Automated Sortation System Market Research, 2032

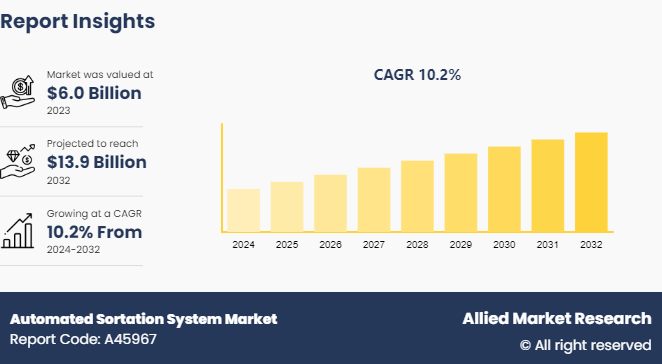

The global automated sortation system market size was valued at $6.0 billion in 2023, and is projected to reach $13.9 billion by 2032, growing at a CAGR of 10.2% from 2024 to 2032.

Market Introduction and Definition

Automated sorting systems are used to categorize a wide range of items, encompassing consumer goods, baggage, mail, and packages, according to different criteria like destination, color, and product category. The increase in requirement for minimizing inventory and streamlining handling procedures is expected to propel the automated sortation system market growth in the foreseeable future. Companies across diverse sectors are prioritizing the optimal utilization of their inventory by providing just-in-time delivery services. Consequently, there is a growing demand for automated solutions to effectively manage operations at distribution centers. The substantial upfront costs associated with producing these systems are impeding the expansion of the automated sortation systems market. In addition, manufacturers must adhere to the regulations established by different governing bodies, which hinders the growth opportunities for industry players. Nevertheless, the increase in demand for these products in airport facilities owing to the rise in tourism is projected to boost the market growth in the coming seven years.

Key Takeaways

The automated sortation system market overview study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automated sortation system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Industry Trends

In January 2022, Dematic is a renowned global provider of innovative automated solutions, specializing in designing, constructing, and supporting intelligent systems. Completed automated a small parts warehouse for the Siemens System Engineering Plant (WKC) located in Chemnitz, Germany. This compact piece picking solution from Dematic not only enhances warehouse space utilization but also streamlines the picking and material flow operations for production. The system is equipped with an AutoStore system featuring more than 45, 000 bins for efficient parts storage.

In June 2021, Satake, a manufacturing company in Japan, specializes in producing equipment for processing and sorting agricultural products. It introduced their newest and most extensive optical sorter called the "NIRAMI series". This advanced technology is specifically designed to effectively sort grains, pulses, seeds, and various other products. The NIRAMI series offers a range of sizes, all equipped with extra wide chutes and flexible configurations, making it suitable for a wide range of applications and processing capacities.

Key Market Dynamics

The automated sortation system market is experiencing rise in growth owing to the expansion of e-commerce sector and advancements in technology. There is a significant increase in the demand for efficient logistics solutions owing to continuous global expansion of e-commerce, driven by the rise in preference for online shopping among consumers and the rapid digital transformation of retailers. Automated sortation systems are crucial in meeting such demands as these help improve operational efficiency and enhance order fulfillment capabilities. For Instance, China, the U.S., and the UK are at the forefront of online retail sales rankings on a national and regional level. In terms of global retail sales percentage, China dominated with 52% automated sortation system market share in 2021, with the U.S. following at 19% and the UK at 4.8%. Such increase in number of sales across these regions creates many possibilities for business to increase adoption of automated sortation systems throughout.

E-commerce businesses encounter the difficulty of handling extensive categories of various products and processing orders promptly to satisfy customer demands for swift shipments. Automated sortation systems tackle these obstacles by automating the sorting procedure, resulting in decreased processing times and enhanced precision. These automated sortation systems make use of cutting-edge technologies including robotics, artificial intelligence (AI) , and ML to streamline sorting operations. AI and ML algorithms use these systems to adjust dynamically to changing sorting standards, guaranteeing effective management of diverse product categories.

Furthermore, high throughput capacity of linear sortation systems plays a crucial role in driving their adoption. These automated sortation systems are specifically engineered to efficiently and swiftly handle large quantities of items. In settings where speed and throughput are of utmost importance, such as distribution centers and fulfillment warehouses, linear sorters stand out by processing thousands of items per hour. This efficiency allows businesses to keep up with the rise in demand for quick delivery times and optimize their supply chain processes.

Market Segmentation

The automated sortation system market is segmented into equipment, application, end use and region. On the basis of equipment, the market is divided into case sorters, pop-up wheel sorter, pivoting arm sorter, and others. On the basis of end use, the market is divided into retail and e-commerce, food & beverages, pharmaceuticals, air cargo, and others. On the basis of sorting type, the market is bifurcated into linear sortation, loop sortation, and pusher sortation systems. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, LA, and MEA.

Regional/Country Market Outlook

During the projected period, the Asia-Pacific market holds a dominant position in the global market for automated sortation systems.

The exponential expansion of online shopping in nations such as China, India, Japan, and South Korea has resulted in a significant increase in the number of parcels being shipped. Utilizing automated sorting systems is essential for effectively handling the large quantity of packages and guaranteeing prompt deliveries. The demand for effective logistics solutions to manage the flow of goods within and across cities is becoming crucial as urbanization and population growth continue to rise in numerous Asia-Pacific nations such as India, and Japan. Automated sortation systems play a key role in optimizing the logistics operations and cutting down on delivery times. Asia-Pacific countries are making significant investments in infrastructure development, which encompasses the enhancement and modernization of transportation and logistics networks. The optimization of these networks is greatly facilitated by the utilization of automated sortation systems, as they effectively enhance the operations of warehouses and distribution centers.

Competitive Landscape

The major players operating in the automated sortation system market include Bastian Solutions, Inc., BEUMER GROUP, Daifuku Co., Ltd., Honeywell Intelligrated, Interroll Group, KNAPP AG, Murata Machinery, Ltd., Siemens, TGW Logistics Group, and Vanderlande Industries B.V.

Recent Key Strategies and Developments

In March 2024, OPEX Corporation, a renowned global pioneer in Next Generation Automation for nearly half a century, introduced its latest cutting-edge sorting and order retrieval solutions, OPEX Sure Sort X with OPEX Xtract. The company's leadership officially revealed these groundbreaking technologies at MODEX 2024, the largest manufacturing and supply chain trade event of the year, hosted at the Georgia World Congress Center in Atlanta.

In August 2023, Falcon Autotech, a leading automation solutions provider, strategically implemented their automated parcel sorting solution at DTDC's Chennai Facility to boost operational efficiency. DTDC Express Ltd, a major integrated express logistics company in India, has selected Falcon Autotech to introduce automation for parcel sorting at their vast 1, 75, 000 sq ft super hub in Chennai, Tamil Nadu.

Key Sources Referred

International Federation of Robotics (IFR)

International Organization for Standardization (ISO)

Material Handling Industry (MHI)

China Federation of Logistics & Purchasing (CFLP)

European Automation Association (euAutomation)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the automated sortation system market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing automated sortation system market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automated sortation system market analysis and segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global automated sortation system market forecast and statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automated sortation system market trends, key players, market segments, application areas, and market growth strategies.

Automated Sortation System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.9 Billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2024 - 2032 |

| Report Pages | 315 |

| By Equipment |

|

| By End Use |

|

| By Sorting Type |

|

| By Region |

|

| Key Market Players | TGW Logistics Group, KNAPP AG, Vanderlande Industries B.V., Siemens, Daifuku Co., Ltd., BEUMER GROUP, Honeywell Intelligrated, Interroll Group, Murata Machinery, Ltd., Bastian Solutions, Inc. |

The automated sortation system market is experiencing rise in growth owing to the expansion of e-commerce sector and advancements in technology. There is a significant increase in the demand for efficient logistics solutions owing to continuous global expansion of e-commerce, driven by the rise in preference for online shopping among consumers and the rapid digital transformation of retailers.

linear sortation is the leading sortation type in the Automated Sortation System Market.

North America held the highest market share in 2023 for Automated Sortation Systems.

The global Automated sortation system market was valued at $6.0 billion in 2023 and is estimated to reach $13.9 billion by 2032, exhibiting a CAGR of 9.1% from 2024 to 2032.?

The top companies analyzed for Automated Sortation System market report are Bastian Solutions, Inc., BEUMER GROUP, Daifuku Co., Ltd., Honeywell Intelligrated, Interroll Group, KNAPP AG, Murata Machinery, Ltd., Siemens, TGW Logistics Group, and Vanderlande Industries B.V.

Loading Table Of Content...