Audio Amplifiers Integrated Circuit Market Research, 2032

The Global Audio Amplifiers Integrated Circuit Market was valued at $5.2 billion in 2022, and is projected to reach $10.3 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

Audio amplifier integrated circuits (ICs) play a crucial role in electronics by amplifying audio signals in devices like audio systems and smartphones. These compact and reliable components enhance audio quality and are essential for modern audio electronics. The growing demand for audio amplifier ICs is fueled by the widespread use of consumer electronics and portable audio devices.

The industry's focus on research and development aims to improve efficiency, reduce power consumption, and enhance audio fidelity, presenting opportunities for innovation in smart amplification and energy-efficient designs. As the industry continues to evolve, audio amplifier ICs remain indispensable, meeting the increasing demand for superior audio experiences across a variety of electronic devices.

Segment Overview

The audio amplifiers integrated circuit market is segmented into power output, application, device type, and amplifier class.

By Power Output

11 Watts To 20 Watts segment accounts for highest share in 2022

By power output, the audio amplifier integrated circuit market is segmented into below 10 Watts, 11 Watts to 20 Watts, 20 Watts to 40 Watts, 40 Watts to 80 Watts, 80 Watts to 120 Watts, and above 120 Watts.

By Application

Consumer Electronics is anticipated to garner highest market share during the forecast period

By application, the market is classified into consumer electronics, professional audio, industrial, and others.

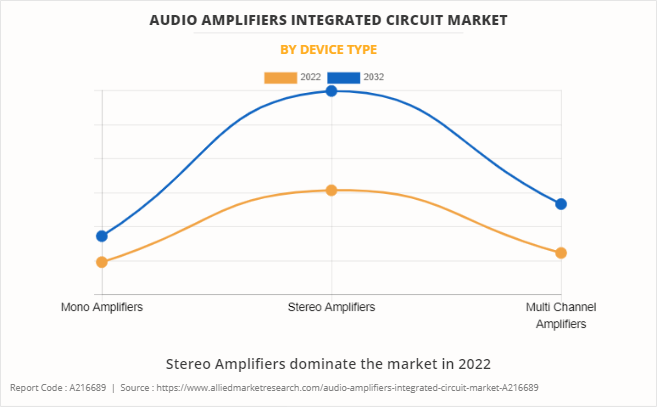

By device type, the audio amplifiers integrated circuit market is segmented into mono amplifiers, stereo amplifiers, and multi-channel amplifiers.

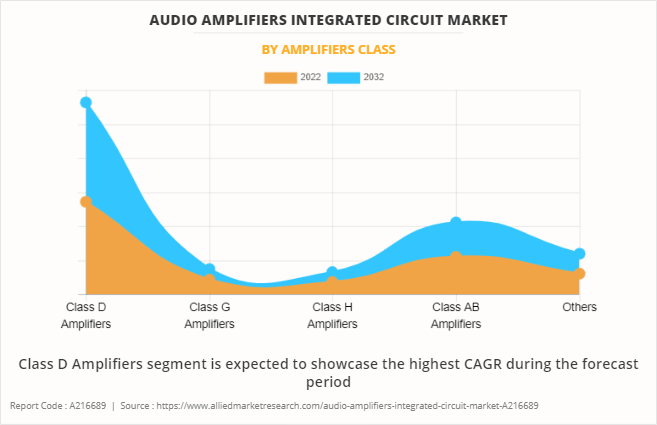

By amplifier class, the market is segmented into Class D amplifier, Class G amplifier, Class H amplifier, Class AB amplifier, and others.

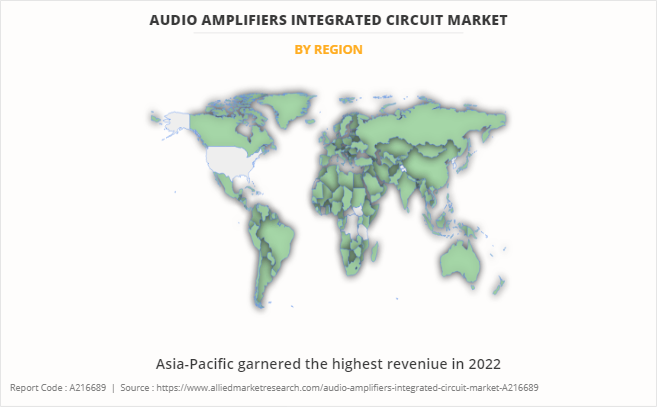

Region-wise, the audio amplifiers integrated circuit market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Taiwan, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

The global audio amplifiers integrated circuit market is expected to witness notable growth during the forecast period, owing to a rise in demand for high-quality audio in consumer electronics. Moreover, increased adoption of wireless audio solutions majorly drives the audio amplifiers integrated circuit market growth. Furthermore, advancements in amplifier technology for improved efficiency are projected to shape the future of the audio amplifiers integrated circuit market.

However, intense competition leading to pricing pressures in the audio amplifier integrated circuit acts as one of the prime factors restraining the audio amplifiers integrated circuit market growth. Further, the expansion of the automotive audio market is projected to provide a lucrative opportunity for the growth of the audio amplifiers integrated circuit market report during the forecast period.

The audio amp IC market is segmented based on device type, amplifier class, power output, application, and region. By device type, the audio amplifiers integrated circuit market is segmented into mono amplifiers, stereo amplifiers, and multi-channel amplifiers. In 2022, the stereo amplifier segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. However, the multi channel segment is expected to emerge as the fastest growing segment of the market during the forecast period 2023-2032.

Based on amplifier class, the audio amp IC market is segmented into class D amplifier, class G amplifier, class H amplifier, class AB amplifier, and others. The class D amplifier segment acquired a major share in the market in 2022 and is expected to grow at a high CAGR% during the period of 2023-2032. By power Output, the audio amplifier ICs industry is segmented into Below 10 Watts, 11 Watts to 20 Watts, 20 Watts to 40 Watts, 40 Watts to 80 Watts, 80 Watts, to 120 Watts, and above 120 Watts. The below 10 Watts segment dominated the industry in terms of market share, owing to a surge in demand for low-voltage consumer electronics solutions in recent years.

By application, the market is classified into consumer electronics, professional audio, industrial, and others. The consumer electronics segment dominated the market in 2022 in terms of revenue and is expected to dominate the market during the forecast period. Asia-Pacific, Specifically China, remains a significant participant in the audio amplifiers integrated circuit market. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced portable devices which is driving the growth of the Audio Amplifiers Integrated Circuit industry in Asia-Pacific.

Competition Analysis

Competitive analysis and profiles of the major global audio amplifiers integrated circuit market players that have been provided in the report include STMicroelectronics N.V., Infineon Technologies AG, ROHM Semiconductor, Cirrus Logic Inc., Analog Devices Inc., Texas Instruments Incorporated, Monolithic Power Systems, Inc., ON Semiconductor, NXP Semiconductors, and MediaTek Inc.

Country Analysis

North America-wise, the U.S. acquired a prime share in the audio amplifiers integrated circuit market size by country in the North American region and is expected to grow at a high CAGR of 5.69% during the forecast period of 2023-2022. The U.S. holds a dominant position in the audio amplifiers integrated circuit market share by company, owing to the presence of prime players such as Texas Instruments Incorporated, Analog Devices Inc., and ON Semiconductor, which have significantly invested in next-generation advanced audio solutions.

In Europe, the Germany dominated the Europe audio amplifiers integrated circuit market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Furthermore, the UK is expected to emerge as one of the fastest growing countries in Europe's audio amplifiers integrated circuit industry with a CAGR of 7.69%, owing to a strong industrial and automotive sector, presence of leading audio amplifiers manufacturers, and government support.

In Asia-Pacific, China holds a dominated market share in Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to its large and growing market, growing popularity of advanced consumer electronics, government support, and presence of leading audio amplifiers integrated circuit Original Equipment‐™s manufactures. However, India is expected to emerge as a dominated country in audio amplifiers integrated circuit market in Asia-Pacific region.

In LAMEA, Latin America is growing the fastest in the audio amplifiers integrated circuit market because of its growing economy, increasing disposable income, and rising demand for consumer electronics. Moreover, the Africa region is expected to grow at a high CAGR of 7.63% from 2023 to 2032, owing to its economic growth, infrastructure investment, and demand for audio amplifier ICs.

Top Impacting Factors

Significant factors that impact the growth of the global audio amplifiers integrated circuit industry include the increasing adoption of wireless audio solutions paired with the advancements in amplifier technology for improved efficiency. Moreover, the growing demand for high-quality audio in consumer electronics is expected to drive the market opportunity. However, intense competition leading to pricing pressures in the audio amplifier ICs is acting as a prime barrier for early adoption, which hampers the growth of the market. On the contrary, the expansion of the automotive audio market is expected to offer potential growth opportunity for the audio amplifiers integrated circuit market during the forecast period.

Historical Data & Information

The audio amplifiers circuit industry is highly competitive, owing to the strong presence of existing vendors. Vendors of audio amplifiers integrated circuit machines with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this audio amplifiers circuit industry is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

STMicroelectronics N.V., Infineon Technologies AG, ROHM Semiconductor, Cirrus Logic Inc, and Analog device Inc. are the top 5 audio amplifiers IC companies holding a prime share in the audio amplifiers integrated circuit market overview. Top market players have adopted various strategies, such as product launch, development, and partnership, to expand their foothold in the audio amplifiers integrated circuit growth projections.

On June 2023, Cirrus Logic unveiled a premium audio solution for PCs, featuring the CS35L56 smart amplifier for higher-performing audio and the low-power CS42L43 SmartHIFITM PC audio codec with integrated MIPI SoundWire interface (v1.2). This solution promises a louder, more immersive audio experience for ultrathin laptops and headphones. It not only simplifies design for PC manufacturers but also contributes to space savings and reduced material costs by minimizing the total number of components.

On July, Cirrus Logic announced the release of their new CS47L63 Smart Codec with advanced noise cancellation and beam forming capabilities, catering to the growing market of smart home devices.

On November 2022, Infineon launched its new MA2304 series, featuring the second generation of MERUS multilevel switching technology. These ICs offer a compact form factor, low switching losses, and high efficiency, making them ideal for battery-powered speakers, Bluetooth/wireless speakers, and multi-room audio systems.

On April 2022, STMicroelectronics launched their new product TDA7901 automotive amplifier, which integrates a buck controller for class-G power switching and supports high-definition audio, a market-unique combination for great listening and high efficiency.

On December 2022, STMicroelectronics launched FDA803S and FDA903S, their newest single-channel fully differential 10W Class-D audio power amplifiers in the STMicroelectronics FDA (fully digital amplifier) family. They are designed for automotive applications like eCall, telematics, and wherever an audio channel needs to reproduce human voice, music, or warning messages at a standard output power level of up to 10W.

On December 2023, Cirrus Logic announced a strategic partnership with EV maker, Rivian to provide high-performance audio solutions for its electric vehicles. This collaboration expands Cirrus's reach into the automotive market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the audio amplifiers integrated circuit market analysis from 2022 to 2032 to identify the prevailing audio amplifiers integrated circuit market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the audio amplifiers integrated circuit market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global audio amplifiers integrated circuit market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global audio amplifiers integrated circuit market trends, key players, market segments, application areas, and market growth strategies.

Audio Amplifiers Integrated Circuit Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.3 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 652 |

| By Power Output |

|

| By Application |

|

| By Device Type |

|

| By Amplifiers Class |

|

| By Region |

|

| Key Market Players | Analog Devices Inc., MediaTek Inc., NXP Semiconductors, Monolithic Power Systems, Inc., STMicroelectronics N.V., Texas Instruments Incorporated, ROHM Semiconductor, Infineon Technologies AG, ON Semiconductor, Cirrus Logic Inc. |

Analyst Review

Audio amplifier integrated circuits (ICs) stand as indispensable components within the electronics industry, exerting a pivotal influence across diverse audio applications, from home entertainment to automotive systems. Operating on the fundamental principle of amplification, these ICs elevate weak audio signals to levels suitable for driving loudspeakers, thereby optimizing the auditory experience.

Audio amplifier integrated circuits are used widely in consumer devices, such as smartphones, tablets, and home entertainment systems. They also play a role in the automotive industry, improving in-car audio. The growing popularity of wearables presents a promising future, bringing up new applications for audio amplifier ICs. As the market evolves, the continued growth of audio amplifier integrated circuits is critical in shaping the future of audio technology, with ongoing research driving design and functionality advances.

The global audio amplifiers integrated circuit market is highly competitive, owing to the strong presence of existing vendors. Audio amplifiers integrated circuit vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to market requirements. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

Rise in demand for portable devices across the consumer electronics, automotive, and commercial sectors globally is driving the need for next generation to enhance audio amplifiers integrated circuit solutions. Moreover, prime economics, such as the U.S., China, Germany, and Japan, plan to develop and deploy next-generation power adapter solutions across various consumer electronics applications such as portal devices, smartphones, home theaters, digital TVs, and more, which is anticipated to provide lucrative opportunities for market growth.

Asia-Pacific exhibits the highest adoption of audio amplifiers integrated circuit and has been experiencing massive expansion of the market. However, Europe is expected to grow at a faster pace, predicting lucrative growth as emerging countries such as UK and Germany are investing in these technologies. Regions such as the Middle East and Africa are expected to offer new opportunities for the growth of the audio amplifiers integrated circuit market in the future.

The key players profiled in the report include STMicroelectronics N.V., Infineon Technologies AG, ROHM Semiconductor, Cirrus Logic Inc., Analog Devices Inc., Texas Instruments Incorporated, Monolithic Power Systems, Inc., ON Semiconductor, NXP Semiconductors, and MediaTek Inc.

The rise of Class D amplifiers for energy efficiency and the integration of AI and machine learning for enhanced sound quality and smart functionalities are the upcoming trends of audio amplifiers integrated circuit market in the world.

Consumer electronics is the leading application of audio amplifiers integrated circuit market.

Asia-Pacific is the largest regional market for audio amplifiers integrated circuit.

The audio amplifiers integrated circuit market was valued at $5,225.00 million in 2022 and is estimated to reach $10,331.40 million by 2032.

STMicroelectronics N.V., Infineon Technologies AG, ROHM Semiconductor, Cirrus Logic Inc., Analog Devices Inc are the top companies in audio amplifier integrated circuit.

Loading Table Of Content...

Loading Research Methodology...