 to 2031.

The forecast period considered for the global antimicrobial packaging market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global antimicrobial packaging market report can be obtained on demand from the website.

The base year considered in the global antimicrobial packaging market report is 2021.

The major players profiled in the antimicrobial packaging market include Avient Corporation, BASF SE, BioCote Limited, Dow, Dunmore, Klockner Pentaplast, Microban International, Mondi, Sciessent, and Takex labo Co.,Ltd.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on material, the plastic segment dominated the market in 2021.

Loading Table Of Content...