Asia security Information and Event Management Market Statistics, 2030

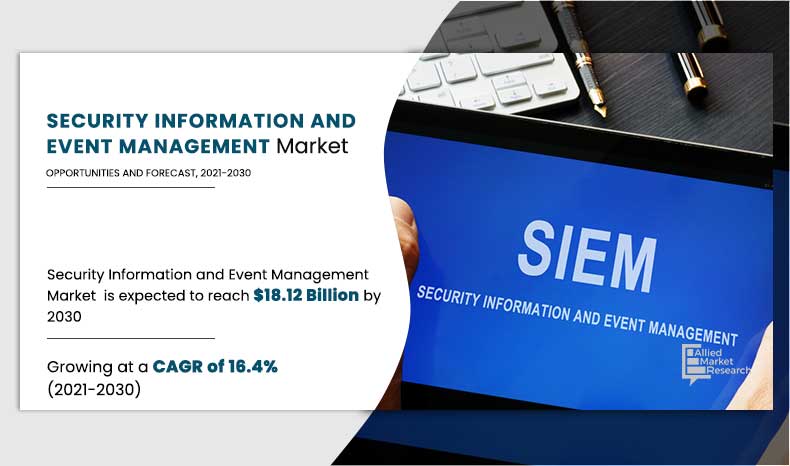

The Asia security information and event management market was valued at $914.73 million in 2020, and is projected to reach $3,483.66 million by 2030, registering a CAGR of 14.2%. Regulatory compliance management such as the Payment Card Industry Data Security Standard (PCI DSS) and Health Insurance Portability and Accountability Act (HIPAA) primarily drives Asia security information and event management market growth. In addition, rise in concerns over IT security has urged organizations to seek more capable defense system as the threat landscape becomes more complex with the dominance of mobile devices and rise in adoption of cloud services.

On the basis of component, the solution segment dominated the overall Asia security information and event management industry in 2020, and is expected to continue this trend during the forecast period. SIEM systems are available in a variety of forms, including traditional server software, hardware appliances, cloud-based, and virtual appliances. SIEM systems are currently built as a data store for high-velocity input, with an emphasis on usability. Need for modern SIEM tools to manage the IT security is expected to drive the growth of the SIEM solution segment in near future.

By Component

Services segment is projected as one of the most lucrative segments.

However, the services segment is expected to witness highest growth of Asia security information and event management market in the upcoming years. Growth in need for better security management, supportive government policies and rules to implement SIEM software, increase in adoption of SIEM on BYOD, and advancements in the SIEM technology has urged users to seek better knowledge and guidance along with the other services to effectively implement the SIEM technology in enterprises to gain maximum output with high quality.

According to the enterprise size, the market was dominated by large enterprises in 2020, and is expected to continue this trend during the forecast period. This is attributed to the fact that the SIEM deployments are complex and costly, which makes large enterprises its predominant users. However, SMEs segment is expected to witness highest growth rate due to rise in challenges regarding security and surveillance among the enterprises.

The report focuses on the growth prospects, restraints, and Asia security information and event management market analysis. The study provides Porter’s five forces analysis of the Asia security information and event management industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the Asia security information and event management market.

By Deployment Model

Cloud segment is projected as one of the most lucrative segments.

Segment Review

The Asia SIEM market is segmented on the basis of component, deployment model, enterprise size, and industry vertical. By component, the market is bifurcated into solution and services. According to the deployment model, the market is classified into on-premise and cloud. As per enterprise size, the market is divided into large enterprises and SMEs. By industry vertical, the Asia SIEM market is categorized into BFSI, government, IT & telecommunication, healthcare & life sciences, retail, manufacturing, and others. By country, the Asia security information and event management market share is studied across China, India, Japan, South Korea, Singapore, Indonesia, and Rest of Asia.

By Country

India is projected as one of the most significant country

Top Impacting Factors

Factors that impact the growth of the Asia security information and event management market include rise in concerns over IT security, surge in adoption of BYOD trend, persistent threat of cybercrimes, supportive IT governance, and regulatory compliance. Other factors that influence the market growth include complication of SIEM solution, high cost of ownership, and inconvenience for IT administrators in validating return on investment (ROI), and Anomaly detection by next generation SIEM.

Rise in concerns over IT security

IT security has become a crucial issue for all organizations regardless of their industry and size. For instance, according to the “Future of Cybersecurity in Asia Pacific and Japan” by Sophos and Tech Research Asia (TRA), organizations in Asia-Pacific are becoming more mature with cybersecurity; however, they are continuing to be hit by a various attacks with 56% suffering from a successful cyber-attack in 2021 up from 32% in 2019. This has pushed the need for security management system that is well-integrated with the IT infrastructure of the company and offers efficient performance at affordable price. Security information and event management offers threat, log, and event management at an affordable cost and with a unified solution to simplify the complexity of managing multiple security solutions with high productivity.

Emergence of next generation security information and event management

Vendors operating in the market are offering advanced security information and event management platform and services to improve the experience of their customers. For instance, in April 2021, Securonix, Inc., one of the leading providers of Next-Gen SIEM launched Securonix Jupiter, the latest offering over its cloud-native SIEM platform. This launch provides new as well as enhanced features enabling the customers with an ability to provide better time-to-value & user experiences for security analysts, respond & detect to advanced threats accurately and more quickly, and add flexible SaaS service options to optimize performance & cost. Such development creates lucrative growth opportunities for the market during the forecast period.

COVID impact analysis

The current estimation of 2030 is projected to be higher than pre-COVID-19 estimates. Post COVID-19, revenue of the Asia security information and event management market size is estimated to be $914.73 million in 2020. It has registered increase in its revenue and is expected to reach $1,058.34 million in 2021. The rising cyber-attacks during the Covid-19 pandemic has pushed demand for security information and event management solutions among the enterprises.

The pandemic has led to the acceleration in digital transformation journey of the enterprises; however, cyber-security has become a major concern. For instance, restrictions due to the work from home and stay at home initiatives has enabled rise of technology usage, leading to the need for ’cyber-safe’ remote-working environment. For instance, in June 2020, Swissinfo.ch, a news and information platform reported that the figures from the National Cyber Security Center (NCSC) found that there were about 350 reported cases of cyber-attacks including fraudulent web sites, phishing, and direct attacks on companies across the Switzerland in April, compared to the norm of 100-150 cases.

Key Benefits for Stakeholders

- This study includes the Asia security information and event management market growth, Asia security information and event management market trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and Asia security information and event management market opportunity.

- The Asia security information and event management market size is quantitatively analyzed from 2020 to 2030 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the Asia security information and event management market forecast.

Asia Security Information and Event Management Market Report Highlights

| Aspects | Details |

| By COMPONENT |

|

| By DEPLOYMENT MODEL |

|

| By ENTERPRISE SIZE |

|

| By INDUSTRY VERTICAL |

|

| By COUNTRY |

|

| Key Market Players | DELL EMC, RSA SECURITY LLC, SPLUNK INC., MCAFEE LLC, IBM CORPORATION, MICRO FOCUS, EXABEAM, RAPID7, SOLARWINDS WORLDWIDE, LLC |

Analyst Review

In accordance with the CXOs of the leading companies, the security information and event management market is at a mature stage and has grown at a respectable rate and is expected to witness average growth rate of 10.1% during the forecast period. The organizations seek tools that satisfy regulation compliance to include identification of possible threats and evaluation as well as easy-to-understand analysis of the data, as the threat landscape is constantly evolving. The market of security information and event management products has also merged with the fellow technologies such as continuous forensic analytics (CFA) and breach detection system (BDS). These changes have presented new opportunities for the market that can fuel significant growth. In the current scenario, many consumers choose to outsource management of their security information and event management products to managed security services providers (MSSPs). Security information and event management vendors adapt their offerings specifically toward MSSPs, which enable them to transform to security operations centers (SOCs) for their customers. This has enriched their revenue generation capabilities as well as increased the availability of security information and event management products for the mid and small size enterprises.

Security information and event management products were traditionally inclined toward log and network event association and compliance reporting. However, the organization seeks more that would also perform incident forensics. This allows vendors to incorporate threat intelligence feed and other contextual information into their offerings to offer improved capabilities as compared to CFA products. Security information and event management systems are mandated by regulatory compliances such as the PCI DSS, and the HIPAA Act and generate event reports.

The CXOs further added that the security information and event management systems market is competitive and comprises number of regional and global vendors competing on the basis of factors such as cost of solutions, reliability, features, and support services. The growth of the market is impacted by rapid advances in the cyber security offerings, whereas the vendor performance is impacted by COVID-19 conditions and industry development.

Vendors operating in the market are offering advanced security information and event management platform and services to improve the experience of their customers owing to the competition. For instance, in April 2021, Securonix, Inc., one of the leading providers of Next-Gen SIEM launched Securonix Jupiter, the latest offering over its cloud-native SIEM platform. This launch provides new as well as enhanced features enabling the customers with an ability to provide better time-to-value & user experiences for security analysts, respond & detect to advanced threats accurately and more quickly, and add flexible SaaS service options to optimize performance and cost.

Loading Table Of Content...