Artificial Organs and Bionic Implants Market Research, 2032

The global artificial organs and bionic implants market was valued at $44.4 billion in 2022, and is projected to reach $92.1 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032. Artificial organs and bionic implants are medical devices designed to replace or augment the function of natural organs or body parts that are damaged, dysfunctional, or missing. These devices utilize advanced technology and engineering principles to restore or enhance bodily functions, improve quality of life, and provide therapeutic benefits to individuals with medical conditions or disabilities. Artificial organs are man-made devices that replicate the structure and function of specific organs in the body. Bionic implants, on the other hand, are electronic or mechanical devices that are implanted within or attached to the body to enhance or restore specific functions. Bionic implants combine biological and technological elements to interface with the body's natural systems and provide additional capabilities.

Market Dynamics

The growth of the artificial organs market share is driven by a rise in prevalence of vision impairment. For instance, according to the data published by World Health Organization (WHO), in October 2022, approximately 2.2 billion people have a near or distance vision impairment globally and about 1 billion of these cases are yet to be addressed. In addition, as per the same source, 8 million people are suffering from age-related macular degeneration across the globe. Thus, rise in the prevalence of age-related macular degeneration and retinitis pigmentosa has resulted in increased demand for artificial organs and bionic implants.

In addition, the increase in cases of hearing loss across the world drive the artificial organs market growth . For instance, according to the World Health Organization (WHO) 2021, 34 million children around the world live with disabling hearing loss. Furthermore, surge in the prevalence of heart diseases and increase in cases of heart failure boost the demand for artificial organs. For instance, according to Centers for Disease Control and Prevention (CDC) 2022, about 697,000 people in the U.S died from heart disease in 2020. According to the same source, every year, about 805,000 people in the U.S. have a heart attack. Out of these 805,000 people, 605,000 people have a first heart attack and 200,000 happen to people who have already had a heart attack. Hence, such factors drive the growth of the artificial organs market size.

Moreover, the aging population is highly susceptible to diseases owing to organ failure coupled with reduced reserve capacity in their organs and decline in organ function, which drives the growth of the artificial organs market size. Artificial organs and bionic implants can play a crucial role in the treatment and rehabilitation of individuals who have experienced trauma or accidents. Therefore, rise in cases of road accidents and injuries resulting in the loss or amputation of limbs increases the demand for artificial organs and bionic implants. Hence, such types of factors drive the growth of the artificial organs market share.

However, the high cost associated with implant procedures and lack of surgical professionals are expected to hinder the growth of artificial organs and bionic implants market. On the contrary, increase in adoption of key strategies such acquisition, product approval, and agreement by key players and technological advancements in artificial organs and bionic implants are artificial organs market opportunity for the growth during the forecast period.

Segmental Overview

The global artificial organs and bionic implants market is segmented on the basis of type, technology, end user, and region. On the basis of type, the market is classified into orthopedic bionics, ear bionics, and others. The orthopedic bionics segment is further bifurcated into bionic hand, bionic leg, and others (bionic limb, bionic finger, bone growth stimulators). By technology, it is bifurcated into electronic and mechanical. Depending on end user, it is segregated into hospitals, ambulatory surgical centers, and others (clinics, transplant research center, and academic institutes). Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

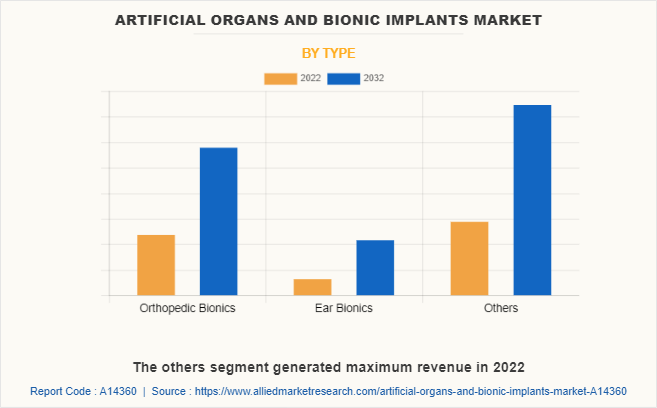

By Type

The artificial organs and bionic implants market is segmented into orthopedic bionics, ear bionics, and others. The others segment generated maximum revenue in 2022 in artificial organs market analysis, owing to high adoption of artificial heart and the availability of various artificial heart, and penile implant. The same segment is expected to witness the highest CAGR during the forecast period, owing to rise in cases of heart disease and rise in research and development activities regarding bionic eye and brain implant.

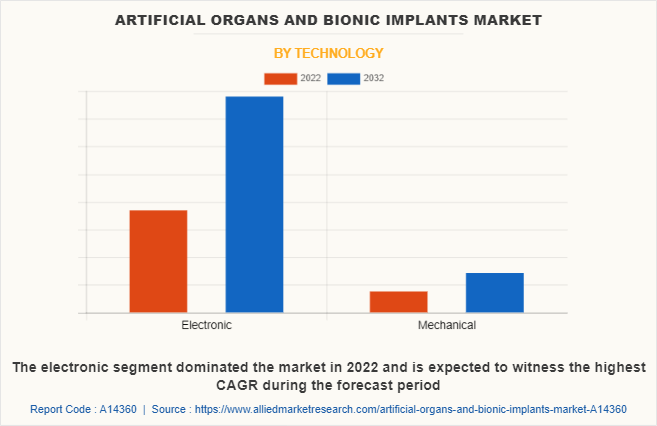

By Technology

The artificial organs and bionic implants market is segmented into electronic and mechanical. The electronic segment dominated the market in 2022 and is expected to witness the highest CAGR during the artificial organs market forecast period, owing to high adoption of electronic artificial organ & bionic implants, and rise in demand for electronic bionic implants, and a surge in clinical trials of electronic bionic implant.

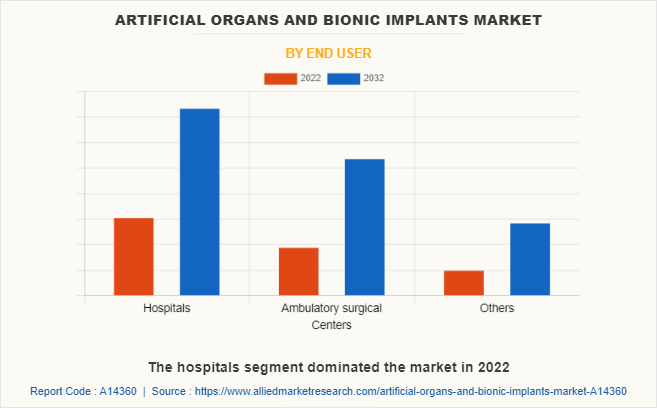

By End User

The artificial organs and bionic implants market is segregated into hospitals, ambulatory surgical centers and others. The hospitals segment dominated the market in 2022, owing to high demand for artificial organs and bionic implants in hospitals and high number of surgical procedures performed in hospitals. The ambulatory surgical centers segment is expected to witness the highest CAGR during the forecast period, owing to an increase in the number of ambulatory surgical centers in developed countries and an increase in awareness regarding ambulatory surgical centers in developing countries such as China, and India.

By Region

North America accounted for a major share of the artificial organs and bionic implants market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Abbott Laboratories, Boston Scientific Corporation, Edward Lifesciences Corporations, Jarvik Heart, Inc., Johnson & Johnson, SynCardia Systems, LLC, and Zimmer Biomet Holding Inc.; rise in number of clinical trials; availability of advanced healthcare facilities; and high healthcare expenditure from the government organizations in the region drive the growth of the market. Furthermore, the existence of a sophisticated reimbursement structure that aims to reduce expenditure levels fosters the growth of the market. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the artificial organs and bionic implants market throughout the forecast period. The presence of key players, high number of patient suffering from heart disease, high purchasing power, rise in the adoption rate of artificial organs and bionic implants products, and significant increase in capital income in developed countries.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributable to rise in road accidents and injuries as well as increase in purchasing power of populated countries, such as China and India. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,411,778,724 population in 2020 and India is the second most populated country having 1,380,004,385 population in 2020. Therefore, a rise in population along with longer life expectancy is expected to drive the growth of the bionic implants market in Asia-Pacific during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the artificial organs and bionic implants market, such as Abbott Laboratories, Berlin Heart GmbH, Boston Scientific Corporation, Cochlear Limited, Edward Lifesciences Corporations, Jarvik Heart, Inc., Johnson & Johnson, Medtronic plc, SynCardia Systems, LLC, and Zimmer Biomet Holding Inc. are provided in the report. There are some important players in the market such as Abbott Laboratories, Cochlear Limited, Edward Lifesciences Corporations, Johnson & Johnson, Medtronic plc, SynCardia Systems, and Zimmer Biomet Holding Inc. These players have adopted agreement, acquisition, product approval, and product launch as their key developmental strategies to improve their product portfolio.

Recent Acquisition in the Artificial Organs Industry

- In December 2022, Johnson & Johnson, one of the world’s largest, most diversified healthcare products company, announced it has completed its acquisition of Abiomed, Inc. Abiomed is now part of Johnson & Johnson and will operate as a standalone business within Johnson & Johnson’s MedTech segment.

- In September 2021, SynCardia Systems, LLC, manufacturer of the world’s only clinically proven and commercially approved total artificial heart, announced that Picard Medical, a portfolio company of Hunniwell Lake Ventures, acquired SynCardia.

Recent Agreements in the Artificial Organs Market

- In April 2023, Picard Medical, Inc., the parent company of SynCardia Systems, LLC announced that it has entered into a definitive business combination agreement with Altitude Acquisition Corp. (“Altitude”), a publicly traded special purpose acquisition company, that will result in Picard Medical becoming a publicly listed company. Upon closing of the transaction, Altitude will be renamed Picard Medical Holdings, Inc., and is expected to remain listed on Nasdaq.

Recent Product Approval in the Artificial Organs Industry

- In December 2022, Abiomed (Johnson & Johnson) announced that the U.S. Food and Drug Administration (FDA) approved the version of Impella ECP that will be used in the Impella ECP Pivotal Trial, and the first two patients have been enrolled in the trial.

- In October 2022, Abiomed (Johnson & Johnson) announced that Impella RP Flex with SmartAssist received U.S. FDA pre-market approval (PMA), the FDA’s highest level of approval, as safe and effective to treat acute right heart failure for up to 14 days. Impella RP Flex is implanted via the internal jugular (IJ) vein, which enables patient mobility, and has dual-sensor technology designed to optimize patient management.

- In January 2022, Regulators in three countries granted approvals to Impella surgical products, as Abiomed (Johnson & Johnson) continues to execute its strategy for sustainable growth with new products, new indications, and new geographies. In the U.S., the FDA granted an Early Feasibility Study (EFS) Investigational Device Exemption (IDE) to Impella BTR (Bridge-to-Recovery). In Asia, Impella 5.5 with SmartAssist received approval from Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) and Hong Kong’s Medical Device Division (MDD).

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current artificial organs market trends, estimations, and dynamics of the artificial organs and bionic implants market analysis from 2022 to 2032 to identify the prevailing artificial organs and bionic implants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the artificial organs and bionic implants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global artificial organs and bionic implants market trends, key players, market segments, application areas, and market growth strategies.

Artificial Organs and Bionic Implants Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 92.1 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 277 |

| By Type |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Abbott Laboratories, SynCardia Systems LLC, Berlin Heart GmbH, Edwards Lifesciences Corporation, Medtronic plc, Johnson & Johnson, Zimmer Biomet Holding Inc., Jarvik Heart, Inc., Cochlear Limited, Boston Scientific Corporation |

Analyst Review

According to the insights of the CXOs, the artificial organs and bionic implants market is poised to grow at a notable pace due to the rise in prevalence of chronic heart diseases, arthritis, and gout. As per the perspectives of CXOs, technological advancements in artificial organs and bionic implants and an increase in number of road accidents & injuries, which further cause bone fracture & disability drive the demand for artificial organs and bionic implants.

The CXOs further added that the demand for new artificial organs and bionic implant options is on the continuous rise due to a surge in demand for organ donors and an increase in number of U.S. FDA approval for artificial organs and bionic implants globally. Moreover, emerging markets gain importance for the majority of the bionic implant manufacturers and distributors, as they focus on unmet demand for treating diseases. Hence, many companies have started introducing technologically advanced products to cater to the needs of a growing population, especially in developing economies. Furthermore, the surge in number of aged individuals who are highly susceptible to orthopedic disorders, dental problems, opacified corneas, hearing loss, and heart attack drives the growth of artificial organs and the bionic implants market.

North America garnered the highest market share in 2022 and is expected to maintain its lead during the forecast period, in terms of revenue, owing to increase in cases of heart diseases, availability of robust healthcare infrastructure, strong presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth owing to increase in use of artificial organ & bionic implants, high unmet medical demands, presence of high population base, and increase in public–private investments in the healthcare sector.

An increase in healthcare expenditure, the surge in the prevalence of arthritis & chronic heart disease, and the rise in demand for organ donors drive the growth of market.

North America accounted for a major share of the artificial organs and bionic implants market in 2022 and is expected to maintain its dominance during the forecast period.

The electronic segment dominated the market in 2022 and is expected to witness the highest CAGR during the artificial organs market forecast period

The artificial organs and bionic implants market was valued at $44,381.60 million in 2022 and is estimated to reach $92,136.10 million by 2032, exhibiting a CAGR of 7.7% from 2023 to 2032.

Zimmer Biomet, Abbott, Boston Scientific Corporation and Stryker are the key companies to hold a major share in the Artificial Organs and Bionic Implants market

Yes, the competitive landscape is included in the Artificial Organs and Bionic Implants market report.

The rise in accidents coupled with the advent of new technologies and materials will drive the Artificial Organs and Bionic Implants market.

Yes, porter's five force analysis is included in the Artificial Organs and Bionic Implants report.

Loading Table Of Content...

Loading Research Methodology...