Automotive Cabin Insulation Market Research, 2033

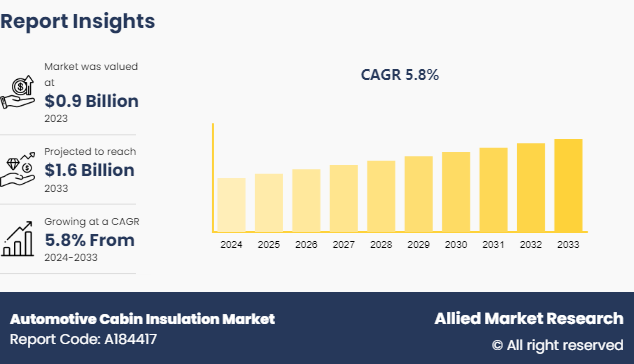

The global automotive cabin insulation market size was valued at $0.9 billion in 2023, and is projected to reach $1.6 Billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033.

Market Introduction and Definition

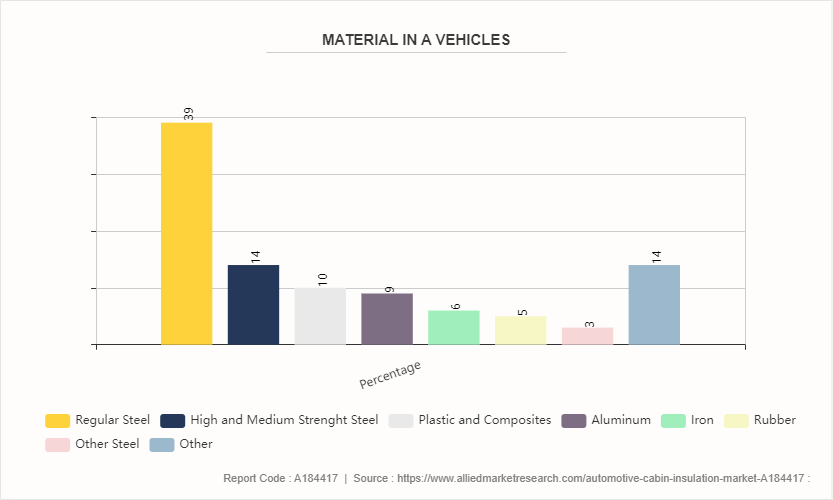

Automotive cabin insulation refers to the materials and techniques used to reduce noise, vibration, and temperature fluctuations within the interior of a vehicle. The primary goals of automotive cabin insulation are to enhance passenger comfort, improve the overall driving experience, and reduce the intrusion of external noises such as wind, road, and engine sounds. This involves using materials that absorb or block sound waves to minimize noise inside the vehicle. Common materials include foam, mass-loaded vinyl, and specialized acoustic panels. These materials are strategically placed in areas such as doors, floors, roofs, and engine compartments.

To maintain a comfortable interior temperature, thermal insulation materials are used to prevent heat from entering or escaping the cabin. These materials include reflective foils, fiberglass, and advanced polymers, which help in keeping the cabin cool in the summer and warm in the winter.

Key Takeaways

The automotive cabin insulation market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major Automotive cabin insulation industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In February 2023, Saint-Gobain Sekurit was dedicated to offering advanced technologies and solutions to enhance passenger comfort and driving enjoyment. Key features such as adequate legroom, adjustable seats, thermal comfort, and infotainment systems significantly contribute to a pleasant driving experience and reduced driver fatigue. A comfortable interior not only boosts customer satisfaction but also enhances the car’s perceived value. Managing in-cabin temperature extremes is crucial, as they can adversely affect passenger comfort and overall driving experience.

Key Market Dynamics

The rise in demand for comfort and luxury is a significant driver of the automotive cabin insulation market share. As consumer preferences shift towards more comfortable and luxurious driving experiences, there is a growing demand for automotive cabin insulation to reduce noise, vibration, and harshness (NVH) , creating a quieter and more pleasant environment inside the vehicle. Furthermore, surge in the automotive industry, and rise in sales of electric and hybrid vehicles have driven the demand for the automotive cabin insulation market size. However, weight implication has hampered the growth of the automotive cabin insulation market growth. Many insulation materials add weight to the vehicle, which can negatively impact fuel efficiency and performance. Automakers must balance the need for effective insulation with the desire to minimize vehicle weight to meet fuel economy and emissions targets. Moreover, inconsistency in the availability of standard material, and cost consideration are major factors that hamper the growth of the automotive cabin insulation market opportunity. On the contrary, the integration of smart and adaptive insulation technologies is a lucrative opportunity for the automotive cabin insulation industry. The automotive industry is witnessing advancements in smart materials and adaptive insulation technologies that can adjust their properties in response to changing environmental conditions or driving situations. The integration of these technologies presents an opportunity for the automotive cabin insulation market to offer more customizable and efficient solutions that dynamically adapt to varying noise levels and driving conditions, enhancing both comfort and performance.

Vehicle Safety and Security System Adoption of Global Automotive Cabin Insulation Market

The adoption of vehicle safety and security systems plays a crucial role in shaping the global automotive cabin insulation market. As automotive manufacturers increasingly prioritize passenger safety and security, cabin insulation solutions are evolving to complement these advancements. Enhanced cabin insulation not only contributes to a quieter and more comfortable driving experience but also supports the effectiveness of safety and security systems. By reducing external noise intrusion and damping vibrations, advanced insulation materials help improve the accuracy and reliability of sensors and communication systems used in modern safety features such as collision detection, lane departure warning, and adaptive cruise control.

Moreover, effective insulation contributes to better thermal management inside the vehicle, which is essential for the proper functioning of electronic components and onboard systems, including security features such as immobilizers and alarm systems. As a result, the demand for automotive cabin insulation is intertwined with the integration and adoption of vehicle safety and security systems, driving the market towards innovative solutions that ensure both comfort and protection for vehicle occupants.

In addition, the adoption of vehicle safety and security systems has become increasingly prevalent in the automotive industry due to heightened concerns for passenger safety and the protection of vehicles against theft and intrusion. As automakers strive to meet stringent safety regulations and consumer expectations for advanced security features, cabin insulation has emerged as a critical component in supporting and enhancing the effectiveness of these systems.

Market Segmentation

The automotive cabin insulation market is segmented into type, application, and region. On the basis of type, the market is divided into textile material, chemical composite, and others. As per application, the market is segregated into passenger cars, and commercial vehicles. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Regional/Country Market Outlook

The U.S. has stringent regulations regarding vehicle noise emissions and safety standards. Regulations such as the Federal Motor Vehicle Safety Standards (FMVSS) and Environmental Protection Agency (EPA) regulations drive automakers to invest in advanced cabin insulation technologies to meet these requirements. Compliance with these standards necessitates the integration of effective insulation solutions, boosting market demand. Furthermore, American consumers prioritize comfort and quietness in their vehicles. With long commutes and extensive highway systems, there is a strong demand for vehicles with superior cabin insulation that reduces road and engine noise, providing a more pleasant driving experience. This consumer preference drives automakers to prioritize cabin insulation in their vehicle designs, thus further boosting market growth.

China is now the largest automobile market in the world, both in terms of sales and manufacturing. In order to meet the demands of both domestic and foreign manufacturers, the nation's rapidly expanding automotive sector has produced a tremendous demand for automobile components, including cabin insulation. In addition, with the rapid economic growth in China, there has been a significant increase in disposable income among the middle class. This has led to higher demand for automobiles, including more luxurious and comfortable vehicles with better cabin insulation for noise reduction and climate control.

In September 2022, the Toray Advanced Materials Korea Inc. (TAK) , established new facilities in the Czech Republic to expand the Airlite™ automotive interior sound acoustic insulation business in Europe. This advanced material enhances passenger comfort by reducing noise from driving, vibrations, and external sources.

In November 2021, the Hyundai Creta and Kia Seltos offered the best sound proofing, noise, vibration, and harshness level under $183.9million. In addition, Hyundai Creta and Kia Seltos offer excellent cabin insulation, reducing road noise and vibrations to enhance passenger comfort. They come with well-engineered interiors, high-quality materials, and advanced acoustic solutions that significantly minimize external noise, making them top choices for those prioritizing a quiet and comfortable ride within this budget.

Competitive Landscape

The report analyzes the profiles of key players operating in the automotive cabin insulation market such as Saint-Gobain, Johns Manville (JM) , DuPont, BASF SE, Carpenter Company, Armacell International GmbH, Lydall Performance Materials, Autoneum Holdings Inc., Covestro AG, and Trevira GmbH. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive cabin insulation market.

Industry Trends

In April 2022, the MuPhony Acoustic insulation was a specialized solution designed by India to enhance the comfort and tranquility of a car's interior environment. By employing advanced materials and construction techniques, MuPhony effectively reduces external noise, vibrations, and harshness (NVH) that penetrate the cabin, thereby creating a quieter and more serene driving experience. This insulation not only diminishes the intrusion of road noise, engine rumble, and wind turbulence but also mitigates unwanted sounds from the vehicle's own mechanical operations, such as the HVAC system or tires. As a result, passengers can enjoy conversations, music, or simply relax without being disturbed by external disturbance.

In May 2024, luxury car companies all over the world were utilizing advanced glass coatings to maintain a comfortable interior temperature while enhancing overall driving experience. These coatings incorporate infrared-reflective technology, which effectively blocks a significant portion of the sun's heat-producing infrared rays from entering the cabin. By minimizing heat intrusion, these coatings help regulate the temperature inside the car, keeping it cooler even under intense sunlight. This is not only enhancing passenger comfort but is also reducing the workload on the vehicle's air conditioning system, leading to improved energy efficiency and fuel economy.

In March 2021, Hutchinson a French company and Va-Q-tec, a German company, formed a strategic partnership leveraging their expertise in vibration control, fluid management, sealing technologies, and highly efficient vacuum insulation panels (VIPs) to develop scalable insulation solutions. Primarily targeting thermal management in eMobility vehicles, they also aim to enhance aircraft cabin insulation.

In May 2024, Boeing, a U.S. company launched ecoDemonstrator program to strengthen operation efficiency and sustainability in cabin interiors. The program includes noise and weight reduction features through cabin insulation.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the automotive cabin insulation market segments, current trends, estimations, and dynamics of the Automotive cabin insulation market analysis from 2024 to 2032 to identify the prevailing Automotive cabin insulation market forecast.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Automotive cabin insulation Market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global automotive cabin insulation market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive cabin insulation market trends, key players, market segments, application areas, and market growth strategies.

Automotive Cabin Insulation Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.6 Billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 357 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Johns Manville, DUPONT, Covestro AG., Armacell, BASF SE, Saint-Gobain, Trevira GmbH, Lydall Performance Materials, Autoneum Holdings Inc., Carpenter Company, LLC |

Upcoming trends in the Automotive Cabin Insulation Market include increased demand for lightweight and sustainable materials, advancements in acoustic insulation technologies, and growing integration of smart insulation solutions to enhance comfort and reduce noise levels inside vehicles.

Passenger Car is the leading application of automotive cabin insulation Market

North America is the largest regional market for Automotive Cabin Insulation

$1.6 billion is the estimated industry size of Automotive Cabin Insulation

Saint-Gobain, Johns Manville (JM) , DuPont, BASF SE, Carpenter Company, Armacell International GmbH, Lydall Performance Materials, Autoneum Holdings Inc., Covestro AG, and Trevira GmbH. are the top companies to hold the market share in Automotive Cabin Insulation

Loading Table Of Content...