All-terrain Vehicle and Utility Terrain Vehicles (ATV and UTV) Market - 2031

The global ATV and UTV market size was valued at $9.4 billion in 2021, and is projected to reach $18.6 billion by 2031, growing at a CAGR of 7.3% from 2022 to 2031.

Report Key Highlighters:

- The report covers the market size for ATVs and UTVs for the year 2021 & is forecasted till the year 2031 with a CAGR of 7.3% from 2022 to 2031.

- The report covers segments such as vehicle type, displacement, power output, fuel type, end use and region.

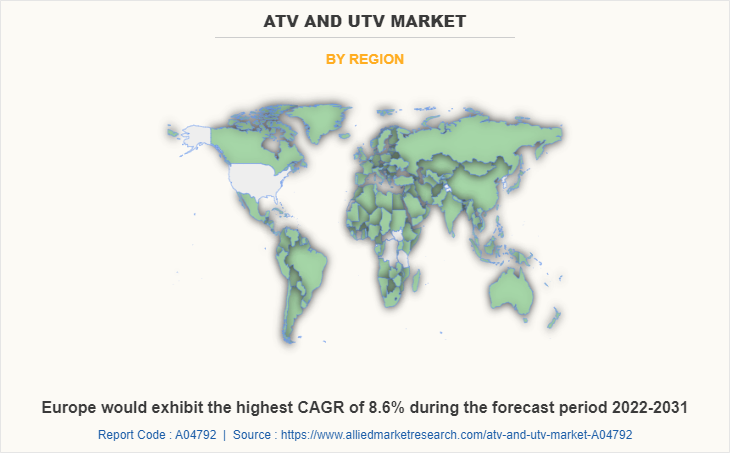

- The report is studied across different regions such as North America, Europe, Asia-Pacific and LAMEA.

- The report includes detailed customization on electric gearbox, analysis on Liquid Cooled Motors as well as includes a detailed list of ATV-UTV tradeshows, exhibitions & associations.

All-terrain vehicles (ATVs) and utility terrain vehicles (UTVs) are popular off-road vehicles that are used for recreational and commercial purposes. An ATV is a vehicle equipped with handlebars and four low-pressure tires which ease driving through a variety of terrain conditions. ATVs are known for their off-road capabilities & movability across all terrain and are applicable in survey, military, agriculture, sports, forestry, and other applications. ATVs & UTVs are typically utilized in off-road terrain, but only a few places allow their use on public roads as well.

These vehicles are handled very differently and require special training before being used. ATVs & UTVs have gained popularity over the past few years as they allow access to remote areas and provide a convenient way to carry supplies & equipment. Moreover, ATVs & UTVs are also used in transportation purposes by removing the use of animals. These vehicles are also used in military, marine, and army's ground unit to patrol, security, and reconnaissance purposes. For instance, in November 2020, Polaris Government & Defense developed sportsman MV850 ATV developed for military applications including, administrative, security, patrol, and reconnaissance purposes during forward operations and training.

Similarly, a utility terrain vehicle (UTV) is constructed to function tasks in an effective manner than a general-purpose vehicle. UTVs are typically smaller and more efficient than full-size vehicles such as cars or SUVs and are designed to operate across rough terrain & challenging environments. It is also known as a side-by-side, four-wheel drive off-road vehicle, with a passenger carrying capacity of two to six at a time.

UTVs are also big & powerful and can accommodate more than one person. They are frequently used to transport supplies and equipment in places where employing a truck is expected to be difficult or impossible.The global ATV and UTV market has been governed by factors such as increase in trend of adventure sports & recreational activities, adoption of ATV & UTV in military activities, and government rules to support driving ATVs and UTVs on road. However, the ban on ATV and UTV driving in wildlife areas due to terrain damage and high maintenance cost of ATVs and UTVs hinder the growth of the market. Furthermore, production of safer ATVs & UTVs and development of electric vehicles provides lucrative opportunity for the growth of the global ATV and UTV market across the globe.

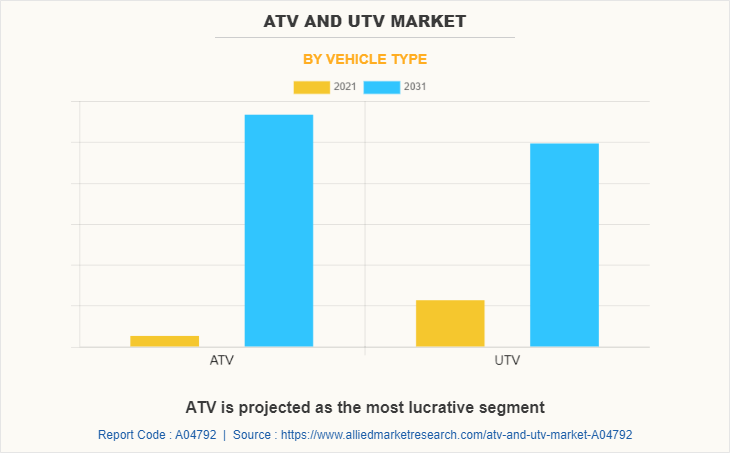

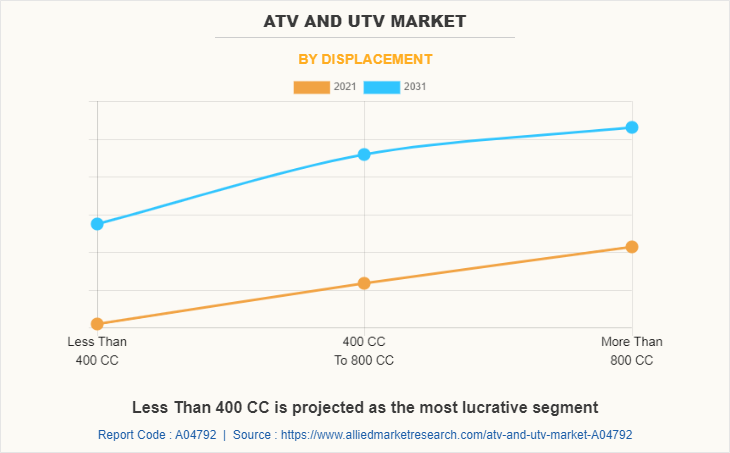

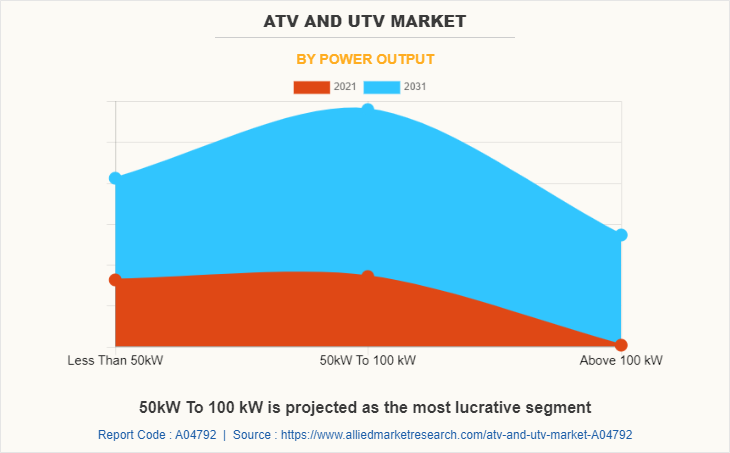

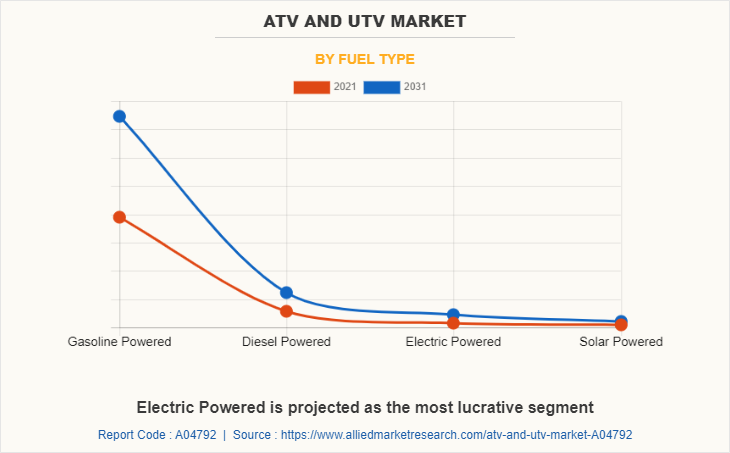

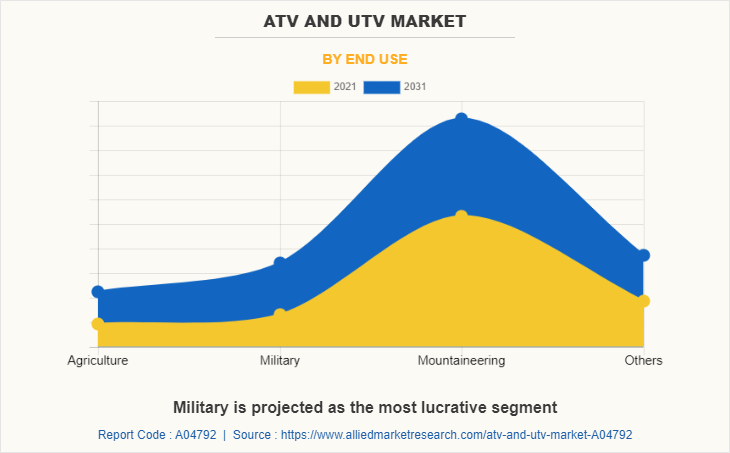

The ATV and UTV market is segmented on the basis of vehicle type, displacement, power output, fuel type, end use, and region. By vehicle type, the market is bifurcated into ATV and UTV. By displacement, it is categorized into less than 400 cc, 400-800 cc, and more than 800 cc. By power output, it is classified into less than 50KW, 50kW to 100 KW, and above 100 KW. By fuel type, it is divided into gasoline powered, diesel powered, electric powered, and solar powered. By end use, it is segregated into agriculture, military, mountaineering, and others.

By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The key manufacturers operating in the global ATV and UTV market are BRP Inc., CFMOTO, Inc., Deere Company, Hisun Motors Corporation, Honda Motor Company Ltd., Kawasaki Heavy Industries Ltd., Kubota Corporation., Kwang Yang Motor Co., Ltd., Polaris Inc., Suzuki Motor Corporation, Textron Inc., and Yamaha Motor Co Ltd.

Government rules to support driving ATVs and UTVs on road

Earlier, driving ATV and UTV on roadways was not allowed for safety purposes. However, in recent days, new bills and ordinances are being passed by government authorities to allow driving ATVs and UTVs on road. For instance, in May 2022, the Government of Newfoundland and Labrador announced new off-road vehicles act and regulations, which improve safety for all off-road vehicle users, expected to be implemented on May 19, 2022. According to this, wearing of helmets on all off-road vehicles will be compulsory and the helmets will also not be necessary for trapping and hunting activities, which involves frequent stops, where speed is less than 20 km/hr. Furthermore, the Board of Commissioners passed an ordinance to allow driving ATV and UTV on Shiawassee County roads with some restrictions. In addition, in October 2020, the Wisconsin Dells Common Council passed an ordinance commencing all city streets to ATV and UTV access. Therefore, government support to allow ATV and UTV on roadways is anticipated to boost the growth of the ATV and UTV market.

Increase in trend of recreational activities and adventure sports

In recent years, sports enthusiasts and tourists are inclining toward trails of off-road vehicles such as UTV and ATV along with related activities for recreational and sport activities purposes. Several leisure activity organizers and tourism councils are introducing UTV and ATV related activities by building tracks and sport setups for these vehicles to attract and retain visitors. For instance, in February 2019, adventure event organizer, ATV Circuit, launched track to ride ATV in Noida, India. It offers 1.5km-long course consisting of a variety of challenges, including tight turns, pylon maneuvers and booby traps for customized 4x4 all-terrain vehicles ranging from 80 cc to 350 cc. This is aimed to witness a positive trend toward adventure sports.

Moreover, several countries are organizing yearly championships, which are gaining popularity at a remarkable rate as anyone capable of driving ATV can participate in the race. For instance, in June 2022, Autosports India announced that it has organized a Mega ATV Championship Season VII grand racing competition, and Overlander Off-Road Adventure & Autocross in Goa from 11th-15th May 2022, where almost 65 teams, 32 Teams for Autocross and 12 Teams for Overlander from across India tested and participated their vehicle projects. Therefore, the increase in trend of such adventure sports attracts tourists and propels the growth of the ATV and UTV market.

Ban on ATV and UTV driving in wildlife area due to terrain damage

Driving an ATV and UTV in a wildlife area can have several detrimental effects on the landscape, including noise pollution, vegetation damage, increased runoff, soil erosion, and deteriorated water quality. ATV and UTV use is prohibited in several nations because it damages the landscape, endangering wildlife habitat and other regions. ATVs also destroy plants and young saplings when they go off trails, which reduces the amount of forest floor cover. Nearby trees are harmed because of exposed and broken roots caused by soil erosion. A few rules have been added to the region to limit unmanaged ATV and UTV use and help wildlife recovery management efforts. ATVs and UTVs are therefore prohibited in wildlife areas because they harm the habitat of wildlife and the health of the grassland, which is anticipated to hamper the growth of the ATV and UTV market.

Production of safer ATVs and UTVs

ATVs and UTVs are used for exploring nature camps and other purposes, but these vehicles are also extremely dangerous and risky. Accident rates associated with ATVs and UTVs are increasing due to the increasing number of such vehicles on the market. For instance, the U.S. registered one of the highest number of ATVs and UTVs accidents. According to the American Academy of Pediatrics (AAP), more than 3,000 children were killed owing to accidents between 1982 and 2015 in an ATV accident and every hour four kids go to the U.S. emergency rooms for injuries sustained in an ATV accident.

In addition, nearly all the accidents related to these vehicles are caused due to the driver’s failure to act in a safe and reasonable manner. Moreover, market players are introducing safer ATVs and UTVs with advanced features such as GPS. For instance, automotive company, Yamaha Motor Corp., USA, announced its proven off-road recreational, utility, and sport ATVs with class-leading safety, capability, comfort, and equipped with GPS tablets. Therefore, the production of ATVs and UTVs with added safety measures to avoid injuries and death hold an opportunity for the key players operating in the ATV and UTV market.

Recent Developments

- In January, 2023, SUZUKI MOTOR CORPORATION through its subsidiary Suzuki Motorcycles launched two new ATVs (all-terrain vehicles) in India. Its feature includes automatic clutch, class leading performance, low maintenance design & modern stylish look that provides complete value in true Suzuki style.

- In November, 2022, KUBOTA Corporation launched a new model of utility vehicles, the Stone Gray model. It comes with a suite of 16 accessories including a premium roof and windshield, LED headlight upgrade and lightbar, and an electric bed dump. It also has a WARN AXON 4,500-pound winch.

- In August, 2022, Yamaha Motor Co. Ltd. through its subsidiary Yamaha Motor Corp., USA, unveiled the 2023 model year lineup of Proven Off-Road ATV and Side-by-Side (SxS) vehicles. The 2023 models include Wolverine RMAX2 1000, RMAX4 1000, X2, and X4, Grizzly, Kodiak 700, Kodiak 450, Raptor 700, Raptor 700R, and YFZ450R, and many more models.

- In August, 2022, Polaris Industries Inc., through its subsidiary Polaris India Pvt. Ltd., launched its flagship ATV, Polaris RZR Pro R Sport in the Indian market. It comes with a 4-stroke 225 HP engine that uses a 4-cylinder layout with a DOHC setup, and three Pro performance true driving modes 2WD, 4WD, and 4WD lock, offering enough traction all the time.

- In June, 2021, Kawasaki Heavy Industries launched brute force 4x4i EPS ATVs. Its features include lusty 37.3 kW {51 PS} @ 6,750 rpm water-cooled fuel-injected V-Twin engines, a 4x4 drive train & electronic power steering (EPS) & two-color options.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ATV and UTV market analysis from 2021 to 2031 to identify the prevailing ATV and UTV market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ATV and UTV market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ATV and UTV market trends, key players, market segments, application areas, and market growth strategies.

ATV and UTV Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 18.6 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 370 |

| By Vehicle Type |

|

| By Displacement |

|

| By Power Output |

|

| By Fuel Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | CFMOTO, SUZUKI MOTOR CORPORATION, Textron Inc., HISUN, Yamaha Motor Co Ltd, KUBOTA Corporation., Deere & Company, Honda Motor Co., Ltd., BRP, POLARIS INDUSTRIES, INC., Kawasaki Heavy Industries, KWANG YANG MOTOR CO., LTD. |

Analyst Review

All-terrain vehicle is also known as quad and quad bike can be operated by handle bars and travels on low-pressure tires. ATVs are intended for maximum two passengers; however, some companies have launched some ATVs with capacity of up to four passengers. Utility vehicle are off-road vehicles designed to perform specific task with more efficiency compared to passenger vehicles. These vehicles have wide range of applications such as farming, material handling, hunting, mountaineering, and others. The ATV & UTV market is not slowing down for some UTV manufacturers. In recent survey done by the key players, the ATV and UTV market experienced weakness in the UTV segment due to regulations for driving ATVs and UTVs on roadways. However, companies are focusing on growth in relationship with dealer network and boosts the user experience to increase the sale of ATVs and UTVs.

Increase in trend of adventure sports and recreational activities, adoption of ATV and UTV in military activities, and government rules to support driving ATVs & UTVs on road propel the growth of the market. Ban on ATV & UTV driving in wildlife area due to terrain damage and high maintenance cost of ATVs and UTVs hinder the growth of the market. Further, focus on production of safer ATVs and UTVs is expected to create numerous opportunities for the key players operating in the ATV and UTV market.

Among the analyzed geographical regions, currently, North America is the highest revenue contributor, followed by Asia-Pacific, North America, and LAMEA. This is attributed to rise in trend of adventure sports and recreational activities in North America.

Key players operating in the global ATV and UTV market are BRP Inc, CFmoto, Deere Company, Hisun Motors Corporation, Honda Motor Company, Ltd., Kawasaki Heavy Industries Ltd, Kwang Yang Motor Co., Ltd., Kubota Corporation, Polaris Industries, Inc., Suzuki Motor Corporation, Textron Inc, and Yamaha Motor Co., Ltd.

The global ATV and UTV market was valued at $9,392.2 million in 2021, and is projected to reach $18,633.7 million by 2031, registering a CAGR of 7.3% from 2022 to 2031

North America is the largest regional market for ATV and UTV

Mountaineering is the leading application of ATV and UTV Market

Increased usage in agriculture use are the upcoming trends of ATV and UTV Market in the world

Loading Table Of Content...

Loading Research Methodology...