ARM Microcontrollers Market Research, 2032

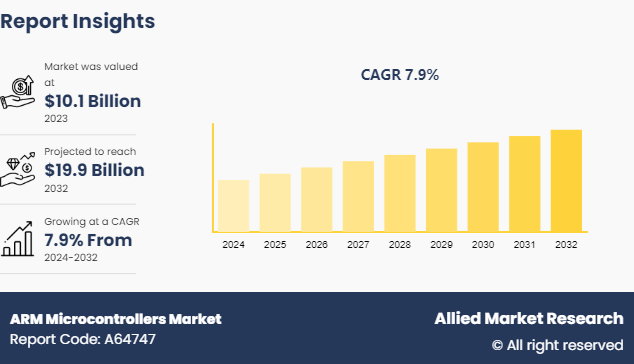

The Global ARM Microcontrollers Market was valued at $10.1 billion in 2023, and is projected to reach $19.9 billion by 2032, growing at a CAGR of 7.9% from 2024 to 2032.

Market Introduction and Definition

ARM stands for Advanced RISC Machine, and it is based on the RISC architecture, which is a commonly used computer configuration. ARM microcontroller is a 32-bit module. They are essential components in modern electronics, playing a crucial role in various applications such as consumer electronics, industrial automation, automotive systems, and Internet of Things (IoT) devices. These microcontrollers are based on the ARM architecture. They offer high performance, have low power consumption, and provide versatility in embedded system design. Key components of ARM microcontrollers include the CPU core, memory, input/output peripherals, and communication interfaces.

ARM microcontrollers follow a typical workflow consisting of program execution, data processing, and communication with external devices. The CPU core executes program instructions stored in memory, processes data, and interacts with input and output peripherals to interface with the external environment.

Key Takeaways

On the basis of product type, the 80-120 Pins segment dominated the ARM Microcontrollers industry in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

On the basis of application, the automotive segment dominated the ARM microcontrollers industry in terms of revenue in 2023. However, the consumer electronics segment is anticipated to grow at the fastest CAGR during the forecast period.

Region-wise, North America generated the largest revenue for ARM microcontrollers market size by country in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

In August 9, 2022, U.S. signed chip act law this act allocates $52 billion to boost domestic semiconductor research, development, and manufacturing. This initiative aims to strengthen U.S. chip independence and could impact ARM microcontroller global market share in the long term.

In February 2022, the European Chip act outlined a $43 billion investment plan to bolster Europe's semiconductor industry. This initiative aims to reduce dependence on Asian manufacturers, potentially impacting the reliance on traditional ARM Microcontroller licensing models by European foundries.

In July 2022, K-semiconductor Strategy 2030 aims to maintain South Korea's dominance in memory chip production while expanding into logic and system semiconductors. This overall growth in the South Korean semiconductor industry could influence the global supply chain and potentially create partnership opportunities for ARM with local manufacturers.

Key market dynamics

The global ARM microcontrollers market has experienced growth due to several factors, such as increase in demand for embedded solutions and continuous technological advancements in semiconductor manufacturing. As industries embrace the Internet of Things (IoT) , smart appliances, automotive electronics, and industrial automation, there is a heightened need for microcontrollers that offer efficient processing capabilities, low power consumption, and seamless connectivity. ARM microcontrollers fulfill these requirements, serving as the backbone of these embedded systems by providing reliable performance and versatile functionality. Moreover, continuous technological advancements in semiconductor manufacturing further boost market growth, which fosters the development of more powerful and energy-efficient ARM-based solutions.

These advancements enhance the performance and reliability of microcontrollers and drive down costs, making ARM microcontrollers increasingly attractive for a wide range of applications across various industries. However, the high initial cost associated with ARM microcontrollers serves as a significant restraint for market growth. Developing and manufacturing ARM-based microcontrollers involves substantial investment in R&D, semiconductor fabrication facilities, and intellectual property licensing. These upfront costs contribute to higher product pricing, making ARM microcontrollers less accessible to smaller companies and budget-conscious consumers. In addition, the complexity of designing and integrating ARM microcontrollers into embedded systems further escalates development costs, particularly for custom or application-specific solutions.

Furthermore, the proliferation of Internet of Things (IoT) devices across industries presents significant growth opportunities for ARM microcontrollers. As IoT adoption continues to expand, demand for energy-efficient, high-performance microcontrollers capable of powering connected devices and facilitating data processing and communication is expected to rise.

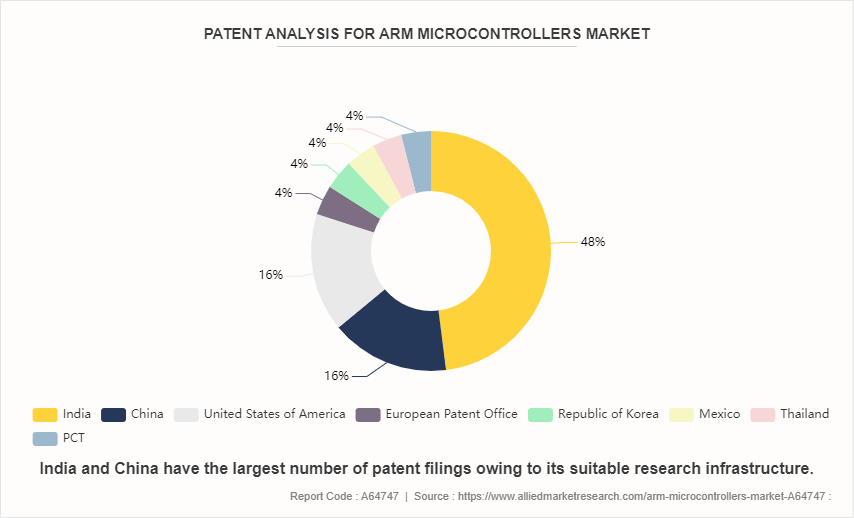

Patent Analysis of Global ARM Microcontrollers Market

The global ARM microcontrollers industry is segmented according to the patents filed in India, China, United States of America, European Patent Office, Republic of Korea, Mexico, Thailand, and PCT. China and India have the largest number of patent filings owing to suitable research infrastructure. Approvals from these authorities such as China National Intellectual Property Administration (CNIPA) , and Indian Patent Office (IPO) are followed/accepted by registration authorities in many of the developing regions/countries. Therefore, these two regions have the maximum number of patent filings.

Market Segmentation

The ARM microcontrollers market is segmented into product, application, and region. On the basis of product, the market is divided into less than 80 pins, 80–120 pins, and more than 120 pins. On the basis of application, the market is classified into automotive, industrial, consumer electronics, telecommunication, medical, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Segment Outlook

By product, the 80-120 Pins segment accounted for more than half of the market due to its versatility, and balanced performance & functionality. These microcontrollers provide ample input/output (I/O) capabilities for diverse peripherals and interfaces while maintaining a compact size suitable for various applications. Moreover, their advanced processing cores, abundant memory resources, and integrated peripherals make them well-suited for implementing intricate functionalities across sectors such as automotive, industrial automation, consumer electronics, and IoT, driving their extensive adoption and market leadership.

By application, the automotive segment held the highest market share in 2022, accounting for nearly half of the ARM microcontrollers market. The utilization of diverse microcontrollers in automotive electronics, along with other electronic control units, has experienced notable growth. Various types of microcontrollers, including Ultra-Reliable KEA Automotive Microcontrollers, S32S Microcontrollers, and Cortex-M3 processors, are increasingly used in automotive applications. The shifting market dynamics for automotive microcontroller manufacturers are influenced by factors such as heightened demand for high-end vehicles and evolving exhaust regulations. In addition, major original equipment manufacturers (OEMs) have engaged in collaborative strategies with local players to expand their product offerings and customer base. A primary driver propelling the automotive microcontrollers market expansion is increase in vehicle production, which consequently fuels the demand for advanced microcontrollers in automobiles.

Regional/Country Market Outlook

On the basis of region, the ARM microcontrollers market insights is analyzed across North America, Europe, Asia Pacific, and LAMEA. North America, particularly ARM microcontrollers for US market, accounted for the largest market share in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period owing to rapid industrialization, urbanization, and technological advancements Moreover, surge in demand for consumer electronics, automotive electronics, and industrial automation solutions in emerging economies such as China, India, and South Korea drives the adoption of ARM microcontrollers. In addition, supportive government initiatives, increasing investments in R&D activities, and the presence of a robust manufacturing ecosystem further contribute to the region's significant growth potential in the ARM Microcontrollers Market Data.

Competitive Landscape

The major ARM microcontrollers manufactures are Microchip, NXP, STMicroelectronics, Texas Instruments, Analog Devices Inc, Toshiba, Cypress Semiconductor, Renesas, Infineon, . Other players in ARM microcontrollers market include Silicon Laboratories, Nuvoton Technology, ZiLOG, Marvell Technology Group, Broadcom Inc., Horizon Robotics, and Microchip Technology, Inc., Candle Semiconductor.

Recent Key Strategies and Developments

In November 2023, Renesas Electronics Corporation, a premier supplier of advanced semiconductor solutions, announced that it designed and tested a 32-bit CPU core based on the open-standard RISC-V instruction set architecture.

In September 2022, Cortus, an innovative French fabless semiconductor company, announced the availability of its secure low power RISC-V microcontrollers (MCUs) that address consumer products and automotive electronics for body control and driving control. These MCUs offer better cost and power efficiency than competitive MCU alternatives. Additional MCUs are projected to come in the next few months, designed for specific customers, creating a product family dedicated to the automotive industry.

In March 2022, Renesas Electronics, the world’s biggest microcontroller supplier, entered the 64bit RISC-V market with parts that are pin compatible with competing ARM devices.

In November 2022, Cortus, an innovative French fabless semiconductor manufacturing group announced two new RISC-V microcontrollers (MCUs) such as Lotus1 and Lotus2. Lotus1 for Low cost consumer MCU with electric motor control and Lotus2: Automotive MCU for body and chassis control. They are designed for ease of use, and to simplify migration from existing MCUs with maximal software reuse to minimize development cost.

Key Sources Referred

Semiconductor Industry Association (SIA)

SEMI.org

IEEE Electron Devices Society (EDS)

U.S. Department of Energy

Global Semiconductor Alliance (GSA)

World Economic Forum

European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing market opportunities, and ARM microcontrollers sector analysis.

- The market research is offered along with information related to key drivers, restraints, and opportunities for arm based microcontroller.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the arm microcontrollers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global ARM microcontrollers industry report.

- ARM Microcontrollers Company List positioning facilitates benchmarking and provides a clear understanding of the present position of the ARM Microcontrollers market share by companies such as atmel microcontroller.

- The report includes the analysis of regional as well as global arm microcontrollers market trends, ARM Microcontrollers Market Forecast, ARM Microcontrollers Manufacturer, ARM Microcontrollers Company List, market segments, application areas, and market growth strategies.

ARM Microcontrollers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 19.9 Billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | Analog Devices, Inc., Analog Devices Inc., Toshiba Corporation, Texas Instruments Inc, Cypress Semiconductor Corporation., Microchip Technology Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Renesas Electronics Corporation, Infineon Technologies AG |

Loading Table Of Content...