Asia-pacific Travel Insurance Market Overview:

Asia-pacific Travel Insurance Market is estimated to reach $9,875 million by 2022, growing at a CAGR of 10.1% from 2016 to 2022. Travel insurance provides security and protection to travelers while traveling domestically or internationally, whether on a business trip or holiday. It is considered as an essential to undertake a carefree trip. This type of insurance not only provides basic coverage such as health insurance and transportation in the event of repatriation, but also a protective cover against missing checked-in luggage, trip cancellation, and other probable casualties.

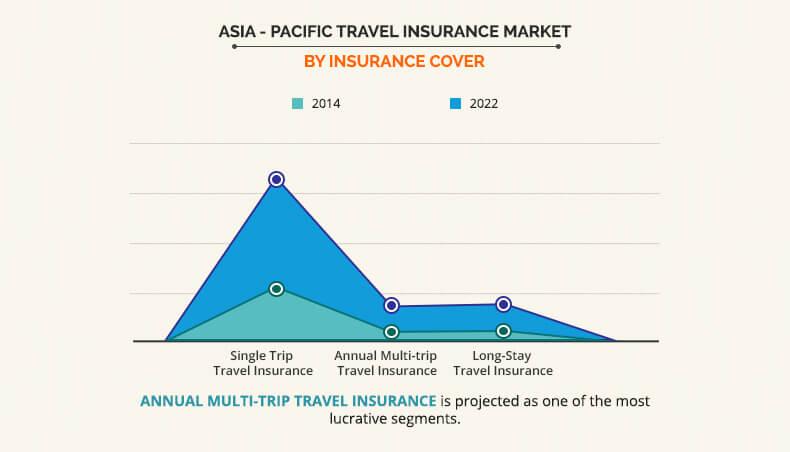

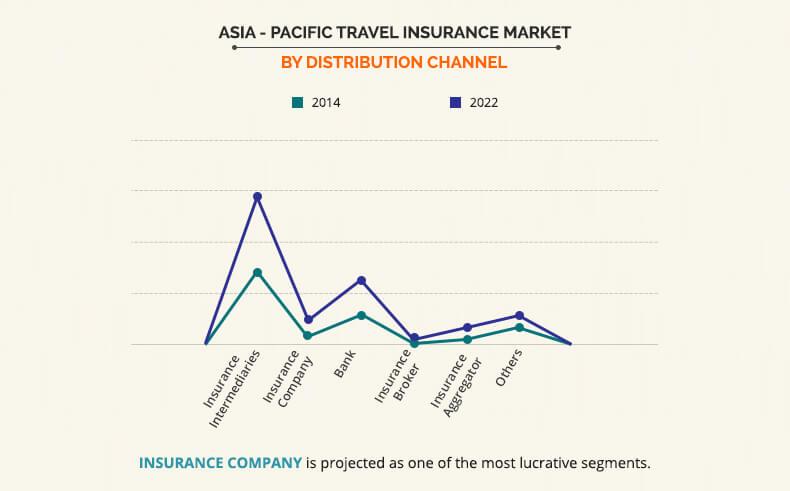

The Asia-Pacific travel insurance market is segmented based on distribution channel, insurance cover, end user, and geography. The distribution channel is categorized into insurance intermediaries, insurance companies, banks, insurance brokers, insurance aggregators, and others. For insurance cover, the market is divided into single trip, annual multi-trip, and long stay. Based on end user, it is classified into senior citizens, educational travelers, backpackers, business travelers, family travelers, and fully independent travelers. Geographically, it is analyzed across China, Japan, India, Australia, New Zealand, Thailand, and rest of Asia-Pacific.

Insurance Intermediaries is the Major Segment

Insurance intermediaries dominate the Asia-Pacific travel insurance market, as they are one of the most traditional and trusted form of distribution channels. Senior citizens and baby boomers opt for intermediaries owing to the long-term relationship and trust associated with them. Insurance intermediaries provide better services and understanding of policies. Moreover, they act as an advisor to an individual to opt for the better policy. Nearly two-thirds of total travel insurance policies sold in the region are carried out by traditional travel agencies and suppliers. During the forecast period, insurance aggregators are expected to grow at a CAGR of 14.4%.

India Possesses High Market Potential

The Indian tourism industry is growing at a steady rate, but the travel insurance market is still in its nascent stage. Increase in awareness related to the significant advantage of travel insurance among the Indian population presents a major opportunity for India to become one of the major travel insurance markets worldwide. Apart from international travelers, the number of domestic travelers across India has also increased. It has been observed that 30 million Indians are subject to domestic traveling each year, thus providing a major opportunity for expansion. Thus, the Indian travel insurance market is expected to grow at a relatively high CAGR during the forecast period.

Domestic travel insurance has witnessed stable growth in India over the past five years, primarily in partnership with tour operators, online travel agents, and airlines. Moreover, single-trip travel insurance is expected to dominate this country, as many travelers purchase the policy that is available while booking a ticket or some use online travel guide to download a plan for purchasing a policy. Over the next five years, online insurance in India is expected to grow at a significant rate, thus creating a substantial opportunity for the travel insurance market. Indians are adopting online-based services at a high rate, due to ease of use, provision of variety of plan selection, and high penetration of internet and smartphones.

Change in International Travel Regulation

Government of various countries, such as Japan, Malaysia, Australia, and Thailand, focus on formulating regulations that mandate the travel insurance for all international travelers to secure the travel of the citizens. Japan has a national health insurance system that covers all the residents of the country, but it is cautious about treating foreign patients due to the low security of reimbursement of expenses incurred. Moreover, the Reciprocal Health Care Agreement, a public health system in New Zealand, offers free hospital care and medical treatment for patients; however, high cost of treatment may limit the patient, in terms of excessive cost. Therefore, government and travel industry across the countries of Asia-Pacific aim on providing travel insurance to the travelers before their journey to secure them from any such type of circumstances.

Key Benefits

- A comprehensive analysis of the current trends and future estimations in the Asia-Pacific travel insurance market is provided.

- The report elucidates on key drivers, restraints, and opportunities and a detailed impact analysis.

- Quantitative analysis is provided from 2014 to 2022, with 2015 as the base year and forecast from 2016 to 2022.

- Porters Five Forces model of the industry illustrates the potency of the buyers and suppliers in the market.

- A quantitative analysis of the current scenario and the forecast period highlights the financial competency of the market.

- The report provides a detailed analysis of the market with respect to distribution channel, insurance cover, end user, and country.

Asia-Pacific Travel Insurance Market Report Highlights

| Aspects | Details |

| By Distribution Channel |

|

| By Insurance Cover |

|

| By End User |

|

| By Country |

|

| Key Market Players | Munich Reinsurance Company, Bajaj Finserv Ltd, MS&AD Insurance Group Holdings, Inc, Ping An Insurance Company of China, Ltd, Dongbu Group, Tokio Marine Holdings, Inc, China Pacific Insurance Co., Ltd, American International Group Inc, Allianz Group, Ace Insurance Company Limited |

Analyst Review

Travel insurance addresses the financial impacts of common problems encountered by the traveler during the course of journey. It provides a protection to safeguard the tourist during travel to foreign countries or domestic areas in the form of monetary compensation to tackle the issues from intense situations. It offers simple health-related safety during the travel along with the services of evacuation or repatriation during the event of emergency, such as outbreaks of viruses, natural disasters, and terrorist attacks. In addition, most travel insurance policies include protective cover against missing checked-in luggage, trip cancellation, and other probable casualties.

Travel insurance service providers offer their services through various form of distribution channels such as insurance intermediaries, insurance companies, banks, insurance brokers, insurance aggregators, and others. Insurance aggregators are expected to grow exponentially during the forecast period, owing to high usage of digitalized channels. Moreover, service providers are investing in more advanced form of technology to cater to the tech-savvy cluster, which largely comprises the younger generation. Furthermore, insurance intermediaries are estimated to maintain their dominance in the Asia-Pacific travel insurance market, as this channel is widely used by senior citizens and baby boomers.

The travel insurance companies in this region have witnessed a continuous shift towards annual multi-trip insurance policy from single-trip insurance policy, wherein multi-trip is expected to grow at relatively high growth rate. Growth in disposable income among individuals and rise in travel among senior citizens have led to increase in number of trips in a year. This creates a huge opportunity for the annual multi-trip travel insurance policy. Moreover, growth of the multi-trip segment is due to expansion of cross-border business, which results rising trips for business travelers. Single-trip travel insurance policy is expected to account for highest market share, due to the growing domestic travel trend among several countries.

Asia-Pacific has witnessed growth in the outbound travel, which creates high demand for travel insurance policy. Rise in travel among baby boomers and senior citizens, high investments for the betterment of digitalized services, and increase in government initiatives for insurance cover are expected to drive the growth of Asia-Pacific travel insurance market.

Established market players have maintained their dominance in Asia-Pacific. However, with the emergence of technologically advanced SMEs and startups, established players are focusing on providing services via online platforms. They aim to expand their market outreach and compete with the emerging players through various scheme such as discount options, sports or activity-related policies, and similar others for consumers.

Loading Table Of Content...