Asia–Pacific Oncology Molecular Diagnostics Market Research - 2035

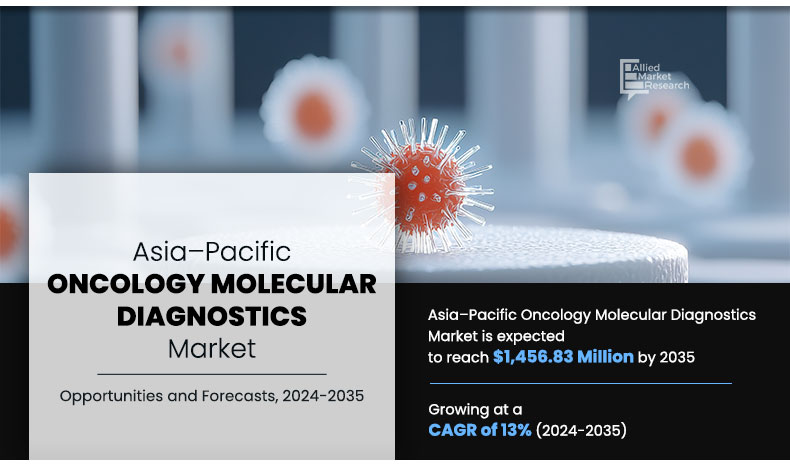

The Asia–Pacific oncology molecular diagnostics market size was valued at $343.31 million in 2023 and is estimated to reach $1,456.83 million by 2035, exhibiting a CAGR of 13% from 2024 to 2035. The Asia-Pacific oncology molecular diagnostics market is driven by rising cancer prevalence, increasing awareness about early diagnosis, and advancements in molecular diagnostic technologies. Government initiatives promoting healthcare infrastructure development and growing investments in research further support market growth. Additionally, the expanding adoption of precision medicine and rising demand for non-invasive diagnostic methods contribute to the market's significant growth potential.

Oncology molecular diagnostics involves the use of advanced molecular techniques to identify genetic and molecular markers associated with cancer. These diagnostics aid in early detection, precise diagnosis, and personalized treatment planning by analyzing DNA, RNA, or protein changes in cancer cells. They play a crucial role in monitoring disease progression, assessing treatment efficacy, and predicting patient outcomes, thereby improving cancer care and enabling targeted therapies tailored to individual patient profiles.

Key Takeaways

By application, the other cancers segment was the highest contributor to the market in 2023.

By type, the polymerase chain reaction (PCR) segment was the highest contributor to the market in 2023.

- By end user, the hospitals segment dominated the market in 2023 and is expected to continue this trend during the forecast period.

Market Dynamics

The Asia–Pacific oncology molecular diagnostics market is driven by rising prevalence of cancer, advancements in molecular diagnostics, government initiatives and funding and developing healthcare infrastructure. Factors such as lifestyle changes, aging populations, and increased exposure to carcinogens have contributed to a surge in cancer cases across the region. According to American Cancer Society, there were 19,964,811 new cancer cases in Asia-Pacific region in 2022. The growing cancer prevalence has heightened the demand for advanced diagnostic solutions that enable early detection and personalized treatment strategies. Molecular diagnostics plays a crucial role in identifying specific genetic mutations and biomarkers, offering precise diagnostic capabilities that guide targeted therapies.

In addition, advancements in molecular diagnostics are driving the growth of the oncology molecular diagnostics market in the Asia-Pacific region by enabling precise and early detection of cancer. Breakthrough technologies such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and liquid biopsy have revolutionized cancer diagnostics, allowing for the identification of specific genetic mutations and biomarkers. According to 2024 article by National Library of Medicine, the sensitivity and accuracy for the identification of uncommon DNA copies and pattern variants have significantly increased owing to techniques such as PCR and tailored NGS. These advancements improve the accuracy of cancer diagnoses and enable the development of personalized treatment plans tailored to individual patients’ genetic profiles. Additionally, the increasing adoption of automated and high-throughput molecular diagnostic platforms enhances efficiency and scalability in clinical and research settings.

Favorable initiatives by public and private organizations play a pivotal role in driving the growth of the Asia-Pacific oncology molecular diagnostics market. Governments across the region are investing heavily in healthcare infrastructure and launching national cancer control programs to improve early detection and treatment outcomes. For instance, in 2024, women investors and philanthropists of the Women Health and Economic Empowerment Network (WHEN), announced investment of more than $100 million over the next three years, with funding targeted for cervical cancer in Southeast Asia. These funds will be working to fill essential gaps for improving the prevention, screening, diagnosis, and treatment of cervical cancer.

Additionally, private organizations are forming partnerships with government for cancer screening and treatment program which also contribute significantly in the growth of the market. For instance, in 2024, Becton Dickinson & Co. (BD) announced comprehensive investments in cervical cancer screening in the Indo-Pacific. BD is working with Obstetric and Gynecological Societies to deliver education for clinicians on cervical cancer screening best practices, with an aim of reaching over 1,200 clinicians and support staff by early 2025. Collaborative efforts, such as public-private partnerships (PPPs), are contributing significantly in the adoption of the molecular diagnosis technique.

Developing healthcare infrastructure is a significant driver for the Asia–Pacific oncology molecular diagnostics market, as many countries in the region are investing heavily in improving their healthcare systems. Governments and private entities are focusing on expanding access to advanced diagnostic tools, upgrading laboratory facilities, and implementing modern technologies to address the rising burden of cancer. This growth in infrastructure enhances the availability and quality of molecular diagnostic services, enabling earlier and more accurate cancer detection and personalized treatment planning. Additionally, the increasing establishment of specialized cancer care centers and laboratories, coupled with collaborations between local and global healthcare organizations, is fostering the adoption of cutting-edge diagnostic methods. These advancements not only improve patient outcomes but also drive demand for oncology molecular diagnostics in Asia-Pacific region.

Segmental Overview

The Asia–Pacific oncology molecular diagnostics market is segmented on the basis of application, type, end user, and country. On the basis of application, the market is divided into colorectal cancer, gastric cancer, breast cancer, lung cancer, and other cancers. As per type, the market is segmented into polymerase chain reaction (PCR), next generation sequencing (NGS), fluorescence In Situ Hybridization (FISH), spectrometry, immunohistochemistry, and others. On the basis of end user, the market is divided into hospitals, reference laboratories, and others. Country-wise, the market is analyzed across Japan, China, Australia, India, South Korea, New Zealand, Singapore, Hong Kong, Taiwan, Thailand, Vietnam, Malaysia, Indonesia, Philippines, Pakistan, Myanmar and Rest of Asia-Pacific.

By Application

The other cancers segment held the largest Asia–Pacific oncology molecular diagnostics market share in 2023. This was attributed to high prevalence of the cancer such as pancreatic cancer and ovarian cancer and heightened the need for early and accurate diagnostic solutions.

By Application

Other Cancer segment held a dominant position in the market in 2023 and Lung Cancer segment is anticipated to grow at a fastest rate during the forecast period.

By Type

The Polymerase Chain Reaction (PCR) segment held the largest Asia–Pacific oncology molecular diagnostics market share in 2023. This is attributed to its widespread adoption in cancer diagnostics. PCR is highly valued for its accuracy, sensitivity, and ability to detect minute amounts of genetic material, making it essential for early cancer detection and monitoring. The region's increasing cancer prevalence, coupled with a growing emphasis on personalized medicine, has amplified the demand for PCR-based diagnostics. Additionally, advancements in PCR technologies, such as quantitative PCR (qPCR) and digital PCR, have enhanced their efficiency and precision, further driving adoption. The expanding healthcare infrastructure and increased investment in diagnostic technologies in countries like China, India, and Japan have also supported market growth.

By Type

Polymerase Chain Reaction (PCR) segment held a dominant position in the market in 2023 However, Next Generation Sequencing (NGS) segment is anticipated to grow at a fastest rate during the forecast period.

By End User

The hospital segment held the largest share of the Asia–Pacific oncology molecular diagnostics market in 2023. This is attributed to the fact that hospitals are primary healthcare providers and serve as the central point for diagnosing and treating cancer, offering advanced molecular diagnostic technologies to accurately detect and monitor various cancer types. These facilities are equipped with state-of-the-art laboratories and expert oncologists, enabling them to handle complex diagnostic procedures, which attracts a high volume of patients. Additionally, the rising prevalence of cancer in the region, combined with increasing awareness about early diagnosis, has driven a surge in hospital visits for molecular diagnostics. Governments across Asia-Pacific countries are also investing significantly in healthcare infrastructure, particularly in hospitals, to improve access to cutting-edge diagnostic tools. Furthermore, hospitals often collaborate with research institutions and diagnostic companies to adopt the latest innovations in oncology molecular diagnostics.

By End User

Hospital segment held a dominant position in the market in 2023 However, Reference Laboratories is anticipated to grow at a fastest rate during the forecast period.

Competition Analysis

The major companies profiled in the Asia–Pacific oncology molecular diagnostics market report include Abbott Laboratories, F. Hoffmann-La Roche Ltd, Siemens Healthineers AG, Danaher Corporation, Thermo Fisher Scientific Inc., Agilent Technologies Inc., Qiagen N.V, Illumina, Inc, Sysmex, Guardant Health, Lucence, LifeStrands, and ACT Genomics.

Recent Developments in Asia–Pacific Oncology Molecular Diagnostics Industry

- In September 2023, Guardant Health, Inc announced that the Japanese Ministry of Health, Labour and Welfare (MHLW) had approved the Guardant360 CDx liquid biopsy test as a companion diagnostic to select patients with unresectable (inoperable) advanced or recurrent non-small cell lung cancer (NSCLC) with HER2 (ERBB2) mutations that has progressed after chemotherapy for treatment with ENHERTU® (trastuzumab deruxtecan). ENHERTU is a specifically engineered HER2-directed antibody drug conjugate developed by Daiichi Sankyo.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Asia–Pacific oncology molecular diagnostics analysis from 2023 to 2033 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Asia–Pacific oncology molecular diagnostics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Asia–Pacific oncology molecular diagnostics market trends, key players, market segments, application areas, and market growth strategies.

Analyst Review

The Asia-Pacific oncology molecular diagnostics market is experiencing significant growth, driven by the increasing incidence of cancer, rising healthcare awareness, and advancements in molecular diagnostic technologies. The shift towards targeted therapies has accelerated the adoption of molecular diagnostics, as these tests provide critical insights into genetic mutations and cancer biomarkers, aiding in early detection and tailored treatment plans. Governments and private sectors are investing in healthcare infrastructure, expanding access to advanced diagnostics, which is further boosting market growth. Furthermore, the expansion of healthcare reimbursement policies and collaborations between biotech companies and healthcare providers are improving the availability of molecular diagnostic tools. However, challenges such as high costs associated with advanced diagnostic tests and the need for skilled professionals might restrain the growth of the market

The total market value of Asia–Pacific oncology molecular diagnostics market was $343.31 million in 2023

The market value of Asia–Pacific oncology molecular diagnostics market is projected to reach $1,456.83 million by 2035.

The forecast period for Asia–Pacific oncology molecular diagnostics market is 2024 to 2035.

The base year is 2023 in Asia–Pacific oncology molecular diagnostics market.

Abbott Laboratories, F. Hoffmann-La Roche Ltd, Siemens Healthineers AG, Danaher Corporation, Thermo Fisher Scientific Inc held a high market position in 2023.

The other cancer segment dominated the market share in 2023, owing to the high prevalence of the cancer such as pancreatic cancer and ovarian cancer. Furthermore, the growing awareness about early diagnosis of cancer is expected to drive the growth of the market

The growth of the Asia–Pacific oncology molecular diagnostics market is driven by rise in prevalence of breast cancer, advancement in molecular diagnostic techniques, and rise in healthcare infrastructure

Oncology molecular diagnostics involves the use of advanced molecular techniques to detect, analyze, and monitor cancer-related genetic and molecular markers in a patient’s tissue, blood, or other bodily fluids. This field has transformed cancer diagnosis, prognosis, and treatment by providing insights into the specific genetic mutations or biomarkers that drive tumor growth and progression

Loading Table Of Content...