Auto Insurance Market Research, 2032

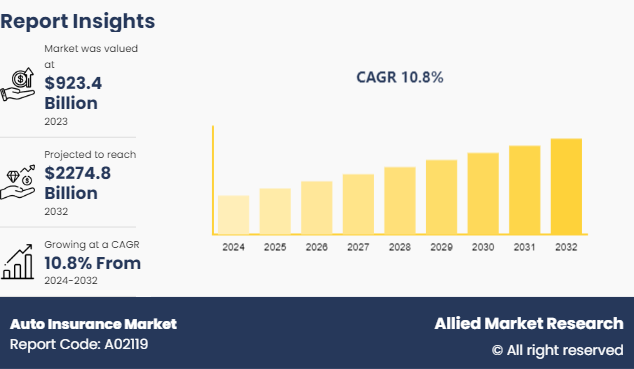

The global auto insurance market size was valued at $923.4 billion in 2023, and is projected to reach $2,274.8 billion by 2032, growing at a CAGR of 10.8% from 2024 to 2032.

Auto insurance is a contract between the user and the insurance company that protects the user against financial loss in the event of an accident or theft. In exchange for the user’s paying a premium, the insurance company agrees to pay the losses as outlined in the policy. Auto insurance provides financial protection to customers against physical damage, resulting from traffic collisions and theft of vehicles. In addition, it covers the cost associated with injuries, death, or property damage caused by the insured owner of the vehicle to another driver, vehicle, or property such as a fence, building, or utility pole in auto insurance sector.

Key Takeaways

The global market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The global market is growing due to rise in a number of accidents, implementation of stringent government regulations for the adoption of auto insurance, auto insurance awareness and increase in automobile sales globally. However, adoption of autonomous vehicles acts as a restraint for the auto insurance industry. In addition, the implementation of technologies in existing products and service lines and the rise in demand for third-party liability coverage in emerging economies are projected to provide ample opportunities for the development of the market during the forecast period.

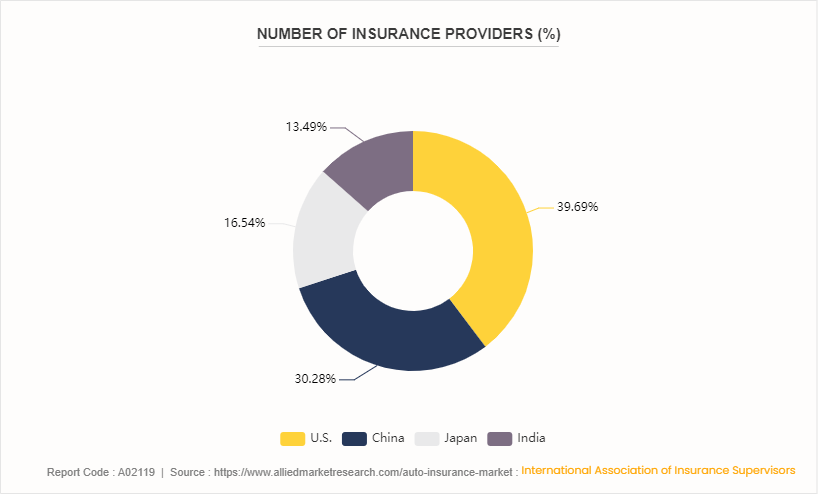

Number of Insurance Providers

In the U.S., the insurance industry is growing, with a significant number of insurance providers offering a wide number of products and services to consumers and businesses. The U.S. auto insurance market growth is characterized by robust competition and innovation from well-established multinational corporations to smaller regional insurers. Moreover, the industry has become increasingly competitive, attracting new businesses, and stimulating innovation, with the Chinese government's efforts to liberalize and reform the market. The presence of a large number of insurance providers in China not only provides consumers with a wide selection of insurance options but also promotes market efficiency and enhances the overall quality of insurance services available to individuals and businesses throughout the country. These factors are further expected to fuel the growth of the auto insurance portfolio.

FIGURE 1: Number of Insurance Providers (%)

Market Segmentation

The auto insurance market analysis is segmented into coverage, distribution channel, vehicle age, application, and region. On the basis of coverage, the market is divided into third party liability coverage and collision/comprehensive/other optional coverages. On the basis of distribution channel, the market is categorized into insurance agents/brokers, direct response, banks and others. On the basis of vehicle age, the market is classified into new vehicles and used vehicles. On the basis of application, the market is bifurcated into personal and commercial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The global auto insurance market share is experiencing substantial growth, with North America playing a pivotal role in this expansion. North America leads the market, propelled by robust technological infrastructure, significant investments in smart technologies, and stringent safety regulations that encourage the integration of advanced security solutions. Europe follows closely, with countries like Germany and the UK at the forefront, leveraging auto insurance solutions. In the Asia-Pacific region, rapid industrialization and increase in awareness of insurance solutions are driving the adoption of AI and predictive analytics technology solutions, particularly in China and Japan, where government initiatives support technological advancements.

In March 2024, China initiated an extensive campaign to curb the tactics used by its insurance sector. This government initiative primarily targeted insurers linked with private conglomerates, which used their extensive finance sector connections to embark on high-risk growth strategies.

In March 2024, the U.S. Department of the Treasury’s Federal Insurance Office (FIO) advanced its efforts to collect insurance data to better understand the impacts of climate-related financial risks on the insurance sector, by launching a first-of-its kind collaboration with state insurance regulators and the National Association of Insurance Commissioners (NAIC) .

Industry Trends

In May 2024, Insurance Bureau of Canada (IBC) launched a new report that recommends policies that governments can adopt to help stabilize commercial insurance premiums for businesses and reduce cost pressures within the auto insurance worldwide.

In May 2023, the U.S. insurance industry reported an investment exposure to debt issued by the Treasury Department of $303.87 billion at year-end 2022.

Competitive Landscape

The major players operating in the auto insurance providers in the industry include Berkshire Hathaway Inc., Admiral Group Plc, People's Insurance Company of China, Allstate Insurance Company, CHINA PACIFIC INSURANCE CO., Tokio Marine Group, Ping An Insurance (Group) Company of China, Ltd., Automobile Insurance, Allianz and .

Report Coverage & Deliverables

The auto insurance market report provides a comprehensive analysis of market size, trends, and key drivers influencing growth. It covers industry dynamics, regional perspectives, and competitive landscapes.

Coverage Type Insights

Auto insurance policies are segmented into liability, collision, and comprehensive coverage, each offering different levels of protection for vehicles and drivers.

Distribution Channel Insights

Direct insurers hold a significant auto insurance market share, alongside agents and brokers, due to growing digitalization and ease of access for consumers.

Vehicle Age Insights

The auto insurance market growth is driving high owing to, an increase in the growth of insuring older vehicles, as premiums for new vehicles often include dealer-sponsored insurance.

Application Insights

Auto insurance is used primarily by private vehicle owners and commercial fleet operators.

Regional Insights

North America dominates the market, followed by Europe and Asia-Pacific.

Key Companies & Market Share Insights:

Leading companies in the market include State Farm, GEICO, and Allstate, significantly contributing to the auto insurance market value.

Recent Key Strategies and Developments

In June 2024, Intuit acquired Zendrive, to accelerate the development and adoption of Karma Drive, a telematics-powered, usage-based auto insurance product offered by Intuit's business unit Credit Karma.

In March 2024, Clearcover launched its revolutionary Generative AI solution. The offering is aimed at further digitizing statement collection to significantly streamline the insurance claims process and enhance customer experience.

Key Sources Referred

Insurance Solutions Incorporated.

United Insurance Solutions

Insurance Regulatory and Development Authority of India

CSC e-Governance Services

Key Benefits For Stakeholders

This report provides a quantitative analysis of the auto insurance market forecast segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the auto insurance market outlook segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global auto insurance market opportunity statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global auto insurance market trends, key players, market segments, application areas, and market growth strategies.

Auto Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2274.8 Billion |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Coverage |

|

| By Distribution Channel |

|

| By Vehicle Age |

|

| By Application |

|

| By Region |

|

| Key Market Players | State Farm Mutual, People's Insurance Company of China, Automobile Insurance, CHINA PACIFIC INSURANCE CO., Ping An Insurance (Group) Company of China, Ltd., Allianz, Allstate Insurance Company, Berkshire Hathaway Inc., Tokio Marine Group, Admiral Group PLC |

The global auto insurance market is undergoing significant changes due to advancements in technology, changing consumer behavior, and evolving regulatory environments.

Personal segment is the leading application of Auto Insurance Market.

North America is the largest regional market for Auto Insurance.

$2,274.8 billion is the estimated industry size of Auto Insurance by 2032.

Berkshire Hathaway Inc., Admiral Group Plc, People's Insurance Company of China, Allstate Insurance Company, CHINA PACIFIC INSURANCE CO., Tokio Marine Group, Ping An Insurance (Group) Company of China, Ltd., Automobile Insurance, Allianz are the top companies to hold the market share in Auto Insurance.

Loading Table Of Content...