ASEAN and China Biosimilars Market Overview:

The ASEAN and China biosimilars market was valued at $687.6 million in 2017 and is expected to reach $5,506.2 million by 2025 with a CAGR of 29.7% during the forecast period. Biologics experiences rapid growth in the pharmaceutical industry that fuels the development of new treatments for life-threatening and rare illnesses. However, expiry of patents of the biologics that incorporate recombinant technology has been on the rise in recent years. Thus, research-based and generic pharmaceutical companies are pursuing the opportunity to develop "generic" substitutes for original biologics that are known as biosimilars.

The ASEAN and China biosimilars market is segmented into molecule type, application, and region. Based on molecule type, the market is divided into human growth hormone, erythropoietin, monoclonal antibodies, insulin, interferon, granulocyte-colony stimulating factor, and peptide. Based on application, the market is classified into blood disorders, oncology diseases, chronic and autoimmune diseases, growth hormone deficiency, and others. Further, the chronic and autoimmune diseases segment is sub-categorized into diabetes, rheumatoid arthritis (RA), glaucoma, and others. Based on region, the market is analyzed across China and ASEAN region.

The key driving factors of the ASEAN and China biosimilars market include rise in the number of blockbuster drugs whose patents would be expiring along with high prevalence of chronic diseases among the ageing population across the ASEAN countries and China. In addition, lower cost of biosimilars drugs than original biologics has fueled the market growth. However, high initial investment in R&D is anticipated to hamper the growth of the market. Moreover, increased focus of the international key players to invest in untapped economies of the ASEAN region and China offers lucrative opportunities for expansion of the biosimilars market.

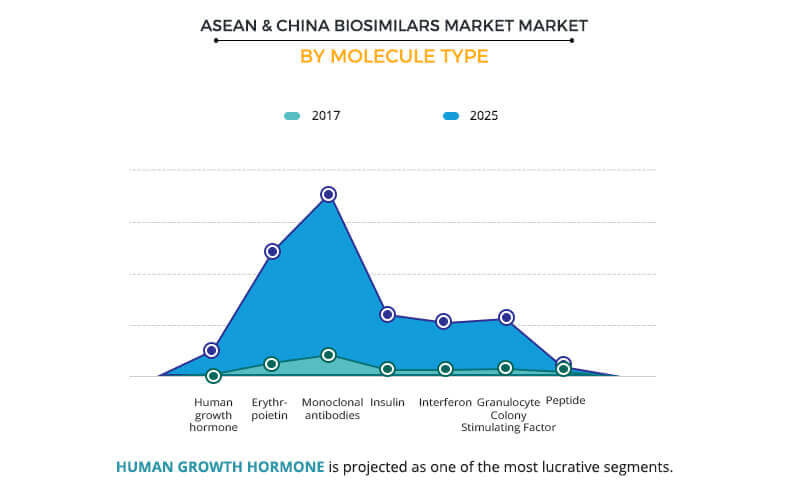

Molecule Type segment review

ASEAN and China biosimilars market comprises seven molecule types, namely, human growth hormone, erythropoietin, monoclonal antibody, insulin, interferon, granulocyte-colony stimulating factor, and peptide. The monoclonal antibody segment generated the highest revenue in 2017 and is anticipated to maintain its dominance throughout the forecast period. This is attributed to the diverse diagnostic applications of the monoclonal antibodies (mAbs) technology in the healthcare industry. In addition, mAbs are increasingly applied in the development of novel treatment options for cancer, infectious, cardiovascular, and inflammatory diseases. The human growth hormone segment is anticipated to grow at a rapid pace from 2018 to 2025 in the ASEAN and China biosimilars market. Increase in the development of new treatment plans that involve shift from originator to biosimilar human growth hormone across the ASEAN countries and China has contributed to the robust growth of the segment.

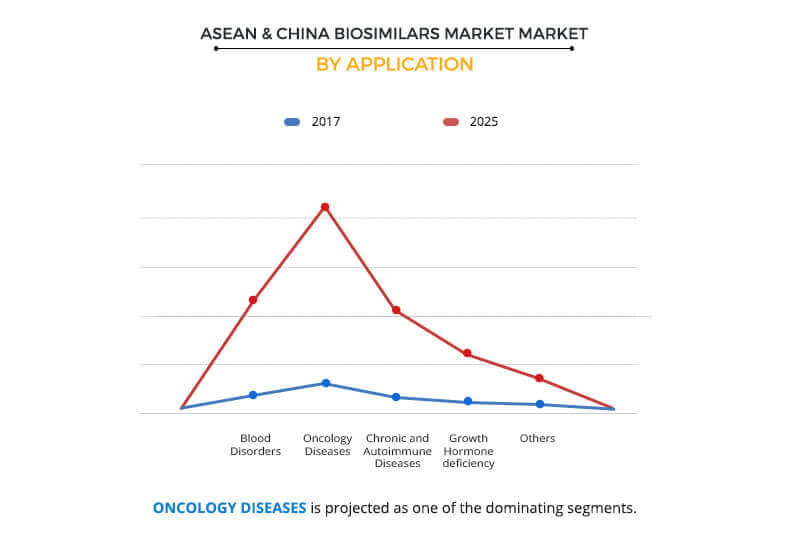

Application segment review

ASEAN and China biosimilars market constitutes five applications, namely, blood disorders, oncology diseases, chronic and autoimmune diseases, growth hormone deficiency, and others. The chronic and autoimmune diseases segment is further categorized into rheumatoid arthritis (RA), diabetes, glaucoma, and others. The oncology diseases segment generated the highest revenue in 2017 and is anticipated to remain dominant throughout the forecast period. This is attributed to rise in healthcare expenditures owing to expensive drugs used in the treatment of cancer. This has propelled the pharmaceutical manufacturers to invest in the production of cheaper alternatives, i.e. biosimilars. However, the chronic and autoimmune diseases segment is anticipated to grow at the fastest pace during 2018-2025 in the ASEAN and China biosimilars market.

Significant increase in the preference for biosimilars such as human growth hormone and monoclonal antibodies, over branded biologics across the ASEAN countries and China has contributed to the growth of the segment. Increase in the prevalence of glaucoma and diabetes across ASEAN countries and China significantly contributed to the highest CAGR of this segment.

The major companies profiled in the report include 3SBIO Inc., Qilu Pharmaceutical, Novartis International AG (Sandoz International GmBH), Pfizer Inc. (Hospira), STADA Arzneimittel, Beijing SL Pharmaceutical Co., Ltd., Fosun Pharmaceutical (Shanghai Fosun Pharmaceutical Co., Ltd.), Amgen Inc., AstraZeneca Plc, and Teva Pharmaceutical Industries Ltd.

Key Benefits ASEAN and China Biosimilars Market:

The study provides an in-depth analysis along with the current trends and future estimations of the ASEAN and China biosimilars market to elucidate the imminent investment pockets.

A comprehensive analysis of the factors that drive and restrict the market growth is provided.

The quantitative analysis of the industry from 2017 to 2025 is provided to enable the stakeholders to capitalize on the prevailing market opportunities.

An extensive analysis of the key segments of the industry is provided to understand the molecule type and applications of biosimilars across ASEAN countries and China.

The key players and their strategies are analyzed to understand the competitive outlook of the market.

ASEAN and China Biosimilars Market Report Highlights

| Aspects | Details |

| By Molecule Type |

|

| By Application |

|

| Key Market Players | Pfizer Inc. (Hospira), 3SBIO INC., STADA Arzneimittel, Amgen Inc., Qilu Pharmaceutical, AstraZeneca Plc, Fosun Pharmaceutical (Shanghai Fosun Pharmaceutical Co., Ltd.), Teva Pharmaceutical Industries Ltd., Novartis International AG (Sandoz International GmBH), Beijing SL Pharmaceutical Co., Ltd. |

Analyst Review

The biosimilars industry is projected to witness paradigm shift in the coming years across ASEAN countries and China. Biosimilars have gained significant momentum in the recent years and are expected to witness this trend in future. In addition, approximately 85 major biologics are anticipated to go off-patent by the end of 2020. Thus, considerable rise in the number of off-patents is expected to create a platform for biosimilar developers and manufacturers. Moreover, insulin and human growth hormone biosimilars serve to be attractive areas for investment in the biosimilars industry. Rise in number of diabetic patients acts as a key contributor to the demand for insulin biosimilars. According to data analysis performed by the Pan African Medical Journal in 2014, approximately 436 million patients are expected to be affected by diabetes by the end of 2030.

Rapid penetration of biosimilars in the management of several chronic diseases along with increase in accessibility of biosimilars drives the growth of the ASEAN and China biosimilars market. Further, increase in number of product approvals exhibited by key players in the market has supplemented the market growth. For instance, Pfizer and Amgen have adopted product approval as their key growth strategy in the recent years.

Loading Table Of Content...