Application Outsourcing Market Research, 2032

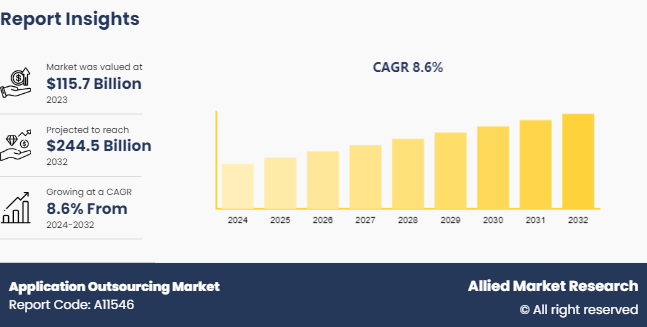

The global application outsourcing market size was valued at $115.7 billion in 2023, and is projected to reach $244.5 billion by 2032, growing at a CAGR of 8.6% from 2024 to 2032. Application outsourcing allows many companies to lower the total cost of ownership and leverage the technical expertise of an outside provider. It is the process of hiring a service provider to develop or enhance a piece of software for business use. Developed software must meet certain quality and infrastructure standards to deliver value to an organization. Application outsourcing management involves evaluating vendors to ensure they are supplying the expected solution or service and fulfilling business requirements.

Key Takeaways

The application outsourcing market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major application outsourcing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The global application outsourcing market growth is rising significantly due to several factors such as the need to innovate and expand business processes, growth in digital transformation, and increased adoption of advanced code analysis software. However, the lack of skilled experts in some regions and unawareness of technology act as restraints for the application outsourcing market. In addition, an increase in spending on IT infrastructure in some of the developing countries is anticipated to provide ample opportunities for market growth during the forecast period.

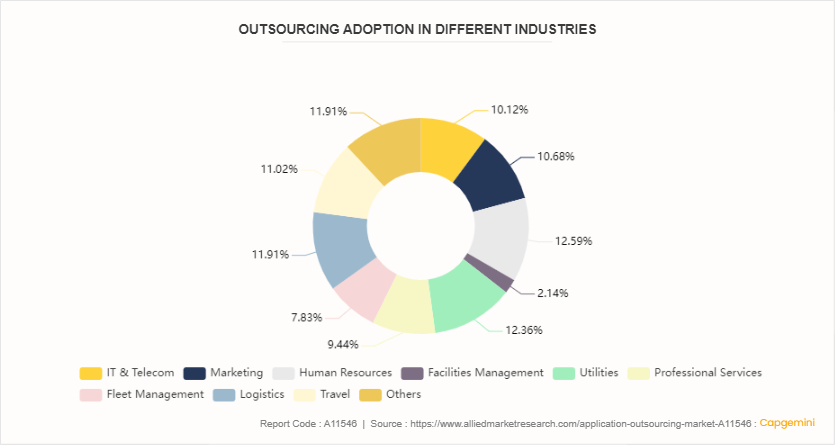

Outsourcing Adoption in Different Industries

Outsourcing services are widely adopted by various industries to eliminate the workload and enhance product efficiency. Of those companies already engaged in some application outsourcing activity, eApplication systems management turned out to be the most commonly outsourced application function; 51% currently outsource this area of spending. According to the article published by Capgemini in 2021, IT management & infrastructure is the most outsourced business function (49%), followed by payroll (39%) and logistics (32%). Finance & Accounting (18%) and legal (13%) joined application (12%) as the three least outsourced business areas.

FIGURE 1: INDUSTRIES MANAGED BY OUTSOURCE SERVICES (%)

Market Segmentation

The application outsourcing market size is segmented into type, enterprise size, end–user, and region. On the basis of type, the market is divided into application development service, application maintenance service, independent software testing service, and others. On the basis of enterprise size, the market is bifurcated into large enterprises and small & medium-sized enterprises. On the basis of end user, the market is classified into automotive, government, consumer electronics, IT & telecom, BFSI, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/Country Market Outlook

The global application outsourcing market has experienced substantial growth, with North America playing a pivotal role in this expansion. North America leads the market, propelled by robust technological infrastructure, significant investments in smart technologies, and stringent safety regulations that encourage the integration of advanced application outsourcing solutions. Europe follows closely, with countries such as Germany and the UK at the forefront, leveraging application outsourcing solutions. In the Asia-Pacific region, rapid digitalization and increase in awareness of smart retail solutions drive the adoption of application outsourcing solutions, particularly in China and Japan, where government initiatives support technological advancements.

In October 2023, the UK government raised $6.09 billion investment framework for public sector organizations to purchase outsourced contact center and business process services over the next four years.

In January 2023, the Japanese government introduced an additional scheme for IT application by government organizations and made online application of IT software possible.

Industry Trends

In February 2024, the UK government launched two tenders for cloud services that could jointly raise $9.5 billion in investment under framework agreements. In a separate application initiative, the UK government is seeking a tech firm to help public policies.

In November 2023, the Government of Canada allocated $669, 650 million for the contract that aims to explore efficient utilization and investment of tax dollars. This move comes as the Canadian government's spending on outsourcing has surged, contrary to the Liberals' 2015 pledge to reduce reliance on external consultants.

Competitive Landscape

The major players operating in the application outsourcing market include Unisys Corporation, Wipro Limited, Hewlett-Packard Development Company, L.P., CGI Group, Dell Inc., Tata Consultancy Services, iGATE, Fujitsu Ltd., IBM Corporation.

Recent Key Strategies and Developments

In July 2023, NTT DATA launched an outsourcing service for security management (MDR service) to prevent incidents and minimize damage when incidents occur.

In March 2023, Rimini Street, Inc. launched Rimini ONE, its outsourcing service program designed to offer a comprehensive set of unified integrated services to run, manage, support, customize, configure, and optimize enterprise applications and software.

Key Sources Referred

GEP

Asian Development

Sourcing Industry Group

Harvard Business Review

KPMG

Key Benefits for Stakeholders

This report provides a quantitative analysis of the application outsourcing industry segments, current trends, estimations, and dynamics of the application outsourcing market analysis from 2023 to 2032 to identify the prevailing application outsourcing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the application outsourcing market forecast segmentation assists to determine the prevailing application outsourcing market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global application outsourcing Market share Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional and global application outsourcing market trends, key players, market segments, application areas, and market growth strategies.

Application Outsourcing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 244.5 Billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Enterprise Size |

|

| By End-User |

|

| By Region |

|

| Key Market Players | IBM Corporation, Dell Inc., Fujitsu Ltd., Hewlett-Packard Development Company, Unisys Corporation, Wipro Limited, iGATE, CGI Group, Accenture plc, Tata Consultancy Services |

The Application Outsourcing market is evolving rapidly, driven by advancements in technology, changing business needs, and the increasing complexity of IT environments.

Application maintenance service is the leading type of Application Outsourcing Market.

North America is the largest regional market for Application Outsourcing in 2023.

$244.5 billion is the estimated industry size of Application Outsourcing in 2032.

Unisys Corporation, Wipro Limited, Hewlett-Packard Development Company, L.P., CGI Group, Dell Inc., Tata Consultancy Services, iGATE, Fujitsu Ltd., IBM Corporation are the top companies to hold the market share in Application Outsourcing.

Loading Table Of Content...