API Banking Market Research, 2032

The global API banking market was valued at $24.7 billion in 2022, and is projected to reach $217.3 billion by 2032, growing at a CAGR of 24.7% from 2023 to 2032.

Application programming interface (API) banking refers to the use of APIs by banks and financial institutions to provide access to their systems and services to external developers, businesses, and third-party applications. API enables secure and standardized communication and integration between different software systems, allowing seamless data exchange and functionality integration. Furthermore, it has revolutionized the financial industry by enabling faster innovation, improved customer experiences, and enhanced collaboration between banks and FinTech companies. Moreover, it has opened up new opportunities for developers and businesses to leverage banking services and data to create innovative products and services.

The rapid digital transformation in the banking and financial services industry is a major driver of the API banking industry. Banks are increasingly adopting API to enable seamless integration with third-party applications, allowing them to offer innovative digital services and enhance customer experience. Furthermore, open banking regulations are fueling the adoption of API banking. These regulations mandate banks to open up their customer data and payment infrastructure through APIs, fostering competition, innovation, and collaboration between traditional banks and FinTech startups. In addition, enhanced customer experience significantly accelerated the growth of the API banking market share. API enables banks to provide personalized and tailored services to their customers. By leveraging API, banks can integrate their systems with various applications, including mobile banking apps, personal finance management tools, and other FinTech services. This integration allows for a seamless and convenient user experience, improving customer satisfaction and loyalty.

However, regulatory compliance and security concerns are significant barriers to API banking market growth. On the contrary, technological advancements, such as cloud computing, big data analytics, and artificial intelligence (AI), have played a crucial role in driving the growth of API banking market. Further, changing customer expectations and preferences are expected to provide lucrative growth opportunities for the API banking market.

The report focuses on growth prospects, restraints, and trends of the API banking market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the API banking market outlook.

Segment Review

The API banking market is segmented into component, deployment, enterprise size, and region. By component, the market is differentiated into solution and service. Depending on deployment, it is fragmented into on-premise and cloud. The enterprise size segment is divided into large enterprises and small- & medium-sized enterprises. Region wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

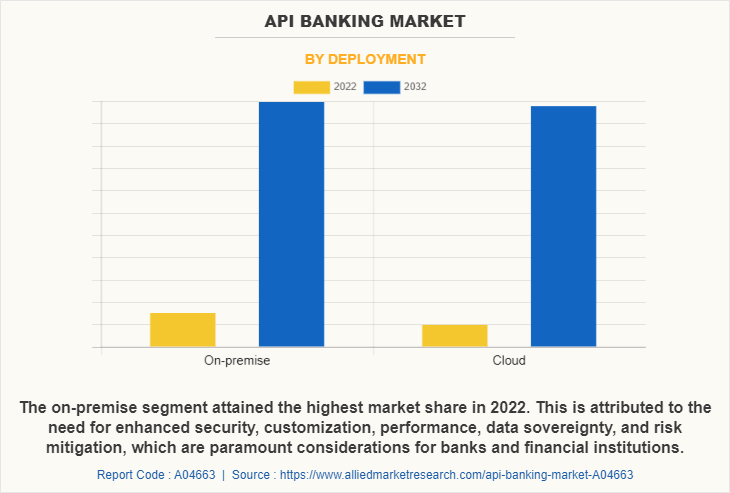

By deployment, the on-premise segment acquired a major share in 2022. This is attributed to the fact that it offers greater customization options and flexibility compared to cloud-based alternatives. Banks can tailor the solution to meet their specific requirements and integrate it seamlessly with their existing infrastructure, legacy systems, and internal processes. This level of customization allows banks to maintain their unique workflows, business rules, and customer experiences while leveraging the benefits of API banking.

However, the cloud segment is attributed to be the fastest-growing segment during the forecast period. This is attributed to the fact that it offers scalability and flexibility, allowing banks and financial institutions to efficiently handle varying workloads and unpredictable traffic patterns. With API running on cloud infrastructure, banks can easily scale up or down their resources based on demand. Furthermore, cloud-based API banking facilitates seamless integration with third-party systems, FinTech applications, and partner platforms.

Region wise, North America dominated the market in 2022. This was attributed to the digitization of banking, regulatory initiatives, FinTech partnerships, and customer-centric solutions. Companies in this region are adopting strategies such as API marketplaces, developer outreach programs, standardization efforts, and secure API management to capitalize on the opportunities offered by this evolving landscape. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the initiatives taken by regulatory authorities in Asia-Pacific, such as the Monetary Authority of Singapore (MAS) and the Reserve Bank of India (RBI), to promote open banking and encourage the use of API in the financial sector. These regulations have facilitated the development of API banking services and increased market adoption.

The key players operating in the API banking market include Infosys Limited, IBM Corporation, BankProv, FidyPay, Razorpay, Google LLC, Oracle Corporation, Salesforce, Inc., SAP SE, and Cloud Software Group, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the API banking industry.

Country-specific Statistics & Information

API drives innovation within the banking industry by enabling the creation of new products and services. Banks can leverage APIs to build ecosystems and platforms that allow developers to extend the functionality of their core banking systems. For instance, in April 2021, the U.S.-based API brokerage platform DriveWealth partnered with Plaid to speed up the funding of online investing accounts. DriveWealth’s API provides its 90 clients, including FinTechs and financial institutions, with the underlying infrastructure to offer fractional share trading and robo-advisory products to their end users. Plaid’s API connects with 4,000 financial services clients, letting consumers link their financial accounts to aggregate their financial data in one place, ease authentication, and initiate payments.

In addition, traditional banks are collaborating with FinTech companies by providing them access to their APIs. These partnerships enable banks to leverage the agility and innovation of FinTechs while offering FinTechs access to the bank's customer base and infrastructure. Such collaborations foster a mutually beneficial ecosystem and drive growth for both parties. For instance, in April 2022, the FinTech API platform FidyPay partnered with Yes Bank to extend digital facilitation to a wide range of businesses, including SMEs, FinTechs, and start-ups. Through this partnership, FidyPay enables a seamlessly connected banking experience for Yes Bank's customers.

The COVID-19 pandemic acted as a catalyst for the API banking market size. It accelerated digital transformation, increased reliance on remote banking, fostered open banking initiatives, improved security measures, and drove collaboration between banks and FinTech startups. These factors collectively contributed to the growth and expansion of the API banking market, as banks recognized the importance of leveraging API to enhance customer experience, streamline operations, and drive innovation in the post-pandemic era.

Top Impacting Factors

Open Banking Initiatives

Open banking regulations, such as the European Union's Revised Payment Services Directive (PSD2) and similar initiatives in other regions, are fueling the adoption of API banking. These regulations mandate banks to open up their customer data and payment infrastructure through API, fostering competition, innovation, and collaboration between traditional banks and FinTech startups. Furthermore, API enables third-party developers and FinTech companies to access banking data securely, develop new financial products & services, and offer personalized experiences to customers.

For instance, under PSD2, banks are required to provide access to customer account information and payment initiation services to authorized third-party providers (TPPs). This has led to the emergence of various innovative services, such as account aggregation apps, payment initiation services, and personal financial management tools, all facilitated by API integrations. Therefore, these factors have been a significant driver of the API banking market growth.

Digital Transformation and Customer Experience

Banks are investing heavily in digital transformation to meet evolving customer expectations and stay competitive. API plays a crucial role in this transformation by enabling banks to create a seamless omnichannel experience for customers. Through API integration, banks can offer services such as real-time balance updates, transaction history, fund transfers, and personalized recommendations across multiple channels, including mobile apps, websites, and other digital touchpoints.

For instance, banks can integrate their systems with payment gateways, enabling customers to initiate transactions directly from mobile banking apps or e-commerce platforms. Moreover, API facilitates the integration of banking services into third-party applications, such as ride-hailing apps offering in-app payments or e-commerce platforms providing instant financing options. Therefore, these factors have significantly contributed to the growth of the API banking market.

Technological Advancements

Rapid advancements in technology, such as cloud computing, big data analytics, and artificial intelligence (AI), have played a crucial role in driving the growth of the API banking market. These technologies enable banks and financial institutions to leverage API to streamline their operations, enhance customer experiences, and create new digital services. For instance, API enables banks to integrate their systems with third-party applications and platforms, allowing customers to access financial services seamlessly. This integration has led to the emergence of innovative services, such as payment initiation, account aggregation, and identity verification. These advancements not only improve customer convenience but also create new revenue streams for banks.

Enhanced Security and Compliance

API provides a secure and controlled way of sharing data and accessing banking services. Banks can implement robust authentication and authorization mechanisms through API, ensuring that only authorized entities can access sensitive customer information or initiate transactions. This strengthens security measures and reduces the risk of fraudulent activities.

In addition, API helps banks comply with regulatory requirements, such as data privacy and security regulations. By exposing standardized API, banks can ensure that customer data is shared in a controlled and compliant manner, with clear consent and data access controls in place. Thus, enhanced security provided by API notably contributes toward the growth of the global market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the API banking market analysis from 2022 to 2032 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the API banking market segmentation assists to determine the prevailing API banking market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as API banking market trends, key players, market segments, application areas, and market growth strategies.

API Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 217.3 billion |

| Growth Rate | CAGR of 24.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 230 |

| By Component |

|

| By Deployment |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | SAP SE, Razorpay, FidyPay, Oracle Corporation., Salesforce, Inc., IBM Corporation, Infosys Limited, BankProv, Cloud Software Group, Inc., Google LLC |

Analyst Review

API enables banks to provide enhanced customer experiences by integrating banking services into customers' everyday lives. Banks are investing in developer support resources and comprehensive API documentation to facilitate seamless integration and encourage developers to use their API. They provide software development kits (SDKs), API documentation portals, and developer forums to assist developers in building applications using their API. This approach improves developer experience and accelerates the adoption of API banking services. Furthermore, to foster innovation and attract developers, banks are organizing hackathons, developer challenges, and API sandboxes. These programs allow developers to experiment with APIs, create new applications, and showcase their solutions. For instance, OCBC Bank in Singapore organizes an annual API hackathon called "APIfication," which encourages developers to build innovative banking applications using the bank's APIs.

In addition, several banks have launched API marketplaces to offer a range of APIs to developers and FinTech firms. These marketplaces provide a platform for collaboration, innovation, and co-creation of new banking services. For instance, DBS Bank in Singapore launched the DBS Developers platform, which offers over 200 APIs for developers to build innovative banking solutions.

The COVID-19 outbreak has had a positive impact on the API banking industry. The pandemic forced banks to accelerate their digital transformation efforts to ensure business continuity and meet changing customer needs. As physical branches faced restrictions and people increasingly relied on digital channels, banks needed to enhance their digital capabilities. API played a pivotal role in enabling faster development and integration of digital services, such as mobile banking apps, payment gateways, and online account access.

The API banking market is fragmented with the presence of regional vendors such as Infosys Limited, IBM Corporation, BankProv, FidyPay, Razorpay, Google LLC, Oracle Corporation, Salesforce, Inc., SAP SE, and Cloud Software Group, Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With the increase in awareness & demand for API banking across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

At a CAGR of 24.7%, the API Banking Market will expand from 2023 - 2032.

By the end of 2032, the market value of API Banking Market will be $217,286.59 million.

Open banking initiatives Digital transformation and customer experience Technological advancements Enhanced security and compliance

The key players operating in the API banking market include Infosys Limited, IBM Corporation, BankProv, FidyPay, Razorpay, Google LLC, Oracle Corporation, Salesforce, Inc., SAP SE, and Cloud Software Group, Inc.

The API banking market is segmented into component, deployment, enterprise size, and region. By component, the market is differentiated into solution and service. Depending on deployment, it is fragmented into on-premise and cloud. The enterprise size segment is divided into large enterprises and small- & medium-sized enterprises. Region wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...