Australia & New Zealand Fertility Services Market Outlook - 2026

The Australia & New Zealand fertility services market generated $709 million in 2018, and is projected to reach $1,020 million by 2026, growing at a CAGR of 4.6% from 2019 to 2026.

Fertility services are treatments that help treat infertility in patients. In vitro fertilization (IVF), surrogacy, intrauterine insemination, and others are different forms of infertility services that help single mothers, couples with infertility problems, and people from the LGBT community to procreate.

Fertility services in the Australia & New Zealand market are estimated to experience significant growth during the forecast period owing to rise in number of infertility cases, trend of delayed pregnancies among women, technological advancements in fertility procedures, and large presence of fertility clinics with trained medical professionals. In addition, availability of advanced fertility treatments, increase in disposable income, and favorable reimbursement policies further augment the market growth in Australia & New Zealand. In addition, recent innovations in IVF technology with surge in assisted reproductive technology (ART) success rate are projected to boost the demand for fertility services in the future. However, higher cost of fertility services can impede the market growth.

Australia & New Zealand Fertility Services Market Segmentation

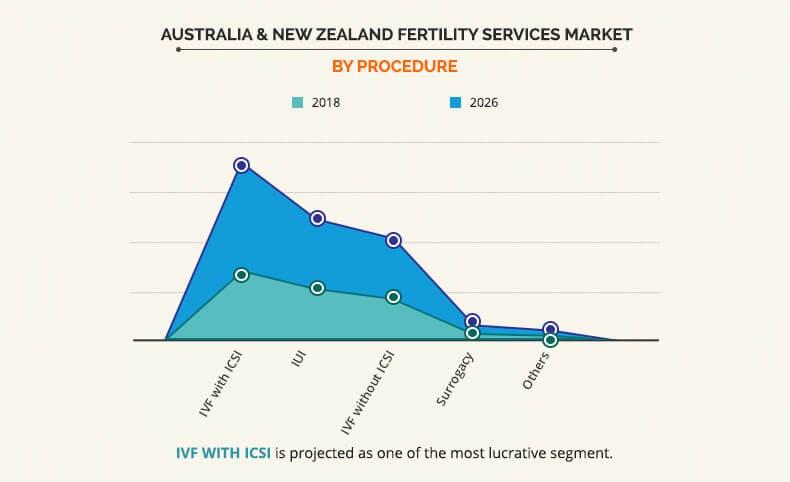

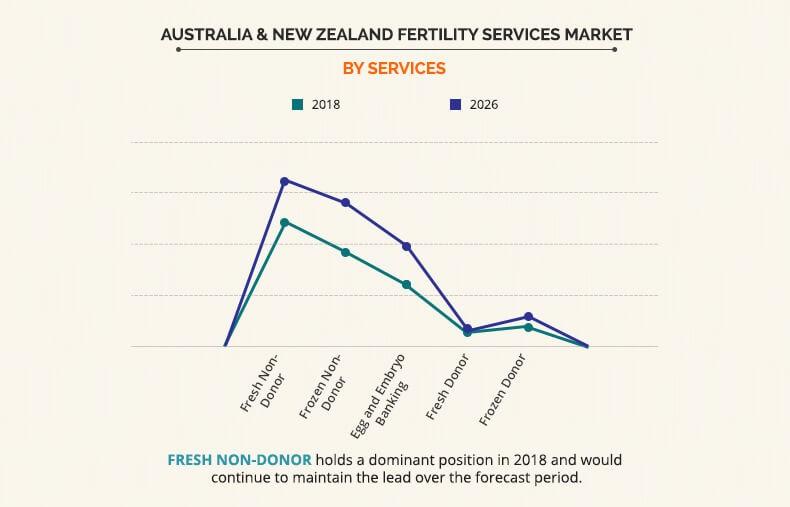

The Australia & New Zealand fertility services market is segmented based on procedure, service, and end user. Based on procedure, the market is divided into IVF with intracytoplasmic sperm injection (ICSI), intrauterine insemination (IUI), IVF without ICSI, surrogacy, and others. Based on service, it is categorized into fresh non-donor, frozen non-donor, egg and embryo banking, fresh donor, and frozen donor. Based on end user, the market is segmented into fertility clinics, hospitals, surgical centers, and clinical research institutes.

Segment review

Based on procedure, the Australia & New Zealand fertility services market is segmented into IVF with ICSI, IUI, IVF without ICSI, surrogacy, and others (GIFT and ZIFT). At present, market is dominated by the IVF with ICSI segment with more than three-fourths Australia & New Zealand fertility services market share in 2018 and is expected to remain dominant throughout the forecast period. Rise in number of risk factors such as changes in lifestyle, increase in stress & obesity, and surge in infertility are the factors that drive the market growth of this segment. IVF with ICSI is preferred in cases of low sperm motility, less sperm production, and severe male factor infertility. The surge in number of male infertility and higher success rate for IVF with ICSI are the key drivers of this market.

Based on service, the Australia & New Zealand fertility services market is categorized into fresh non-donor, frozen non-donor, egg and embryo banking, fresh donor, and frozen donor. Fresh non-donor segment is the major revenue contributor and is estimated to remain dominant during the forecast period due to preferable use of this technique. Delayed pregnancy trends in women, technological advancements, advantages of fresh embryo transfer over the frozen embryo technique, increase in rate of infertility, and higher success rate of this technique are the major drivers of the fresh non-donor segment.

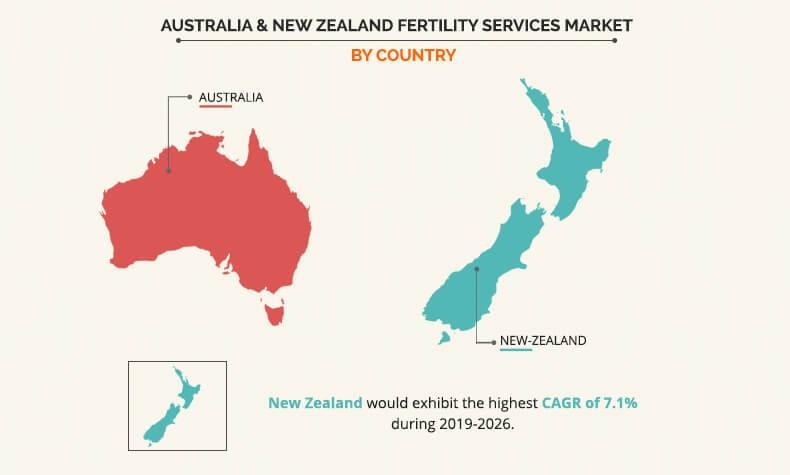

New Zealand presents lucrative opportunities for the key players operating in the fertility services market, owing to rise in number of infertile population, growth in demand for IVF services, wide availability of fertility clinics with favorable reimbursement policies for fertility services.

The key players profiled in this report include Adora Fertility, Care Fertility, City Fertility, Fertility Associates Limited, Fertility First, Fertility SA, GENEA LIMITED, Monash IVF Group Limited, National Women’s Health, and Virtus Health.

Key Benefits for Australia & New Zealand Fertility Services Market:

- The study provides an in-depth analysis of the Australia & New Zealand fertility services market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers Australia & New Zealand fertility services market analysis from 2018 to 2026, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the market.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook and Australia & New Zealand fertility services market growth.

Australia & New Zealand Fertility Services Market Report Highlights

| Aspects | Details |

| By Procedure |

|

| By Service |

|

| By End User |

|

| Key Market Players | ADORA FERTILITY, GENEA LIMITED, FERTILITY FIRST, MONASH IVF GROUP LIMITED, FERTILITY SA, CARE FERTILITY, NATIONAL WOMEN’S HEALTH, FERTILITY ASSOCIATES LIMITED, VIRTUS HEALTH, CITY FERTILITY |

Analyst Review

Fertility services are treatments that assist in treating infertility in patients. In vitro fertilization (IVF), surrogacy, intrauterine insemination, and others are different forms of infertility services that help single mothers, couples with infertility problems, and people from the LGBT community to procreate. The adoption of fertility services is expected to increase due to surge in the number of infertile population in Australia & New Zealand.

Increase in popularity of IVF, rise in number of infertile population, favorable reimbursement policies for fertility services, and technological advancements in fertility procedures significantly boost the growth of the fertility services market during the forecast period. In addition, surge in number of single mothers, and rise in demand for fertility services in the LGBT community, further support the market growth in Australia & New Zealand.

Recent innovations in ART technology with surge in assisted reproductive technology (ART) success rate are projected to influence the demand for fertility services in the future. However, higher cost, complications associated with ART treatment, and multiple pregnancies associated with fertility treatments are expected to hinder the market growth.

Loading Table Of Content...