Asia-Pacific Digital Remittance Market Outlook - 2026

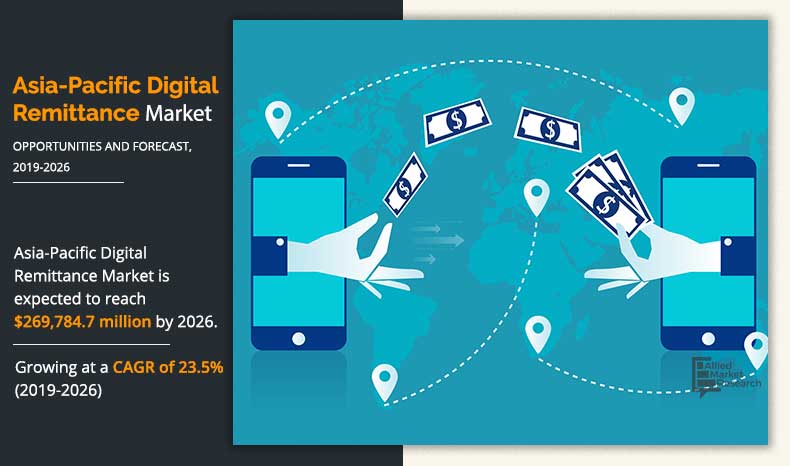

The Asia-Pacific Digital Remittance Market was valued at $49.85 billion in 2018 and is estimated to reach $269.78 billion by 2026, registering a CAGR of 23.5% from 2019 to 2026. Digital remittance is referred to as the transfer of money by foreign migrants to their native countries by using digital transfer networks such as easy-to-use mobile applications, digital wallets, and others.

The market witness’s entry of digital remittance operators, which poses a serious challenge to traditional cash-in-hand providers due to reduced user fees and ease of usability. Numerous benefits of using digital remittance such as convenience, speed, lower cost, elimination of the need for tedious form-filling processes, agents, and codes and others, have shifted the focus of consumers toward digital transactions for money remittance.

The remittance industry is shifting their focus on being digitally remastered. Factors such as growth in base of customers comfortable with using mobile devices in Asia-Pacific, rise in competition from new entrants, and margin pressures due to a growing consensus on lowering remittance transaction fees drive the penetration of digital channels. There are numerous benefits of using digital remittances such as convenience, speed, lower cost, elimination of the need for tedious form-filling processes, agents, e wallet use and codes and others, have shifted the focus of consumers toward digital transactions for money remittance.

Existing remittance service providers in this region adopt digital channels to complement their existent services network whilst new entrants. People of different Asian countries are increasingly engaging with their overseas counterparts for business, leisure, education, medical, entertainment-related activities, which involve transfer of money overseas. Traditional ways of transferring money via banks and money transfer operators have been expensive due to high transfer charges along with hidden fees that are unknown to the customers. This is an important trend observed in Asia-pacific digital remittance market.

Increase in cross-border transactions and move towards cashless, mobile banking, and mobile-based payment solutions dominate payment trends in Asia-Pacific, which also drives the Asia-Pacific digital remittance market growth. In addition, adoption of digital transfer network such as mobile phone technology, mobile money, digital currencies, distributed ledgers, electronic identification, and others to remit money has made cross-border payments negligible in cost, instant, auditable, and accessible to everyone. This acts as an important factor to boost the Asia-Pacific digital remittance market.

Furthermore, increase of the remittance industry in the developing counties in the Asia-Pacific region is expected to fuel the growth of the digital remittance market. However, lack of awareness & guidance is a major factor that restrains people from opting for digital remittance transfer mode. Conversely, rise in internet and mobile penetration in Asia-Pacific is expected to provide lucrative opportunities for the market. In addition, technological innovations in the digital remittance industry in this region primarily to provide user-friendly apps and smarter ways to connect to domestic payment systems is expected to provide opportunities for the Asia -pacific digital remittance market growth.

Segment Review

Depending on remittance type, the Asia-Pacific digital remittance market size is bifurcated into inward digital remittance and outward digital remittance. The outward digital remittance segment is expected to be the largest contributor to the Asia-Pacific digital remittance market forecast period, owing to continuous growth in the digital payment industry and the rise in digital spending by consumers, is expected to increase the use of digital channels for money transfer.

By Remittance Type

Inward Digital Remittance segment is projected to be the most lucrative segment

By remittance channel, Asia-Pacific digital remittance market are classified into banks, money transfer operators (MTOs), and others. The banks are the largest contributor toward the market growth, as banks have been integrating technologies into their remittance services to provide faster transfer time. In addition, banks are rapidly adopting digital innovation to gain a competitive advantage over the other players due to a major shift toward digitization in the cross-border money transfer industry.

By Remittance Channel

Money Transfer Operator segment holds a dominant position in 2018 and would continue to maintain the lead over the forecast period

The study analyzes the current Asia-Pacific digital remittance market trends of the across different countries such as China, Japan, India, Hong Kong, Singapore, Taiwan, Indonesia, and rest of Asia-Pacific. Among these, China was the major revenue contributor to the market in 2018, owing to a major shift toward digital payment, the market players of China are focusing on the launch of electronic cross-boundary remittance services. In addition, the significant growth of digital remittance in China owing to lower fees by the remittance service provider makes the process of sending and receiving money much easier than the traditional method.

By Country

China holds a dominant position in 2018 and would continue to maintain the lead over the forecast period

However, Singapore is expected to grow at the highest rate during the forecast period in Asia-pacific digital remittance market share. This is attributed to widespread use of communication applications or social networking among foreign workers is also projected to be a good opportunity for FinTech companies. In addition, key players of the market are expanding their presence in this region. For instance, in April 2017, TransferWise, Europe’s leading money transfer service, partnered with DBS Bank to expand its presence in Singapore.

The key players operating in the Asia-Pacific digital remittance market industry include InstaReM, Remitly, Inc., Flywire, SingX Pte Ltd., Azimo Limited, WorldRemit Ltd., TransferWise Ltd., Ripple, MoneyGram, and TNG Wallet.

Key Benefits for Stakeholders

- This report entails a detailed quantitative analysis of the current market trends from 2019 to 2026 to identify the prevailing Asia-Pacific digital remittance market opportunity.

- Market estimations are based on a comprehensive analysis of the key developments in the industry.

- The Asia-Pacific market is comprehensively analyzed with respect to providers, inward digital remittance and outward digital remittance

- Asia-pacific digital remittance market analysis based on country helps understand the market to assist in strategic business planning.

- The development strategies adopted by key manufacturers are enlisted to understand the competitive scenario of the market.

Asia-Pacific Digital Remittance Market Report Highlights

| Aspects | Details |

| By REMITTANCE TYPE |

|

| By REMITTANCE CHANNEL |

|

| By COUNTRY |

|

| Key Market Players | SINGX PTE LTD, INSTAREM, FLYWIRE CORPORATION, TNG FINTECH GROUP INC, TRANSFERWISE LTD, AZIMO LTD, WORLDREMIT LTD, MONEYGRAM INTERNATIONAL, INC, REMITLY, INC, RIPPLE |

Analyst Review

Digital remittance is referred as sending money by a cross-border foreign migrant to another person via digital platforms, which is a modern convenience that makes transferring funds easier, quicker as well as enables remote sends.

Adoption of digital transfer network such as mobile phone technology, mobile money, digital currencies, distributed ledgers, electronic identification, and others to remit money has made cross-border payments negligible in cost, instant, auditable, and accessible to everyone. This is act as an important factor to boost digital remittance market in the Asia-Pacific market. In addition, increase in cross-border transactions and move toward cashless, mobile banking, and mobile-based payment solutions dominate payment trends in Asia-Pacific, which drives the growth of the digital remittance market.

Furthermore, increase of the remittance industry in the developing counties in the Asia -pacific region, which is expected to the fuel growth of digital remittance market. However, lack of awareness & guidance is a major factor restrict growth of Asia-Pacific digital remittance. On the contrary, innovative technology in the digital remittance industry in this region, primarily that offers smarter ways and user-friendly apps to connect to domestic payment systems is expected opportunity to growth opportunities for Asia -Pacific digital remittance market.

Inward digital remittance receipt of funds either locally or from offshore through digital channel is the major shareholder in the market. In addition, major initiatives taken by the government of different countries are expected to boost the digital penetration of inward remittances in this region.

The banks are the largest contributor toward the market growth, as banks have been integrating technologies into their remittance services to provide faster transfer time.

The use of digital remittance is highest in china. China’s financial technology companies are on the rise, owing to rapid digitization. In addition, china is traditionally a cash-based economy; however, major shift toward digital or mobile payments from traditional banking and card infrastructure at an accelerating rate is expected to increase digitization in the remittance industry

The Global Asia-Pacific Digital Remittance Market is expected to grow at a CAGR of 23.5% from 2019 to 2026.

The Global Asia-Pacific Digital Remittance Market is projected to reach $269.78 billion by 2026.

To get the latest version of sample report

Increase in cross-border transactions and move towards cashless, mobile banking, and mobile-based payment solutions drives the growth of Asia-Pacific Digital Remittance Market.

The key players profiled in the report include InstaReM, Remitly, Inc., Flywire, SingX Pte Ltd., Azimo Limited, WorldRemit Ltd., TransferWise Ltd., Ripple, MoneyGram, and TNG Wallet.

On the basis of top growing big corporations, we select top 10 players.

The Asia-Pacific Digital Remittance Market is segmented on the basis of remittance type, remittance channel and country.

The key growth strategies of Asia-Pacific Digital Remittance market players include product launch, partnership, acquisition, expansion, product enhancement, and collaboration.

Inward Digital Remittance segment holds a dominant position during the forecast period.

China holds a dominant position in 2018 and would continue to maintain the lead over the forecast period.

Loading Table Of Content...