Aspirin Drugs Market Research, 2035

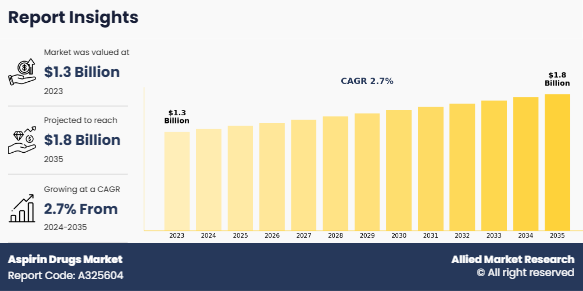

The global aspirin drugs market size was valued at $1.3 billion in 2023, and is projected to reach $1.8 billion by 2035, growing at a CAGR of 2.7% from 2024 to 2035. The aspirin drug market is expanding, driven by rise in aging population. The aging population is particularly contributing to aspirin consumption, as older individuals are more susceptible to heart-related conditions. A survey conducted by the University of Michigan in March 2024, found that one in four adults aged 50–80 (25%) reported taking aspirin regularly (three or more days per week).

Aspirin, also known as acetylsalicylic acid, is a widely used nonsteroidal anti-inflammatory drug (NSAID) with analgesic, antipyretic, and anti-inflammatory properties. It works by inhibiting cyclooxygenase (COX) enzymes, reducing prostaglandin production, which helps relieve pain, fever, and inflammation. In addition, aspirin acts as an antiplatelet agent, preventing blood clot formation, making it essential in cardiovascular disease prevention and stroke management. It is commonly used for conditions such as headaches, arthritis, muscle pain, and heart attack prevention. Available in various formulations, including tablets and enteric-coated versions, aspirin is one of the most affordable and accessible drugs globally. However, prolonged use may cause gastrointestinal side effects, requiring cautious administration, especially in high-risk individuals.

Key Takeaways

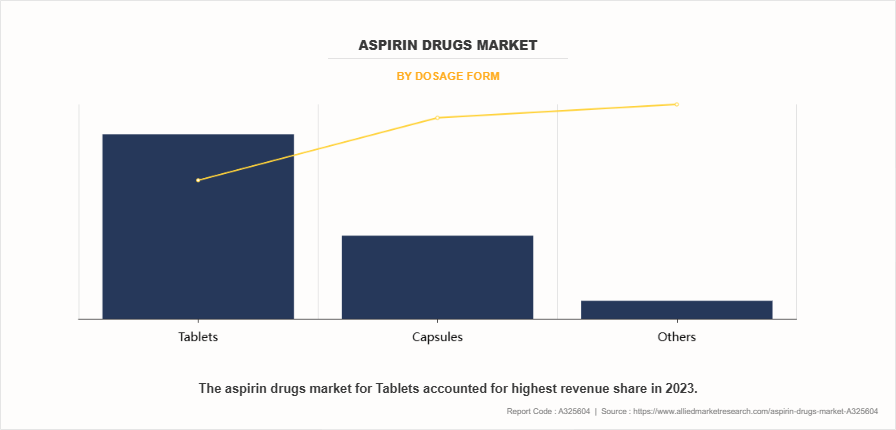

- On the basis of dosage form, the tablet segment dominated the aspirin drugs market share in 2023. However, the others segment is anticipated to grow at the highest CAGR during the forecast period.

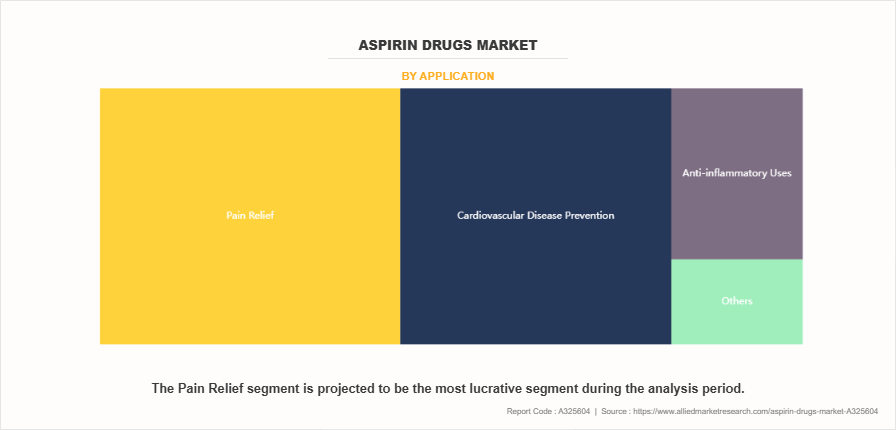

- On the basis of application, the pain relief segment dominated the market share in 2023. However, the others segment is anticipated to grow at the highest CAGR during the forecast period.

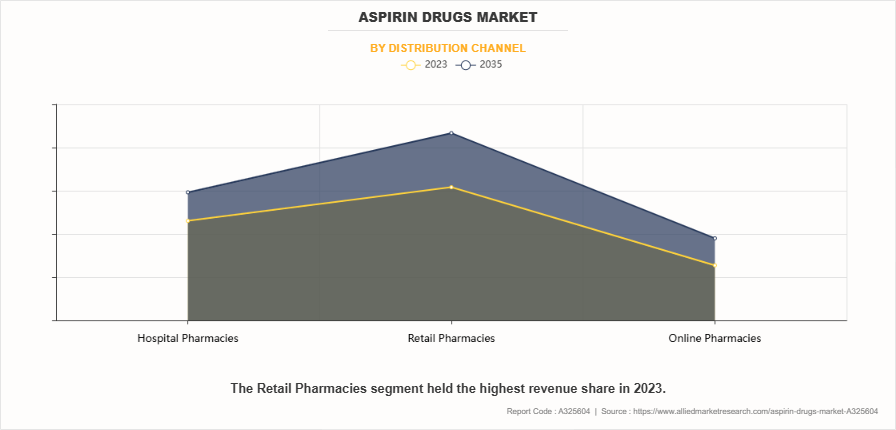

- On the basis of distribution channel, the retail pharmacies segment dominated the aspirin drugs market share in 2023. However, the online pharmacies segment is anticipated to grow at the highest CAGR during the forecast period.

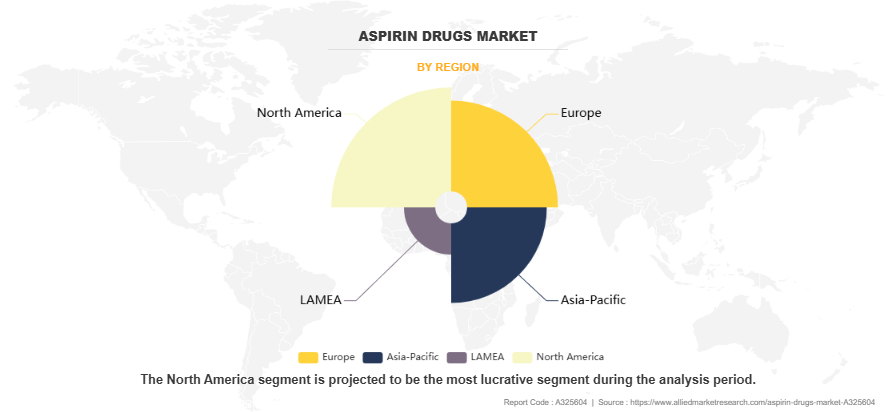

- Region-wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the aspirin drugs market forecast period.

Market Dynamics

The aspirin drugs market growth is driven by several key factors that contribute to its sustained growth across various therapeutic applications. One of the primary drivers is rise in prevalence of cardiovascular diseases (CVDs) globally. As heart disease remains a leading cause of mortality, aspirin’s role as an antiplatelet agent in preventing heart attacks and strokes continues to drive demand. Physicians widely prescribe aspirin for patients at risk of cardiovascular events, driving its significance in long-term therapy. In addition, rise in awareness of campaigns by healthcare organizations, such as the American Heart Association, has encouraged patients to adopt aspirin therapy for CVD prevention, further expanding the market.

Another major driver is the widespread use of aspirin for pain management. As a nonsteroidal anti-inflammatory drug (NSAID), aspirin is extensively used for relieving headaches, muscle pain, arthritis, and inflammatory conditions. Its affordability and availability as an over-the-counter (OTC) medication make it a preferred choice for self-medication. Rise in prevalence of chronic pain conditions, including osteoarthritis and rheumatoid arthritis, has fueled demand for analgesic medications, with aspirin remaining a popular option. In addition, the trend toward self-care and pain relief solutions without a prescription has supported market expansion, particularly in retail and online pharmacy channels.

Also, continuous advancements in pharmaceutical formulations aimed at improving aspirin’s safety profile drive the aspirin drugs market growth. Traditional aspirin use has been associated with gastrointestinal side effects, such as ulcers and bleeding. However, introduction of enteric-coated and gastro-resistant aspirin has helped minimize these adverse effects, enhancing patient compliance. Extended-release formulations and microencapsulation technologies have also contributed to better tolerability, allowing long-term use for cardiovascular prevention and chronic pain management. These innovations have not only improved patient adherence but have also expanded the market by addressing concerns related to aspirin’s gastrointestinal risks.

However, the aspirin drug market faces significant restraint due to availability of alternative medications and regulatory challenges. Many patients and healthcare providers opt for alternatives like acetaminophen, ibuprofen, or selective COX-2 inhibitors, which offer pain relief with a lower risk of gastrointestinal side effects. In addition, stringent regulatory guidelines impact aspirin’s market growth, with health authorities imposing warnings about its potential risks, including gastrointestinal bleeding and Reye’s syndrome in children. These regulatory challenges influence prescribing patterns and consumer confidence, limiting aspirin’s widespread adoption. As a result, competition from alternative drugs and regulatory constraints continues to challenge market expansion.

However, an emerging opportunity in the aspirin drugs market lies in its expanding application in cancer prevention and treatment. Ongoing clinical trials, such as the Add-Aspirin study, are investigating aspirin’s potential role in reducing the risk of cancer recurrence, particularly in colorectal and gastrointestinal cancers. Research suggests that aspirin’s anti-inflammatory and antiplatelet properties may help prevent tumor progression, offering new therapeutic possibilities beyond its traditional uses. If clinical findings confirm aspirin’s efficacy in oncology, it could open new avenues for market growth, attracting investments from pharmaceutical companies and broadening its therapeutic scope. With increasing interest in preventive medicine and oncology research, the potential expansion of aspirin into cancer prevention represents a promising growth opportunity in the pharmaceutical landscape.

Segmental Overview

The aspirin drugs industry is segmented into dosage form, application, distribution channel, and region. On the basis of dosage form, it is segmented into tablets, capsules, and others. On the basis of application, it is classified into pain relief, cardiovascular disease prevention, anti-inflammatory uses, and other applications. On the basis of distribution channel, it is classified into hospital pharmacies, retail pharmacies, and online pharmacies. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

By Dosage Form

By dosage form, the tablet segment dominated the aspirin drug market share in 2023. This was attributed to its broad availability, ease of use, and accurate dosage control. Tablets are favored for their extended shelf life, affordability, and patient convenience, making them a popular choice for both prescription and OTC applications. In addition, innovations in enteric-coated and extended-release formulations have improved patient adherence by minimizing gastrointestinal side effects.

However, the others segment is expected to register the highest CAGR during the forecast period owing to its growing role in specialized treatments. Injectable aspirin is increasingly used in emergency cardiovascular care, while suppositories serve as an alternative for patients with gastrointestinal concerns or swallowing difficulties. Furthermore, granules provide flexible dosing options, supporting better patient adherence and contributing to market expansion.

By Application

By application, the pain relief segment dominated the aspirin drug market share in 2023, owing to its widespread use in managing headaches, muscle aches, and other pain-related conditions. Aspirin’s proven efficacy as an analgesic, along with its availability in various formulations, has contributed to its strong demand. In addition, rise in prevalence of chronic pain and growing consumer preference for over-the-counter (OTC) pain relievers have further driven the segment growth.

However, the others segment is expected to register the highest CAGR during the forecast period, owing to its expanding therapeutic applications. Aspirin’s antipyretic properties continue to drive demand for fever treatment, while its antithrombotic effects are increasingly utilized in post-surgical recovery to prevent clot formation. In addition, ongoing clinical trials investigating aspirin’s potential in esophageal cancer prevention and treatment are fueling research investments, further accelerating the market growth.

By Distribution Channel

By distribution channel, the retail pharmacies segment dominated the market in 2023, owing to its widespread accessibility, robust distribution networks, and increasing consumer preference for over-the-counter (OTC) medications. Retail pharmacies provide convenient purchasing options, pharmacist guidance, and a diverse range of aspirin formulations. In addition, the growing trend of self-medication, particularly for pain relief and cardiovascular disease prevention, along with the expansion of pharmacy chains in emerging markets, has further fueled the segment growth in the aspirin drug market.

However, the online pharmacies segment is expected to register the highest CAGR during the forecast period owing to rapid adoption of e-commerce, rise in internet penetration, and the convenience of home delivery. Online platforms offer competitive pricing, easy accessibility, and doorstep delivery, making them an appealing choice for consumers.Furthermore, growth of telemedicine, increased availability of digital prescriptions, and expanding regulatory approvals for online drug sales are driving the segment growth, particularly in regions with a well-established digital healthcare infrastructure.

By Region

Region-wise, North America was the largest shareholder in the aspirin drug market in 2023, owing to rise in prevalence of cardiovascular diseases, widespread awareness of preventive healthcare, and strong healthcare infrastructure. The region benefits from substantial healthcare investment, a well-established pharmaceutical industry, and presence of major market players. In addition, increase in geriatric population, rise in adoption of OTC drugs, and favorable regulatory policies have further fueled the demand for aspirin in both prescription and over-the-counter applications.

However, Asia-Pacific is anticipated to register the highest CAGR during the forecast period owing to rise in prevalence of cardiovascular diseases, rise in healthcare awareness, and increase in geriatric population. The region is witnessing rapid urbanization, improved healthcare infrastructure, and expanding pharmaceutical manufacturing capabilities, making aspirin drugs more accessible. In addition, rise in OTC drug adoption, increase in disposable income, and government initiatives to improve cardiovascular health are further driving the market growth in the region. Expansion of online pharmacies also contributes to the growth of the market in the Asia-Pacific region.

Competition Analysis

Competitive analysis and profiles of the major players in the aspirin drugs market size are Bayer AG, Perrigo Company plc, Cardinal Health, Thermo Fisher Scientific Inc., Mayne Pharma Group Limited, Advacare Pharma Inc., Dexcel Pharma Limited, Hyloris Pharmaceuticals SA, Conical Pharmaceuticals, and Geri-Care Pharmaceuticals Corp. The key players have adopted product approval, partnership, and clinical trials as the key strategies for expansion of their product portfolio.

Recent Developments in Aspirin Drugs Industry

- In February 2023, Huma Therapeutics Limited ("Huma"), a leading global digital health company, and Bayer, a leading global life sciences company, partnered to develop the Bayer Aspirin Heart Risk Assessment, an online tool that quickly assesses an individual's risk factors for developing cardiovascular disease (CVD) over the next 10 years, which can be shared with a healthcare professional as part of ongoing health management.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aspirin drugs market analysis from 2023 to 2035 to identify the prevailing aspirin drugs market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aspirin drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aspirin drugs market trends, key players, market segments, application areas, and market growth strategies.

Aspirin Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 1.8 billion |

| Growth Rate | CAGR of 2.7% |

| Forecast period | 2023 - 2035 |

| Report Pages | 264 |

| By Dosage Form |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Bayer AG, Thermo Fisher Scientific Inc., Advacare Pharma Inc., Cardinal Health, Conical Pharmaceuticals, Perrigo Company plc, Mayne Pharma Group Limited, Hyloris Pharmaceuticals SA, Geri-Care Pharmaceuticals Corp., Dexcel Pharma Limited |

Analyst Review

According to CXOs, the aspirin drug market is primarily driven by rise in prevalence of cardiovascular diseases, increase in adoption of preventive healthcare, and rise in geriatric population. They emphasized that innovations in formulations, such as enteric-coated and extended-release aspirin, are improving patient compliance and reducing gastrointestinal side effects, thereby expanding market reach. Surge in over-the-counter (OTC) sales and the shift toward self-medication trends are further contributing to the market growth.

CXOs also highlighted the importance of regulatory approvals and strategic partnerships is contributing to market expansion. Introduction of aspirin-based combination therapies for cardiovascular disease prevention is driving adoption across healthcare settings. In addition, collaborations between pharmaceutical companies, healthcare providers, and online pharmacy platforms are significantly improving accessibility to aspirin products. However, challenges such as gastrointestinal complications associated with long-term use, competition from alternative anticoagulants, and stringent regulatory guidelines hamper the market growth.

North America currently dominates the market due to its strong healthcare infrastructure, rise in awareness of cardiovascular disease prevention, and widespread OTC drug availability. CXOs anticipate Asia-Pacific to grow at the highest CAGR in the coming years. , driven by rise in healthcare awareness, increase in government initiatives for cardiovascular health, and expanding pharmaceutical manufacturing capabilities. Growth of e-commerce platforms and online pharmacies is expected to further accelerate demand in emerging markets.

The total market value of aspirin drugs market was $ 1.3 billion in 2023.

The market value of aspirin drugs market is projected to reach $ 1.8 billion by 2035.

The forecast period for aspirin drugs market is 2024 to 2035

The base year is 2023 in aspirin drugs market .

Aspirin, also known as acetylsalicylic acid, is a widely used nonsteroidal anti-inflammatory drug (NSAID) with analgesic, antipyretic, and anti-inflammatory properties. It works by inhibiting cyclooxygenase (COX) enzymes, reducing prostaglandin production, which helps relieve pain, fever, and inflammation. In addition, aspirin acts as an antiplatelet agent, preventing blood clot formation, making it essential in cardiovascular disease prevention and stroke management.

Loading Table Of Content...

Loading Research Methodology...