Augmented Analytics In BFSI Market Research, 2032

The global augmented analytics in BFSI market was valued at $1.7 billion in 2022, and is projected to reach $14.5 billion by 2032, growing at a CAGR of 24.4% from 2023 to 2032.

Augmented analytics in BFSI enables financial institutions to automate and accelerate the data analysis process, identify patterns, trends, and anomalies, and make more accurate predictions and informed decisions. It also empowers financial professionals to uncover hidden opportunities, mitigate risks, personalize customer experiences, detect fraudulent activities, and optimize operational efficiency. In addition, augmented analytics plays a crucial role in revolutionizing the way financial institutions leverage data to drive innovation, gain a competitive edge, and deliver value to their customers.

The BFSI sector generates vast amounts of data on a daily basis, including transactional data, customer data, market data, and more thus, this data can be extremely valuable. Therefore, in this case augmented analytics uses advanced technologies such as machine learning, natural language processing, and artificial intelligence to automate the data analysis process and provide actionable insights to business users. Thus, this drives the growth of the market. Furthermore, BFSI sector is highly regulated, and financial institutions are required to comply with various regulations and guidelines thus this augmented analytics technology help these institutions to manage their data and make more informed decisions while adhering to regulatory requirements.

However, BFSI organizations need to ensure that they have appropriate measures in place to safeguard the privacy and security of their customers' data while adopting augmented analytics solutions. Hence, failure to do so may hinder the adoption and growth of the augmented analytics market in the BFSI industry. In addition, to fully leverage these technologies, organizations need skilled professionals who are capable of understanding and utilizing them effectively but the shortage of skilled professionals that understand augmented analytics and its application in the BFSI sector, may hinder the adoption of augmented analytics in BFSI market share. On contrary, by integrating machine learning algorithms, augmented analytics technology, financial institutions can identify patterns, anomalies, and trends in their data, leading to improved risk assessment, fraud detection, and compliance monitoring.

Hence, these capabilities enable proactive decision-making, thereby mitigating risks, and preventing potential losses. Therefore, this helps to reduce errors and improve operational workflows, and can ultimately enhance customer satisfaction, increase operational productivity, and will drive profitability in BFSI sector.

The report focuses on growth prospects, restraints, and trends of the augmented analytics in BFSI market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the augmented analytics in BFSI market.

Segment Review

The augmented analytics in BFSI market is segmented on the basis of component, deployment mode, enterprise size, application, and region. Based on component, it is segmented into solution and service. By deployment mode, it is segmented into on-premise and cloud. By enterprise size, it is segmented into large enterprises and small and medium-sized enterprises. By application, it is segmented into risk and compliance management, customer analytics, fraud detection, portfolio management, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

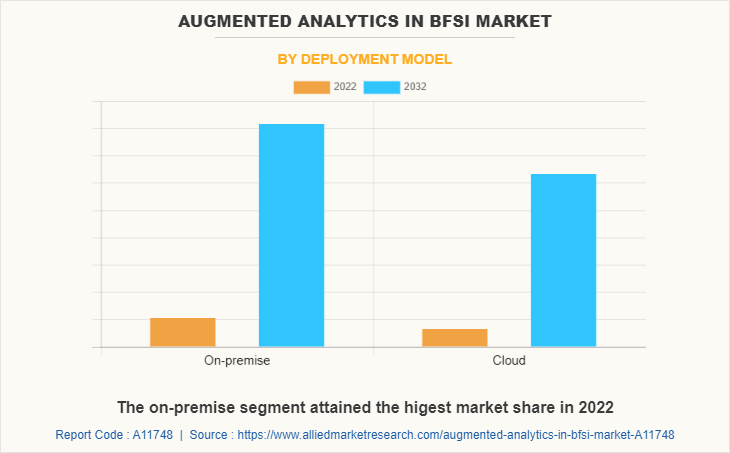

Based on deployment mode, the on-premise segment attained the highest growth in 2022 for the augmented analytics in BFSI market size. This is because by leveraging on-premise augmented analytics solutions, BFSI companies can benefit from increased data security, improved data governance, and enhanced control over their analytics infrastructure. However, the cloud segment is considered to be the fastest growing segment during the forecast period. This is because cloud-based augmented analytics platforms offer the advantage of scalability, flexibility, and cost-effectiveness, allowing BFSI companies to leverage the power of advanced analytics without heavy infrastructure investments. In addition, the cloud solution also enables real-time data access and collaboration, facilitating seamless integration across multiple departments and branches which boost the augmented analytics in BFSI market growth in this segment.

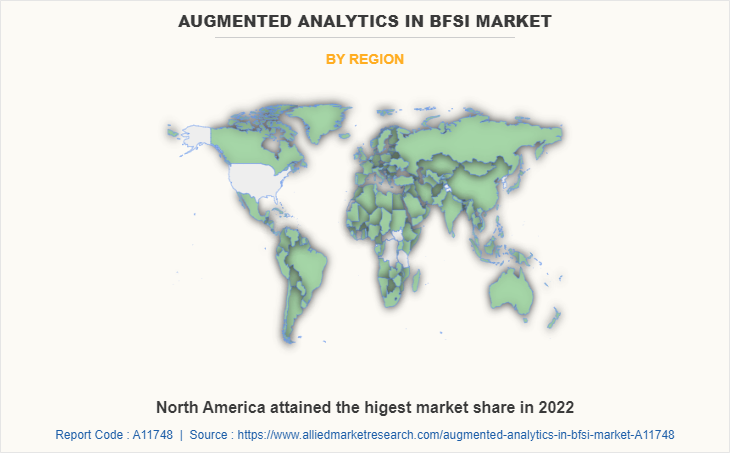

By region, North America attained the highest growth in 2022. This is because North America has been at the forefront of adopting augmented analytics in the BFSI market, because the region offers a highly developed financial sector and a favorable regulatory environment that encourages innovation. Furthermore, the major financial hubs such as New York and Silicon Valley have witnessed significant investments in augmented analytics technology, which leads to the growth of the market in this region.

However, the Asia-Pacific region is considered to be the fastest growing region during the forecast period. This is because increasing digitalization and widespread use of technology in the region provide a rich source of data, offering massive opportunities for financial institutions to leverage augmented analytics tools. Moreover, the ability to tackle this data through advanced analytics techniques opens up path for personalized customer experiences, optimized risk management, and streamlined operations which will boost the market in upcoming years in this region.

The report analyzes the profiles of key players operating in augmented analytics in BFSI market such as Alteryx, Inc., IBM Corporation, Information Builders, Microsoft Corporation, QlikTech International AB, SAP SE, Salesforce.com, Inc., SAS Institute Inc., and Tableau Software Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the augmented analytics in BFSI industry.

Market Landscape and Trends

The augmented analytics in the banking, financial services, and insurance (BFSI) sector is witnessed significant growth in recent years due to integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) to automate data preparation, data discovery, and data visualization processes, enabling faster and more accurate decision-making in the BFSI industry. Furthermore, one of the key future trends in the augmented analytics market is the increasing adoption of AI-powered chatbots and virtual assistants. These intelligent conversational interfaces assist customers in performing financial transactions, obtaining personalized recommendations, and accessing real-time data insights. Therefore, by leveraging natural language processing and machine learning algorithms, these chatbots provide a seamless user experience while enhancing customer engagement and satisfaction.

Moreover, another significant trend is the integration of augmented analytics into existing business intelligence (BI) platforms. As traditional BI tools are being enhanced with augmented analytics capabilities, allowing BFSI organizations to gain deeper insights from complex data sets and generate actionable intelligence. Thus, the combination of BI and augmented analytics empowers financial institutions to make data-driven decisions, identify potential risks, and uncover new business opportunities.

In addition, the adoption of augmented analytics in regulatory compliance is also expected to witness substantial growth. Because due to the stringent regulations in the BFSI sector, organizations are increasingly relying on augmented analytics solutions to automate compliance processes, monitor transactions, and detect fraudulent activities. Thus, the integration of advanced analytics techniques, such as anomaly detection and pattern recognition, helps in identifying and mitigating compliance risks effectively. Hence, the future trends include the adoption of AI-powered chatbots, integration with existing BI platforms, emphasis on regulatory compliance, and leveraging big data and IoT. Thus, these trends will empower financial institutions to derive actionable insights, enhance operational efficiency, and deliver superior customer experiences in an increasingly data-centric and competitive landscape. Therefore, these are some of the major market trends of augmented analytics in BFSI industry.

Top Impacting Factors

Growing Data Volumes in BFSI Industry

The BFSI sector generates vast amounts of data on a daily basis, including transactional data, customer data, market data, and more thus, this data can be extremely valuable in making informed business decisions, but it can also be overwhelming to manage and analyze manually. Therefore, in this case augmented analytics uses advanced technologies such as machine learning, natural language processing, and artificial intelligence to automate the data analysis process and provide actionable insights to business users. Thus, by automating data preparation, analysis, and visualization, augmented analytics tools enable business users to make faster and more accurate decisions based on insights generated from the vast amounts of data available to them.

Furthermore, in the BFSI industry, augmented analytics tools are used for a range of applications, including fraud detection, risk management, compliance monitoring, customer segmentation, and more. As data volumes continue to grow in this industry, the adoption of augmented analytics is expected to accelerate further, enabling BFSI organizations to gain a competitive edge through data-driven decision-making.

Growing Popularity of Online Banking

Augmented analytics is a technology that uses machine learning, natural language processing, and other advanced technologies to enhance the speed, accuracy, and effectiveness of data analysis. This helps financial institutions make better decisions by providing them with deeper insights into their data. For instance, augmented analytics can be used to analyze customer data to identify patterns and trends, such as which products or services are most popular among specific demographics. This information is then used to inform marketing and sales strategies, improve customer experience, and increase profitability. Another instance is risk management as augmented analytics is used to analyze financial data and identify potential risks, such as exposure to a particular sector or market. Hence, this information can be used to inform investment decisions and help manage risk more effectively.

Furthermore, customer analytics is another area where augmented analytics is used to improve decision-making. Therefore, by analyzing customer data, financial institutions can gain insights into customer behavior, preferences, and needs. This information can be used to tailor products and services to specific customer segments, improve customer experience, and increase customer retention. Therefore, the ability to make more informed decisions based on deeper insights is a key driver for the adoption of augmented analytics in the BFSI market.

Augmented Analytics help to Ensure Compliance by Automating Compliance Reporting

The BFSI sector is highly regulated, and financial institutions are required to comply with various regulations and guidelines thus this augmented analytics technology help these institutions to manage their data and make more informed decisions while adhering to regulatory requirements. Furthermore, with the help of augmented analytics tools, BFSI companies automate compliance reporting, monitor transactions in real-time, and identify potential risks and fraudulent activities. In addition, augmented analytics also help to reduce errors and inconsistencies in reporting, which is crucial for meeting regulatory requirements. Moreover, augmented analytics also help financial institutions to gain insights into customer behavior, which can be used to improve customer experiences and meet regulatory requirements related to customer privacy and data protection. Thus, augmented analytics help BFSI companies to improve their compliance processes, reduce risk, and enhance decision-making capabilities, which is essential in a highly regulated industry like BFSI.

Data Privacy and Security Concerns

BFSI organizations deal with sensitive and confidential information of their customers, such as personal and financial data, therefore use of augmented analytics in such an environment requires the collection and processing of large amounts of data, which may increase the risk of data breaches and cyber-attacks. Thus, any of such incident lead to loss of trust of customers and damage to the reputation of the organization. Moreover, the regulatory environment in the BFSI industry is stringent and has specific guidelines for data privacy and security, thus implementation of augmented analytics solutions requires compliance with these regulations, which may require additional investment and resources. Therefore, BFSI organizations need to ensure that they have appropriate measures in place to safeguard the privacy and security of their customers' data while adopting augmented analytics solutions. Hence, failure to do so may hinder the adoption and growth of the augmented analytics market in BFSI industry.

Lack of Skilled Professionals

Augmented analytics involves the use of advanced technologies such as machine learning, natural language processing, and data visualization to automate and simplify the process of data analysis and decision-making. However, to fully leverage these technologies, organizations need skilled professionals who are capable of understanding and utilizing them effectively. Furthermore, in the BFSI industry there is a growing demand for professionals who can work with data and analytics tools to derive insights and improve business outcomes. Consequently, there is also a shortage of skilled professionals in this area, which can hinder the adoption of augmented analytics. For instance, in the insurance sector the adoption of advanced analytics has been slower than other industries due to a lack of skilled professionals.

According to a report by McKinsey & Company, the insurance industry faces a talent gap of nearly 400,000 data scientists and other data-related roles by 2020. Therefore, to address this issue, organizations need to invest in training programs and partnerships with educational institutions to develop a pipeline of skilled professionals. In addition, they should also leverage advanced analytics tools that require minimal technical expertise, making it easier for non-technical professionals to use and gain insights from data.

Operational Efficiency and Cost Reduction due to use of Augmented Analytics in BFSI

Operational efficiency and cost reduction present significant opportunities for augmented analytics in the Banking, Financial Services, and Insurance (BFSI) market, as it refers to the use of advanced technologies such as machine learning, artificial intelligence, and natural language processing to enhance data analysis and decision-making processes.

Furthermore, in the BFSI sector, where vast amounts of data are generated and analyzed daily, leveraging augmented analytics can lead to improved operational efficiency and reduced costs. Thus, by harnessing augmented analytics capabilities, financial institutions can automate and streamline their data analysis workflows. This automation eliminates the need for manual data processing, which is often time-consuming and prone to human error. Therefore, with augmented analytics, complex data sets can be quickly and accurately analyzed, allowing financial institutions to gain valuable insights and make informed decisions faster.

Moreover, traditional data analysis methods often require a significant investment of time, resources, and expertise. Thus, by employing augmented analytics tools and technologies, financial institutions can reduce the reliance on specialized data analysts and data scientists. These advanced analytics platforms can empower business users with self-service capabilities, allowing them to perform sophisticated data analysis tasks without extensive technical knowledge. This shift in the analytics paradigm not only saves costs but also increases agility and responsiveness to changing market conditions. In addition, by integrating machine learning algorithms, financial institutions can also identify patterns, anomalies, and trends in their data, leading to improved risk assessment, fraud detection, and compliance monitoring. These capabilities enable proactive decision-making, thereby mitigating risks, and preventing potential losses. Hence, this helps to reduce errors and improve operational workflows, and this can ultimately enhance customer satisfaction, increase operational productivity, and drive profitability. Therefore, operational efficiency and cost reduction are vital opportunities that augmented analytics brings to the BFSI market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the augmented analytics in BFSI market forecast from 2023 to 2032 to identify the prevailing augmented analytics in BFSI market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the augmented analytics in BFSI market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global augmented analytics in BFSI market trends, key players, market segments, application areas, and market growth strategies.

Augmented Analytics in BFSI Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.5 billion |

| Growth Rate | CAGR of 24.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 465 |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | Microsoft Corporation, QlikTech International AB, Salesforce.com, Inc., Alteryx, Inc., Tableau Software Inc, SAP SE, IBM CORPORATION, SAS Institute Inc., Information builders |

Analyst Review

Augmented analytics in BFSI refers to the application of advanced analytical techniques such as machine learning, natural language processing, and artificial intelligence to enhance the accuracy and speed of financial analysis in the banking, financial services, and insurance sectors. Moreover, the augmented analytics market in BFSI (Banking, Financial Services, and Insurance) has been experiencing rapid growth in recent years. As the augmented analytics tools and platforms have been widely adopted in the BFSI sector, they offer a wide range of benefits, including enhanced decision-making, increased efficiency, improved customer experience, and reduced costs. Furthermore, the market is expected to continue growing in the coming years, driven by the increasing demand for data-driven insights and the growing adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP). In addition, the BFSI sector is particularly well-suited to the application of augmented analytics, given the massive amounts of data generated by financial transactions and the need for rapid, accurate analysis of this data to inform business decisions. Thus, this creates significant opportunities for vendors and service providers operating in the augmented analytics space to develop innovative products and services tailored to the specific needs of the BFSI industry.

Furthermore, market players are adopting strategies such as partnership and product launch for enhancing their services in the market and improving customer satisfaction. For instance, in April 2023, QlikWorld and HARMAN expanded their strategic relationship partnership to deliver joint solutions for HARMAN’s Digital Transformation Solutions (DTS) customers. Therefore, with this partnership it will help customers to streamline, simplify and modernize enterprise operations. Similarly, in April 2023, SAP launched a new product named SAP Analytics Cloud which brings together analytics and planning with unique integration to SAP applications and seamless access to heterogenous data sources. It helps everyone in any organization to make decisions without doubt with trusted insights and integrated plans. Therefore, such strategies are boosting the growth of the augmented analytics in BFSI market in the upcoming years.

Moreover, some of the key players profiled in the report include Alteryx, Inc., IBM Corporation, Information Builders, Microsoft Corporation, QlikTech International AB, SAP SE, Salesforce.com, Inc., SAS Institute Inc., and Tableau Software Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The global augmented analytics in BFSI market was valued at $1,683.27 million in 2022, and is projected to reach $14,482.58 million by 2032, growing at a CAGR of 24.4% from 2023 to 2032.

The global augmented analytics in BFSI market was valued at $1,683.27 million in 2022, and is projected to reach $14,482.58 million by 2032, growing at a CAGR of 24.4% from 2023 to 2032.

Growing data volumes in BFSI industry Growing popularity of online banking Augmented analytics help to ensure compliance by automating compliance reporting

Alteryx, Inc., IBM Corporation, Information Builders, Microsoft Corporation, QlikTech International AB, SAP SE, Salesforce.com, Inc., SAS Institute Inc., and Tableau Software Inc.

The augmented analytics in BFSI market is segmented on the basis of component, deployment mode, enterprise size, application, and region. Based on component, it is segmented into solution and service. By deployment mode, it is segmented into on-premise and cloud. By enterprise size, it is segmented into large enterprises and small and medium-sized enterprises. By application, it is segmented into risk and compliance management, customer analytics, fraud detection, portfolio management, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...