Automated Pallet Truck Market Research, 2033

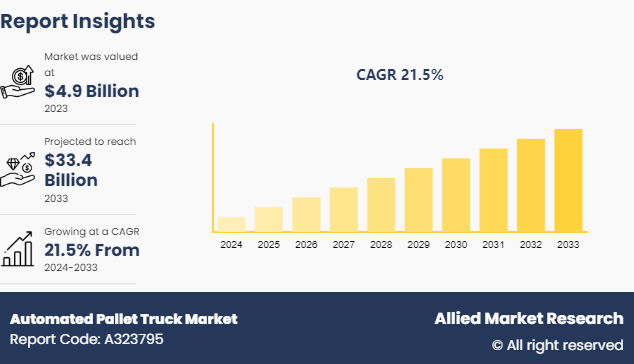

The global automated pallet truck market was valued at $4.9 billion in 2023, and is projected to reach $33.4 Billion by 2033, growing at a CAGR of 21.5% from 2024 to 2033.

Market Introduction and Definition

An automated pallet truck is a type of material handling equipment used in warehouses, distribution centers, and manufacturing facilities to transport and handle palletized goods. Unlike traditional manual pallet trucks that require human operators to push or pull them, automated pallet trucks are equipped with various technologies to navigate and operate autonomously or semi-autonomously. These trucks are designed to move pallets of goods efficiently and safely within a facility. They typically feature electric propulsion systems for movement and may utilize technologies such as sensors, cameras, lasers, and onboard computers to navigate through the facility, avoid obstacles, and interact with other equipment or personnel.

Key Takeaways

The automated pallet truck market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automated pallet truck industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In April 2023, Doosan Industrial Vehicle partnered with Kollmorgen, a leading provider of motion control and automation solutions, to develop automated forklifts. This collaboration aims to integrate Kollmorgen's advanced automation technology with Doosan's expertise in industrial vehicles, enhancing the capabilities of forklifts to operate autonomously and efficiently in warehouse and logistics environments.

Key Market Dynamics

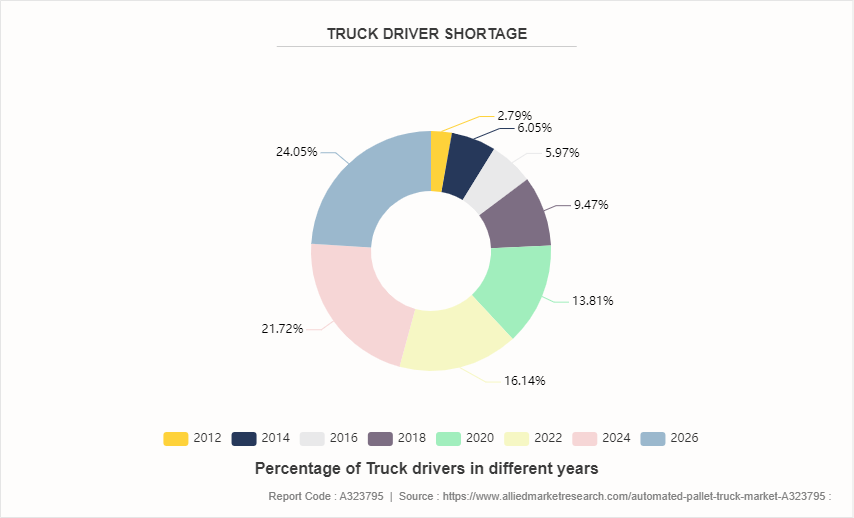

The rise in demand for warehouse automation is a significant driver of the automated pallet truck market. With the growth of e-commerce and omnichannel retailing, there's a rising need for warehouse automation to handle the surge in order volumes efficiently. Automated pallet trucks play a crucial role in this scenario by automating material handling tasks, reducing labor costs, and improving operational efficiency. Furthermore, safety regulations and the emphasis on creating safer work environments, and technological advancement have driven the demand for the automated pallet truck market size.

However, high initial investment cost has hampered the growth of the automated pallet truck market share. Initial cost of implementing automated pallet trucks and related infrastructure can be significant, which may deter smaller companies or those with budget constraints from investing in this technology. Also, the return on investment (ROI) period for automated pallet trucks may be longer compared to traditional manual equipment, further impacting adoption rates. Moreover, integration challenges, limited flexibility and adaptability are major factors that hamper the growth of the automated pallet truck market size. On the contrary, the continued growth of e-commerce and the shift towards same-day or next-day delivery services present significant opportunities for the automated pallet trucks industry. As warehouses and distribution centers strive to meet the demands of online shoppers efficiently, the demand for automation solutions, including automated pallet trucks, is expected to rise.

Aftermarket and Replacement Parts Demand of Global Automated Pallet Truck Market

As automated pallet truck industry are subjected to regular use in demanding warehouse and distribution environments, various components may experience wear-and-tear over time. This creates a consistent demand for replacement parts such as wheels, batteries, motors, sensors, and control systems to ensure the continued operation of the equipment. The expanding adoption of automated pallet trucks globally is driving the aftermarket demand for replacement parts. As more companies invest in automation to improve operational efficiency and meet growing demand, there is a corresponding need for maintenance and repair services, as well as a steady supply of spare parts to support the installed base of equipment.

Ongoing technological advancements in automated material handling systems result in the development of more sophisticated and efficient pallet trucks. While this drives the demand for newer models, it also creates opportunities in the aftermarket segment as older equipment may require upgrades or retrofits to remain competitive or comply with evolving industry standards. Many companies that invest in automated pallet trucks also opt for service contracts or maintenance agreements with suppliers or third-party service providers. These agreements often include provisions for regular inspections, preventive maintenance, and the provision of replacement parts as needed, contributing to the aftermarket parts demand.

Market Segmentation

The automated pallet truck market is segmented into type, application, and region. On the basis of type, the market is segmented into pallet transporting truck, and pallet stacking truck. As per application, the market is segregated into production and manufacture, distribution and logistics, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, Latin America, and Middle East Africa.

Regional/Country Market Outlook

The U.S. has a highly developed industrial infrastructure, including warehouses, distribution centers, and manufacturing facilities, which require efficient material handling solutions. The demand for automated pallet truck market growth is high in such environments to streamline operations, increase productivity, and reduce labor costs. The U.S. has been an early adopter of automation technologies in various industries, including logistics and warehousing. Companies in the U.S. have been quick to recognize the benefits of automated pallet trucks in improving operational efficiency, safety, and throughput, leading to widespread adoption and a larger market share.

The U.S. is home to many leading manufacturers and technology companies that specialize in robotics, automation, and material handling equipment. These companies continuously innovate and develop advanced automated pallet trucks with enhanced capabilities, driving market growth and competitiveness. The rapid growth of e-commerce in the U.S. has fueled the demand for automated pallet truck market opportunity. With the rise of online shopping, there's a need for fast and accurate order fulfillment, which automated material handling solutions can efficiently address. The U.S. being a major market for e-commerce contributes to the high demand for automated pallet trucks.

In March 2023, Big Joe introduced an autonomous pallet mover in partnership with Thoro.Ai, a company specializing in artificial intelligence and automation solutions. This collaboration combines Big Joe's expertise in material handling equipment with Thoro.Ai's advanced AI technology to develop a pallet mover capable of autonomous operation. The autonomous pallet mover streamlines pallet transportation tasks within warehouses and distribution centers, offering increased efficiency, flexibility, and productivity. It leverages AI algorithms and sensor technology to navigate warehouse environments, pick up and transport pallets, and interact safely with humans and other equipment. Through this partnership, Big Joe aims to provide innovative solutions that meet the evolving needs of the material handling industry.

In June 2021, Hikrobot, MOV.AI, and BOWE Group have joined forces to offer autonomous pallet movers worldwide. This partnership combines the strengths of each company to deliver advanced solutions in autonomous material handling. Hikrobot, known for its expertise in robotics and automation, provides cutting-edge hardware and technology for autonomous pallet movers. MOV.AI contributes its robotics operating system, enabling seamless integration and control of robotic systems.

Competitive Landscape

The report analyzes the profiles of key players operating in the automated pallet truck market such as Aichikikai, Amazon Robotics, ATAP Inc, Daifuku, Dematic, JBT Corporation, Meidensha, Mitsubishi Caterpillar Forklift, Seegrid Corporation, and Swisslog. These players have adopted various strategies to increase their market penetration and strengthen their position in the automated pallet truck market.

Industry Trends

In March 2024, Tompkins Robotics' PickPallet automated pallet truck enhances industrial efficiency by automating the process of picking and transporting palletized goods within warehouses and distribution centers. This robotic system utilizes advanced robotics and artificial intelligence technologies to perform tasks traditionally carried out by human workers.

In May 2024, Mobile Industrial Robots (MiR) will be showcasing its latest autonomous mobile robots (AMRs) at Automate 2024 in booth 1241. This trade show, organized by A3, promises to be the biggest yet, offering over 365, 000 square feet of exhibit space, featuring more than 800 exhibitors, and expecting around 30, 000 registrants. Attendees will have the opportunity to explore cutting-edge technologies in robotics, machine vision, artificial intelligence (AI) , and motion control, while also benefiting from various learning and networking opportunities.

In February 2024, Grenzebach developed a new automated forklift truck specifically designed for transporting Euro pallets. This innovative solution streamlines pallet handling operations within warehouses and distribution centers.

In April 2023, Doosan Industrial Vehicle partnered with Kollmorgen, a leading provider of motion control and automation solutions, to develop automated forklifts. This collaboration aims to integrate Kollmorgen's advanced automation technology with Doosan's expertise in industrial vehicles, enhancing the capabilities of forklifts to operate autonomously and efficiently in warehouse and logistics environments.

In March 2024, Tompkins Robotics' PickPallet automated pallet truck enhances industrial efficiency by automating the process of picking and transporting palletized goods within warehouses and distribution centers. This robotic system utilizes advanced robotics and artificial intelligence technologies to perform tasks traditionally carried out by human workers.

In May 2024, Mobile Industrial Robots (MiR) will be showcasing its latest autonomous mobile robots (AMRs) at Automate 2024 in booth 1241. This trade show, organized by A3, promises to be the biggest yet, offering over 365, 000 square feet of exhibit space, featuring more than 800 exhibitors, and expecting around 30, 000 registrants. Attendees will have the opportunity to explore cutting-edge technologies in robotics, machine vision, artificial intelligence (AI) , and motion control, while also benefiting from various learning and networking opportunities.

In February 2024, Grenzebach developed a new automated forklift truck specifically designed for transporting Euro pallets. This innovative solution streamlines pallet handling operations within warehouses and distribution centers.

In April 2023, Doosan Industrial Vehicle partnered with Kollmorgen, a leading provider of motion control and automation solutions, to develop automated forklifts. This collaboration aims to integrate Kollmorgen's advanced automation technology with Doosan's expertise in industrial vehicles, enhancing the capabilities of forklifts to operate autonomously and efficiently in warehouse and logistics environments.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the automated pallet truck market segments, current trends, estimations, and dynamics of the automated pallet truck market analysis from 2022 to 2032 to identify the prevailing automated pallet truck market forecast.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automated pallet truck market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global automated pallet truck market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automated pallet truck market trends, key players, market segments, application areas, and market growth strategies.

Automated Pallet Truck Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 33.4 Billion |

| Growth Rate | CAGR of 21.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 488 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Amazon Robotics, JBT Corporation, Mitsubishi Caterpillar Forklift, Dematic, Swisslog AG, Meidensha Corporation, Daifuku, Seegrid Corporation, ATAP Inc, Aichikikai |

The upcoming trends in the global automated pallet truck market include increased adoption of AI and IoT for enhanced navigation and efficiency, integration of advanced safety features, growth in e-commerce driving demand for automation in warehouses, and a shift towards sustainable and energy-efficient solutions.

Production and Manufacture is a leading application of automated pallet truck market.

North America is largest regional market for automated pallet truck.

$33.4 billion is the estimated industry size of Automated Pallet Truck.

Aichikikai, Amazon Robotics, ATAP Inc, Daifuku, Dematic, JBT Corporation, Meidensha, Mitsubishi Caterpillar Forklift, Seegrid Corporation, and Swisslog.

Loading Table Of Content...