Aroma Chemicals Market Research, 2031

The global aroma chemicals market size was valued at $5.1 billion in 2021, and is projected to reach $8.5 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031. The aroma chemicals market is propelled by the rising demand for personal care and cosmetic products, as consumers increasingly seek premium fragrances in perfumes, skincare, and toiletries. In addition, their growing use in food and beverage applications, where they enhance flavor profiles in processed foods, beverages, and confectioneries, further boosts market growth. These trends, driven by evolving lifestyles and preferences, make aroma chemicals indispensable across multiple industries.

Aroma chemicals are chemical compounds that exist in both natural and synthetic forms. These impart attractive fragrance and odor due to which these are used in the formulation of various products such as consumer products, deodorants, perfumes, and many others. These are used in cosmetics, toiletries, soaps & detergent, and other sectors.

The rising demand for personal care and cosmetic products is a significant driver for the growth of the aroma chemicals market. Consumers increasingly seek high-quality, fragranced products such as perfumes, deodorants, shampoos, and skincare items, boosting the need for aroma chemicals as essential ingredients. Changing lifestyles, growing urbanization, and rising disposable incomes, particularly in emerging economies, have amplified this demand. Additionally, innovative formulations in cosmetics and the trend toward personalized fragrances have further spurred the market. Aroma chemicals enhance product appeal, making them indispensable for manufacturers in the competitive personal care and cosmetics industries.

However, the availability of alternative substitute over expensive aroma chemicals is anticipated to hamper the growth of the market. In addition, surge in demand for eco-friendly fragrances and complex manufacturing process is anticipated to make it time consuming and tedious process for aroma chemicals. In response to this, the long lasting exposure of synthetic aroma chemical may have adverse health effect on human. These factors are expected to hamper the aroma chemicals market growth

Rapid shift of consumers toward natural and bio-based aroma chemicals has gained popularity for natural based aroma chemicals. Several key manufacturers have increased their production capacity for natural and bio based aroma chemicals. For instance, Citrus and Allied Essences Ltd and Kao Chemicals companies are actively engaged in offering natural and bio based aroma chemicals for various end use industries. These factors are increasing the potential sales of aroma chemicals; thus, offering most lucrative opportunities for the market.

The aroma chemicals market analysis is done on the basis of type, process, product, and region. By type, it is divided into natural and synthetic. By process, it is classified into food & beverages, fine fragrances, cosmetics & toiletries, soaps & detergents, and others. By product, the market is segmented into benzenoids, musk chemicals, terpenes, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The major companies profiled in the aroma chemicals market forecast include, BASF SE, Bell Flowers & Fragrances, Eternis, Givaudan, Henkel AG & Co. KGAA, Kao Chemicals Europe, Privi Speciality Chemicals Limited, S H Kelkar and Company Limited, Symrise, and Takasago International Corporation.

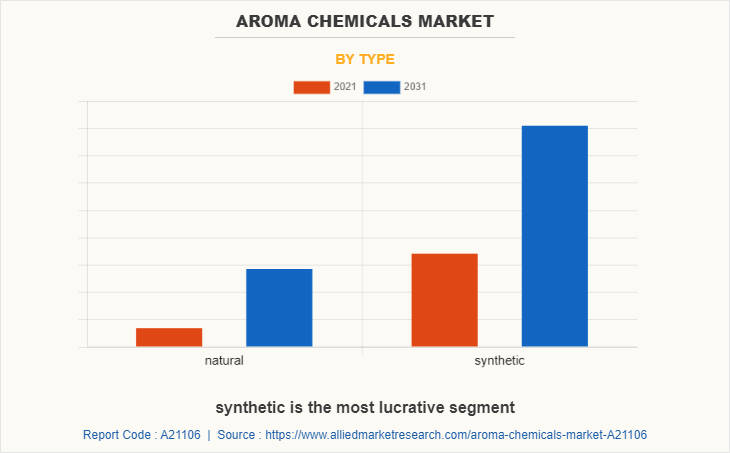

Aroma Chemicals Market, By Type

In 2021, the synthetic type segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.7% during the forecast period. This is attributed to the fact that, the FMCG companies are coming out with a variety of personal care and skin care products in different price ranges, and consumption patterns of cosmetics among teenagers increased substantially between 2005 and 2015 because of increasing awareness and desire to look good. According to an article published by India Brand Equity Foundation in December 2017, beauty and cosmetics are the grooming market in India and are expected to reach US$ 20 billion by 2025 from US$ 6.5 billion in 2017. The synthetic aroma chemical based products are extensively used in the personal care and beauty care sector in the form of lotions, ointments, creams, foundations, perfumes, scent, and others. This is anticipated to increase the demand for synthetic based aroma chemicals during the forecast period.

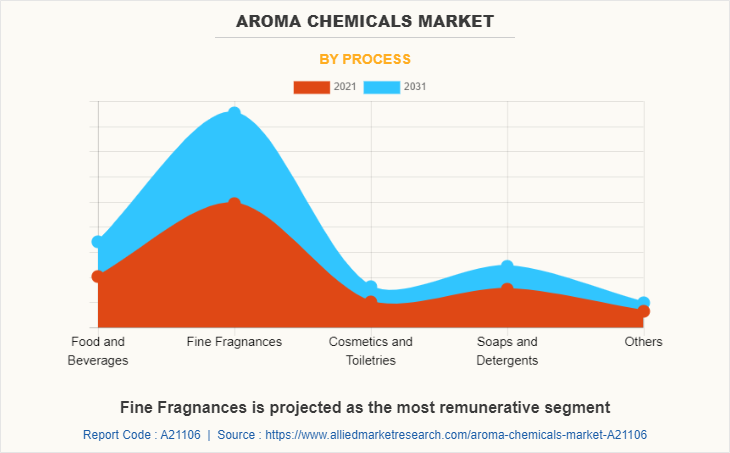

Aroma Chemicals Market, By Process

The fine fragrances segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 5.7% during forecast period. The fine fragrances process segment dominated the global market, with 49% of the total share in 2021. The rise in demand for branded perfumery and scent among people is driving the overall growth of fine fragrances. Furthermore, there are several manufacturing companies actively engaged in the manufacturing of customized perfumeries for the men, women, and twin & teen. For instance, Sapphire Flavors & Fragrances Company offers amber, woody, leather, or fougère brand perfumes especially for men. Amber scents are often considered animalistic and use ambergris or labdanum combined with vanilla, flowers, and woods which is natural aroma chemical. This is augmented to increase the demand for aroma chemicals during the forecast period.

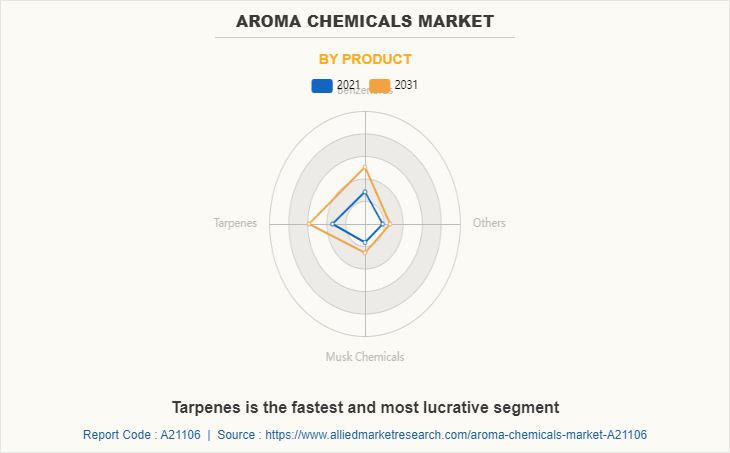

Aroma Chemicals Market, By Product

The fine fragrances segment dominated the global market in 2021, and is anticipated to grow at a CAGR of 5.7% during forecast period. The surge in demand for hand wash fragrances, ointment, creams, lotion, and sanitizers amid pandemic has escalated the demand for terpenes. This is anticipated to increase the overall demand for terpenes during the forecast period. The demand for terpenes has increased in the cosmetics and food & flavoring sector owing to its medicinal properties terpenes. This is expected to enhance the demand for terpenes based aroma chemicals; thus, creating remunerative opportunities for the market.

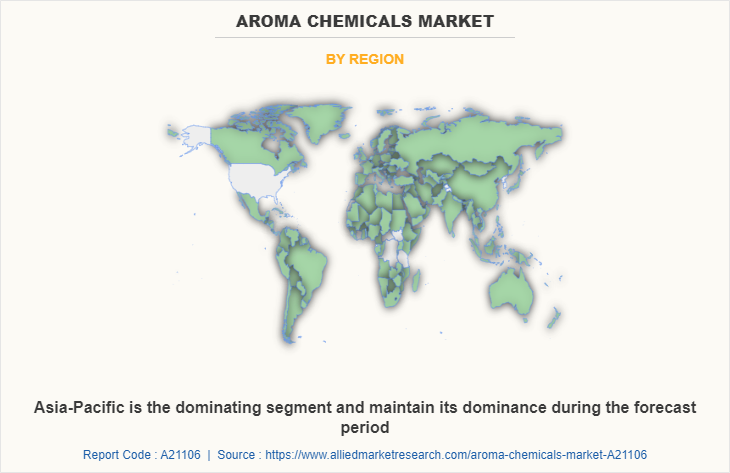

Aroma Chemicals Market, By Region

The Asia-Pacific aroma chemicals market size is projected to grow at the highest CAGR during the forecast period, and accounted for a major aroma chemicals market share in 2021, with 43% of the total share. The region is showcasing high potential growth owing to the increase in the food & beverages sector where aroma chemicals are used predominantly. Natural and synthetic aroma chemicals are mainly used in large scale as a flavoring agent in dairy, convenience goods, confectionery, drinks & beverages, and other products for providing exotic and niche flavors to the products. These factors are expected to increase the demand for aroma chemicals during the forecast period.

TECHNOLOGY TREND ANALYSIS

Advanced biotechnological processes use fermentation to produce natural aroma chemicals by employing microorganisms to synthesize desired compounds. This approach reduces reliance on traditional extraction methods, which are often resource-intensive and environmentally taxing. Fermentation ensures consistent quality, scalability, and sustainability, meeting the growing demand for eco-friendly and ethically sourced fragrance ingredients.

Microencapsulation technology is advancing stability and controlled release of fragrances in aroma chemicals. By encapsulating active ingredients in protective materials like silica or polymers, this approach enhances their longevity and stability. For instance, sol-gel encapsulation offers high retention rates for volatile compounds, making it suitable for sustainable fragrance applications. Studies show microencapsulation can improve fragrance stability by up to 80% compared to unprotected formulations, expanding applications in personal care and household products.

Advanced techniques such as Gas Chromatography-Mass Spectrometry (GC-MS) play a crucial role in the aroma chemicals market by precisely identifying and analyzing complex fragrance compounds. This technology ensures superior quality control, enables the detection of impurities, and supports the development of high-purity aroma chemicals, enhancing product reliability and consumer satisfaction.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aroma chemicals market analysis from 2021 to 2031 to identify the prevailing aroma chemicals market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aroma chemicals market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aroma chemicals market trends, key players, market segments, application areas, and market growth strategies.

Aroma Chemicals Market Report Highlights

| Aspects | Details |

| By type |

|

| By process |

|

| By Product |

|

| By Region |

|

| Key Market Players | Takasgo International Corporation, Givaudan, Privi speciality chemicals, BASF SE, S H Kelkar and Company Limited, Henkel AG, Bell Flowers and Fragrances, Symrise, Eternis Fine Chemicals Ltd., Kao Corporation |

Analyst Review

According to CXOs of leading companies, the global aroma chemicals market is expected to exhibit high growth potential. Aroma chemicals are of natural origin, non-toxic, and possess pleasant odor; therefore, these are extensively used in the cosmetics and beauty care, detergent and soaps, consumer products, and other end-use sectors.

In addition, the rise in demand from cosmetics and beauty care industry for various natural and synthetic fragrances is anticipated to surge the demand for aroma chemicals in upcoming years. Furthermore, these are used in fabric care industry as these are non-toxic and thus help improve aesthetic value of fabrics.

The CXOs further added that sustained economic growth and the development of the cosmetics and consumer products have surged the popularity of aroma chemicals.

The global aroma chemicals market was valued at $5.1 billion in 2021, and is projected to reach $8.5 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031.

Increase in food and beverages sector and escalating demand from cosmetics and personal care products are the other major growth factors in the aroma chemicals market.

Fine fragrances industry is projected to increase the demand of aroma chemicals market

BASF SE, Bell Flowers & Fragrances, Eternis, Givaudan, Henkel AG & Co. KGAA, Kao Chemicals Europe, Privi Speciality Chemicals Limited, S H Kelkar and Company Limited, Symrise, and Takasago International Corporation.

The fine fragrances process segment dominated the global market, with 49% of the total share in 2021. The rise in demand for branded perfumery and scent among people is driving the overall growth of fine fragrances

The aroma chemicals market is segmented on the basis of type, process, product, and region. On the basis of type, the market is categorized into natural and synthetic. On the basis of process, it is divided into food and beverages, fine fragrances, cosmetics and toiletries, soaps and detergents, and others. On the basis of product the market is segmented into benzenoids, musk chemicals, terpenes, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Rapid shift in the consumer lifestyle, rise in trends for personal grooming products, increase in demand for luxurious, exotic, and premium fragrances, and surge in home fragrances industry escalate the overall growth of the market. For instance, according to an article published by India Brand Equity Foundation in the June 2019, the global home fragrance industry was estimated at around USD 7.2 billion in 2018. Natural aroma chemical products are extensively used as natural fragrances in the home fragrances and perfume industry for enhancing the aesthetic value of home. These factors may act as one of the key drivers responsible for the growth of aroma chemicals in the market.

Loading Table Of Content...