Automatic Shot Blasting Market Research, 2031

The global automatic shot blasting market size was valued at $753.3 million in 2021, and is projected to reach $1.2 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031.

Automatic shot blasting is a process of bombarding abrasive material made of steel, silicon carbide, and other abrasive materials on the product surface. This technique is used to clean the surface by removing mill scale, corrosion, and other impurities that would reduce the product life. In addition, with the help of PLC and software installation in a shot blasting machine the process is fully automized.

High-quality finishing supplies are needed by various sectors. As the world's population has expanded, so has the demand for various construction materials. Several governments are focusing on building the infrastructure needed for affordable housing. The residential market was expected to be a major contributor to the construction industry's forecast 4.5% value growth in 2022, according to the Association of Equipment Manufacturers. Heavy construction equipment will be more necessary as both developed and developing countries' construction activity are growing. In addition, automatic shot blasting machines are used by Original Equipment Manufacturers (OEMs) and aftermarket sales organizations in the automotive industry to strengthen, polish, and clean various metal surfaces. A significant issue in the automotive industry is corrosion. It adversely affects several parts' physical attributes, including strength. Shot blasting may smooth surfaces up to 75% more quickly than conventional techniques. Thus, increase in concerns regarding corrosion is, anticipated to augment the automatic shot blasting market growth in the near future.

Due to its great strength, steel and silicon are frequently used in the construction of automatic shot blasting equipment. Because of this, market participants find it challenging to maintain profitability and set budgets when steel and silicon costs fluctuate. For instance, since March 2020, the cost of steel in the U.S. has climbed by more than 215%, to $1,825. Prior to that, starting in at least 2017, cost of steel was in the $500–$800 range. In addition, silicon metal costs have doubled since COVID-19. These alterations are significantly limiting the market expansion for automatic shot blasting industry.

The demand for automatic shot blasting machines has decreased in the year 2020, owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic has shut-down production of automotive production, building construction and other sectors for the end-user, mainly owing to prolonged lockdowns in major global countries. This has hampered the growth of the automatic shot blasting machines market significantly during the pandemic. The major demand for automatic shot blasting machines was previously noticed from giant manufacturing countries including China, U.S., Germany, Spain, and the UK which was badly affected by the spread of coronavirus, thereby halting demand for automatic shot blasting machines. This is expected to lead to re-initiation of the manufacturing industry at its full-scale capacities, which is likely to help the automatic shot blasting market to recover by end of 2022.

Each industrial machine is being produced with the expansion and advancement of industrial technology. For instance, Wheelabrator introduced a new digital tool in March 2022 that monitors and shows the total performance of a shot-blast machine. It helps operators to spot problems and obstructions that prevent their blast machines from operating at their peak performance. Moreover, Wheelabrator, a producer of automatic shot blasting machines, offers contemporary shot blasting machines with features like exhaust ducting, quick turnaround, self-contained, fully equipped shot blast machines, tested and proven disc blast wheels, automatic PLC control, and other features. This enables fabricators to complete numerous operations with a single equipment. It is projected that these technical developments would create lucrative chances for the expansion of automatic shot blasting equipment.

Segmental Overview

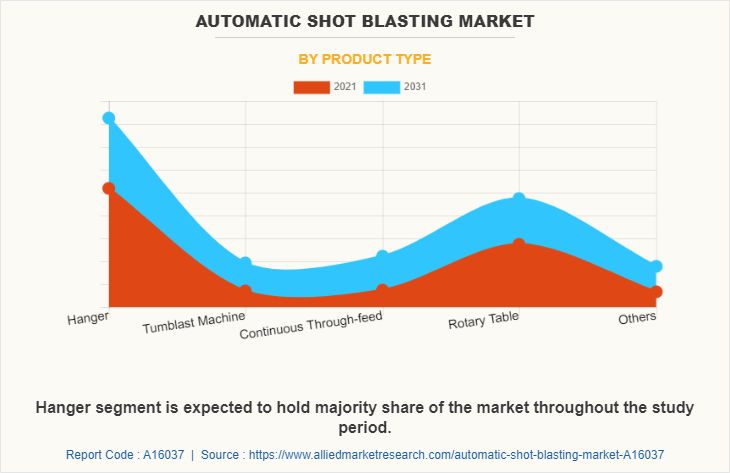

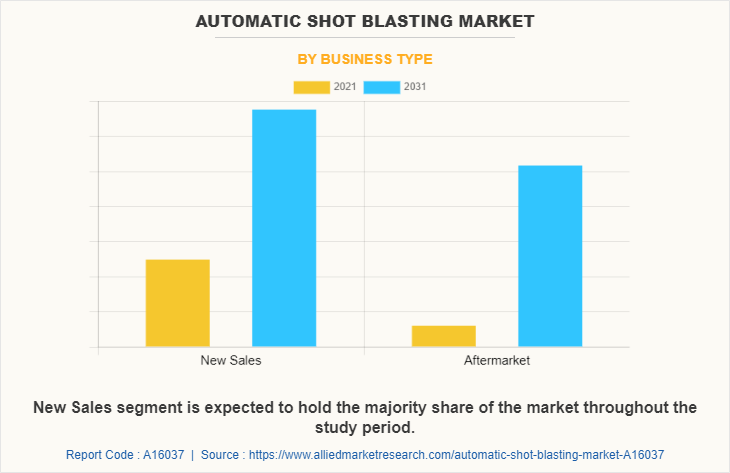

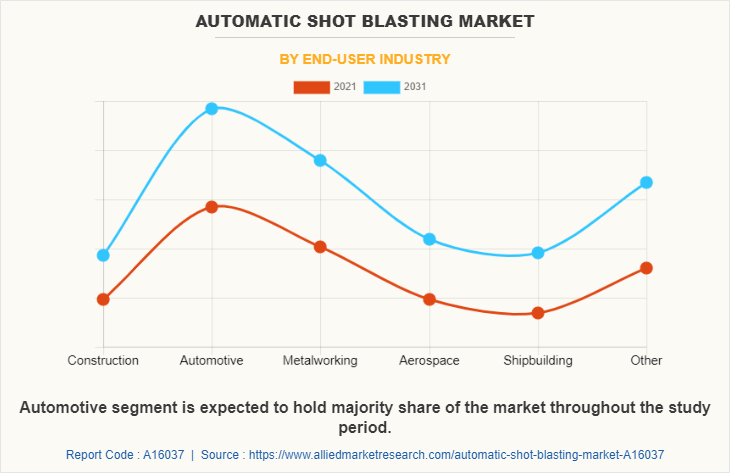

The market is segmented on the basis of product type, business type, end user, and region. On the basis of product type, the market is divided into hanger type, tumblast machine, continuous through-feed, rotary table, and others. On the basis of business type, the market is divided into new sales, and aftermarket. On the basis of end-user industry, the market is divided into construction, automotive, metalworking, aerospace, shipbuilding, and other.

Region wise, the global automatic shot blasting machines market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By product type: The automatic shot blasting machines market is categorized into hanger type, tumblast machine, continuous through-feed, rotary table, and others. Hanger type automatic shot blasting machines manual movement or motorized movement of hangers into the Blasting cabin. Machine is used to remove rust, scale, sand and burrs from many kinds of work pieces. Tumblast machine are polygon drum type which allow for intensive and gentle shot blasting at high capacity in a polygon-shaped trough rocking back and forth. The continuous through-feed machines provide continuous, flexible, and automated blast-cleaning of tumble-proof parts, including forgings and castings. The rotary table shot blasting machine is suitable for shot blasting small and medium size parts. The rotary table size varies as per customer requirement. The other segment includes continuous belt blasting machines, wire mesh belt blast machines, roller conveyor blast machines, and blast cabinets. Hanger type segment is expected to exhibit the largest revenue contributor during the forecast period. Continuous through-feed is expected to exhibit the highest CAGR share in the product type segment in the automatic shot blasting machines market during the forecast period.

By business type: The automatic shot blasting machines market is classified into original equipment manufacturer (OEM), and aftermarket. Original equipment (OEM) manufacturer offers automatic shot blasting machines and parts that can be marketed by another manufacturer, dealers or distributors to sell to the end users. After-sales is the secondary market that offers parts, and other components. In addition, it includes services used in repair and maintenance for automatic shot blasting machines. New sales segment is expected to exhibit the largest revenue during the forecast period. Aftermarket segment is expected to exhibit the highest CAGR share in the business type segment in the automatic shot blasting machines market during the forecast period.

By end-user industry: The automatic shot blasting machines market is divided into construction, automotive, metalworking, aerospace, shipbuilding, and other. Construction sectors requires large machines such as dozer, hydraulic hammer, mixing equipment’s and others for construction application. These machine parts required to be highly finished, automatic shot blasting machines are used for finished these parts and remove corrosion removal, and cleaning. The automotive industry requires finishing, cleaning, and corrosion removal of a variety of automotive parts. Metal fabrication sector automatic shot blasting machines is used for variety of application such as deburring, cleaning and corrosion removal. Aerospace industry requires high precision component for reduced overall weight and high quality and efficiency of products. Automatic shot blasting machines technique is used for finishing of these highly accurate products such as jet engines, turbine blades and others. Ships requires automatic shot blasting machines mainly for corrosion removal, cleaning and debris removal. The other type of end user includes foundry and oil & gas. Automotive is expected to exhibit the largest revenue share in the end-user industry segment in the automatic shot blasting machines market during the forecast period. The metalworking segment is expected to exhibit the largest CAGR during the forecast period.

By region: The automatic shot blasting machines is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest revenue in automatic shot blasting machines market share. And LAMEA is expected to exhibit highest CAGR during forecast period.

COMPETITION ANALYSIS

The major players profiled in the automatic shot blasting machines include AGTOS GmbH., Blastclean System Pvt. Ltd, Goff Inc., Norican Group, Qingdao Qinggong Machinery Co. Ltd., Rösler Oberflächentechnik GmbH, Sintokogio Ltd., STEM d.o.o., Siapro d.o.o., and Shandong Kaitai Group Co.

Major companies in the market have adopted product launch, collaboration acquisition and partnership as their key developmental strategies to offer better products and services to customers in the Automatic shot blasting machines market.

Some examples of business expansion and collaboration in the market

In June 2022, AGTOS Gesellschaft für technische Oberflichensysteme mbH extended its sales operations in France in June 2022 to get in touch with clients for any inquiries regarding shot blast technology.

In November 2022, Sinto America has signed partnership with KB Foundry Services, LLC. This partnership focuses on foundry product machining, cleaning, corrosion removal and refurbishing of the parts.

In December 2022, Norican Group and Wuxi Xinan Technology Co., Ltd. signed a strategic agreement at his Hanjiang facility in Norican. Under the agreement, Norican will leverage its advantages and resources to provide advanced technology and products to Xinan, including integrated die casting units, melting furnaces, batch furnaces, shot blasting machines, dedusting systems and digital products.

In February 2019, Shinto Kogyosho Co., Ltd. has acquired . FROHN North America, Inc., a service-oriented manufacturer of blasting abrasives, steel shots and shot peening accessories.

The product launch and product development in the market

In March 2022, Wheelabrator introduced a new digital tool in March 2022 that monitors and shows the total performance of a shot-blast machine. It helps operators to spot problems and obstructions that prevent their blast machines from operating at their peak performance.

In July 2022 At a Peddinghaus Corporation location in Chicago, the U.S., AGTOS Gesellschaft fuir technische Oberflachensysteme mbH installed the AGTOS monorail shot blast machine.

In May 2022, AMT company has introduced PostProDP MAX, a fully automated depowering and shot blasting system created for large component runs and use in big batches. Machines is used to remove corrosion, slurry material and clean the surface of the product.

In January 2022, Résler Oberflachentechnik GmbH developed a new blasting system equipped with two high-performance Gamma 300G turbines with an installed capacity of 11 kW each. This ensures short cycle times. Compared to conventional turbines, the Gamma 300G turbine is equipped with specially designed curved throwing blades to generate up to 20% more jet power.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the automatic shot blasting market forecast, current trends, segments, estimations, and dynamics of the automatic shot blasting market analysis from 2021 to 2031 to identify the prevailing automatic shot blasting market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automatic shot blasting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global automatic shot blasting market share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automatic shot blasting market trends, key players, market segments, application areas, and market growth strategies.

Automatic Shot Blasting Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.2 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Product Type |

|

| By Business Type |

|

| By End-user Industry |

|

| By Region |

|

| Key Market Players | Siapro d.o.o., Goff Inc., STEM d.o.o., Qingdao Qinggong Machinery Co. Ltd., Rosler Oberflachentechnik GmbH, Shandong Kaitai Group Co. Ltd., Sintokogio Ltd., AGTOS Gesellschaft fr technische Oberflchensysteme mbH, Blastclean System Pvt. Ltd, Norican Group |

Analyst Review

The automatic shot blasting machines market witnessed a huge demand in Asia- Pacific followed by Europe in 2021. The highest share of the Asia- Pacific market is attributed to increase in demand for automatic shot blasting machines due to application in varieties of industries such as aerospace, automotive, and construction.

Automatic shot blasting is the technique of bombarding the product surface with abrasive material composed of steel, silicon carbide, and other abrasive materials. This process is utilized to clean the surface by removing corrosion, mill scale, and other contaminants that might shorten the lifespan of the product. In addition, programmable logic controller (PLC) and software installation of a shot blasting machine may be used to automize the machine processes.

Infrastructure and construction industry growth is driving an automatic shot blasting machines market. Shot blasting equipment serves a large industrial metal-using sector, helps remove rust and corrosive materials, such as chemical stains, faded paint, mill scale, and heat treatment scale, from the machinery surface. Automatic shot blasting machines are used by Original Equipment Manufacturers (OEMs) and aftermarket sales organizations in the automotive industry to strengthen, polish, and clean various metal surfaces.

A significant issue in the automotive industry is corrosion. It adversely affects physical attributes, including strength of several parts. Automatic shot blasting machines are widely used in the plants of manufacturing facilities, and the growth of the manufacturing sector is expected to provide opportunities for the growth of the automatic shot blasting machines market. Automatic shot blasting machines are made of steel and silicon, owing to its high strength.

Any fluctuation in the prices of steel and silicon thus makes it difficult for the market players to stay profitable. Such factors restrain market growth. Technological advancements are anticipated to provide lucrative opportunities for the automatic shot blasting machines growth.

The key players that operate in the automatic shot blasting machines include AGTOS GmbH., Blastclean System Pvt. Ltd, Goff Inc., Norican Group, Qingdao Qinggong Machinery Co. Ltd., Rösler Oberflächentechnik GmbH, SINTOKOGIO LTD., STEM d.o.o., Siapro d.o.o., and Shandong Kaitai Group Co.

The global automatic shot blasting market was valued at $753.3 million in 2021, and is projected to reach $1,196.7 million by 2031, registering a CAGR of 4.63% from 2022 to 2031.

The forecast period considered for the global automatic shot blasting market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global automatic shot blasting market report can be obtained on demand from the website.

The base year considered in the global automatic shot blasting market report is 2021.

The major players profiled in the automatic shot blasting market include AGTOS GmbH., Blastclean System Pvt. Ltd, Goff Inc., Norican Group, Qingdao Qinggong Machinery Co. Ltd., Rösler Oberflächentechnik GmbH, SINTOKOGIO LTD., STEM d.o.o., Siapro d.o.o., and Shandong Kaitai Group Co.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on product type, hanger segment dominated the market in 2021.

Loading Table Of Content...