Automation Components Market Research: 2031

The Global Automation Components Market size was valued at $116.7 billion in 2021, and is projected to reach $296.8 billion by 2031, growing at a CAGR of 9.6% from 2022 to 2031.Automation components are used to improve the ability of the machinery by making it smart. Components such as sensors, motors, and actuators, are helpful for upgrading machinery to smart machinery. In addition, automation components are utilized for the installation of machinery.

Market Dynamics

Aerospace, defense, medical, steel & metal, electronic, and other industries are just a few of the industries that can use automation components. In developing countries such as India, China, and Africa, the demand for basic goods like electronics, personal care products, food, beverages, and medications has surged dramatically due to the exponential expansion in the world's population. This rise in consumer product demand has also increased the demand for manufacturing equipment, which in turn encourages the use of automation components in machine production and maintenance.

Also, the need for automation components like motors, gears, screws, sensors, and other parts is on the rise as automation and robots are used in a wide range of industries for production lines and other tasks. Major players in the industry such as Bosch Rexroth, Emerson Electric Co., Nidec Corporation and Parker Hannifin Corporation, are offering automation components for small- and large-scale industries. All such instances are expected to drive the automation components market growth.

The rapid pace of innovation, the need for industrial providers to adapt to new technology infrastructures and improve their operations and business processes, and the difficulty for businesses in this fiercely competitive market to plan, develop, and deploy new infrastructures while simultaneously focusing on their core competencies are the main factors limiting the growth of the automation components industry. Moreover, barriers to the expansion of the automation industry include technical competency gaps, a lack of understanding of the benefits of automated operations, and ongoing manufacturing process innovation.

The quick rate of innovation, the need for industrial providers to adapt to new technology infrastructures and enhance their operations and business processes, and the organization's difficulty in planning, building, and deploying new infrastructures while simultaneously focusing on their core strengths in this fiercely competitive market are the main factors limiting the growth of the market for automation components. Moreover, barriers to the expansion of the automation industry include technical competency gaps, a lack of understanding of the benefits of automated operations, and ongoing manufacturing process innovation.

Global internet penetration has undergone a significant transformation during the last five years. The expansion of the automation components markets overall in manufacturing, aerospace, and other industries is significantly influenced by the emergence of the Internet of Things (IoT) and smart applications platform. To expand their product range, major market participants are concentrating on the creation of new items. For instance, in October 2021, SKF launched its new four-row cylindrical roller bearing. By means of this launch, it extended its range with a four-row cylindrical roller bearing (4rCRB), aimed at demanding applications in long product rolling mills. The new SKF Explorer 4rCRB design offers up to 50% longer service life than the previous generation 4rCRB. Such advancements in automation components are expected to offer lucrative opportunities for the expansion of the market during the forecast period.

Segmental Overview

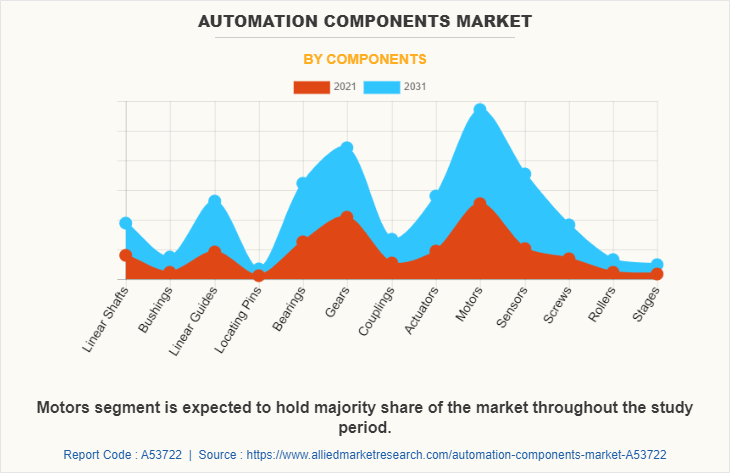

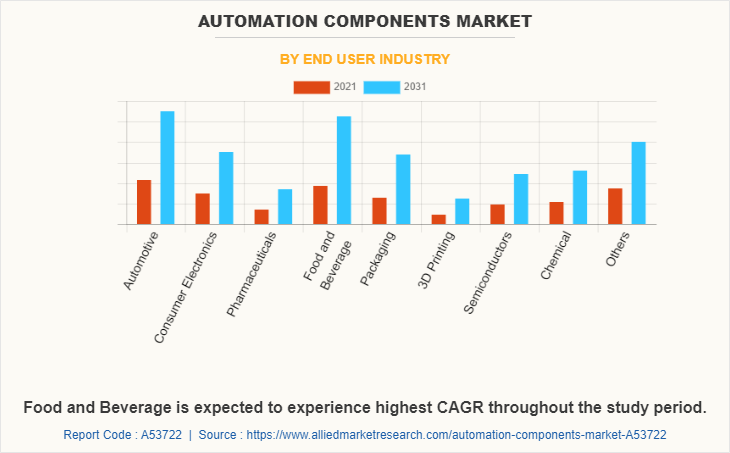

The automation components market is segmented on the basis of component, end user industry and region. By component, the market is divided into linear shafts, bushings, linear guides, locating pins, bearings, gears, couplings, actuators, motors, sensors, screws, rollers, and stages. By end user industry, the market is divided into automotive, consumer electronics, pharmaceuticals, food and beverage, packaging, 3D printing, semiconductors and chemicals.

Region-Wise,

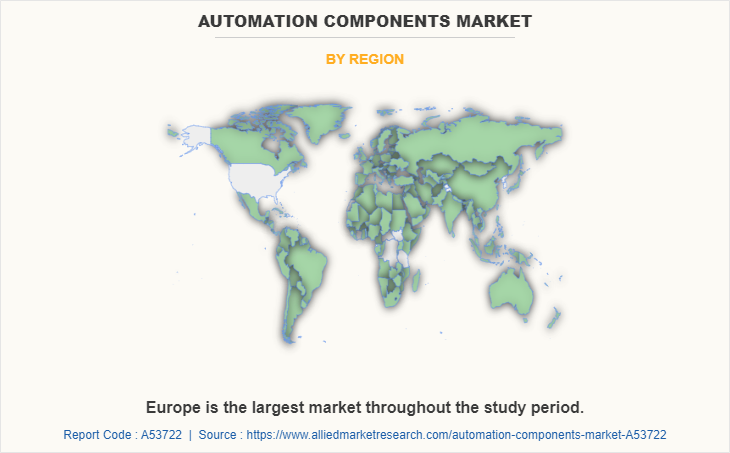

The automation components market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (France, Germany, UK, Italy, Switzerland, Austria, Belgium, Luxembourg, Netherlands, Czech Republic, Poland, Hungary, Slovakia, Romania, Sweden, Denmark, Norway, Finland, Spain, Portugal and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Component:

The automation components market is categorized into linear shafts, bushings, linear guides, locating pins, bearings, gears, couplings, actuators, motors, sensors, screws, rollers, and stages. The linear shaft is a horizontal, expertly crafted bar on which linear bearings are mounted to provide a linear guide system to support or direct the movement of equipment in a linear direction. The most typical application of bushings, which resemble thin tubes, is in machinery with rotating or sliding shafts in order to increase performance and lessen vibration and noise.

Bushings are useful for drilling operations in hydraulic external gear pumps, motors, and drill jigs. The linear guide is a component of a machine that moves heavy objects effortlessly in a straight line by using bearings that were designed for rotary motion. Locating pins can be used to locate a workpiece on a fixture, or to align two pieces of a fixture. One round fixture locating pin and one diamond pin are often used together to locate two holes without binding, because the diamond pin is relieved to locate in only 1 axis.

Bearing is a form of machine element that is helpful in constraining the relative motion to only the desired motion. Bearing used in a machine helps in reducing the friction between the moving parts thus providing free linear movement of the associated parts around a fixed axis. Gears are used to transmit rotary motion from one shaft to another, gears are structures with teeth that mesh together. The radius and number of teeth are two crucial characteristics that define gears. Usually, a shaft or base is used to mount them or link them to other components. Couplings are mostly used to connect two pieces of rotating machinery while allowing for some degree of end movement, misalignment, or both.

An actuator is a component that transforms energy and signals provided by either electric, pneumatic, or hydraulic source into the mechanical movement in the mechanism that generates mobility. It can generate either rotational or linear motion. The motor converts electrical energy into mechanical energy. Its components include rotor, bearings, stator, air gap, windings, and commutator. Its components include rotor, bearings, stator, air gap, windings, and commutator. A sensor is a gadget that receives input of any kind from the physical world and reacts to it. Light, heat, motion, moisture, pressure, and a variety of other environmental phenomena can all be inputs.

The motor segment is expected to be the largest revenue contributor during the forecast period. The sensor segment is expected to exhibit the highest CAGR share in the component segment in the automation components market during the forecast period.

By End User Industry:

The automation components market is classified into smart, and conventional. automotive, consumer electronics, pharmaceuticals, food and beverage, packaging, 3D printing, semiconductors, and chemicals. The current generation of automobiles are software-enabled, data-generating, network-connected machines, which opens the door to new (data) products and services. Industrial automation technology is assisting automakers in remaining competitive by enhancing everything from research to design, production, and even marketing processes campaigns for their products.

Automation components are used in a variety of machinery such as spare parts, vehicles, manufacturing machinery, robotics and others. In consumer electronics sector automation components used in variety of products such as TV, fridge, oven and other household products. Advancements in automation components and increased flexibility in the use of robotics, robots cover a wide range of applications and nature of products in the pharmaceutical industry. Robots are used in hospitals, clinics, pharmaceutical companies, and by medical device manufacturers.

The automotive segment is expected to account for the largest revenue during the forecast period, and the packaging segment is expected to exhibit the highest CAGR share in end user industry segment in the automation components market during the forecast period.

By Region:

The automation components market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Europe had the highest revenue in the automation components market share. Asia-Pacific is expected to exhibit the highest CAGR during the forecast period.

COMPETITION ANALYSIS

The major players profiled in the automation components market include Shanghai Kgg Robots Co, Ltd, SKF, Automation Component Ltd, Bosch Rexroth, Emerson Electric Co., Fluid Power South Inc., Nidec Corporation, Parker Hannifin Corporation, Rockwell Automation Inc., and SDP/SI.

Major companies in the market have adopted product launch, acquisition, and partnership as their key developmental strategies to offer better products and services to customers in the automation components market.

Some examples of acquisition and expansion in the market

In October 2022, Rockwell Automation, Inc. acquired CUBIC, a company that specializes in modular systems for the construction of electrical panels.

In March 2023, Rockwell Automation, Inc. acquired Knowledge Lens by means of this acquisition it offers services and solutions provider that delivers actionable business insights from enterprise data, combining digital technologies with deep data science, artificial intelligence (AI), and engineering expertise. Knowledge Lens will join Rockwell’s premier digital services business, Kalypso, to accelerate transformational outcomes for more manufacturers around the world.

In July 2021- Siemens AG expanded its partnership with SAP SE to offer a new solution for the services and asset lifecycle management. By means of this partnership, it plans to connect plant floor operations, product development, and remote condition monitoring with original equipment manufacturers (OEMs) to facilitate collaboration across the asset lifecycle.

In June 2021- Rockwell Automation Inc. acquired Plex Systems, a smart manufacturing solution provider, for $2.22 billion. Through this acquisition, it aims to expand its industrial cloud offerings with Plex Systems’ cloud-native smart manufacturing platform.

The product launch and product development in the market

In October 2021, SKF launched its new Four-Row Cylindrical Roller Bearing. By means of this launch, it extended its range with a four-row cylindrical roller bearing (4rCRB), aimed at demanding applications in long product rolling mills. The new SKF Explorer 4rCRB design offers up to 50% longer service life than the previous generation 4rCRB.

In October 2022, Rockwell Automation, Inc. launched its new FactoryTalk Design Hub. By means of this launch, industrial organizations can now transform their automation design capabilities into a more simplified, productive way to work powered by the cloud. Teams of all sizes, skillsets, and locations can work smarter through enhanced collaboration, improved lifecycle management, and on-demand access to cloud-based software. The result is increased design productivity, faster time to market, and systems that cost less to build and maintain.

Some investment and collaboration in the market

In August 2022, Emerson invested into Emerson Ventures, its corporate venture capital arm, in Spearix Technologies, Inc., whose adaptive, multi-core radio processor provides a system-level solution for Industrial Internet of Things (IIoT) wireless communication.

In June 2020, SKF invested in strengthening its manufacturing facilities in China for ball bearings. The investment is in line with the Group’s region-for-region manufacturing strategy.

In July 2022, SKF and ABB collaborated in the automation of manufacturing processes. ABB are installed in the bearing manufacturer’s state-of-the-art factory; the two companies are now taking the next step in their collaboration.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automation components market analysis from 2021 to 2031 to identify the prevailing automation components market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automation components market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automation components market trends, key players, market segments, application areas, and market growth strategies.

Automation Components Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 296.8 billion |

| Growth Rate | CAGR of 9.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Components |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | NIDEC CORPORATION, Automotion Components Ltd, Fluid Power South Inc., Shanghai KGG Robots Co., Ltd., Emerson Electric Co., SDP/SI, Rockwell Automation Inc., Bosch Rexroth AG, Parker Hannifin Corporation, SKF |

Analyst Review

The global automation components market witnessed huge demand in Europe. The highest share of the Europe market is attributed to increasing demand for automation components in the automotive and industrial sectors.

Automation components are used to enhance the capability of machinery by making it smarter. In order to transform machinery into smart machinery, components like sensors, motors, and actuators are helpful. Moreover, elements of automation are used in the installation of machinery. Moreover, the number of vehicles in developing economies is witnessing exponential growth. For instance, India and China have emerged as major automotive markets in the last decade. According to International Energy Agency, India has approximately 25 vehicles per thousand people as of 2021, and the number is expected to cross 150 by the year 2040. The rapid increase in the number of new on-road vehicles fuels the demand for automation components markets growth. Furthermore, lack of awareness of the advantages of automated processes and technical proficiency, alongside the continuous innovation in manufacturing processes, poses challenges to the automation market growth. In addition, In the past five years, a tremendous change has been observed in internet penetration globally. The emergence of the Internet of Things (IoT) and smart applications platform is an important factor for the overall growth of the automation components market in manufacturing, aerospace, and other industries.

The major players profiled in the automation components market include Automation Component Ltd, Bosch Rexroth, Emerson Electric Co., Fluid Power South Inc., Nidec Corporation, Parker Hannifin Corporation, Rockwell Automation Inc. SDP/SI, Shanghai Kgg Robots Co, Ltd, and SKF

The global automation components market was valued at $116,693.1 million in 2021 and is projected to reach $296,815.8 million by 2031, registering a CAGR of 9.6% from 2022 to 2031.

The forecast period considered for the global automation components market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global automation components market report can be obtained on demand from the website.

The base year considered in the global automation components market report is 2021.

The major players profiled in the automation components market include Automation Component Ltd, Bosch Rexroth, Emerson Electric Co., Fluid Power South Inc., Nidec Corporation, Parker Hannifin Corporation, Rockwell Automation Inc. SDP/SI Shanghai Kgg Robots Co, Ltd, and SKF.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on component, the motor segment dominated the market in 2021.

Loading Table Of Content...

Loading Research Methodology...