Aquaculture Equipment Market Research, 2033

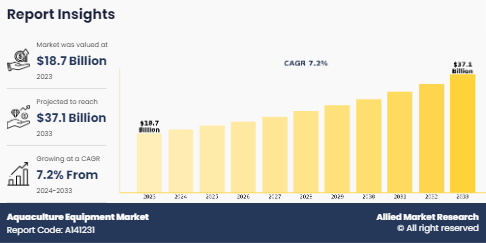

The global Aquaculture Equipment Market was valued at $18.7 billion in 2023 and is projected to reach $37.1 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033.

Aquaculture equipment refers to an advanced fish farming technology designed to harvest marine organizations such as fish, crustaceans, mollusks, and aquatic plants. This equipment is essential for creating and maintaining optimal conditions for the growth and harvesting of these organisms in various aquaculture systems, which can include ponds, tanks, cages, and raceways.

The aquaculture equipment market is expected to witness notable growth during the forecast period, owing to the rise, expansion, and growth of the aquaculture industry. Moreover, the surge in demand for seafood drives the aquaculture equipment market outlook. Furthermore, an increase in investment in the establishment and modernization of aquaculture feeding systems and farms is projected to shape the future of fish farming technology. However, the concerns about food safety in aquaculture are acting as one of the prime factors that restrain the market growth. Further, the rise in government measures is projected to provide a lucrative opportunity to expand the market during the forecast period.

Segment Overview

The aquaculture equipment market forecast is segmented into type, end users, distribution channel, and region.

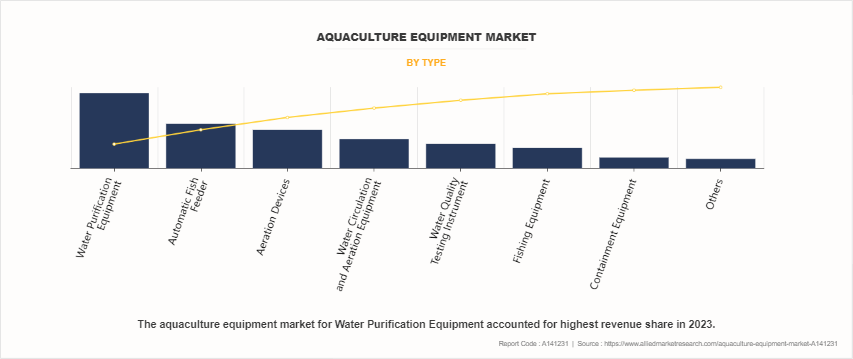

By type, the aquaculture equipment market share is divided into water purification equipment, aeration devices, water circulation and aeration equipment, automatic fish feeders, fishing equipment, containment equipment, water quality testing instruments, and others. The water purification equipment segment accounted for the major share in the year 2023 and is expected to dominate the market during the forecast period.

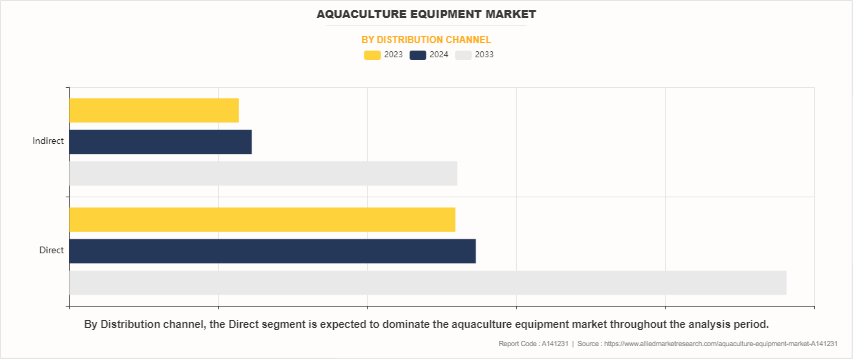

By distribution channel, the aquaculture equipment industry report is bifurcated into direct and indirect. The direct distribution channel dominated the market, owing to the high sales across various customer segments. Direct sales allow manufacturers to establish strong relationships with customers, ensuring tailored solutions and enhanced customer service.

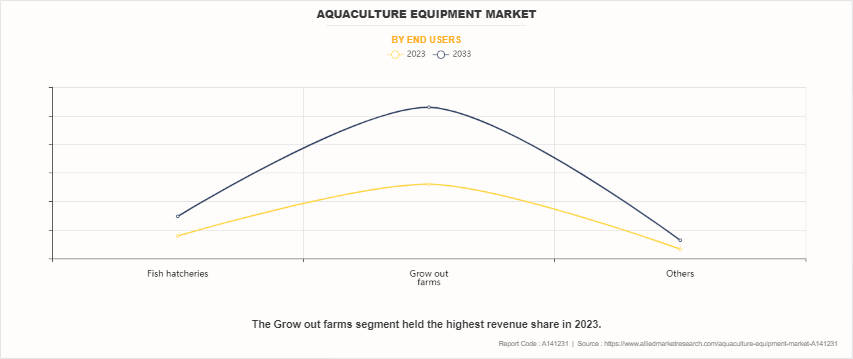

By end user, the aquaculture equipment sector analysis is classified into fish hatcheries, grow-out farms, and others. The grow-out farms dominated the industry in the year 2023, owing to the increasing demand for seafood and the growing trend of sustainable aquaculture practices. Grow-out farms benefit from advancements in aquaculture technology, enabling higher productivity and efficient resource management. The rising consumer preference for farmed fish, which provides a stable supply chain, has further contributed to the aquaculture equipment market growth.

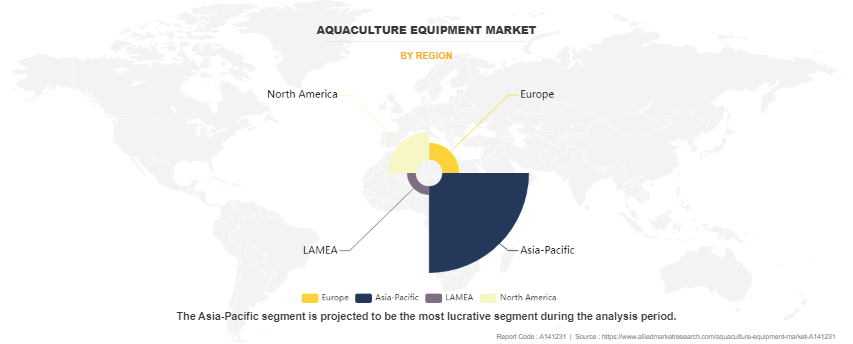

Region-wise, the aquaculture equipment market data is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific, Specifically China accounted major share in the aquaculture equipment market opportunity within the year of 2023, owing to the countrys substantial investments in aquaculture infrastructure and technology. China's vast coastline and freshwater resources, combined with a rising domestic demand for seafood, have driven the growth of aquaculture practices. Furthermore, government initiatives promoting sustainable aquaculture and the modernization of farming techniques have significantly boosted the market in this region.

Competitive Analysis

The aquaculture equipment market share by companies is analyzed across Aquaculture Equipment Ltd, Aquaculture Systems Technologies, LLC, Norfab Equipment Ltd., Sino Aqua Corporation, Faivre ETS, Xylem, Baader Group, CPI Equipment CA, Pioneer Group, PRAqua, and other top players. Market players have adopted various strategies, such as product launch, collaboration & partnership, joint venture, and acquisition, to expand their foothold in the aquaculture equipment market.

Country Analysis

In North America aquaculture equipment market size by country is dominated by the U.S.which accounted for a major share of the market in 2023, owing to a diverse range of aquaculture practices, including freshwater and marine fish farming. Furthermore, the aquaculture equipment for the U.S. market has experienced significant growth due to increasing consumer demand for sustainable seafood and innovations in aquaculture technology. Additionally, government support through grants and research initiatives has bolstered the development of advanced aquaculture systems, making the U.S. a key player in the market.

In Europe, Germany plays a crucial role in the aquaculture equipment market insights, characterized by its focus on sustainability and technological advancement. The country is known for its stringent regulations regarding environmental protection, driving the demand for eco-friendly aquaculture solutions. With a growing emphasis on local seafood production and advancements in recirculating aquaculture systems (RAS), Germany has positioned itself as a leader in innovative aquaculture practices within Europe.

In Asia-Pacific, China is the largest player in the aquaculture equipment market, accounting for a significant share in 2023. The country's vast aquaculture industry benefits from extensive coastal and freshwater resources, facilitating the production of a wide variety of fish and shellfish. Driven by strong domestic demand for seafood and government initiatives promoting sustainable practices, China continues to lead in the adoption of advanced aquaculture technologies, ensuring high productivity and efficiency.

In Latin America, Brazil and Chile are significant contributors to the aquaculture equipment market. Brazil is expanding its aquaculture sector, focusing on tilapia and shrimp farming, driven by rising local and export demands. In contrast, Chile, known for its salmon farming industry, has invested heavily in technology and sustainable practices, making it a leader in aquaculture in the region. Both countries benefit from favorable climatic conditions and a growing awareness of sustainable seafood practices, enhancing the market landscape in Latin America.

Top Impacting Factors

The global aquaculture equipment industry is growing due to rising demand for sustainable seafood and advancements in technology that improve efficiency. Increased consumer awareness of the benefits of farmed seafood supports market growth, while the emphasis on eco-friendly practices presents further opportunities. However, intense competition creates pricing pressures, which can hinder the market, particularly for smaller vendors. Conversely, the expansion of global fish consumption and investments in aquaculture infrastructure in developing regions are expected to drive significant growth. As countries aim to enhance food security, the adoption of advanced aquaculture systems is likely to increase.

Recent Key Developments/ Strategies

Aquaculture Equipment Ltd, Aquaculture Systems Technologies, LLC, Xylem, Baader Group, and CPI Equipment CA are the top 5 aquaculture equipment market companies holding a prime share in the aquaculture equipment market overview. Top market players have adopted various strategies, such as product launch, development, and partnership, to expand their foothold in the aquaculture equipment growth projections.

- In February 2022, Baader acquired Skaginn 3X, an Icelandic equipment manufacturer, in 2022. This acquisition allows Baader to enhance its offerings in pelagic and whitefish processing solutions, as well as subchilling, thawing, freezing, and co-product handling for the seafood, poultry, and meat sectors. With this integration, Baader positions itself as a comprehensive solution provider for all fish species.

- In April 2021, Baader launched the BAADER 608, the latest in their BAADERING technology, designed for improved efficiency, hygiene, and user-friendliness. This new machine offers a larger capacity, a higher yield, and better process reliability. Its innovative features include a smooth, easy-to-clean interior, automatic priming, and a touchscreen control panel. The BAADER 608 is aimed at enhancing food quality and sustainability by maximizing resource efficiency and reducing downtime.

- In February 2022, PR Aqua announced to design and supply of equipment for Upward Farms' new 250,000 sq. ft. RAS facility in Luzerne County, PA. The facility will produce 160 MT of hybrid striped bass annually, using fish nutrients to fertilize leafy greens sold at Whole Foods.

- In March 2022, CPI Equipment CA collaborated with Moleaer, a nanobubble technology company, and Grieg Seafood BC Ltd. to pioneer a sustainable solution for semi-enclosed salmon farming. The project, known as the CO²L Flow system, significantly reduced oxygen use by 75% using Moleaers nanobubble technology. This innovation benefits fish health and welfare while minimizing environmental impact.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aquaculture equipment market analysis from 2023 to 2033 to identify the prevailing aquaculture equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aquaculture equipment market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global aquaculture equipment market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global aquaculture equipment market trends, key players, market segments, application areas, and market growth strategies.

Aquaculture Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 37.1 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 315 |

| By Type |

|

| By End Users |

|

| By Distribution channel |

|

| By Region |

|

| Key Market Players | PRAqua, CPI Equipment CA, Pioneer group, Faivre ETS, Baader Group, Norfab Equipment Ltd., Sino Aqua Corporation, Aquaculture Systems Technologies, LLC, Xylem, Aquaculture Equipment Ltd |

Analyst Review

Aquaculture equipment encompasses the tools, machinery, and systems used in the cultivation of aquatic organisms such as fish, shellfish, and seaweed. This includes tanks, cages, feeding systems, aeration devices, water quality monitors, and biosecurity equipment. They are designed to optimize growth, health, and sustainability. Aquaculture equipment supports efficient and environmentally responsible farming practices. It is crucial for maintaining water quality, ensuring proper nutrition, preventing diseases, and facilitating harvesting and processing in aquaculture operations.

The global aquaculture equipment market is highly competitive, owing to the increase in demand for seafood, driven by population growth and rise in health consciousness. This demand prompts continuous innovation and technological advancements in the industry, leading to the development of sophisticated and efficient equipment. In addition, government support and favorable regulations for sustainable aquaculture practices further intensify competition. Companies are investing heavily in research and development to offer advanced solutions such as automated feeding systems, biosecure containment systems, and IoT-enabled monitoring devices. The presence of numerous players ranging from large multinational corporations to local manufacturers also contributes to the competitive landscape, with each striving to capture market share and expand their global footprint.

Among the analyzed geographical regions, Asia-Pacific exhibits the highest adoption of aquaculture equipment and has been experiencing massive expansion of the market. On the other hand, LAMEA is expected to grow at a faster pace, predicting lucrative growth due to increase in investments in aquaculture infrastructure, favorable government policies, and the rise in demand for seafood. In addition, the region's abundant natural resources and suitable climatic conditions support aquaculture activities, further driving the adoption of advanced equipment and fostering market growth

The market is projected to reach $37.1 billion by 2033, growing at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2033.

The global aquaculture equipment market was valued at $18.7 billion in 2023.

Key drivers include the expansion of the aquaculture industry, increased demand for seafood, and rising investments in the establishment and modernization of aquaculture feeding systems and farms.

Upcoming trends in the global aquaculture equipment market include a strong emphasis on sustainable practices, the integration of smart technology and IoT for real-time monitoring, and enhanced biosecurity measures to protect aquatic species. Additionally, there is rising interest in alternative protein sources, leading to innovative equipment solutions, alongside the development of advanced feeding systems that optimize feed utilization. Finally, increased investment in aquaculture infrastructure in emerging markets is driven by growing seafood demand and food security initiatives.

The top 5 companies are Aquaculture Equipment Ltd, Aquaculture Systems Technologies, LL, Xylem: A leading global water technology company, Xylem, Baader Group, and CPI Equipment CA.

Asia-Pacific is the largest regional market for Aquaculture Equipment

Loading Table Of Content...

Loading Research Methodology...