Automotive Adhesives Market Research, 2033

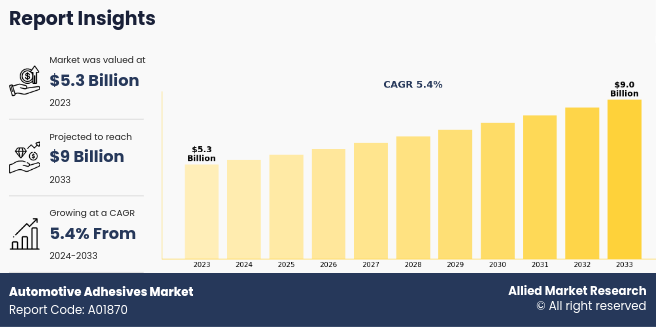

The global automotive adhesives market size was valued at $5.3 billion in 2023, and is projected to reach $9.0 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033. The surge in demand for lightweight vehicles and the growth in the adoption of electric vehicles are key drivers for the automotive adhesive market. Lightweight vehicles are increasingly favored for their improved fuel efficiency and reduced emissions, prompting manufacturers to replace traditional metal fasteners with advanced adhesives that offer strong bonding while minimizing weight.

Introduction

Automotive adhesives are specialized bonding agents used in the manufacture and assembly of vehicles. They are formulated to bond various materials commonly found in automotive applications, such as metals, plastics, composites, and glass. These adhesives play a crucial role in enhancing vehicle performance, safety, and durability by providing strong and reliable bonds between components.

Automotive adhesives come in various types, including structural adhesives for high-strength applications, sealants for weatherproofing, and pressure-sensitive adhesives for lightweight and flexible bonding. They are designed to withstand harsh environmental conditions such as temperature extremes, moisture, and vibrations, ensuring long-lasting adhesion in demanding automotive environments. In addition, advancements in automotive adhesives contribute to weight reduction, improved fuel efficiency, and compliance with safety and environmental regulations.

Key Takeaways

The global automotive adhesives market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of resin type, technology, vehicle type, application, 4 major regions, and more than 15 countries.

The global automotive adhesives market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

The key players in the automotive adhesives market are Henkel AG & Co. KGaA, Bostik SA, 3M, DOW, Sika AG, H.B. Fuller Company, PPG INDUSTRIES, INC, Jowat SE, Illinois Tool Works Inc., and Solvay.

The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

Countries such as China, the U.S., Mexico, Germany, and Brazil hold a significant share in the global automotive adhesives market.

Market Dynamics

The surge in demand for lightweight vehicles is significantly driving the demand for automotive adhesives. As automotive manufacturers strive to meet increasingly stringent fuel efficiency and emissions regulations, they are focusing on reducing vehicle weight. Lightweight vehicles contribute to better fuel economy and improve overall performance and handling. Moreover, the shift towards lighter materials necessitates the use of advanced adhesives that effectively bond new, lightweight materials such as high-strength steels, aluminum alloys, and composite materials. All these factors are expected to drive the demand for the automotive adhesives market during the forecast period.

However, the high cost of advanced adhesives is a significant factor that hampers the growth of the automotive adhesive market. Advanced adhesives developed with cutting-edge technologies and high-performance materials come with a higher price tag compared to conventional adhesive solutions. This cost increase is primarily due to the sophisticated production processes, extensive research and development, and the use of specialized raw materials required to create these high-performance products. All these factors hamper automotive adhesives market growth.

Advancements in curing technologies are driving opportunities in the automotive adhesive sector. Modern adhesives now feature faster curing times through innovations such as UV light or heat activation. This efficiency accelerates the manufacturing process and increases productivity on the assembly line. For automotive manufacturers, faster curing adhesives lead to reduced production times and lower operational costs, thereby improving overall efficiency and output. All these factors are anticipated to offer new growth opportunities for the automotive adhesives market during the forecast period.

Segments Overview

The automotive adhesives market is segmented into resin type, technology, vehicle type, application, and region. On the basis of resin type, the market is classified into polyurethane, epoxy, acrylics, silicone, SMP, polyamide, and others. On the basis of technology, the market is segmented into hot melt, solvent based, water based, pressure sensitive, and others. On the basis of vehicle type, the market is classified into passenger vehicle, light commercial vehicle, and heavy commercial vehicle. On the basis of application, the market is classified into body-in-white (BIW), powertrain, paint shop, and assembly. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

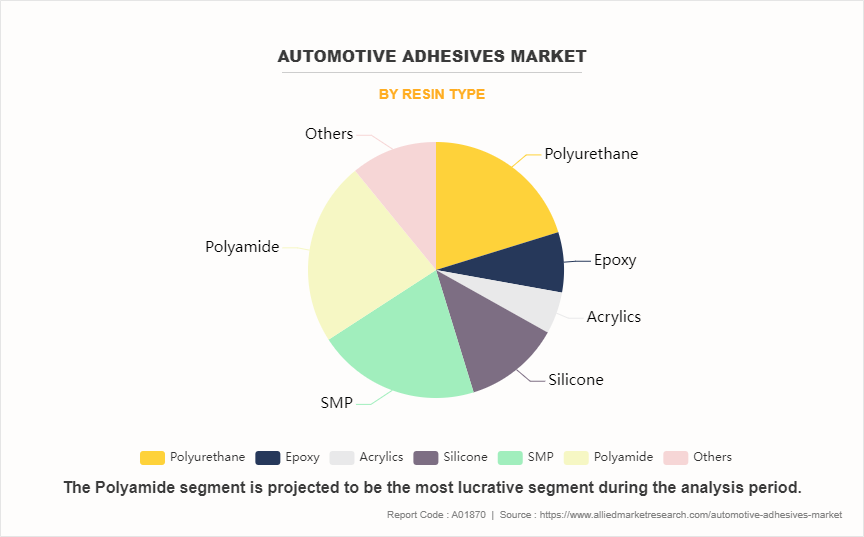

On the basis of resin type, the market is classified into polyurethane, epoxy, acrylics, silicone, SMP, polyamide, and others. The polyamide segment accounted for less than one-fourth of the automotive adhesives market share in 2023 and is expected to maintain its dominance during the forecast period. Polyamide adhesives are lightweight and provide strong bonding strength that makes them ideal for replacing traditional metal fasteners and welding methods. This shift reduces the overall weight of the vehicle and supports the integration of diverse materials, such as aluminum, composites, and plastics, in modern car designs. In addition, the trend toward electric vehicles (EVs) boosts the demand for polyamide adhesives. EVs require adhesives that provide thermal management, secure battery components, and offer flexibility to accommodate different materials used in battery and electronic systems.

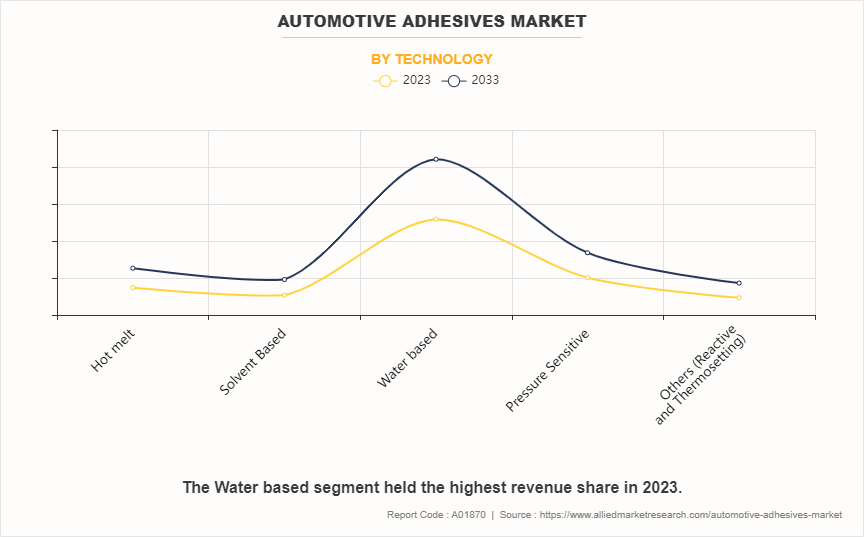

On the basis of technology, the market is segmented into hot melt, solvent based, water based, pressure sensitive, and others. The water based segment accounted for less than half of the automotive adhesives market share in 2023 and is expected to maintain its dominance during the forecast period. As governments and regulatory bodies worldwide implement stricter regulations to minimize the emission of volatile organic compounds (VOCs), automotive manufacturers are seeking eco-friendly alternatives to traditional solvent-based adhesives. Water-based adhesives contain fewer harmful chemicals and have lower VOC emissions that makes them an ideal choice for meeting these regulatory requirements. This trend is particularly evident in regions such as Europe and North America, where emission standards are rigorous, pushing manufacturers to adopt water-based solutions to comply with environmental guidelines and minimize their ecological footprint.

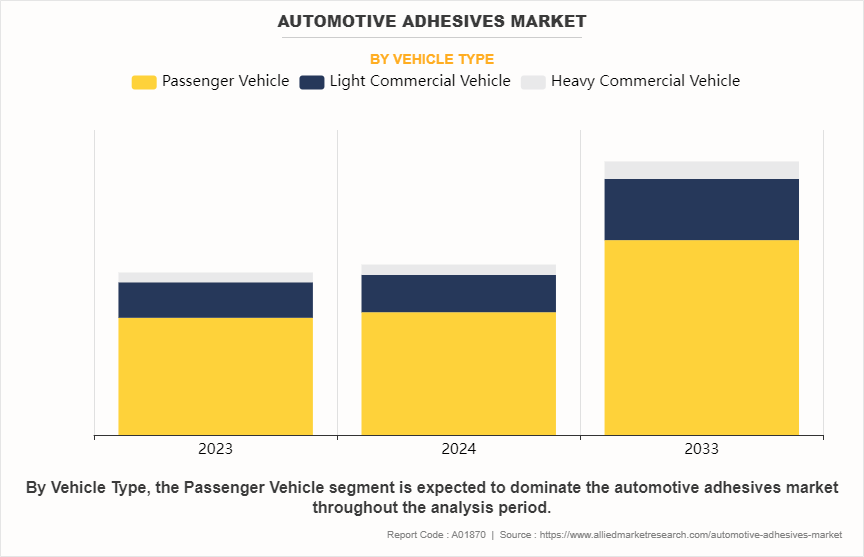

On the basis of vehicle type, the market is classified into passenger vehicle, light commercial vehicle, and heavy commercial vehicle. The passenger vehicle segment accounted for less than three-fourths of the automotive adhesives market share in 2023 and is expected to maintain its dominance during the forecast period. Automotive adhesives enable the use of lightweight materials such as aluminum, composites, and high-strength plastics, replacing heavier metal components and traditional joining techniques such as welding or mechanical fasteners. This transition reduces the overall weight of vehicles and allows for better fuel efficiency and performance, which are increasingly important selling points for consumers. The versatility and bonding strength of adhesives make them essential in supporting this trend, as they are used across various substrates, enhancing structural integrity without adding excess weight.

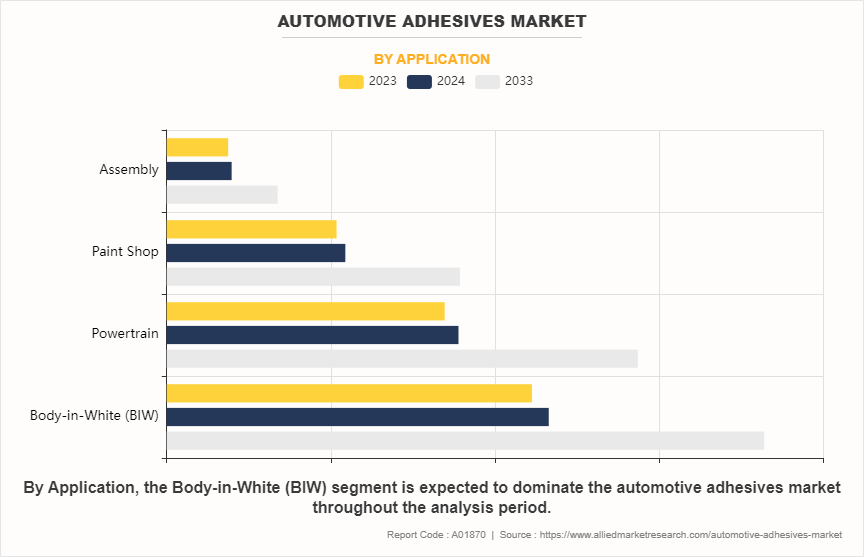

On the basis of application, the market is classified into steam and body-in-white (BIW), powertrain, paint shop, and assembly. The body-in-white (BIW) segment accounted for more than two-fifths of the automotive adhesives market share in 2023 and is expected to maintain its dominance during the forecast period. As manufacturers strive to produce lighter and more fuel-efficient vehicles, they increasingly rely on a combination of materials such as aluminum, high-strength steel, and composites instead of traditional steel alone. Automotive adhesives are essential in joining these dissimilar materials, offering flexibility and durability that mechanical fasteners or welding methods are not provided. Adhesives distribute stress evenly across the joint, improving overall structural integrity while reducing the potential for material fatigue. This approach contributes to vehicle lightweighting and enhances crash performance by creating strong, energy-absorbing bonds in critical areas of the BIW structure.

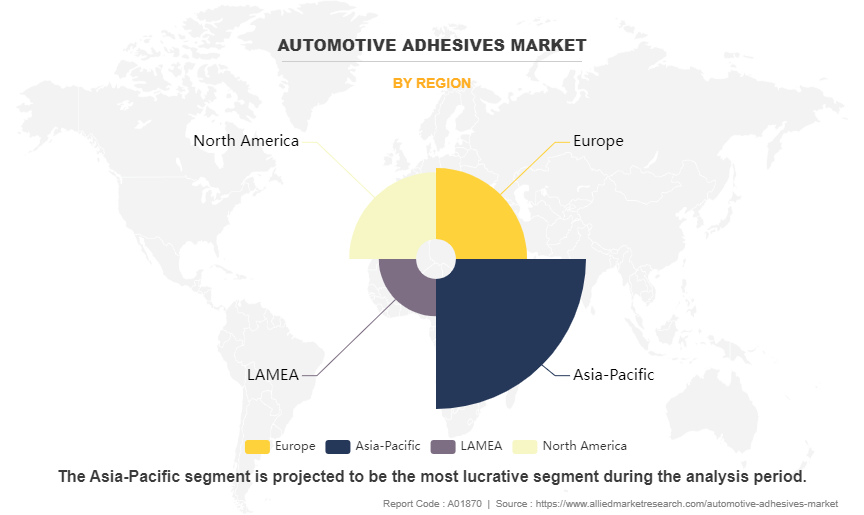

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA. The Asia-Pacific region accounted for more than two-fifths of the automotive adhesives market share in 2023 and is expected to maintain its dominance during the forecast period. Adhesives are essential in EV manufacturing, particularly for battery assembly, where they play a crucial role in thermal management, vibration reduction, and overall structural stability. The increasing emphasis on safety and durability in EVs has led to the development of advanced adhesive technologies that cater specifically to these requirements. Moreover, the rising trend of smart vehicles and automation in the automotive sector has fueled demand for adhesives that support bonding and sealing of complex electronic components, ensuring longevity and reliability.

Competitive Analysis

Key players in the automotive adhesives industry include Henkel AG & Co. KGaA, Bostik SA, 3M, DOW, Sika AG, H.B. Fuller Company, PPG INDUSTRIES, INC, Jowat SE, Illinois Tool Works Inc., and Solvay. In the global automotive adhesives industry, companies have adopted investment and acquisition strategies to expand the market or develop new products. For instance, in July 2024, Henkel AG & Co. KGaA announced the completion of Phase III of its manufacturing facility in Kurkumbh, near Pune, Maharashtra. The Kurkumbh site, which was launched in 2020, serves the growing demand of Indian industries for high-performance solutions in adhesives, sealants, and surface treatment products. The new Loctite plant in the Kurkumbh manufacturing site is expected to drive growth of Henkel in the Indian market. Moreover, in May 2024, H.B. Fuller Company, a leading adhesives manufacturer, announced its acquisition of ND Industries Inc., a prominent provider of specialty adhesives and fastener locking and sealing solutions for the automotive, electronics, aerospace, and other industries. This acquisition is expected to boost the demand for automotive adhesives market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive adhesives market analysis from 2023 to 2033 to identify the prevailing automotive adhesives market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive adhesives market forecast and segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive adhesives market trends, key players, market segments, application areas, and market growth strategies.

Automotive Adhesives Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 9 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 1170 |

| By Resin Type |

|

| By Technology |

|

| By Vehicle Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Dow, 3M, Sika AG, Solvay, Henkel AG & Co. KGaA, Bostik SA, Illinois Tool Works Inc., H.B. Fuller Company, Jowat SE, PPG INDUSTRIES, INC |

Analyst Review

According to the opinions of various CXOs of leading companies, the automotive adhesives market is expected to witness an increase in demand during the forecast period. The surge in demand for lightweight vehicles and growth in adoption of electric vehicles are expected to increase the demand for automotive adhesives during the forecast period. As automotive manufacturers focus on reducing vehicle weight to improve fuel efficiency and meet stringent emissions standards, there is a heightened need for advanced adhesives that provide strong, durable bonds while contributing to overall weight reduction. Lightweight vehicles incorporate a variety of materials such as advanced composites, aluminum, and high-strength steels, all of which require specialized adhesives to ensure structural integrity and performance.

Moreover, the need for automotive adhesives is particularly pronounced due to the unique design and material requirements of EV powertrains and battery systems. Electric vehicles typically feature extensive use of lightweight materials to offset the weight of the battery packs and enhance energy efficiency. Adhesives play a critical role in securely bonding these materials and components, including battery enclosures, interior panels, and electronic components, while maintaining the necessary thermal and electrical insulation.

The global automotive adhesives market was valued for $5.3 billion in 2023 and is estimated to reach $9.0 billion by 2033, exhibiting a CAGR of 5.4% from 2024 to 2033.

Asia-Pacific is the largest regional market for Automotive Adhesives.

Body-in-white (BIW) is the leading application of Automotive Adhesives Market.

Technological advancements in adhesive formulations is the upcoming trends of Automotive Adhesives Market in the globe.

Key players in the automotive adhesives market include Henkel AG & Co. KGaA, Bostik SA, 3M, DOW, Sika AG, H.B. Fuller Company, PPG INDUSTRIES, INC, Jowat SE, Illinois Tool Works Inc., and Solvay.

Loading Table Of Content...

Loading Research Methodology...