Automotive Aluminum Market Research, 2033

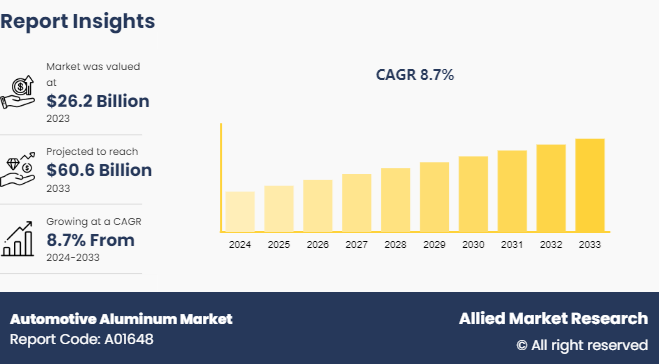

The global automotive aluminum market was valued at $26.2 billion in 2023, and is projected to reach $60.6 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033.

Market Introduction and Definition

Automotive aluminum refers to aluminum and its alloys specifically designed and utilized for various components and structures within vehicles. These components include body panels, engine blocks, wheels, chassis, suspension systems, and other parts. Automotive aluminum is favored in the automotive industry due to its lightweight properties, which contribute to improved fuel efficiency, handling, and overall performance of vehicles. Additionally, aluminum offers excellent corrosion resistance and recyclability, making it an environmentally sustainable choice for automotive applications.

Key Takeaways

- The automotive aluminum market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,850 product literatures, industry releases, annual reports, and other such documents of major automotive aluminum industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Technological innovations have enhanced the properties and production efficiency of aluminum, making it an increasingly attractive material for automotive aluminum manufacturers such as Novelis Inc., Vedanta, Aluminium & Power. In addition, advancements are the development of high-strength aluminum alloys. These alloys provide improved mechanical properties such as increased strength and durability while maintaining aluminum’s inherent lightness. This makes them ideal for use in critical vehicle components where weight reduction is crucial for improving fuel efficiency and overall vehicle performance. All these factors are expected to drive the demand for the automotive aluminum market during the forecast period.

However, Fluctuating aluminum prices significantly restrain the growth of the automotive aluminum market. Price volatility introduces uncertainty for automakers and suppliers, affecting cost structures and profit margins. Influenced by global supply-demand dynamics geopolitical tensions, energy costs and market speculation unexpected price increases lead to higher production costs. Manufacturers often struggle to pass these costs onto consumers in a highly competitive market resulting in squeezed margins and reduced profitability?. All these factors are expected to hamper the growth of the automotive aluminum market.

Technological innovations in aluminum production have significantly contributed to the expansion of opportunities within the automotive aluminum market. This innovation encompass various aspects of aluminum manufacturing such as refining processes, alloy compositions, and shaping techniques. In addition, innovation lies in the development of novel refining methods aimed at enhancing the purity and strength of aluminum alloys. By refining the material to higher standards manufacturers produce aluminum with improved mechanical properties making it more suitable for demanding automotive applications. All these factors are anticipated to offer new growth opportunities for automotive aluminum market during the forecast period.

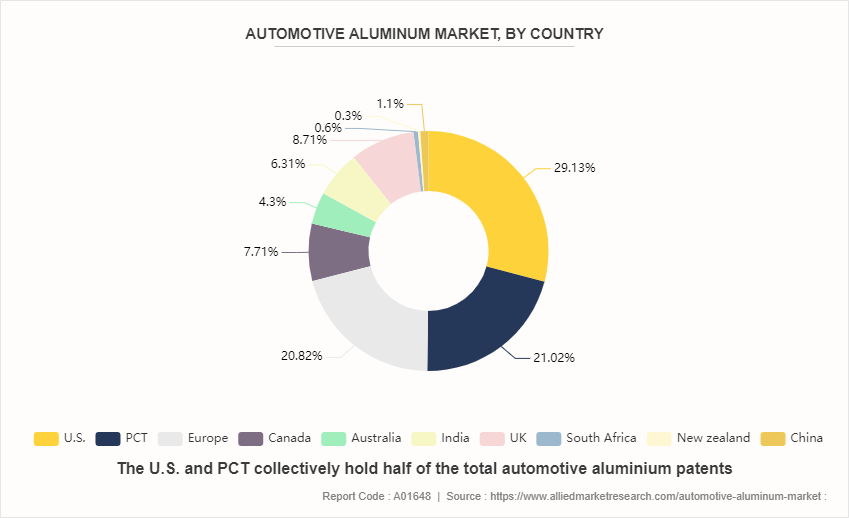

Patent Analysis of Global Automotive Aluminum Market, by Country

The U.S. and PCT collectively hold half of the total automotive aluminum patents that indicate strong innovation and investment in this technology in U.S. countries. This suggests fierce competition and a significant focus on automotive aluminum R&D in these leading economies. U.S. and has the highest patent filed those accounts for 29.1% of the total global patents related to the automotive aluminum market. Europe and Canada, although holding smaller percentages of automotive aluminum patents individually, collectively contribute to the overall Asian dominance in automotive aluminum innovation. This reflects the region's strong presence in materials science and engineering R&D.

Market Segmentation

The automotive aluminum market is segmented into form, vehicle type, application, and region. Based on form, the market is classified into sheet, plate, bar, tube. and others. By vehicle type, the market is divided into commercial vehicles (light commercial vehicles, heavy commercial vehicles) , passenger cars, and others. By application, the market is divided into hood, pillars, hinges, motors, sunroof railings, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Public Policies

Safety Standards

Regulations emphasize stringent safety measures for automotive aluminum production and usage to prevent hazards such as structural failure, corrosion, and thermal issues. Standards specify proper material specifications, manufacturing processes, and quality control measures to mitigate potential risks and ensure the safety and reliability of aluminum components in vehicles.

Quality Assurance and Certification

Manufacturers of automotive aluminum components often need to obtain certifications or adhere to rigorous quality assurance programs to demonstrate compliance with industry regulations. Complying with these regulatory factors is vital for manufacturers, assemblers, and users of automotive aluminum to ensure safety, reliability, and legal compliance. Adherence to standards helps in preventing structural failures, ensuring proper functionality of vehicle components, and maintaining uniformity in manufacturing practices across various sectors and regions.

Regional Market Outlook

Automotive aluminum is extensively utilized in engine components and powertrain systems. Its high thermal conductivity makes it ideal for parts such as engine blocks, cylinder heads, and transmission housings, where efficient heat dissipation is vital for optimal performance. Furthermore, aluminum’s capacity to withstand high temperatures enhances the durability and reliability of these components, ensuring smooth vehicle operation across diverse driving conditions prevalent in the Asia-pacific region. According to The Automotive Mission Plan 2016-26 is a mutual initiative by the Government of India and the Indian automotive industry to lay down the roadmap for the development of the industry.

Competitive Landscape

The major players operating in the automotive aluminum market include Novelis Inc, Arconic, Kaiser Aluminum, Nippon Light Metal Holdings Co., Ltd, Vedanta Aluminium & Power, BALCO, Dana Limited., Alcoa Corporation, UACJ Corporation., Rio Tinto.

Recent Key Strategies and Developments

In July 2022, Rio Tinto announced a substantial investment of USD 188 million in Canada's aluminum sector. The plan entails a significant expansion in aluminum billets production, with a targeted increase of 202, 000 metric tons. This expansion will primarily focus on enhancing the capacity of the existing casting center located at Rio Tinto's Alma plant. The investment underscores Rio Tinto's commitment to bolstering its presence in the aluminum market and capitalizing on opportunities for growth and development in Canada's aluminum industry.

In February 2022, Emirates Global Aluminum PJSC (EGA) announced its intention to build the largest aluminum recycling facility in the United Arab Emirates. With an annual capacity of 150, 000 tons, the plant aims to transform post-consumer aluminum scrap into low-carbon aluminum billets. Additionally, it will process pre-consumer aluminum scrap generated from extrusion operations. This initiative underscores EGA's commitment to sustainable practices and reducing its carbon footprint through the recycling of aluminum materials.

Industry Trends

The aerospace and defense industry generated $952 billion in combined sales in 2022, a 6.7% increase from the prior year. In addition, the A&D industry generated $418 billion in economic value, which represented 1.65% of total nominal GDP in the U.S.

The Chinese automotive manufacturing sector, the largest in the world, produced 27.02 million units in 2022. This represents a 3.4% increase from the 26.08 million vehicles produced in 2021, according to the China Association of Automobile Manufacturers.

In March 2022, Ford Motors revealed plans to introduce three all-electric passenger vehicles in Europe by the conclusion of 2024. Additionally, the company set an ambitious target to achieve annual sales exceeding 600, 000 electric vehicles in the European region by 2026. This strategic move underscores Ford's commitment to expanding its electric vehicle lineup and capturing a significant share of the growing electric vehicle market in Europe.

According to India Brand Equity Foundation (IBEF) , the global EV market was estimated at approximately US$ 250 billion in 2021 and by 2028, it is projected to grow by 5 times to US$ 1, 318 billion.

Key Sources Referred

The Aluminum Association

International Renewable Energy Agency

International Energy Agency

Invest India

International Brand Equity Foundation

International Aluminum Institute

Aluminum Extruders Council

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive aluminum market analysis from 2024 to 2033 to identify the prevailing automotive aluminum market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive aluminum market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive aluminum market trends, key players, market segments, application areas, and market growth strategies.

Automotive Aluminum Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 60.6 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Form |

|

| By Vehicle Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Vedanta Aluminium & Power, Rio Tinto, Nippon Light Metal Holdings Co., Ltd, UACJ Corporation., Dana Limited., Alcoa Corporation, Arconic, Novelis Inc., Kaiser Aluminum, BALCO |

Advances in aluminum alloy technologies, growing use of aluminum in electric vehicles are the upcoming trends of Automotive Aluminum Market in the world.

hoods is the leading application of Automotive Aluminum Market.

Asia-Pacific is the largest regional market for Automotive Aluminum

$60.6 billion is the estimated industry size of Automotive Aluminum market by 2033.

Novelis Inc, Arconic Kaiser, Aluminum, Nippon Light Metal Holdings Co., Ltd, Vedanta Aluminium & Power, BALCO, Dana Limited, Alcoa Corporation, UACJ Corporation, Rio Tinto are the top companies to hold the market share in Automotive Aluminum

Loading Table Of Content...