At-home Genetic Testing Market Research, 2035

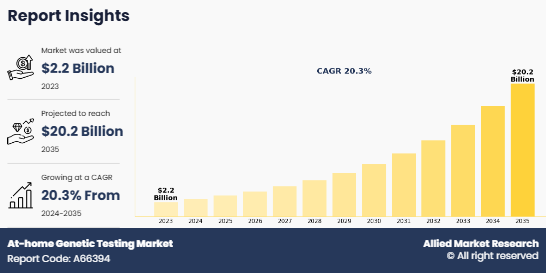

The global at-home genetic testing market size was valued at $2.2 billion in 2023, and is projected to reach $20.2 billion by 2035, growing at a CAGR of 20.3% from 2024 to 2035. The at-home genetic testing market is driven by rising awareness of genetic predispositions to diseases, and advancements in DNA sequencing technology. The growing demand for ancestry and health-related genetic insights has fueled the adoption of direct-to-consumer (DTC) genetic tests, making genetic information more accessible. For instance, according to an article published by American Society for Clinical Investigation in 2024, over 15 million people, or 4.6% of the U.S. population, were diagnosed with at least 1 autoimmune disease from January 1, 2011 to June 1, 2022.

At-home genetic testing refers to direct-to-consumer (DTC) genetic testing that allows individuals to analyze their DNA from the comfort of their homes without needing a healthcare provider's prescription. These tests typically involve collecting a saliva or cheek swab sample, which is then sent to a laboratory for analysis. The results provide insights into various genetic traits, ancestry, health predispositions, carrier status for inherited conditions, and even personalized wellness factors like nutrition and fitness.

Key Takeaways

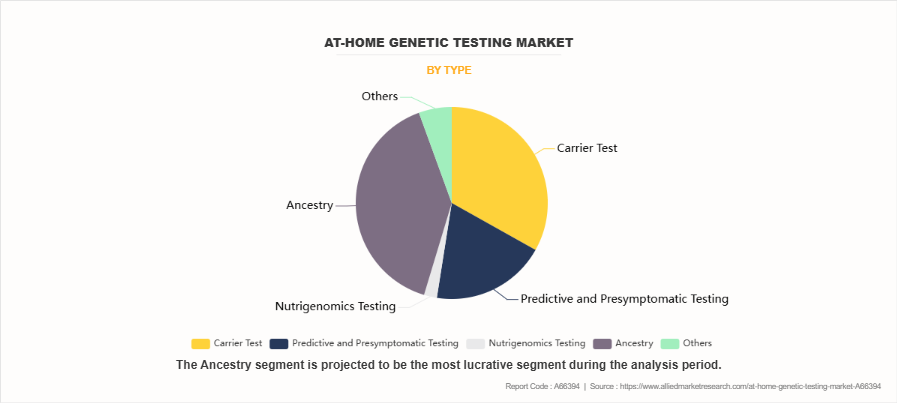

- On the basis of type, the ancestry segment dominated the at-home genetic testing market share in 2023. However, the carrier test segment is anticipated to be the fastest-growing segment during the forecast period.

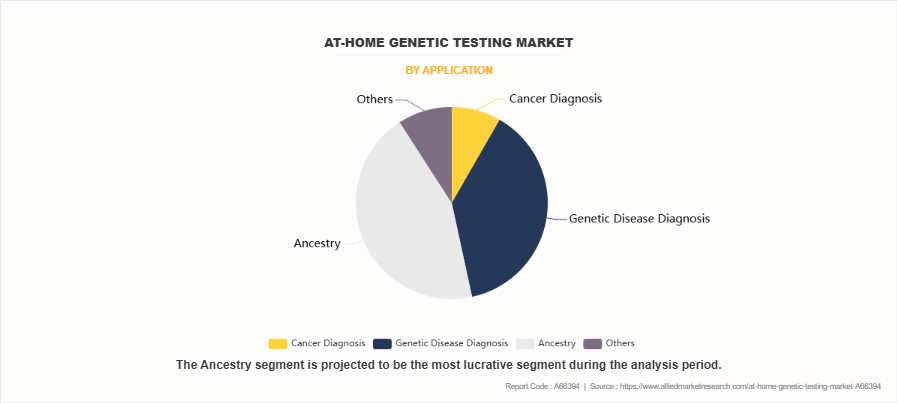

- On the basis of application, the ancestry segment dominated the global market in 2023. However, the genetic disease diagnosis segment is anticipated to be the fastest-growing segment during the forecast period.

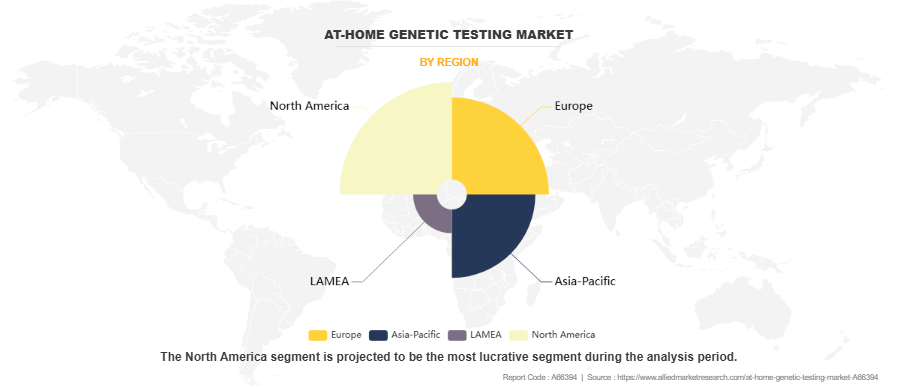

- North America dominated the market in terms of revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

According to at-home genetic testing market forecast analysis, the market is experiencing significant growth driven by increasing consumer interest in personalized healthcare, technological advancements, and the growing awareness of genetic predispositions to various health conditions. In addition, rise in number of genetic diseases and chronic diseases further drive the demand for at-home genetic testing. For instance, according to the National Cancer Institute, around 2 million new cases of cancer were diagnosed in the U.S. in 2024. Direct-to-consumer (DTC) genetic testing has gained widespread popularity as it enables individuals to access valuable genetic insights without requiring a prescription or medical consultation. The convenience of at-home sample collection, typically through saliva or cheek swabs, further contributed to the market expansion.

According to at-home genetic testing market opportunity analysis one of the primary growth drivers of this market is the rise in demand for personalized health and wellness solutions. Consumers are increasingly interested in understanding their genetic makeup to make informed decisions about lifestyle, nutrition, fitness, and disease prevention. At-home genetic tests offer insights into hereditary risks for conditions such as cardiovascular diseases, diabetes, and certain types of cancer. This growing health consciousness, coupled with the increasing adoption of preventive healthcare strategies, is fueling market demand.

At-home genetic testing market growth is driven by expanding application of genetic testing beyond health predisposition analysis. Consumers are using at-home tests for ancestry and genealogy research, paternity testing, and even lifestyle-related insights such as nutrigenomics and pharmacogenomics. The ability to uncover ancestry details and hereditary traits has made genetic testing appealing to a broader audience, further boosting market expansion.

The growing integration of at-home genetic testing with digital health platforms and telemedicine services has also contributed to its increasing adoption. Many companies now offer comprehensive reports along with access to genetic counselors or healthcare professionals who can help interpret the results and provide personalized recommendations. This integration enhances the value of at-home testing and aligns with the broader trend of digital healthcare solutions.

Government initiatives and regulatory support for genetic research and precision medicine are further driving at-home genetic testing market size. As regulatory frameworks evolve to ensure test accuracy, data privacy, and ethical considerations, consumer confidence in at-home genetic testing is improving. Additionally, pharmaceutical companies and research institutions are increasingly collaborating with genetic testing firms to leverage genetic data for drug development and personalized medicine.

However, concerns over data privacy and the security of genetic information remain significant, as consumers worry about potential misuse by third parties, including insurance companies and employers, which may restrict the market growth. In addition, the high costs associated with advanced genetic testing and limited insurance coverage for such services restrict accessibility for a broader population.

On the other hand, increase in consumer demand for personalized health insights, advancements in genetic sequencing, and the convenience of direct-to-consumer testing provide lucrative opportunity for the At-home genetic testing market growth.

Segmental Overview

The at-home genetic testing industry is segmented on the basis of type, application, and region. By type, the market is classified into carrier test, predictive and presymptomatic testing, nutrigenomics testing, ancestry, and others. By application, the market is classified into cancer diagnosis, genetic disease diagnosis, ancestry, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Type

The ancestry segment dominated the at-home genetic testing market share in 2023. This is attributed to the growing consumer interest in exploring genetic heritage, family lineage, and ethnic background. The increasing accessibility of at-home genetic testing kits, coupled with advancements in DNA analysis, has made ancestry testing more accurate and affordable, driving widespread adoption.

However, carrier test segment is expected to register the highest CAGR during the forecast period. This is attributed to increase in awareness of inherited genetic disorders and the rising demand for reproductive health screening. Carrier testing enables individuals and couples to identify potential genetic risks for passing hereditary conditions to their children, fueling its adoption, particularly among expecting parents and those planning for pregnancy.

By Application

The ancestry segment dominated the market in terms of revenue in 2023, attributed to the rise in consumer interest in discovering family heritage, ethnic origins, and ancestral migration patterns. The increasing availability and affordability of direct-to-consumer (DTC) genetic testing kits have made ancestry testing more accessible to a broad audience. Advancements in DNA sequencing technology and large genealogy databases have enhanced the accuracy and depth of ancestry insights, further driving demand. Additionally, strong marketing efforts, social media influence, and collaborations between genetic testing companies and ancestry research organizations have contributed to the segment's growth.

However, genetic disease diagnosis segment is expected to register the highest CAGR during the forecast period. This is attributed to the rise in prevalence of genetic disorders, increase in awareness of early disease detection, and advancements in genomic sequencing technologies. The growing adoption of genetic testing for diagnosing hereditary conditions such as cystic fibrosis, sickle cell anemia, and certain types of cancer has significantly driven the demand for at-home genetic testing.

By Region

The at-home genetic testing market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in terms of revenue in 2023. This is attributed to the presence of leading genetic testing companies, coupled with continuous advancements in DNA sequencing technologies, which has significantly driven market growth. In addition, strong regulatory frameworks and evolving guidelines for genetic testing have enhanced consumer confidence, promoting market expansion.

The growing integration of genetic testing with digital health platforms and telemedicine services has improved accessibility, allowing individuals to make informed healthcare decisions. Furthermore, rise in investments in genomics research, precision medicine, and strategic collaborations between biotechnology firms and healthcare providers have contributed to the regionl market dominance.

Asia-Pacific is expected to grow at the highest rate during the forecast period owing to increase in consumer awareness of genetic testing and expanding healthcare infrastructure. The growing adoption of direct-to-consumer (DTC) genetic tests for ancestry exploration, health risk assessment, and personalized medicine is fueling market expansion in the region. Government initiatives supporting genetic research and precision medicine, along with rising investments from biotechnology and healthcare companies, are further driving growth.

The increase in prevalence of genetic disorders and the growing interest in preventive healthcare are also contributing to the market expansion. Moreover, the presence of emerging market players and strategic partnerships between international and regional companies are expected to enhance product availability and affordability, accelerating market penetration in Asia-Pacific.

Competition Analysis

Major key players that operate in the global at-home genetic testing market are Myriad Genetics, Inc., Ancestry, Gene by Gene, Ltd., MyHeritage Ltd., Prenetics Global Limited, Color Health, Inc., Living DNA Ltd., 23andMe Holding Co., Rhythm Biosciences, and Mapmygenome. Key players operating in the market have adopted product launch and partnership as their key strategies to expand their product portfolio.

Recent Developments in the At-Home Genetic Testing Industry

- In August 2024, Genetic Technologies Limited, a global leader in genomics-based tests in health, wellness and serious disease and the parent company of geneType announced the global launch of the geneType Risk Assessment portfolio on wholly owned EasyDNA platform currently selling in 42 countries.

- In May 2024, Color Health announced partnerships with SkinIO and Bexa to integrate their distributed solutions for skin cancer screening and breast cancer early detection into Color's Virtual Cancer Clinic. With the addition of new, innovative screening technologies, Color is building on its program for employers to significantly increase cancer screening and detection rates, and manage cancer holistically. Through Bexa, examinations for breast cancer can be conveniently accessible at worksites across all 50 U.S. states, and with SkinIO, screenings for skin cancer are available to anyone with a smartphone.

- In June 2024, MapmyGenome, a leader in personal genomics and preventive health, and Humanity Inc., a pioneer in health and longevity data analysis and user behavior change, announced a strategic partnership aimed at transforming personalized healthcare. This collaboration will combine the power of advanced genomics with cutting-edge data analytics and behavior change methods to deliver holistic health solutions through the Humanity AI Health Coach App.

- In August 2022, Prenetics Global Limited, a global leader in genomic and diagnostic testing, announced the launch of Circle Snapshot, a variety of at-home blood tests that feature the world first painless, patented, push-button blood collection device, to enable individuals to discover one current health status from home.

- In August 2022, Verogen, Inc. and Gene by Gene announced a partnership to accelerate the adoption of forensic investigative genetic genealogy. As part of the agreement, Gene by Gene, parent company of FamilyTreeDNA, will support DNA uploads generated from the Verogen ForenSeq Kintelligence kit, the only ANAB accredited technology approved for forensic investigative genetic genealogy (FIGG).

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the at-home genetic testing market analysis from 2023 to 2035 to identify the prevailing at-home genetic testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the at-home genetic testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global at-home genetic testing market trends, key players, market segments, application areas, and market growth strategies.

At-home Genetic Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 20.2 billion |

| Growth Rate | CAGR of 20.3% |

| Forecast period | 2023 - 2035 |

| Report Pages | 270 |

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | Mapmygenome, Ancestry, Rhythm Biosciences, Color Health, Inc., Myriad Genetics, Inc., Living DNA Ltd., Prenetics Global Limited, Gene by Gene, Ltd., 23andMe Holding Co., MyHeritage Ltd. |

Analyst Review

This section provides various opinions of top-level CXOs in the global at-home genetic testing market. According to the insights of CXOs, the global at-home genetic testing market is expected to exhibit high growth potential attributable to the increase in demand for personalized healthcare, rise in prevalence of genetic disorders, and growing consumer interest in ancestry and wellness testing. However, the high cost of genetic testing may restrict the market growth in emerging countries. CXOs further added that the advancements in DNA sequencing technologies, reduced testing costs, and the expanding availability of direct-to-consumer (DTC) genetic tests further support market growth. Additionally, the integration of artificial intelligence (AI) and big data analytics in genetic testing, increasing telehealth adoption, and supportive regulatory frameworks contribute to the market’s expansion.

Furthermore, North America dominated the market share, in terms of revenue in 2023, owing to the strong presence of key industry players, high consumer awareness, and widespread adoption of direct-to-consumer (DTC) genetic tests. Favorable regulatory frameworks, advanced healthcare infrastructure, and increasing demand for personalized medicine further contributed to the region’s market dominance. However, Asia-Pacific is anticipated to witness notable growth owing to rise in consumer awareness and increase in adoption of direct-to-consumer (DTC) genetic testing. Technological advancements, expanding healthcare infrastructure, and the presence of emerging market players further drive growth. Additionally, government initiatives supporting genetic research and the increasing demand for personalized medicine contribute to the region’s rapid expansion

The at-home genetic testing market was valued at $2,193.45 million in 2023

The at-home genetic testing market is estimated to reach $20,161.74 million by 2035,

The forecast period for At-home Genetic Testing Market is 2024-2035

Major key players that operate in the At-home Genetic Testing Market are Ancestry, MyHeritage Ltd., 23andMe Holding Co., Gene by Gene, Ltd

The base year is 2023 in At-home Genetic Testing Market

Loading Table Of Content...

Loading Research Methodology...