The global automotive aftermarket was valued at $438.7 billion in 2021, and is projected to reach $828.2 billion by 2031, growing at a CAGR of 6.2% from 2022 to 2031.

The automotive aftermarket is segmented into Application, Distribution, Vehicle Type and Position.

The automotive aftermarket refers as manufacturing, remanufacturing, distributing, redistribution, end-retail, reselling, and installation activities related to vehicles. The aftermarket encompasses parts for replacement, collision, appearance, and performance. Digitalization of automotive repair and component sales has emerged due to the incorporation of advanced technologies, which has increased the popularity of the automotive aftermarket. Digital-driven product and services are setting new trends and add traction to the market growth.

Factors such as growth of automotive post sale services, stringent government regulations to replace or upgrade the vehicle components, and rise in trend of vehicle customization coupled with increase in disposable income are anticipated to boost the growth of the global automotive aftermarket during the forecast period. However, increase in demand for shared mobility and volatile prices of raw materials are expected to hinder the growth of the global automotive aftermarket industry during the forecast period. Moreover, growth of automotive e-commerce and increase in demand for technologically advanced features is expected to create an opportunity for the automotive aftermarket in near future.

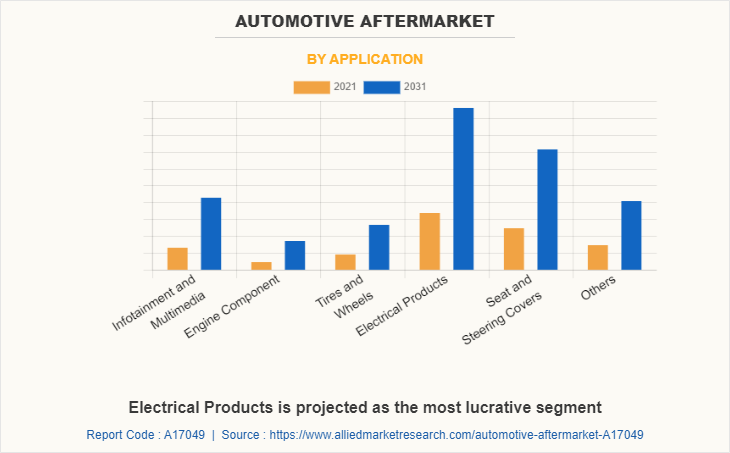

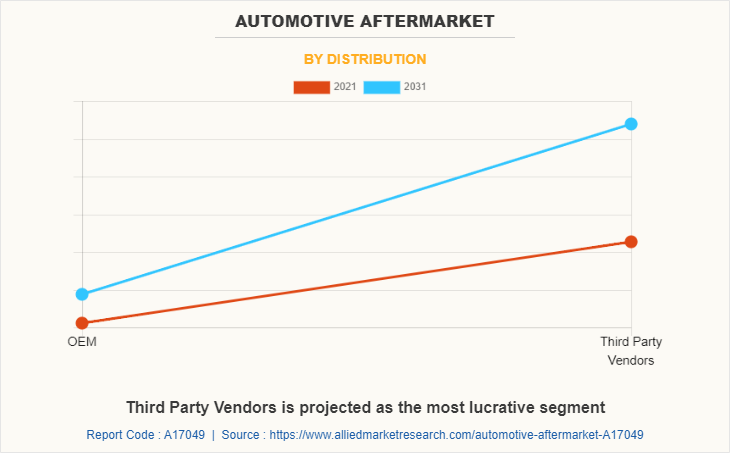

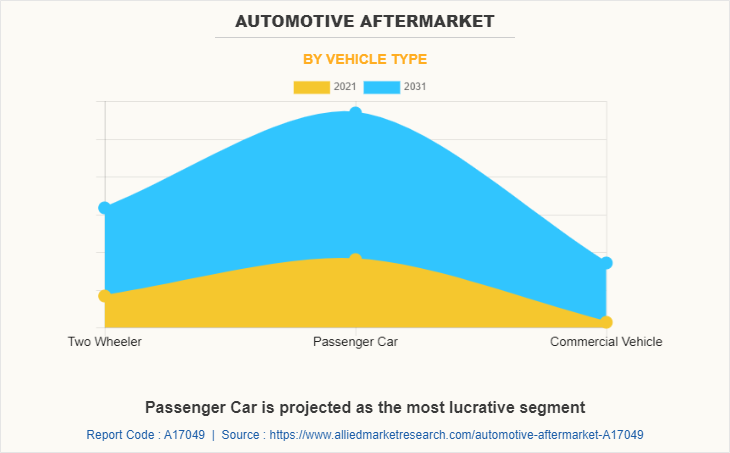

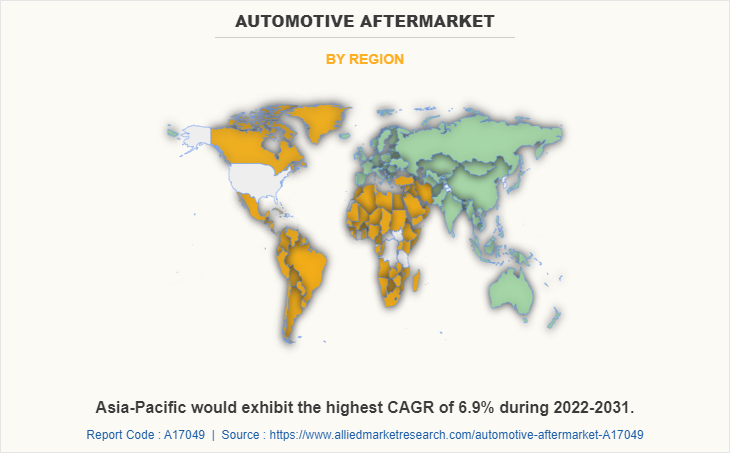

The automotive aftermarket is segmented basis of application, distribution, vehicle type, position, and region. By application, it is divided into infotainment and multimedia, engine component, tires and wheels, electrical products, seat and steering covers, and others. By distribution, it is divided into OEM and third party vendors. By vehicle type, it is segmented into two wheeler, passenger cars, and commercial vehicles. By position, it is divided into external accessories and internal accessories. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in this automotive aftermarket are Alpine Electronics, Inc., Auto Zone, Inc., Bridgestone Corporation, Continental AG, Denso Corporation, Ford Motor Company, Harman International (SAMSUNG ELECTRONICS), Hella KGaA Hueck & Co., Hyundai Mobis, Michelin, Osram Licht AG, Panasonic Corporation, Pioneer Corporation, Robert Bosch GmbH, The Goodyear Tire & Rubber Company, The Yokohama Rubber Co. Ltd., and Visteon Corporation.

Growth of automotive post sale services

The aftermarket service is used for replacement of the damaged part in the vehicle or for the addition of new components in the existing vehicles. The customers need to change various components of their vehicles at specific interval of time. For instance, passenger vehicles need to change their tires every 3-4 years, depending on the driving condition. Thus, automotive components have a large aftermarket. Moreover, the aftermarket is gaining traction due to the customer inclination toward installation of advanced components in vehicles to improve vehicle appearance and ensure safety while driving. This increased inclination among customers leads to the growth of aftermarket service, which is expected to eventually lead to the growth of the automotive aftermarket in the near future. Furthermore, the contribution of automotive component manufacturers in the aftermarket segment boosts the growth of the segment. For instance, in July 2021, JK Tyre signed an agreement with Ki Mobility Solutions Private Ltd. (KMS) for providing 24 hours assistance to the customer service portfolio range across the country and to develop a large service network to drive the next phase of growth and deliver best practices in the aftermarket service business. Owing to all these factors, the demand for automotive aftermarket is expected to witness significant growth during the forecast period.

Stringent government regulations to replace or upgrade vehicle components

Many countries are mandating stringent rules and regulations to replace the car accessories after the expiry date. For instance, National Highway Traffic Safety Administration (NHTSA) has stated a new regulatory norm for car parts such as tires, rims, seat belts, and others to be originally manufactured and must be replaced according to the life span of the product. Such mandates are expected to in turn boost the sales of the passenger car accessories; thereby, contributing toward the market growth. Moreover, the growth of aftermarket vehicle is fostered by a rise in customer awareness for adopting safe automobile technology. For instance, camera manufacturers are creating sophisticated camera systems to meet the rising need for safety solutions in the automotive industry. For instance, Ring announced the development of Car Cam for the automotive industry in September 2020. The Car Cam can be installed on a car's dashboard and includes two cameras, one facing the front windshield and the other facing the inside. Moreover, the adoption of safety and driver assistance systems in luxury automobiles has increased across the globe due to the strict government regulations on installing cameras in vehicles. For instance, effective on May 1, 2018, the National Highway Traffic Safety Administration (NHTSA) ordered that all new automobiles must include a backup rearview camera. Increase in awareness for automotive safety technology among customers is expected to propel the growth of the automotive aftermarket.

Increase in demand for shared mobility

People who are not capable of purchasing a car can experience seamless travel through mobility services. According to the Bureau of Transportation Statistics, the average cost to own and operate a vehicle is around $9,000, assuming 15,000 miles are traveled annually. Mobility as a service decreases such costs to the user by providing improved utilization of transport services, such as car sharing and ride hails. In addition, such services reduce city congestion and decrease overall vehicle emissions. Therefore, digitally enabled car sharing and ride hailing manages travel needs in the smartest way and it also provides a hassle-free and environmentally sound alternative to private car ownership. The entire process, from travel planning to payments, can be handled by a single mobile app. In coming years, ride hailing services are projected to play a major role in this space by reducing the manual tasks and thereby minimizing the overall time and cost. This trend is expected to hamper the growth of the automotive aftermarket. The number of users relying on ride-sharing applications has increased in recent years. For instance, in April 2021, Lyft launched Lyft Pass for Healthcare, which lets patients initiate their own medical rides. Furthermore, Lyft also invested in several partnerships, most noticeably in healthcare transportation, which provides new mobility options for non-drivers, including older people, younger people, people with disabilities, and people without access to a vehicle. The ride sharing service is helping the environment & society by reducing greenhouse gas emissions due to decreased vehicle ownership and reduces the need of an individual parking space. Thus, increased use of public transportation globally leads to reduction in vehicle sales; thereby, impeding the market growth.

Growth of automotive e-commerce

The e-commerce industry has witnessed growth due to the unavailability of products domestically, affordable costs, consumer-focused targeting by market players, and higher quality of goods. Moreover, e-commerce offers a lot of advantages for SMEs to expand their businesses and become multinational, and also presents an opportunity for OEMs to sell their products directly to consumers, relieving them from the complex supply chain. Growing digital service adoption index in the emerging country will boosts the use of e-commerce logistics market globally. Digital service adoption index is a global index measuring every country’s digital adoption across all industry verticals, such as government, business, and people. For organizations, digital technologies provide efficiency and connectedness and allow organizations to survive in a world where technology is highly prevalent. E-commerce players have made use of digital transformation to increase their footprint in their respective markets. E-commerce breaks down geographic barriers for companies and allows sales in places that can be challenging to reach with traditional models, owing to which the automotive OEMs and component manufacturers across the globe are shifting their focus on online sales channels. For instance, in October 2020, Bosch Rexroth launched a new e-commerce portal designed to provide the easiest access to select authorized Bosch Rexroth products, with the ability for customers to buy products with a credit card and schedule fast delivery. Owing to all these factors, the growth of e-commerce is expected to propel the demand for automotive aftermarket during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive aftermarket analysis from 2021 to 2031 to identify the prevailing automotive aftermarket opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive aftermarket segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive aftermarket trends, key players, market segments, application areas, and market growth strategies.

Automotive After Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Distribution |

|

| By Vehicle Type |

|

| By Position |

|

| By Region |

|

| Key Market Players | The Yokohama Rubber Co. Ltd., Alpine Electronics, Continental, Visteon, Osram Licht AG, Bridgestone Corporation, Pioneer Corporation, Panasonic Corporation, Ford Motor Company, Hella KGaA Hueck & Co., Robert Bosch GmbH, Auto zone, Michelin, Hyundai Mobis, The Goodyear Tire & Rubber Company, DENSO Corporation, HARMAN International |

Analyst Review

The automotive aftermarket is expected to witness significant growth, due to increase in customer preference for periodic vehicle maintenance and adoption of comfort & safety features. Moreover, companies across the globe are adopting the online sales channel to increase their customer reach, reduce the cost, and streamline operations. This shift in companies’ model is expected fuel the growth of the automotive aftermarket during the forecast period.

Factors such as growth of automotive post sale services, stringent government regulations to replace or upgrade the vehicle components, and rise in trend of vehicle customization coupled with increase in disposable income are anticipated to boost the growth of the global automotive aftermarket during the forecast period. However, increase in demand for shared mobility and volatile prices of raw materials are expected to hinder the growth of the global automotive aftermarket during the forecast period. Moreover, growth of automotive e-commerce and increase in demand for technologically advanced features are expected to create an opportunity for the automotive aftermarket in near future.

To fulfil the changing demand scenarios, market participants are concentrating on product launch to offer a diverse range of products and meet new business opportunities. For instance, in December 2021, The Goodyear Tire & Rubber Company introduced “ElectricDrive GT” which is company’s first replacement tire, built for electric vehicles, which delivers all-weather long lasting tread wear and low noise ride for rider and passenger. Moreover, in July 2020, Continental AG launched web portal for the automotive aftermarket, through which it is bundling information about its product and service portfolio for the automotive aftermarket in a new online portal. In addition, market participants are continuously focusing on business expansion efforts to increase their geographic reach. For instance, in September 2019, Denso Corporation expanded the plant of Denso Hokkaido Corporation to increase production of semiconductor sensors and enhance its domestic production system.

The automotive aftermarket is segmented on the basis of application, distribution, vehicle type, position and region. By application, it is divided into infotainment and multimedia, engine component, tires and wheels, electrical products, seat and steering covers, and others. By distribution, it is divided into OEM and third party vendors. By vehicle type, it is segmented into two wheeler, passenger cars, and commercial vehicles. By position, it is divided into external accessories and internal accessories. By region, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

The key players that operate in this market are Alpine Electronics, Inc., Auto Zone, Inc., Bridgestone Corporation, Continental AG, Denso Corporation, Ford Motor Company, Harman International (SAMSUNG ELECTRONICS), Hella KGaA Hueck & Co., Hyundai Mobis, Michelin, Osram Licht AG, Panasonic Corporation, Pioneer Corporation, Robert Bosch GmbH, The Goodyear Tire & Rubber Company, The Yokohama Rubber Co. Ltd., and Visteon Corporation

The global automotive aftermarket industry was valued at $438.7 billion in 2021, and is projected to reach $828.2 billion by 2031.

Growth of automotive e-commerce, and Increase in demand for technologically advanced features are the upcoming trends of Automotive AfterMarket

Electrical Products is the leading application of Automotive AfterMarket

Asia-Pacific is the largest regional market for Automotive AfterMarket

The key players that operate in this automotive aftermarket are Alpine Electronics, Inc., Auto Zone, Inc., Bridgestone Corporation, Continental AG, Denso Corporation, Ford Motor Company, Harman International (SAMSUNG ELECTRONICS), Hella KGaA Hueck & Co., Hyundai Mobis, Michelin, Osram Licht AG, Panasonic Corporation, Pioneer Corporation, Robert Bosch GmbH, The Goodyear Tire & Rubber Company, The Yokohama Rubber Co. Ltd., and Visteon Corporation

Loading Table Of Content...