Aquaculture Market Summary

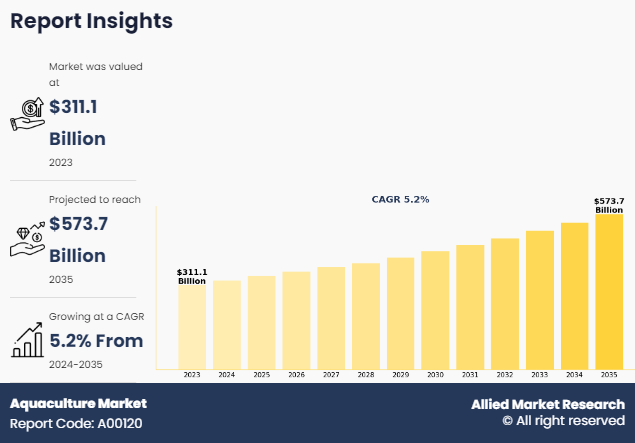

The global aquaculture market size was valued at $311.1 billion in 2023, and is projected to reach $573.7 billion by 2035, growing at a CAGR of 5.2% from 2024 to 2035. The rise in demand for sustainable practices, technology adoption, alternative feeds, land-based aquaculture, value- added products, and transparency have driven the demand for aquaculture industry.

Key Market Trends and Insights

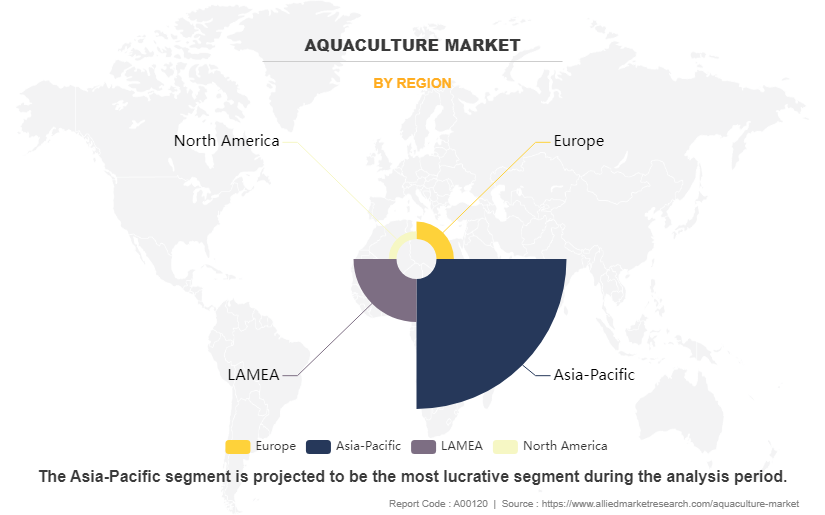

Region wise, North America generated the highest revenue in 2023.

The global aquaculture market share was dominated by the freshwater segment in 2022 and is expected to maintain its dominance in the upcoming years

The mollusk segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2023 Market Size: USD 311.1 Billion

- 2035 Projected Market Size: USD 573.7 Billion

- Compound Annual Growth Rate (CAGR) (2024-2035): 5.2%

- North America: Generated the highest revenue in 2023

According to the Food and Agriculture Organization (FAO), aquaculture, also known as aqua farming, is defined as farming of aquatic organisms such as fin fish, carps, mollusks, crustaceans, and aquatic plants. This farming procedure involves interventions in rearing process to enhance production, such as regular stocking, feeding, and protection from predators. Aquaculture farming involves 580 species that are currently farmed all over the world, representing a wealth of genetic diversity both within and among species. Aquaculture is practiced by some farmers in developing countries and by multinational companies that can hold ownership of the stock being cultivated. Eating fish is part of cultural traditions of many people and in terms of health benefits, it has an excellent nutritional profile. It is a good source of protein, fatty acids, vitamins, minerals, and essential micronutrients.

Key Takeaways

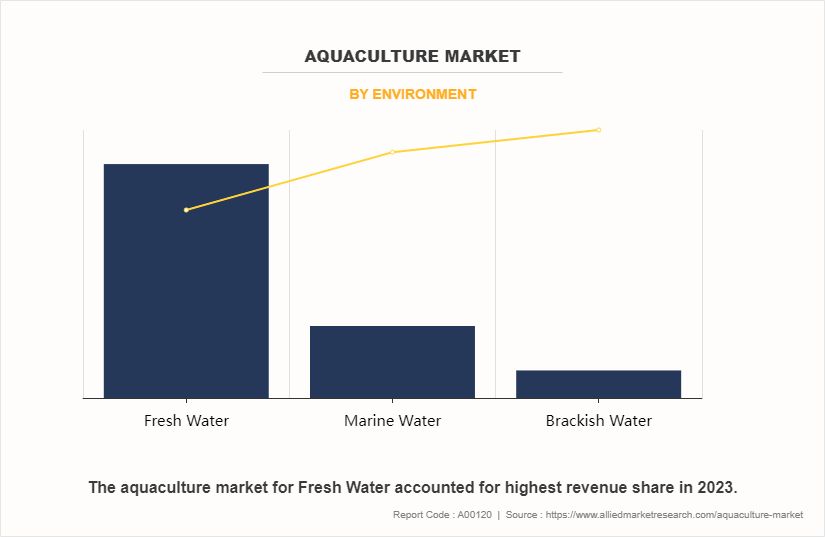

- By environment, the freshwater segment dominated the aquaculture market in 2023.

- By fish type, the mollusk segment dominated the aquaculture market in 2023.

- By region, North America dominated the aquaculture market in 2023.

Market Dynamics

Expansion in Food & Beverage industry

The global food & beverages market has witnessed robust growth in the last few years driven by innovation in food systems, improved logistics, increase in affordability, growth in global trade, and increase in consumer spending. Furthermore, the food & beverages industry has been evolving continuously according to consumer requirements. In addition, demand for convenience and packaged food has increased multifold, owing to consumer preference toward ready-to-eat and cost-effective food. Furthermore, recent years have seen expansion of the food processing industry, which is expected to boost the demand for fast food, which, in turn, is projected to positively impact the demand for meat and seafood around the world. According to aquaculture market trend, all these factors collectively drive the growth of the global aquaculture market.

Rise in fish production to meet food supply

With the global population reaching the 7.8 billion mark, the question of food security is on the rise. To combat this adverse situation, production of fish is given a major boost. Increase in fish production over the years has experienced growth, owing to rise in the fish farming activities along coastal areas. Government support for fish farming also propels growth of the aquaculture market. Effective management plans need to be formulated to increase production of fish and maintain the global food supply. The situation seems more critical for some highly migratory, straddling, and other fishery resources that are exploited solely or partially in the high seas. The United Nations Fish Stocks Agreement that entered into force in 2001 is used as a legal basis for management measures of the high seas' fisheries, which boosts growth of the aquaculture market in the region.

Rise in the act of animal cruelty in animal farms and slaughterhouses

There has been a rise in concern about harsh treatment of farm animals, owing to the overwhelming demand for meat worldwide. According to the United Nations (UN), the number of industrial livestock animals such as pigs, calves, and chicken sent to slaughter each year is equivalent to eight times the human population on the planet. This inhumane treatment of animals has sparked an outrage among various people around the world and has led to rise of institutions that oppose the meat industry. Some prominent organizations such as People for Ethical Treatment of Animals (PETA) and Animal Equality are encouraging people to reduce meat consumption and look for alternative solutions to diet. Graphic videos and photographs are often posted on websites of these organizations, which concerts their claims and makes consumers weary of the meat industry. This badly affects sales of meat products and ultimately acts as a restraint for the meat industry, affecting the aquaculture market growth.

Adoption of veganism

Veganism is the practice of desisting from the use of animal products such as meat and dairy. This is an associated philosophy that rejects the commodity status of animals. This form of diet includes the use of plant-based milk and vegetables for nutrition. Veganism has become very popular in many countries and is particularly popular in the fitness community. A large number of people have adopted a vegan lifestyle as it is said to have health benefits such as cancer prevention, weight loss, and increased energy levels. Adoption of veganism has had a bad effect on sales of seafood and meat products and has been one of the major restraints for seafood, meat, and dairy industries.

Evolution in inland fishing and use of more sustainable technology in aquaculture

New technologies such as recirculating aquaculture systems (RAS) and Aquaponics (growing of both plants and animals together) help increase production and reduce water pollution. This can be more beneficial, if they can be powered by renewable energy and designed to prevent water loss, owing to evaporation. Adopting polyculture aquaculture techniques across the world is expected to decrease water pollution and environmental degradation. Moreover, use of integrated multi-trophic polyculture technology to decrease organic waste in water and thus increase fish production, which is an opportunity for the aquaculture industry. Application of genetic principles to increase production from aquatic animals currently lags far behind that of plant and livestock sectors. Only a small percentage of farmed aquatic species have been subjected to genetic improvement programs, however, biotechnology and genetics can increase production and enhance ecological sustainability. Development of biotechnology in the aquaculture sector is leading to production of healthy and fast-growing animals through environment-friendly means.

Expanding Sustainable Aquaculture to Address Food Security

As the world's population is projected to reach nearly 10 billion by 2050, there is an increasing pressure to enhance food production systems to meet the growing demand for nutritious and sustainable food sources. Moreover, aquaculture presents a promising opportunity to address this challenge by providing a reliable and efficient means of producing protein-rich seafood. Unlike traditional wild fisheries, which face depletion and overexploitation, aquaculture offers the potential for controlled and predictable production of fish, crustaceans, and mollusks in diverse environments, including freshwater, marine, and brackish water systems, whichg provide aquacultre market opportunities.

SEGMENTAL OVERVIEW

The aquaculture market is segmented on the basis of environment, fish type, and region. The environment segment includes marine water, fresh water, and Brackish Water. On the basis of fish type, the market is divided into carps, mollusks, crustaceans, mackerels, mollusk and others. Region wise, it is analyzed across North America (the U.S., Mexico, and Canada), Europe (Russia, Norway, Iceland, and rest of Europe), Asia-Pacific (China, the Philippines, Japan, Indonesia, Vietnam, Australia, and rest of Asia-Pacific), Latin America and MEA.

By Environment

By environment, the freshwater segment dominated the global aquaculture market, registering a CAGR of 5.2% in 2022 and is anticipated to maintain its dominance during the aquaculture market forecast period. Freshwater is naturally present on earth’s surface in the form of ice sheets, glaciers & ice bergs, bogs, ponds, lakes, rivers & streams, and underground as groundwater in aquifers and underground streams. Salmon, trout, and tench are the major fish found in freshwater ecosystems. Almost 95% freshwater aquaculture production is from Asia, with China being the dominant country. Where carp species are most commonly cultured, however, tilapias, catfish, and a few other species are produced in large quantities in the country, thus increasing the aquaculture market share.

Fisheries and aquaculture are governed by fisheries policy in various regions such as China, Bangladesh, and Thailand. For instance, in Bangladesh, the fisheries policy adopted in 1998 included policy for freshwater aquaculture (Section 6.0 of the fisheries policy of 1998) to develop freshwater fish cultivation in the country, which drives the market growth.

By Fish Type

By fish type, the mollusk segment dominated the global aquaculture market, registering a CAGR of 5.2% in 2023 and is anticipated to maintain its dominance during the forecast period. Mollusks are very popular in Europe and Asia-Pacific. They are considered as the most nutritional source of white meat. Their color varies widely with the environment used for their breeding area. For example, in brackish water, sea beams tend to be darker in color with shades of grey and black to blend with the environment. Mollusk is highly valued in Mediterranean and European cuisines for its delicate flavor and firm texture, obtain from fish farming and aqua farming. As consumer demand for seafood has increased globally, particularly for premium species, mollusk has become sought after in international markets, driving aquaculture production.

Moreover, mollusk is well-suited to aquaculture due to its relatively fast growth rate, adaptability to captivity, and tolerance to a wide range of environmental conditions. This makes it an attractive species for aquaculture farmers looking to diversify their operations or enter high-value markets. Mediterranean countries, particularly Greece, Spain, and Turkey, have developed significant aquaculture industries focused on mollusk production. These countries benefit from access to export markets in Europe, North America, and Asia, where mollusk is in demand among consumers and chefs seeking premium seafood products.

By Region

By region, North America dominated the global aquaculture market, registering a CAGR of 5.3% in 2023 and is anticipated to maintain its dominance during the forecast period. The developed countries in North America are enabling market players to opt for advanced aquaculture infrastructure to increase overall productivity and fish quality. Consumer health consciousness is also expected to drive the North America aquaculture market. According to aquaculture market analysis, in both Canada and the U.S., there is a strong institutional support for aquaculture and government commitments to boost industry expansion. In the U.S., for instance, the Department of Commerce recently established an aquaculture policy to promote development of a highly competitive and sustainable aquaculture industry. In addition, the objectives of this 1999 policy include forecast increases in production by 2025 and increase in aquaculture employment from 180,000 to 600,000 people. This is driven by the U.S. need to meet increase in seafood demands and help offset the $6 billion annual trade deficit in edible seafood products.

Competitive Analysis

Major companies profiled in the aquaculture market report include Cermaq Group AS (Mitsubishi Corporation), Cooke Aquaculture Inc., Grupo Farallon Aquaculture, Leroy Sea Food Group, Marine Harvest ASA, P/F Bakkafrost, Selonda Aquaculture S.A., Stolt Sea Farm, Tassal Group Limited, and Thai Union Group Public Company Limited.

The market for aquaculture is anticipated to expand due to a rise in demand for seafood, increased awareness about its health benefits and nutritional content, and expansion of aquaculture in developing regions. In addition, factors such as innovation, collaboration, product launch, partnership and expansion are opportunistic for market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aquaculture market analysis from 2023 to 2035 to identify the prevailing aquaculture market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aquaculture market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aquaculture market trends, key players, market segments, application areas, and market growth strategies.

Aquaculture Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 290 |

| By Environment |

|

| By Fish Type |

|

| By Region |

|

| Key Market Players | NIPPON SUISAN KAISHA, LTD., LEROY SEAFOOD GROUP ASA (LEROY), COOKE AQUACULTURE, MARINE HARVEST ASA (MARINE), THAI UNION GROUP PLC (THAI UNION), ALPHA GROUP LTD, CERMAQ GROUP AS (MITSUBISHI CORPORATION), AQUACULTURE TECHNOLOGIES ASIA LIMITED, TASSAL GROUP LIMITED (TASSAL), P/F BAKKAFROST (BAKKAFROST) |

Analyst Review

The aquaculture market holds a substantial scope for global growth. The market, which is in its growth stage, is expected to contribute significantly to the global market in the next six years. With governments promoting the fish-farming industry, use of new technologies and development of infrastructure in the aquaculture industry drives the market. A large number of players are stepping into the aquaculture market with innovative techniques. Rise in concern of consumers around the world regarding the intake of protein also drives the market for aquaculture companies. The resultant water pollution and change in climatic conditions across the globe disturbs aquatic ecosystem, which presents a huge hurdle for the aquaculture industry to overcome.

According to CXOs, the increasing global demand for seafood presents a lucrative opportunity for aquaculture companies to expand their operations and capture market share. As consumers and regulators increasingly prioritize sustainability, aquaculture offers a more environmentally friendly alternative to wild-caught seafood, positioning companies that adopt sustainable practices for long-term success. The advances in technology, including genetics, feed formulation, and water management, present opportunities to improve efficiency, productivity, and profitability in aquaculture operations.

Moreover, addressing environmental concerns such as water pollution, habitat destruction, and disease management is crucial for maintaining the sustainability and reputation of aquaculture operations. Compliance with evolving regulations related to environmental stewardship, food safety, and animal welfare requires ongoing investment in monitoring, reporting, and compliance programs.

The global aquaculture market size was valued at $311.1 billion in 2023, and is projected to reach $573.7 billion by 2035

The global Aquaculture market is projected to grow at a compound annual growth rate of 5.2% from 2024 to 2035 $573.7 billion by 2035

The key players profiled in the reports includes NIPPON SUISAN KAISHA, LTD., LEROY SEAFOOD GROUP ASA (LEROY), ALPHA GROUP LTD, MARINE HARVEST ASA (MARINE), THAI UNION GROUP PLC (THAI UNION), CERMAQ GROUP AS (MITSUBISHI CORPORATION), P/F BAKKAFROST (BAKKAFROST), AQUACULTURE TECHNOLOGIES ASIA LIMITED, COOKE AQUACULTURE, TASSAL GROUP LIMITED (TASSAL)

By region, North America dominated the global aquaculture market, registering a CAGR of 5.3% in 2023 and is anticipated to maintain its dominance during the forecast period.

Rise in Global Demand for Seafood, Technological Advancements and Innovations

Loading Table Of Content...

Loading Research Methodology...