The global automated truck loading system market size was valued at $2.8 billion in 2022, and is projected to reach $6.6 billion by 2032, growing at a CAGR of 9% from 2023 to 2032.

Report Key Highlights:

- The report covers a detailed analysis on the automated truck loading system used in logistic industry.

- The market has been analyzed from the year 2022 till the year 2032.

- Latest developments have been mentioned in the research study.

- Top companies operating in the industry has been profiled in the research study.

- The research study includes different segments & regions across which the market has been analyzed.

The technology that allows the automatic loading and unloading of goods and materials in and out the truck is called automated truck loading system technology. The system can decrease the time taken to load and unload, which can increase overall productivity and decrease any time wastage. Moreover, it reduces the labor cost, as the system does not require a large amount of labor and minimizes the risk of injuries. Some systems are designed to maximize the use of available space in trucks which ensures effective, and swift loading and unloading. Manufacturers of the automated truck loading system offer customized solutions based on the size, weight, and number of package or parcel.

This technology can be used in any sector which includes logistics and distribution centers, manufacturing, ports and terminals, food and beverage, agriculture, mining and construction, parcel or package shipment, and even waste management. For instance, the system is used in manufacturing industry to automate the loading of the finished onto the trucks. Similarly, it can also be used in ports and terminals to load and unload the containers, and cargo to avoid any kind of accident and reduce congestion. The automated loading system technology has enhanced operational efficiency, ensuring consistency, complementing safe loading practices, and reducing labor costs.

The factors such as rise in rapid industrialization and increased safety of the work environment supplement the growth of the automated truck loading system market. However, high installation charges and availability of inexpensive labor are the factors expected to hamper the growth of the market. In addition, integration of automated truck loading system with other systems and use of advanced robotics creates market opportunities for the key players operating in automated truck loading system industry.

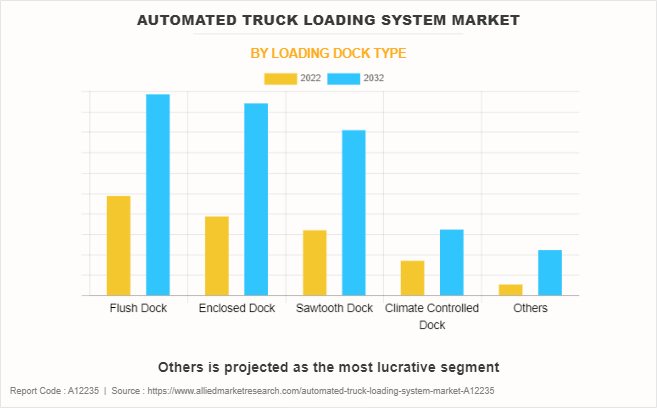

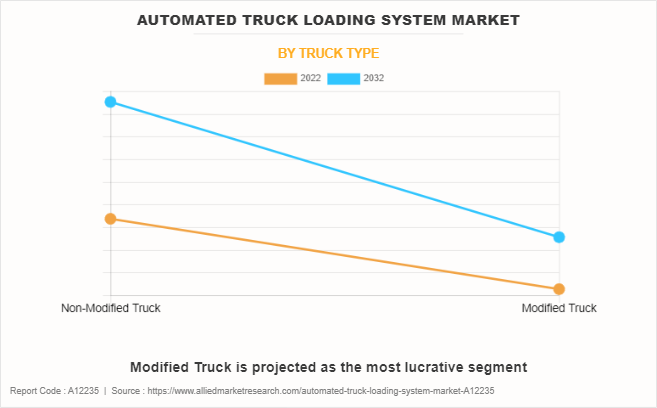

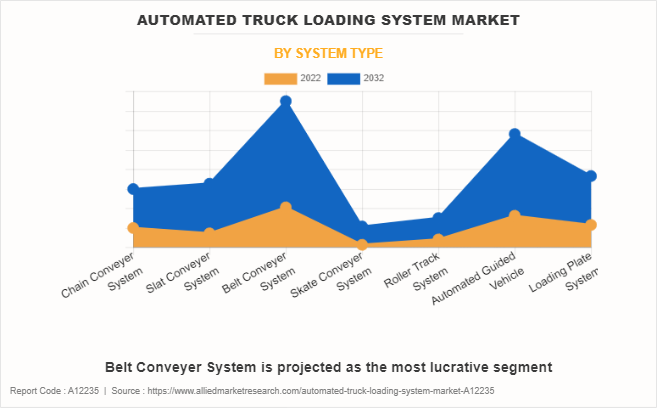

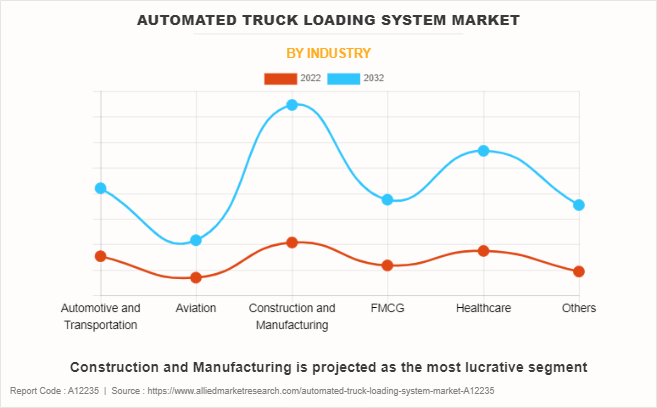

The automated truck loading system market is segmented into loading dock type, truck type, system type, industry and region. On the basis of loading dock type, the market is divided into flush dock, enclosed dock, sawtooth dock, climate control dock, and others. On the basis of truck type, the market is bifurcated into modified truck, and non-modified truck. On the basis of system type, the market is classified into chain conveyor system, slat conveyor system, belt conveyor system, skate conveyor system, roller track system, automated guided vehicle, and loading plate system. On the basis of industry, the market is classified into automotive, aviation, construction & manufacturing, FMCG, logistics, healthcare, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

The key players in global automated truck loading system market include ACTIW LTD., BEUMER GROUP, Cargo Floor B.V., Joloda Hydraroll Limited, Ancra Systems B.V., Euroimpianti S.p.A, GEBHARDT Fördertechnik GmbH, HAVER & BOECKER OHG, Secon Components S.L., and Asbreuk Service B.V.

Rise in rapid industrialization

The nations and industries after the events such as COVID-19 and Russia-Ukraine war have taken initiatives to make themselves self-reliant so that their economies do not get affected by any such events in the future. This has created a rapid rise in industrialization all around the world. For instance, Manufacturing USA is a national network of institutes established to ensure the United States' global leadership in advanced manufacturing through large-scale public-private partnership in technology, supply chain, and workforce development. Manufacturing USA will get $97 million in funding from the FY 2023 budget, which will support five Commerce-sponsored institutions that will promote collaboration through industry-relevant research and development that will encourage innovation in US manufacturing industry. The Budget also includes $275 million for the Manufacturing Extension Partnership (MEP). This investment will allow the MEP to boost domestic supply chains while also assisting small and medium-sized firms in improving their competitiveness. The growth of the nations around the world is expected to give rise in the rapid industrialization and drives the automated truck loading system market share.

Increased safety of the work environment

A warehouse is a building which can store any kind of products for the further production or the transportation. The safety of the product and the person handling the product is essential. If the product’s safety is compromised, it may lose its integrity. Similarly the safety of the worker is also important as any casualty can create havoc in the organization. The use of technology such as automated truck loading systems in the warehouse is expected to achieve both the purpose. It can help the workers to avoid any accident on the deck where the package or parcel is loaded and unloaded. The capability makes it a savior for both the worker and the parcel and helps in the growth of the system in the warehouses all around the world.

Availability of inexpensive labor

The demand for the automated truck loading system may be hampered due to availability of inexpensive labor in many regions of the world. The regions such as Bangladesh, and China are some of the most populated countries in the world. The standard of living and income level in such regions are low. The low cost of living in the many regions around the world such as in India, and China makes it viable for the industries to hire workers at very inexpensive cost and enables industries to dodge the idea of automation of various processes which is expected to cost them a considerate amount of capital. Thus, availability of inexpensive labor may act as a barrier for the excessive sale of the automation or automated truck loading system.

Integration with other systems

The automated truck loading system with its potential has helped industries by enhancing safety and reducing accidents in the warehouse. The system has potential to do more, as it can be integrated with various other technologies. For instance, it can be integrated with the warehouse management system which is expected to facilitate load planning, inventory management, and efficient fulfilment of the order. Similarly, Internet of things (IoT) can be integrated with the automated loading system which helps it to communicate with internal components as well as external components of the surrounding in the warehouse or a store unit. Connectivity with different systems is anticipated to help in the predictive maintenance, data sharing, and remote monitoring of the system.

Key Developments in Automated Truck Loading System Industry

- In July 2022, Ancra Systems partnered with VisionNav Robotics, a driverless internal logistics solutions provider. In this partnership Ancra systems supported VisionNav's product range of VisionNav and enhance its automated truck loading system (ATLS) portfolio, and target Europe and North American markets.

- In June 2022, BEUMER Group acquired the FAM Group, a supplier of conveyor system and loading technology. The acquisition is expected to help the company to enhance its product with the technology of FAM Group.

- In June 2020, Ancra Systems partnered WELCOTECH Intralogistics Solutions. The partnership is expected to help the Ancra Systems to offer its product and service related to it in the Brazilian market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automated truck loading system market analysis from 2022 to 2032 to identify the prevailing automated truck loading system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automated truck loading system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automated truck loading system market trends, key players, market segments, application areas, and market growth strategies.

Automated Truck Loading System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.6 billion |

| Growth Rate | CAGR of 9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Loading Dock Type |

|

| By Truck Type |

|

| By System Type |

|

| By Industry |

|

| By Region |

|

| Key Market Players | Cargo Floor B.V., GEBHARDT Fordertechnik GmbH, Asbreuk Service B.V., ACTIW LTD., Ancra Systems B.V., Euroimpianti S.p.A, Joloda Hydraroll Limited, Secon Components S.L., HAVER & BOECKER OHG, BEUMER Group |

Usage of belt conveyor system are the upcoming trends of Automated Truck Loading System Market in the world

Construction And Manufacturing is the leading application of Automated Truck Loading System Market

North America is the largest regional market for Automated Truck Loading System

The global automated truck loading system market was valued at $2,822.0 million in 2022, and is projected to reach $6,554.9 million by 2032, registering a CAGR of 9.0% from 2023 to 2032.

Key players analyzed in the report include ACTIW LTD., BEUMER GROUP, Cargo Floor B.V., Joloda Hydraroll Limited, Ancra Systems B.V., Euroimpianti S.p.A, GEBHARDT Fördertechnik GmbH, HAVER & BOECKER OHG, Secon Components S.L., and Asbreuk Service B.V.

Loading Table Of Content...

Loading Research Methodology...