Aortic Aneurysm Repair Market Research, 2032

The global aortic aneurysm repair market size was valued at $3.2 billion in 2022, and is projected to reach $5.8 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

An aortic aneurysm refers to an abnormal bulging or ballooning of the aorta, the main artery that carries oxygenated blood from the heart to the rest of the body. It occurs when the walls of the aorta weaken and become vulnerable to expansion and rupture. Aortic aneurysms can develop in different parts of the aorta, such as the ascending aorta, aortic arch, or descending aorta. If left untreated, they can lead to life-threatening complications, such as severe internal bleeding or organ damage.

Aortic aneurysm repair procedure involves surgical intervention or endovascular techniques to repair or replace the weakened or damaged section of the aorta. It typically entails removing the weakened portion and replacing it with a synthetic graft to reinforce the vessel's integrity and prevent rupture. By addressing the aneurysm, this procedure helps reduce the risk of life-threatening complications and ensures proper blood flow throughout the body.

Market Dynamics

Growth of aortic aneurysm repair market size is mainly due to the rise in incidences of aortic aneurysm such as abdominal aortic aneurysm and thoracic aortic aneurysm. In addition, surge in demand for advanced treatment procedures and devices, and rise in awareness among people regarding aortic aneurysm and its treatment option is anticipated to drive the market growth.

In addition, increase in prevalence of aortic aneurysm is attributed to several factors such as surge in aging population, increase in the prevalence of risk factors such as high blood pressure & high cholesterol, and changes in lifestyle habits. Thus, increasing the demand for aortic aneurysm repair devices and further driving the growth of the market. Moreover, advancements in medical technology and improved treatment techniques have led to better management of this chronic condition, which contributes to the growth of the market.

Furthermore, the market has witnessed a significant rise in the adoption of minimally invasive methods, which is driving its growth. Minimally invasive techniques, such as endovascular aneurysm repair (EVAR), have gained popularity due to their advantages over traditional open surgery, including shorter hospital stays, reduced postoperative pain, and faster recovery times.

Additionally, technological advancements in imaging, stent graft design, and navigation systems have further improved the efficacy and safety of these procedures. Advanced imaging techniques enable better visualization of the aortic anatomy, aiding in precise graft placement. Furthermore, the development of innovative stent grafts with enhanced sealing and durability properties has increased the success rate of aortic aneurysm repair. Thus, such technological advancements have collectively contributed to the growth of the aortic aneurysm repair market and are expected to continue driving its expansion during the aortic aneurysm repair market forecast.

Moreover, the rise in the number of approvals from regulatory agencies is further fueling the market growth. For instance, in April 2022, Terumo Aortic, a leading manufacturer of medical devices and supplies, received the US Food and Drug Administration (FDA) approval of the Thoraflex Hybrid Frozen Elephant Trunk (FET) device for commercial sale in the U.S. for the treatment of patients with complex aortic arch disease. Similarly, In January 2021, W. L. Gore & Associates, Inc. (Gore), a global materials science company, received Food and Drug Administration (FDA) approval for the new Gore Excluder Conformable AAA Endoprosthesis with an active control system, a new EVAR solution which builds on the proven clinical performance of the Gore Excluder AAA Device and incorporates design elements similar to the Conformable Gore Tag Stent Graft. Thus, such new developments and regulatory approvals in the sector are boosting aortic aneurysm repair market growth.

However, the growth of the aortic aneurysm repair market is hindered by the unavailability of specific devices in developing regions and a shortage of skilled healthcare professionals. Limited access to advanced medical devices and technologies poses challenges to effectively treating aortic aneurysms. Furthermore, the scarcity of healthcare professionals with expertise in aortic aneurysm repair restricts the ability to provide optimal care, thereby impeding market expansion.

The COVID-19 outbreak had a negative impact on the growth of aortic aneurysm repair industry. The pandemic has caused partial or complete shutdown of production facilities in many countries, leading to a suspension of production activities in most industrial units across the world. This has affected the manufacturing and development activities related to aortic aneurysm repair devices. The prolonged lockdowns in major countries such as the U.S., China, Japan, India, and Germany have also resulted in a decrease in patient visits to hospitals and clinics, which has affected the demand for aortic aneurysm repair procedures.

However, on the contrary, recent research from the American Heart Association, in May 2023, suggests a potential boost in the demand for aortic aneurysm repair treatments. The study revealed that individuals who had previously contracted COVID-19 were significantly more likely to experience rapid abdominal aortic aneurysm growth, surpassing the average rate of 2.7 mm per year. This finding highlights a concerning association between COVID-19 infection and the accelerated progression of aortic aneurysms. Thus, the anticipated increase in cases requiring aortic aneurysm repair treatments is expected to drive the growth of the aortic aneurysm repair industry in the forecast period.

Segmental Overview

The aortic aneurysm repair market is segmented into product type, procedure type, and region. By product type, the market is categorized into aortic stent-grafts and hybrid stent-grafts. On the basis of procedure type, it is segregated into open surgery, endovascular aortic aneurysm repair, and frozen elephant trunk (FET). The open surgery is further categorized into abdominal open repair and thoracic open repair. The endovascular aortic aneurysm repair is further categorized into abdominal endovascular aortic aneurysm repair , thoracic endovascular aortic aneurysm repair, and others (branched endovascular aortic repair, fenestrated endovascular aortic repair, branched thoracic endovascular aortic repair (B-TEVAR)). Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America and Middle East and Africa).

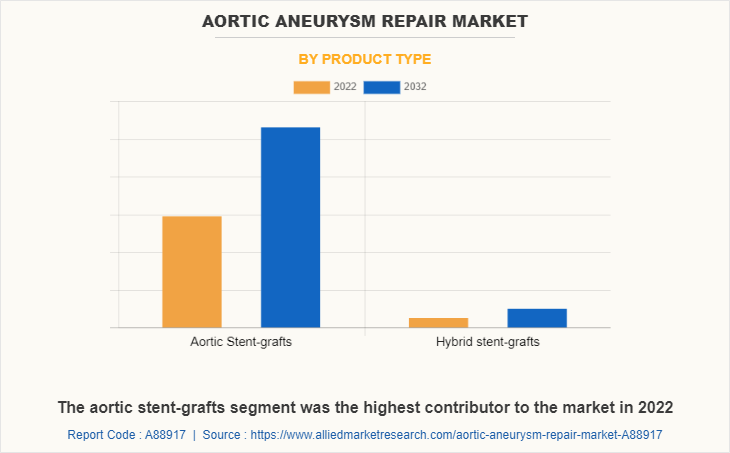

By Product Type:

The aortic stent graft segment accounted for the largest aortic aneurysm repair market share in 2022 is expected to remain dominant during the forecast period, owing to its increase in adoption for aortic aneurysm repair surgeries. Moreover, the ongoing advancements in stent graft technology and increasing adoption of endovascular techniques contribute to the segment growth. However, the Hybrid stent-grafts is projected to register highest CAGR during the forecast period owing to its potential advantages in treating complex aortic pathologies. Further, advancements in stent graft technology have enabled the development of hybrid stent-grafts with improved durability, flexibility, and ease of deployment.

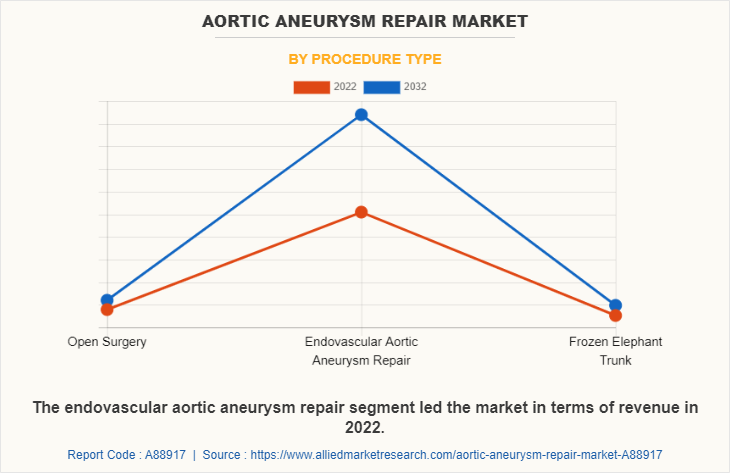

By Procedure Type:

The endovascular aortic aneurysm repair segment occupied highest aortic aneurysm repair market share in 2022 and is expected to remain dominant during the forecast period, owing to advantages such as minimally invasive procedures, shorter hospital stays, faster recovery, and reduced postoperative complications compared to open surgical repair. In addition, advancements in endovascular devices, improved patient outcomes, and increase in adoption of minimally invasive techniques by healthcare providers contribute to the growth of the endovascular aortic aneurysm repair segment in the market. However, the frozen elephant trunk (FET). is projected to register highest CAGR during the forecast period owing to advantages over traditional open surgical repair in terms of reduced invasiveness and postoperative complications. Furthermore, advancements in surgical techniques and the development of specialized devices have improved the effectiveness and safety of the FET procedure.

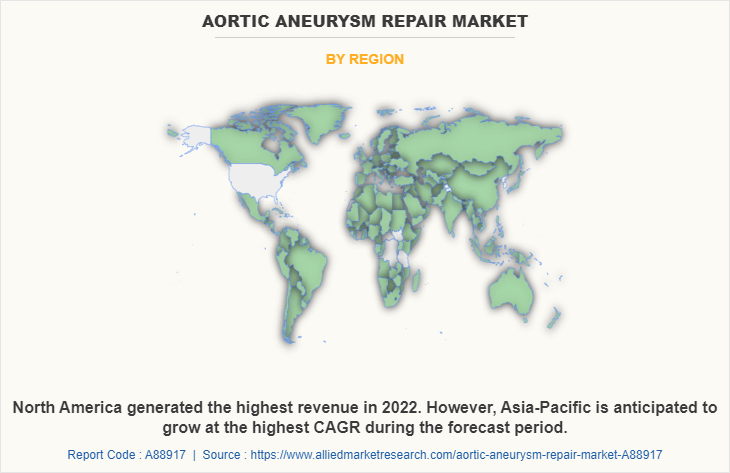

By Region:

The aortic aneurysm repair market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest share of the aortic aneurysm repair market‐¯in terms of revenue in 2022, due to alarming increase in the incidence of coronary artery diseases (CADs), including aortic aneurysm, in the region. This is attributed to factors such as rise in geriatric population, adoption of advanced stents grafts for aortic aneurysm and availability of reimbursements schemes for aortic aneurysm procedures . In addition, the surge in demand for aortic aneurysm repair devices and presence of major key players offering advanced devices is driving the market growth.

On the other hand, Asia-Pacific is expected to witness the highest growth during the forecast period owing to owing to surge in demand for minimally invasive procedures, rise in cardiovascular disorders and rise in healthcare reforms regarding cardiovascular disease. In addition, the increasing awareness about aortic aneurysm procedures and available stent grafts is anticipated to contribute toward the growth of the aortic aneurysm repair market in Asia-Pacific.‐¯

Competition Analysis

Competitive analysis and profiles of the major players in the aortic aneurysm repair such as Medtronic plc, Artivion, Inc, Terumo Corporation, W. L. Gore and Associates, Inc., MicroPort Scientific Corporation, Cook Group Inc, Endologix LLC, Bentley InnoMed GmbH, Cordis Corporation and Braile Biomédica S.A. The key players have adopted strategies such as product launch, product approval and innovation to enhance their product portfolio.‐¯

Recent Approvals in the Aortic Aneurysm Repair Market

- In May 2023, Terumo Aortic, a leading manufacturer of medical devices and supplies, received the US Food and Drug Administration (FDA) approval of the Relay Pro Thoracic Stent-Graft device for the treatment of dissection and transection in the United States.

- In May 2022, W. L. Gore & Associates (Gore), a global materials science company, received the U.S. Food and Drug Administration (FDA) approval for GORE TAG Thoracic Branch Endoprosthesis (TBE) for the endovascular repair of lesions of the descending thoracic aorta, while maintaining flow into the left subclavian artery (LSA), in patients that are at high risk for LSA debranching procedures and have appropriate anatomy.‐¯

- In January 2023, MicroPort Endovascular MedTech, a subsidiary of MicroPort Scientific Corporation, received registration approval from the Ministry of Food and Drug Safety of Korea (MFDS) for its independently developed Minos® Abdominal Aortic Stent-Graft and Delivery System (Minos Stent Graft System). This is the first time the Minos Stent Graft System has received marketing approval in an overseas market in Asia.

Recent Launches in the Aortic Aneurysm Repair Market

- In April 2021, MicroPort Endovascular MedTech, a subsidiary of MicroPort Scientific Corporation, announced the launch/ first implantation of Castor Aortic Branched Stent-Graft and Delivery System, successfully completed in Italy.

- In May 2021, Endologix LLC, a global medical device company, dedicated to improving patients’ lives with innovative interventional treatments for vascular disease, announced the first implant of its ALTO Abdominal Stent Graft in Canada following recent approval from Health Canada.

Recent Acquisition in the Aortic aneurysm repair market

- In November 2019, Terumo Corporation announced acquisition of Aortica Corporation, a U.S.-based company dedicated to advancing the science of personalized vascular therapy. Aortica has developed an automated case planning software known as‐¯AortaFit, designed to precisely match fenestrations on an endograft with the unique locations of each individual patient’s branch arteries during Fenestrated Endovascular Aortic Repair (FEVAR). This acquisition will Support Continued Growth of Its Vascular Graft Business and Contribute to Personalised Aortic Therapy.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aortic aneurysm repair market analysis from 2022 to 2032 to identify the prevailing aortic aneurysm repair market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aortic aneurysm repair market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aortic aneurysm repair market trends, key players, market segments, application areas, and market growth strategies.

Aortic Aneurysm Repair Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.8 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 226 |

| By Product Type |

|

| By Procedure Type |

|

| By Region |

|

| Key Market Players | Cook Group Inc, Braile Biomédica S.A., Bentley InnoMed GmbH, Artivion, Inc., Medtronic plc, MicroPort Scientific Corporation, Endologix Inc., W. L. Gore & Associates, Inc., Terumo Corporation, Cordis Corporation |

Analyst Review

The demand for efficient and high-quality devices for the treatment of aortic aneurysm is significantly high, which is expected to offer profitable opportunities for the expansion of the market. Moreover, a rise in awareness among the people regarding aneurysm repair and replacement procedures is anticipated to boost the market growth.

Increase in incidence of diseases such as hypertension and atherosclerosis attributing to aortic aneurysm in the population of developed as well as developing regions has largely contributed toward the revenue growth in 2022 and is expected to maintain this trend throughout the forecast period. Moreover, market players have invested in the development of technologically advanced devices with increased clinical indications and improved efficacy and quality, which is expected to drive the growth of the market.

In addition, there has been a surge in trend toward minimally invasive aortic aneurysm repair procedures, which can offer benefits such as reduced recovery time and fewer complications compared to traditional open-heart surgery. Endovascular Aortic Aneurysm Repair (EVAR), Branched Thoracic Endovascular Aneurysm Repair (B-TEVAR) are examples of a minimally invasive procedure that is gaining traction in the market.

Moreover, the aortic aneurysm repair market has become increasingly competitive, with a growing number of companies developing new treatments and technologies. Furthermore, North America accounted for the largest share in terms of revenue in 2022, owing to advancement in technology, increase in number of endovascular surgical procedures carried out, and upsurge in number of key players offering advanced stent grafts.

However, Asia-Pacific is anticipated to witness notable growth owing to high prevalence of aging population, growing adoption of minimally invasive procedures, surge in prevalence of hypertension and atherosclerosis cases, and rise in awareness regarding early diagnosis and treatment.

Aortic aneurysm repair involves medical procedures aimed at treating and managing these abnormalities. Surgical repair typically involves replacing the weakened section of the aorta with a synthetic graft, while endovascular repair involves the insertion of a stent graft to reinforce the weakened area.?

The major factor that fuels the growth of the aortic aneurysm repair market are Rise in prevalence of Aortic Aneurysms , increase in demand for minimally invasive procedures and increase in product approvals for aortic aneurysm devices drive the growth of the global chronic kidney disease treatment market.

Top companies such as Medtronic plc , Artivion, Inc,? Terumo Corporation, W. L. Gore and Associates, Inc., MicroPort Scientific Corporation held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The aortic stent-grafts segment is the most influencing segment in aortic aneurysm repair market owing to increase in adoption for aortic aneurysm repair surgeries. Moreover, the ongoing advancements in stent graft technology and increasing adoption of endovascular techniques contribute to the segment growth.

The base year is 2022 in aortic aneurysm repair market.

The forecast period for aortic aneurysm repair market is 2023 to 2032

The market value of aortic aneurysm repair market in 2032 is $5,790.74 million

The total market value of aortic aneurysm repair market is $3,193.87 million in 2022.

Loading Table Of Content...

Loading Research Methodology...