Arthroscopy Devices Market Research, 2030

The global arthroscopy devices market size was valued at $18.0 billion in 2020, and is projected to reach $41.9 billion by 2030, growing at a CAGR of 8.5% from 2021 to 2030. An arthroscope is a medical device used to visualize, examine, and execute therapeutic interventions inside the body joints, including knee, hip, spine, shoulder, and elbow. Arthroscopy devices can examine bone joints for specific conditions, such as osteoarthritis, rheumatoid arthritis, tendinitis, and bone tumor.

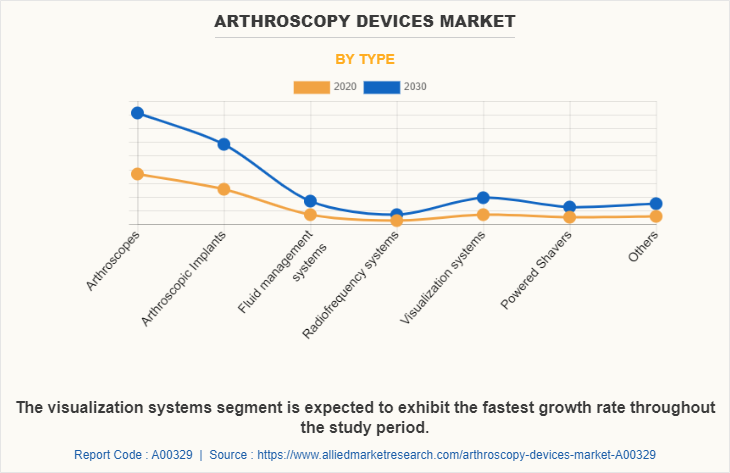

Prevalence of musculoskeletal disorders, including osteoarthritis and rheumatoid arthritis, owing to geriatric population, drives the demand for arthroscopy procedure. Moreover, increase in number of sport injuries requiring arthroscopy procedure to prevent complete joint replacements propels the arthroscopy market growth. In addition, arthroscopic implants dominate the global arthroscopy devices market share, and is expected to maintain its dominance during the forecast period. This is attributed to diverse applications of these implants with improved designs, including smart and customized implants to treat different conditions and increase in adoption of implants in arthroscopy procedures of damaged joints.

According to the World Health Organization, the number of people aged 60 years and above was 1 billion in 2019, and is expected to reach 1.4 billion by 2030 and 2.1 billion by 2050. This will increase number of patients suffering from musculoskeletal disorders, thereby increasing the demand for arthroscopy devices. Furthermore, as of 2021, 1.71 billion people suffer from musculoskeletal conditions, and it is the leading cause of disability across the globe. This creates a demand for medical devices that can effectively examine and treat bone and joint conditions. In addition, expenditure on healthcare facilities in significantly increasing in emerging economies. For instance, according to the India Brand Equity Foundation, the hospital industry in India is expected to reach $132.84 billion in FY22 up from $61.79 billion in FY17 registering a CAGR of around of 16–17%. Furthermore, the use of arthroscopy devices enables patients to recover in short time with minimal complications.

The novel coronavirus rapidly spread across various countries and regions, causing an enormous impact on lives of people and overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic increased importance of government healthcare facilities, thereby increasing healthcare expenditure across the globe. Furthermore, number of COVID-19 cases is expected to reduce in the future as vaccine is introduced in the market. This has led to reopening of research facilities for arthroscopy devices at their full-scale capacities. This will help the market to recover by start of 2022. Companies involved in manufacturing of arthroscopy devices must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working post pandemic.

Furthermore, rise in number of sports-related injuries, owing to increase in number of sports tournaments has increased the use of arthroscopy devices. In addition, there is increase in demand for invasive treatments. Furthermore, advancements in technologies enabled use of arthroscopy devices for a wide range of bone and joint ailments, thereby being a major arthroscopy devices market opportunity.

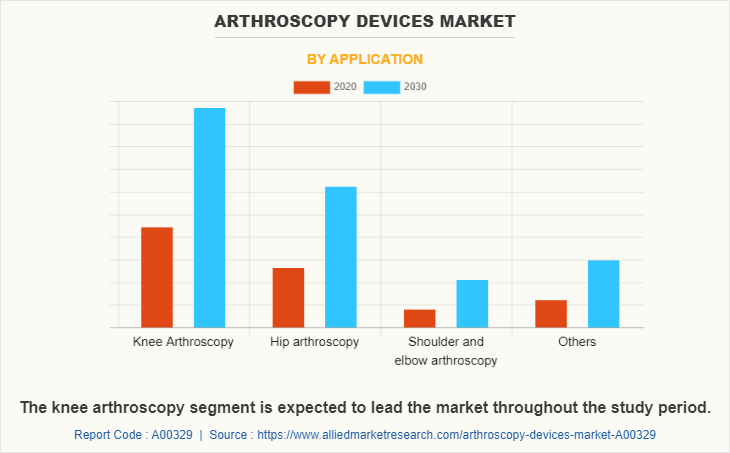

The arthroscopy devices market is segmented on the basis of product, application, and region. Depending on the product, the market is categorized into arthroscopic implants, arthroscopes, fluid management systems, radiofrequency systems, visualization systems, powered shaver systems, and other arthroscopy equipment. According to the application, it is classified into knee arthroscopy, hips arthroscopy, shoulder & elbow arthroscopy and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in 2020, accounting for the largest arthroscopy devices market share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to rise in geriatric population and increase in healthcare expenditure.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging arthroscopy devices market trends and dynamics.

- In-depth arthroscopy devices market analysis is conducted by constructing market estimations for key market segments between 2021 and 2030.

- Extensive analysis of the arthroscopy devices market size is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global arthroscopy devices market forecast analysis from 2021 to 2030 is included in the report.

- The key players within arthroscopy devices industry are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the arthroscopy devices industry.

Arthroscopy Devices Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Johnson & Johnson, Medtronic plc, Conmed Corporation, Henke Sass Wolf GmbH, Karl storz GmbH & Co. KG, Arthrex, Inc., Richard Wolf GmbH, Stryker Corporation |

Analyst Review

The arthroscopy devices market witnessed significant growth in past few years, owing to rapid growth of pharmaceutical industry across the globe and increase in expenditure on healthcare facilities in developing countries.

Rise in demand for pharmaceutical products fueled by increase in global population and rise in geriatric population boost the demand for arthroscopy devices in the pharmaceutical industry. Furthermore, rise in the number of patients suffering from orthopedic conditions has created a demand for effective arthroscopy devices. In addition, use of arthroscopy devices enables speedy recovery of the patient with minimal postoperative complications. In addition, surge in people suffering from obesity positively influences the market.

Moreover, supportive government initiatives and rapid growth of healthcare industry in developing countries are expected to provide lucrative growth opportunities for the arthroscopy devices market.

Acquisition is key growth strategy of arthroscopy devices industry players

North America is the largest regional market for arthroscopy devices.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

In 2020, $17960.8 million is the estimated industry size of arthroscopy devices.

Arthrex, Inc, Conmed Corporation, Johnson & Johnson and Medtronic, Plc. are some of the top companies to hold the market share in arthroscopy devices.

Loading Table Of Content...