Automotive Climate Control System Market Insights, 2032

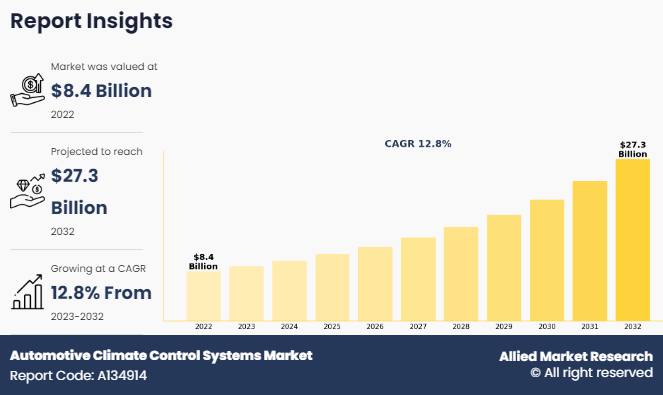

The global automotive climate control system market size was valued at USD 8.4 billion in 2022 and is projected to reach USD 27.3 billion by 2032, growing at a CAGR of 12.8% from 2023 to 2032.

The rise in demand for comfort and convenience is a significant driver of the growth of the automotive climate control system market. Consumer need for more comfort and convenience in vehicles is one of the main factors propelling the automotive climate control systems market. Modern heating, ventilation, and air conditioning (HVAC) systems in cars are becoming more common as consumers demand comfortable inside spaces regardless of the outside weather. Furthermore, stringent environmental regulations have driven the demand for the automotive climate control system market size.

However, high upfront cost has hampered the growth of the automotive climate control systems industry. The high upfront cost of integrating cutting-edge HVAC technologies into cars is one of the main obstacles facing the automotive climate control systems business. The affordability and adoption rates of vehicles may be impacted by the addition of technologies such as air filtration/purification, dual zone/multi-zone systems, and automated climate management, which can raise production costs. Moreover, complexity of integration and supply chain disruptions are major factors that hamper the growth of the automotive climate control systems market size.

Key Takeaways:

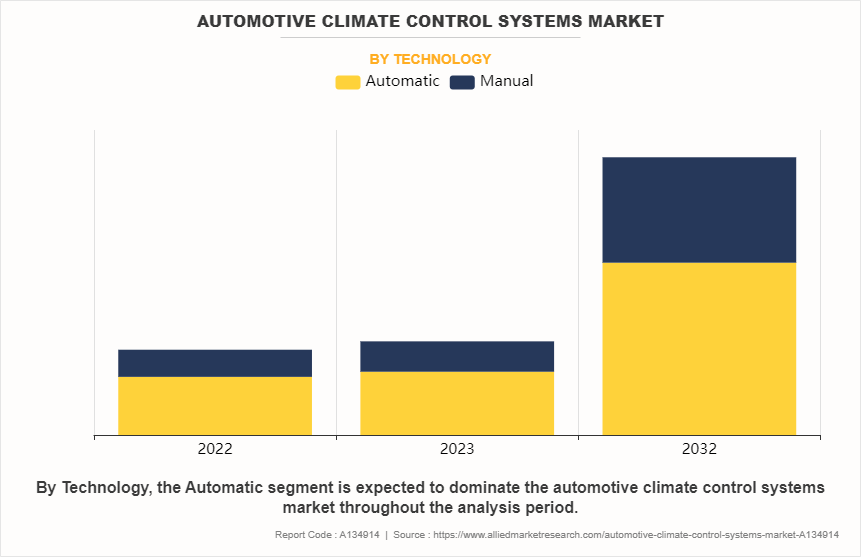

- On the basis of technology, the automatic segment held the largest share in the automotive climate control system market in 2022.

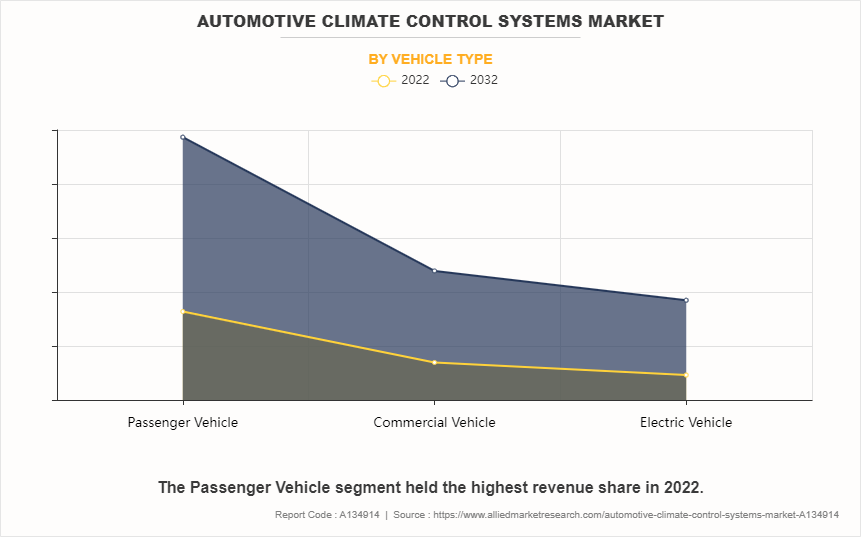

- By vehicle type, the passenger vehicle segment held the largest share in the market in 2022.

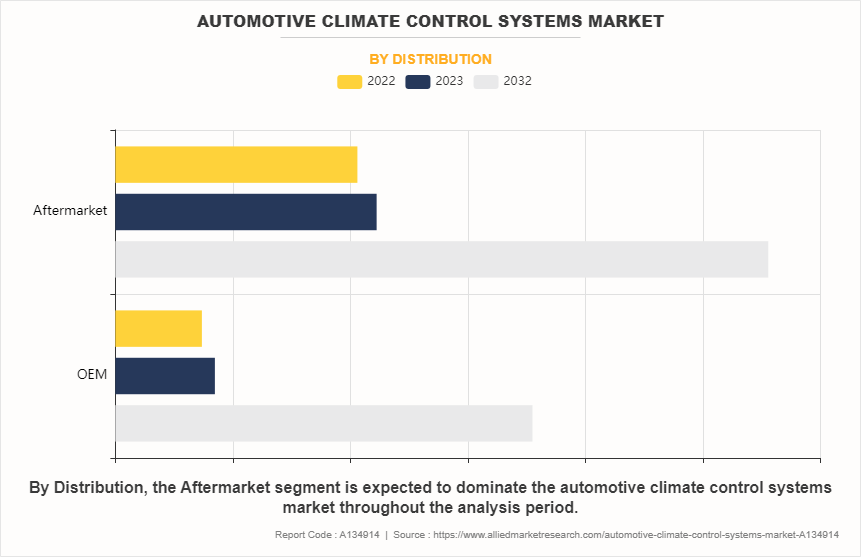

- On the basis of distribution, the aftermarket segment held the largest share in the market in 2022.

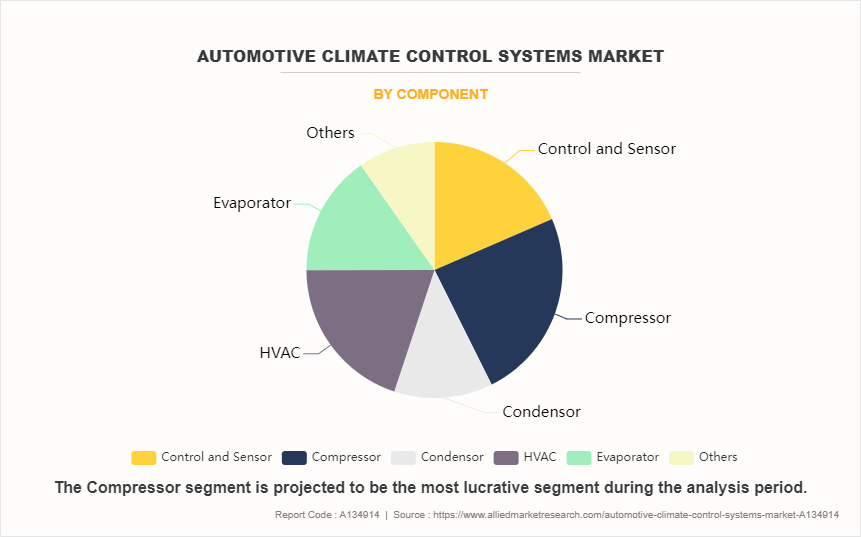

- By component, the compressor segment held the largest share in the market in 2022.

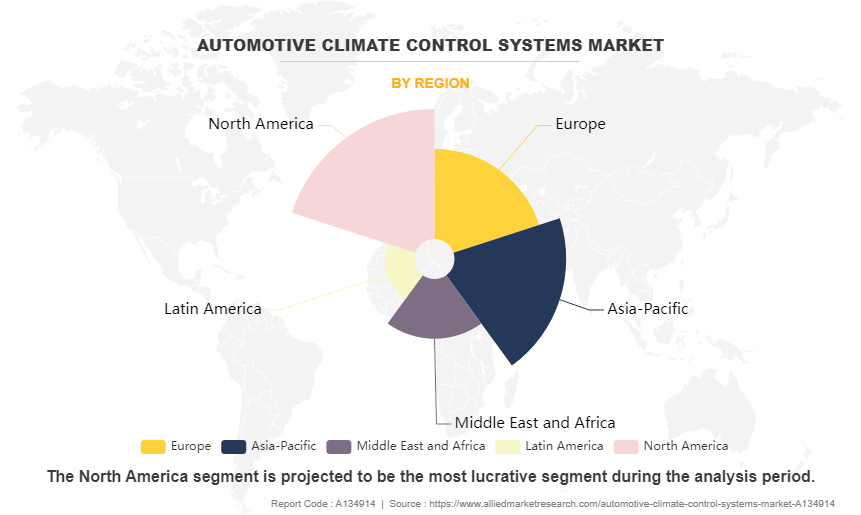

- On the basis of region, North America held the largest market share in 2022.

The automotive climate control system market is the area of the automotive industry dedicated to developing, producing, and delivering parts and systems that control and preserve the temperature inside cars. In order to safeguard the comfort and safety of car occupants, this market includes goods and services that control temperature, humidity, air quality, and airflow. Furthermore, heating, air conditioning (AC), ventilation, air distribution, air filtration and purification, and advanced controls such as dual zone/multi-zone and automatic climate control are common key components and features of automobile climate control systems.

The automotive climate control system market refers to the industry involved in the production, distribution, and installation of components and systems designed to regulate and maintain the internal temperature and air quality within vehicles. These systems are essential for ensuring passenger comfort and safety by controlling factors such as heating, ventilation, and air conditioning (HVAC). The market encompasses a wide range of products and services, including heating systems, air conditioning units, HVAC modules, controls and sensors, filters, and related components.

When the weather is hot, the air conditioning system is essential for cooling and dehumidifying the inside cabin. Refrigerant (like R134a) is compressed and circulated via a closed-loop system to power the device. An AC system's compressor, condenser, evaporator, and expansion valve are its essential parts. When the refrigerant reaches the condenser, where it releases heat and condenses into a liquid, the compressor pressurizes it into a high-pressure gas. As the liquid refrigerant reaches the evaporator, it loses pressure and temperature as it goes through an expansion valve. Before the air is returned to the cabin, it is cooled and dehumidified in the evaporator where heat from the cabin air is absorbed.

For instance, in October 2022, Polestar introduced its 3 electric SUV models in the global automotive climate control system market. The SUV has an advanced climate control system to comfort passengers during long-duration journeys.

For instance, in November 2021, the Marelli Corporation has developed an indoor air quality (IAQ) purification system, which kills bacteria and viruses in vehicles and indoor environments. The system utilizes UV-A and UV-C light combined with a titanium dioxide (TIO2) filter to destroy airborne bacteria and viruses, including COVID-19, with greater than 99% effectiveness within 15 minutes.

On the contrary, rapid advancement in technology is lucrative opportunity for the growth of the automotive climate control system market. Technological advancements in connectivity allow climate control systems to be remotely controlled and monitored using smartphone apps or car telematics platforms. Customers can ensure a comfortable environment without wasting electricity by pre-conditioning the interior of their vehicle before getting inside. Connectivity makes it easier to upgrade and diagnose systems over the air, which improves system functioning and dependability.

Segment Review:

The global automotive climate control system market is segmented on the basis of technology, vehicle type, distribution, component and region. By technology, segment covered in this study include automation, and manual. By vehicle type, the market is segmented into passenger vehicle, commercial vehicle, and electric vehicle. By distribution, the market bifurcated into OEM, and Aftermarket, by Component, the segmented into control and sensor, compressor, condenser, HVAC, Evaporator, and others. By region, the market is analysed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

By Technology

On the basis of technology, the automatic segment attained the highest market share in 2022 in the automotive climate control systems industry. This is attributed to the fact that automatic climate control systems offer unparalleled convenience and ease of use for vehicle occupants. Instead of manually adjusting temperature settings, users can set their desired cabin temperature, and the system automatically maintains this temperature by adjusting fan speed, air distribution, and heating/cooling settings as needed. This hands-free operation enhances user experience, especially during long drives or in changing weather conditions.

Meanwhile, the manual segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that the cost of manufacturing and installing manual climate control systems is lower than that of automatic systems. Automakers may choose manual controls to keep overall vehicle prices cheaper in price-sensitive countries or vehicle categories, appealing to purchasers on a tight budget.

By Vehicle Type

On the basis of vehicle type, the passenger vehicle segment attained the highest market share in 2022 in the automotive climate control system market. This was due to passenger comfort and convenience being given the most importance in the design of passenger vehicles, which includes automobiles, SUVs, and luxury cars. With the ability to customize comfort settings, maintain ideal cabin temperatures, and reduce driver and passenger fatigue on lengthy trips, automotive climate control systems are essential to improving the entire driving experience.

Meanwhile, the electric vehicles segment is projected to be the fastest-growing segment during the forecast period. This was attributed to be fact that electric vehicles are inherently more energy-efficient than traditional internal combustion engine vehicles. This efficiency extends to climate control systems, where electric vehicles require less energy to heat or cool the cabin compared to their fossil fuel counterparts. As a result, climate control systems in EVs can operate more efficiently, contributing to extended battery range and improved overall efficiency.

By Distribution

On the basis of distribution, the aftermarket segment attained the highest market share in 2022 in the automotive climate control system market. This was due to vehicles age and their original climate control systems may become less efficient or malfunction, leading to a need for replacement. The aftermarket segment benefits from this demand for replacement parts as vehicle owners seek to restore or upgrade their climate control systems to maintain comfort and functionality.

Meanwhile, the OEM segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that OEMs integrate climate control systems directly into new vehicles during the manufacturing process. As the automotive industry experiences growth in new vehicle sales, the OEM segment naturally benefits from the inclusion of climate control systems in these vehicles. This direct integration ensures that OEMs capture a significant portion of the market share for climate control systems.

By Component

On the basis of component, the compressor segment attained the highest market share in 2022 in the automotive climate control system market. This was due to compressor is a critical component of automotive air conditioning systems, responsible for compressing and circulating refrigerant throughout the system. It plays a central role in cooling the air inside the vehicle cabin during hot weather, making it an indispensable part of climate control systems.

Meanwhile, the condenser segment is projected to be the fastest-growing segment during the forecast period. This was attributed to be fact that condensers play a crucial role in the refrigeration cycle of automotive air conditioning systems. They are responsible for cooling and condensing the high-pressure, high-temperature refrigerant vapor into a liquid state, which is then circulated back to the evaporator to absorb heat from the vehicle cabin. This essential functionality ensures that condensers are integral components of all automotive air conditioning systems.

By Region

On the basis of region, North America attained the highest market share in 2022 and emerged as the leading region in the automotive climate control system market. This is attributed to the fact that automotive manufacturing industry in North America is strong, with top automakers creating a wide variety of cars with cutting-edge temperature control systems. The widespread adoption and integration of temperature control systems across vehicle models is facilitated by the presence of significant automotive OEMs (Original Equipment Manufacturers) and component suppliers.

However, Asia-Pacific is projected to be the fastest-growing region for the automotive climate control system market during the forecast period. This growth is attributed to China, Japan, India, and South Korea being among the largest automobile markets in the world, and all located in the Asia-Pacific region. The demand for advanced temperature control systems in passenger cars, commercial vehicles, and electric vehicles (EVs) has increased due to the automotive industries' explosive rise in these nations.

The report focuses on growth prospects, restraints, and trends of the automotive climate control system market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the automotive climate control system market.

Competitive Analysis:

The report analysis the profiles of key players operating in the automotive climate control system market such as DENSO CORPORATION., Hanon Systems, Hitachi Astemo Indiana, Inc., Johnson Electric Holdings Limited, MAHLE GmbH, Marelli Corporation, MITSUBISHI HEAVY INDUSTRIES, LTD., OMEGA Environmental Technologies, SANDEN CORPORATION, and Sensata Technologies, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive climate control system market.

Top Impacting Factors:

Rise in Demand for Comfort and Convenience

For passengers in cars, comfort is essential, whether on long vacations, road trips, or everyday commuting. No matter the outside weather, automotive climate control systems are essential for preserving the ideal cabin temperatures and air quality and creating a relaxing and pleasurable atmosphere. Furthermore, with the custom settings available on modern climate control systems, drivers and passengers can customize the temperature, ventilation, and seat heating/cooling to suit their own preferences. By allowing various occupants to personalize their comfort levels, features such as dual- or multi-zone climate control improve overall enjoyment.

For instance, in September 2023, DENSO launched Everycool, a commercial vehicle cooling system designed for trucks, aimed at improving cooling efficiency while reducing environmental impact. This innovative system incorporates advanced technologies to achieve higher efficiency in managing engine temperature and cabin comfort, which are crucial aspects for heavy-duty vehicles such as trucks.

Moreover, effective temperature control is made possible by automotive climate control systems, which provide rapid heating in the winter and efficient cooling in the summer. By using sensors to monitor cabin conditions and automatically modify settings, automatic climate control systems increase convenience and decrease the need for manual intervention. Therefore, rise in demand for comfort and convenience drives the demand for automotive climate control systems market share.

Stringent Environmental Regulations

Strict environmental laws place severe restrictions on the number of pollutants and greenhouse gases (GHGs) that vehicles can emit. To comply with regulations, automakers are required to incorporate systems that minimize emissions from their vehicles. Systems for controlling the climate have an impact on both overall car efficiency and emissions reduction plans. Moreover, to lessen their dependency on fossil fuels and cut carbon emissions, many regions have put in place fuel economy rules. Automotive climate control systems minimize the effect on vehicle range in electric and hybrid vehicles, optimize HVAC operation, and use less energy. All these factors add to fuel efficiency.

For instance, in April 2024, Mahindra & Mahindra's upcoming launch of the XUV 3XO, previously known as the XUV 300 facelift, on April 29, 2024, introduced exciting new features including remote climate control accessible via AdrenoX-connected car technology. This innovative capability allows drivers to control the vehicle's climate settings remotely using a smartphone or other connected device, enhancing convenience and comfort.

In addition, environmental restrictions that aim to reduce air pollution and promote greener transportation alternatives have an impact on the shift towards electric cars (EVs) and hybrid vehicles. In electrified vehicles, sophisticated climate control systems are necessary to regulate the interior temperature and air quality while maintaining efficiency and maintaining passenger comfort. Therefore, stringent environmental regulations are driving the demand of the automotive climate control systems market analysis.

Rise in Sales of Electric and Hybrid Vehicles

The heating, ventilation, and air conditioning (HVAC) requirements of electric and hybrid vehicles differ from those of conventional internal combustion engine vehicles. To maintain passenger comfort and battery efficiency, effective climate control systems are necessary for regulating cabin temperature independently of engine heat. Furthermore, climate control systems have an important effect on an electric vehicle's efficiency and range. Modern HVAC systems that maximize driving range and improve overall vehicle performance must reduce energy usage while preserving passenger comfort.

Moreover, in electric and hybrid vehicles, efficient climate control is crucial for battery thermal management. By keeping batteries at the ideal temperature, HVAC systems enhance battery performance, safety, and life, which in turn supports the dependability and durability of electric drivetrains. In addition, advanced climate control systems and other comfort and convenience features are top priorities for buyers of electric and hybrid vehicles. To satisfy consumers, automakers need to provide dependable and effective HVAC systems that improve the whole driving experience. Therefore, rise in sales of electric and hybrid vehicles is driving the demand for the automotive climate control system market growth.

High Upfront Cost

The initial investment required to install advanced climate control systems in cars can increase the vehicle's total cost of purchase, especially for electric and hybrid models. Cost-conscious buyers could be discouraged from choosing cars with premium HVAC systems because of the greater initial outlay. Furthermore, consumers often weigh the perceived benefits of advanced climate control systems against their upfront cost. If the perceived value or utility of the system does not justify the additional expense, potential buyers may opt for more basic vehicle configurations to minimize costs.

Moreover, increased initial expenditures may restrict market accessibility, especially in price-sensitive markets where affordability is the main factor in choosing a car. Due to financial restrictions, some customers might place a higher value on other luxuries or features of the car than sophisticated climate control alternatives. In addition, while advanced climate control systems might provide long-term advantages like reduced energy use and enhanced comfort, buyers might prioritize short-term expenses above assessing the overall cost of ownership over the course of the car's life. Therefore, high upfront and maintenance cost is hampering the growth of the automotive climate control system market opportunity.

Complexity of Integration

Advanced temperature control system integration in automobiles necessitates cooperation and coordination between several engineering specialties, such as HVAC, electrical systems, software, and vehicle architecture. Complicated integration procedures can raise production costs and cause delays in development, which might hinder automotive climate control system market adoption overall. Furthermore, climate control systems need to work with a variety of car platforms, such as hybrid, electric, and internal combustion engine automobiles. There are technical obstacles that must be overcome in order to provide smooth integration across various vehicle architectures and powertrains, which may prevent widespread adoption.

In addition, in order to communicate with onboard computers and vehicle networks, advanced temperature control systems frequently rely on networked sensors and components. It can be technically challenging to ensure compatibility, reliability, and interoperability with current vehicle systems, necessitating specialist knowledge and resources. In addition, the design of user interfaces and user experiences (UI/UX) are also complicated integrations. Climate control systems need to meet consumer expectations for usability and functionality by providing smooth operation and user-friendly controls. Customer happiness and market acceptance can be impacted by intricate UI/UX design. Therefore, complexity of integration is hampering the growth of the automotive climate control systems market trends.

Rapid Advancements in Technology

The development of high-performance and more economical car climate control systems is made possible by ongoing technological breakthroughs. Modern innovations include heat pumps, variable-speed compressors, and sophisticated thermal management systems maximize energy use, enhance passenger comfort, and boost system efficiency as a whole. Furthermore, technology integration makes it possible to add intelligent elements to climate control systems, improving functionality and user experience. Drivers and passengers can enjoy convenience and personalization owing to connected car technologies, which enable remote management of HVAC settings through smartphone apps, voice commands, or entertainment systems in the car.

In addition, the electrification of automobiles, including hybrid and electric models, is facilitated by technological advancements. In electric vehicles, advanced climate control systems are essential for controlling cabin temperature and maximizing energy efficiency, which promotes sustainability and lessens environmental effect. Therefore, rapid advancements in technology are lucrative opportunity for automotive climate control system market forecast.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive climate control system market analysis from 2022 to 2032 to identify the prevailing automotive climate control System market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive climate control system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive climate control system market trends, key players, market segments, application areas, and market growth strategies.

Automotive Climate Control Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 27.3 billion |

| Growth Rate | CAGR of 12.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 485 |

| By Technology |

|

| By Vehicle Type |

|

| By Distribution |

|

| By Component |

|

| By Region |

|

| Key Market Players | MAHLE GmbH, Hitachi Astemo Indiana, Inc., Sensata Technologies, Inc., Johnson Electric Holdings Limited, Marelli Corporation, Sanden Corporation, DENSO CORPORATION, Hanon Systems, Mitsubishi Heavy Industries, Ltd., OMEGA Environmental Technologies |

Upcoming trends in the automotive climate control systems market include the integration of advanced HVAC technologies for improved energy efficiency, adoption of eco-friendly refrigerants to meet environmental regulations, and the incorporation of AI and IoT for smarter, personalized cabin comfort control.

The leading application of automotive climate control systems is in passenger vehicles, where they are essential for providing comfortable cabin environments, meeting consumer demand for comfort, and enhancing driving experiences.

North America is the largest regional market for Automotive Climate Control Systems

USD $27316.9 million is the estimated industry size of Automotive Climate Control Systems

DENSO CORPORATION., Hanon Systems, Hitachi Astemo Indiana, Inc., Johnson Electric Holdings Limited, MAHLE GmbH, Marelli Corporation, MITSUBISHI HEAVY INDUSTRIES, LTD., OMEGA Environmental Technologies, SANDEN CORPORATION, and Sensata Technologies, Inc.

Loading Table Of Content...

Loading Research Methodology...