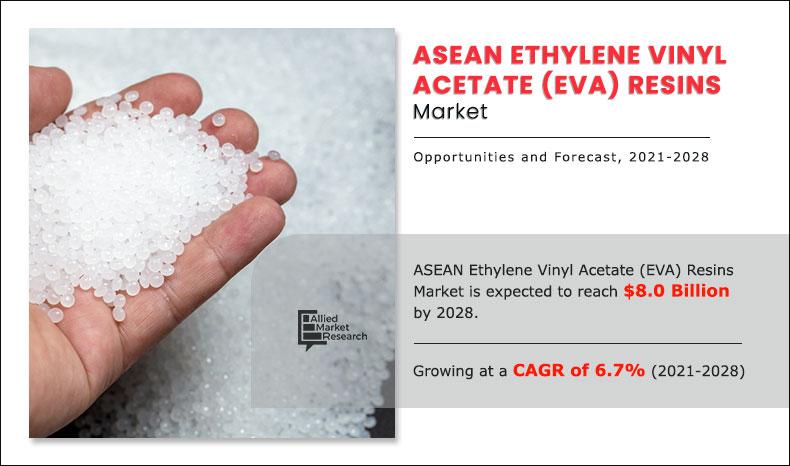

ASEAN Ethylene Vinyl Acetate (EVA) Resins Market Outlook - 2021–2028

The ASEAN ethylene vinyl acetate (EVA) resins market size was valued at $4.4 billion in 2019, and is projected to reach $8.0 billion by 2028, growing at a CAGR of 6.7% from 2021 to 2028.

Ethylene vinyl acetate (EVA) resins are manufactured through copolymerization of ethylene and vinyl acetate. The autoclave process and the tubular reactor process operated up to 2400 bar (autoclave) and 3500 bar (tubular), respectively, are used for the copolymerization. Ethylene vinyl acetate (EVA) resins are used in the production of packaging film, foam, wire & cable, solar cell encapsulation, and hot melt adhesives.

The vinyl acetate content in EVA resin varies from 0.2% to 40% whereas in the high-density EVA the VA% can be more than 50%. EVA with low melt index (MI) offers high strength, superior viscosity, and hot tack (relative melting and bonding strength) as compared to its high melt index counterparts. As the VA% increases in EVA resins, it becomes highly transparent and less crystalline. EVA resins are widely used in the packaging and paper industries, owing to their properties such as enhanced flexibility and low sealing temperature. In addition, the high-density EVA is used in photovoltaic panels due to high transparency, which are used in solar energy generation.

Rapid industrialization and increase in disposable income of individuals across the emerging economies, such as Indonesia and Thailand, are the key factors that fuel the demand for automobiles. This further boosts the demand for EVA resins, as they are widely applicable in the manufacturing of automobile bumpers and molded parts. In addition, development of the packaging film industry across the developing countries, such as Singapore and the Philippines, is expected to drive the ASEAN ethylene vinyl acetate (EVA) resins market growth.

Government initiatives and joint venture between domestic players and foreign players is expected to attract new investments in countries such as Malaysia and Singapore. For instance, in 2018, Petroliam Nasional Berhad and Saudi Aramco entered in a new joint venture. The joint venture operates the refineries and natural gas production, which further propelled the demand for EVA resin.

However, factors such as availability of inexpensive substitutes such as natural rubber, synthetic rubber, and low-density polyethylene and issues related with the usage of EVA in photovoltaic packaging are expected to hinder the market growth. On the contrary, introduction of bio-based ethylene vinyl acetate materials with no adverse effects is anticipated to provide lucrative growth opportunities for the market growth.

The ASEAN ethylene vinyl acetate (EVA) resins market is segmented on the basis of type, application, end user, and country. Depending on type, the market is classified into polypropylene (PP) vinyl acetate-modified polyethylene (low VA density), polyethylene (PE) thermoplastic ethylene vinyl acetate (medium VA density), and ethylene vinyl acetate rubber (high VA density). By application, the market is segmented into film, foam, hot melt adhesives, wire and cables, extrusion coating, solar cell encapsulation, and others. By end user, the market is classified into building & construction, aerospace, wind power, marine, consumer goods, and others. Country wise, it is analyzed across China, India, Vietnam, Malaysia, Indonesia, Thailand, Singapore, and Rest of ASEAN

The major key players operating in the industry include Arkema S.A., Braskem S.A., Celanese Corporation, DOW Inc., Innospec Inc, ExxonMobil Corporation, Formosa Plastics Corporation, Hanwha Chemical Co, Ltd., Total SA, Lyondell Basell Industries N.V., SIPCHEM, Eastman Chemical Company, China Petrochemical Corporation, and Lotte Chemical Corporation.

By Type

Ethylene VA Rubber is projected as the most lucrative segment

Polyethylene (PE) thermoplastic ethylene vinyl acetate (medium VA density) emerged as the highest contributor to the ASEAN ethylene vinyl acetate (EVA) resins market share due to rise in application of EVA resins in sealant materials and industrial adhesives.

Foam accounted for highest revenue share owing to increase in application EVA foams in automotive and electronics due to its high flexibility and high resilience. In addition, advanced properties such as vibrations and impact absorptions, and low production cost make it superior to conventional vinyl and natural rubber products.

By Application

Solar Cell Encapsulation is projected as the most lucrative segment

Footwear accounted for major market share owing to the growing application of EVA resins in footwear bottoming components due to their low cost, lightweight nature, and shock absorbance properties.

China is one of the major producers of EVA and also accounts for more than 35% of the total demand for EVA. The rise in demand for EVA in manufacturing foam for footwear, sport related products, automobile bumpers, films & flexible packaging, helmets, and others boosts the market growth. Furthermore, rise in demand for clean energy through solar energy is anticipated to increase the demand for EVA due to increase in awareness regarding the usage of EVA in solar power generation and agriculture industry.

By End User

Photovoltaic Panels is projected as the most lucrative segment

Impact Of Covid-19

The major end users of resins such as construction, packaging, automotive, and transportation have been negatively impacted due to the ongoing pandemic outbreak.

The ongoing health crisis has increased the supply-demand gap, hampering the global resin supply chain.

The global construction industry was valued at 10.15 trillion USD in 2018, but is expected to witness a decrease in demand for any construction activities mainly due to the in non-availability of workforce, shortage in raw materials, and further due to decrease in demand for new homes. The global automotive supply chain has been disrupted due to the ongoing pandemic situation as countries affected badly by the pandemic had to stop all the manufacturing activities.

Further, restrictions on workforce have forced companies to operate at minimum workforce. This has hit the output of major automobile companies. On the demand side, sales of private vehicles are expected to increase as people want to maintain social distancing while travelling. This will hamper public transport sector while enriching the private vehicles sector.

By Country

Malaysia exhibits CAGR of 6.0% during 2020-2028

Key Benefits For Stakeholders

- The ASEAN ethylene vinyl acetate (EVA) resins market analysis covers in-depth information of major industry participants.

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The report provides an in-depth analysis of the ASEAN ethylene vinyl acetate (EVA) resins market forecast for the period 2021–2028.

- The report outlines the current ASEAN ethylene vinyl acetate (EVA) resins market trends and future estimations of the market from 2019 to 2028 to understand the prevailing opportunities and potential investment pockets.

- The key drivers, restraints, and market opportunity and their detailed impact analysis is elucidated in the study.

ASEAN Ethylene Vinyl Acetate (EVA) Resins Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By End User |

|

| By Country |

|

| Key Market Players | ARKEMA S.A., LYONDELLBASELL INDUSTRIES HOLDING B.V., BRASKEM, HANWHA CHEMICAL CORPORATION, DOW INC., SIPCHEM, THAI ASIA POLYMER CO., LTD., CHINA PETROCHEMICAL CORPORATION, DAIREN CHEMICAL CORPORATION, INNOSPEC INC, CELANESE CORPORATION, TOTAL SA, FORMOSA PLASTICS CORPORATION, ADTEK CONSOLIDATED SDN. BHD, THE POLYOLEFIN COMPANY (SINGAPORE) PTE LTD, LOTTE CHEMICAL CORPORATION, ENTEC POLYMERS, TPI POLENE PUBLIC COMPANY LIMITED, LG CHEM, EASTMAN CHEMICAL COMPANY, EXXONMOBIL CORPORATION |

Analyst Review

According to the insights of the CXOs of leading companies, development of the packaging industry and rise in demand for EVA & EVA-based resin and foam across various end-user industries, including packaging, footwear, automotive, and photovoltaic panels, are the key factors that boost the market growth. However, increase in competition from substitutes and problems associated with use of EVA in photovoltaic packaging, such as decomposition due to exposure to UV rays and limited shelf life of the EVA sheet are some of the factors projected to hinder the market growth. As per the CXOs, Thailand is projected to register a significant growth in the projected timeframe, due to surge in manufacture of photovoltaic panels for the production of solar energy in the ASEAN region.

Development of the packaging industry, increasing disposable income, robust investment in solar energy generation set-ups, and rise in demand from foam and footwear industries are expected to drive the ASEAN Ethylene Vinyl Acetate (EVA) Resins market growth.

ASEAN Ethylene Vinyl Acetate (EVA) Resins market has a market revenue of $4.4 billion in 2019.

The market demand of EVA in the ASEAN region is expected to witness steady growth where the market may witness supply crunch due to production swings. This is attributed to shifting trend from Vinyl acetate-modified polyethylene (low VA density) towards medium and high VA density Ethylene Vinyl Acetate (EVA) Resins, which are widely used in photovoltaic and automotive applications. The low density EVA is expected to witness high price due to reduced supply in domestic market.

China is expected to hold the highest market share in ASEAN Ethylene Vinyl Acetate (EVA) Resins market.

Business expansion, joint venture, merger, technology transfer/ licensing, acquisition and partnerships are the key growth adopted by the market players.

Thermoplastic Ethylene VA is the leading segment in the ASEAN Ethylene Vinyl Acetate (EVA) Resins market.

Automotive manufacturers, packaging & paper industry, paint, coatings and adhesives industry, electronics & electrical, pharmaceutical, footwear, and photovoltaic industries are the potential customers of ASEAN Ethylene Vinyl Acetate (EVA) Resins industry.

Loading Table Of Content...