Automotive Composites Market Research, 2033

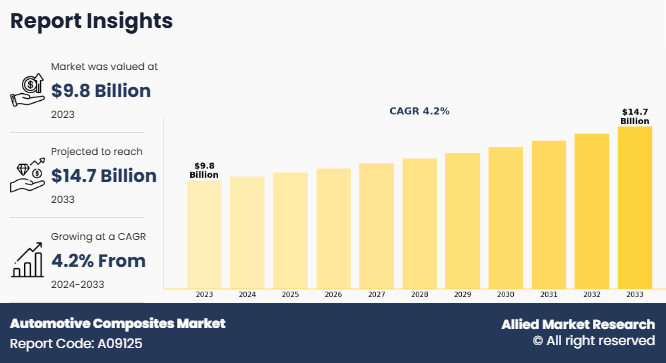

The global automotive composites market size was valued at $9.8 billion in 2023, and is projected to reach $14.7 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033. The demand for automotive composites is being propelled by rising environmental regulations and a heightened focus on sustainability, as well as an increasing need for lightweight vehicles. Governments worldwide are setting stricter emission standards to combat climate change, pushing automakers to seek materials that reduce vehicle weight, thereby improving fuel efficiency and lowering CO2 emissions.

Introduction

Automotive composites are materials used in vehicles, comprising different substances combined to enhance performance. They consist of fibers such as carbon or glass, embedded within a matrix such as epoxy or thermoplastic resin. This composition results in lightweight, strong components for body panels, chassis, and structural reinforcements. As compared to traditional materials such as steel, automotive composites offer advantages in weight reduction, fuel efficiency, and safety of vehicles. They are utilized extensively in modern vehicle manufacturing to meet stringent regulatory standards, improve durability, and reduce environmental impact, aligning with industry trends toward sustainability and advanced engineering solutions.

Key Takeaways

The global automotive composites market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of fiber type, resin type, application, 4 major regions, and more than 15 countries.

The global automotive composites market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

The key players in the automotive composites industry includes Toray Industries, Inc., SGL Carbon SE, Teijin Limited, Hexcel Corporation, Owens Corning, Mitsubishi Chemical Holdings Corporation, Gurit Holding AG, Solvay S.A., TenCate Advanced Composites, and Huntsman Corporation.

The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

Countries such as China, the U.S., Canada, Germany, and Brazil hold a significant share in the global automotive composites market.

Market Dynamics

The ability of automotive composites in producing lightweight body panels is one of the most significant drivers of the automotive composites market growth. Stringent regulations to reduce carbon emissions and improve fuel efficiency, automakers are increasingly turning to these materials to make vehicles lighter. Composites offer a high strength-to-weight ratio, enabling manufacturers to reduce vehicle weight while maintaining structural integrity and safety standards.

Moreover, as governments tighten emission standards, automakers are under pressure to produce vehicles that consume less fuel and emit fewer pollutants. Lightweight composites contribute to improved fuel efficiency by reducing vehicle weight, thereby lowering fuel consumption and emissions. This factor is especially crucial in electric vehicles (EVs), where reducing weight directly translates to extended battery range. In addition, automotive composites offer superior performance as compared to traditional materials. They are engineered to exhibit specific mechanical properties, such as high tensile strength, stiffness, and impact resistance that makes them ideal for various automotive applications, including chassis, body panels, and structural components. Enhanced performance contributes to better driving dynamics, safety, and overall vehicle quality. All these factors are expected to drive the demand for the automotive composites market during the forecast period.

However, one of the primary restraints impacting the automotive composite market expansion is the high cost associated with composite materials as compared to traditional metals such as steel and aluminum. The manufacturing processes involved in producing composite materials such as molding, curing, and finishing, are often complex and capital-intensive. In addition, the cost of raw materials used in composites, such as carbon fibers and resins, remains relatively high. As a result, automakers face challenges in justifying the higher upfront investment required for integrating composites into vehicle structures. All these factors hamper automotive composites market growth.

Moreover, sustainability has become a key factor across industries such as automotive manufacturing. Composites offer environmental benefits as compared to traditional materials, such as reduced energy consumption during production and lower greenhouse gas emissions over the product lifecycle. Moreover, advancements in recyclable and bio-based composite materials present opportunities for manufacturers to align with sustainable practices and cater to eco-conscious consumers. Developing innovative recycling technologies and incorporating renewable feedstocks into composite production processes further enhances the sustainability credentials of automotive composites. All these factors are anticipated to offer new growth opportunities for the automotive composites market during the forecast period.

Segments Overview

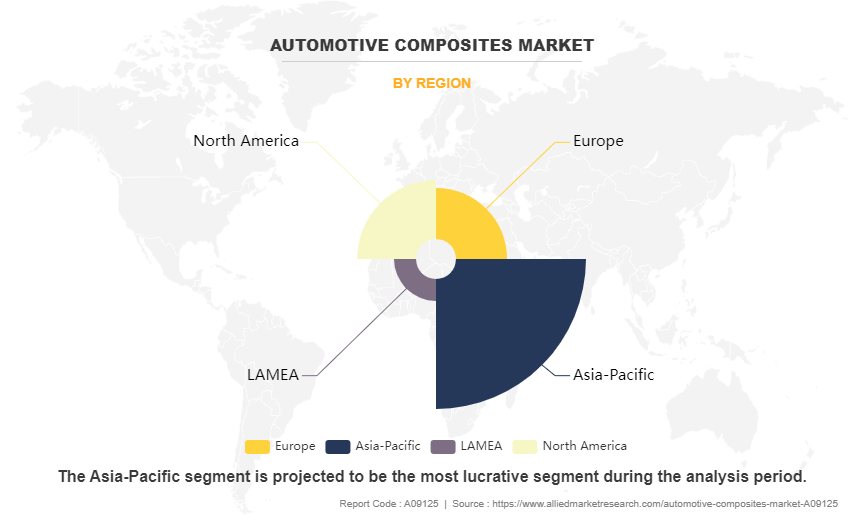

The automotive composites market is segmented on the basis of fiber type, resin type, application, and region. On the basis of fiber type, the market is categorized into glass fiber, carbon fiber, and others. By resin type, the market is classified into thermosets and thermoplastics. By application, the market is divided into exterior, interior, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

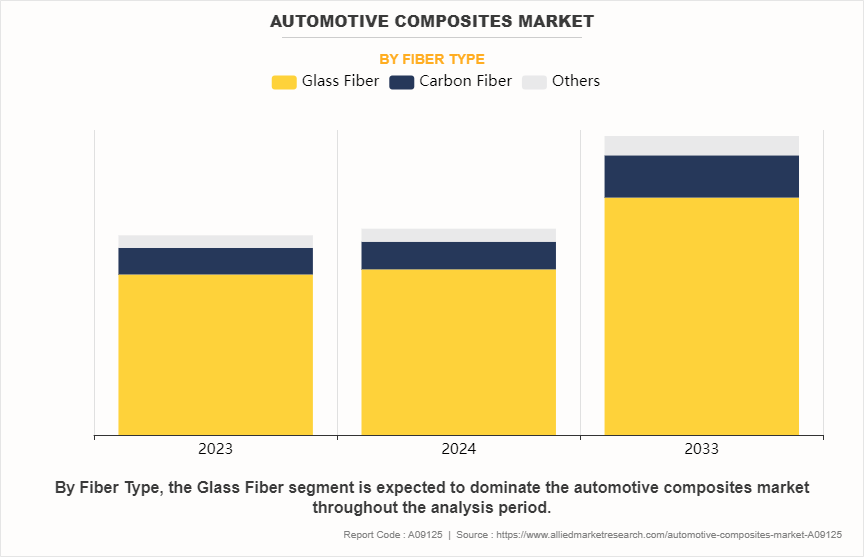

On the basis of fiber type, the market is categorized into glass fiber, carbon fiber, and others. The glass fiber segment accounted for more than four-fifths of the automotive composites market share in 2023 and is expected to maintain its dominance during the forecast period. The use of glass fiber in automotive composites is driven by multiple factors, with lightweighting and fuel efficiency leading the charge. As automakers strive to meet increasingly stringent emissions regulations and efficiency standards, glass fiber composites present an effective solution. Glass fiber-reinforced plastics (GFRP) significantly reduce vehicle weight without compromising strength or structural integrity, contributing to enhanced fuel economy and reduced COâ‚‚ emissions.

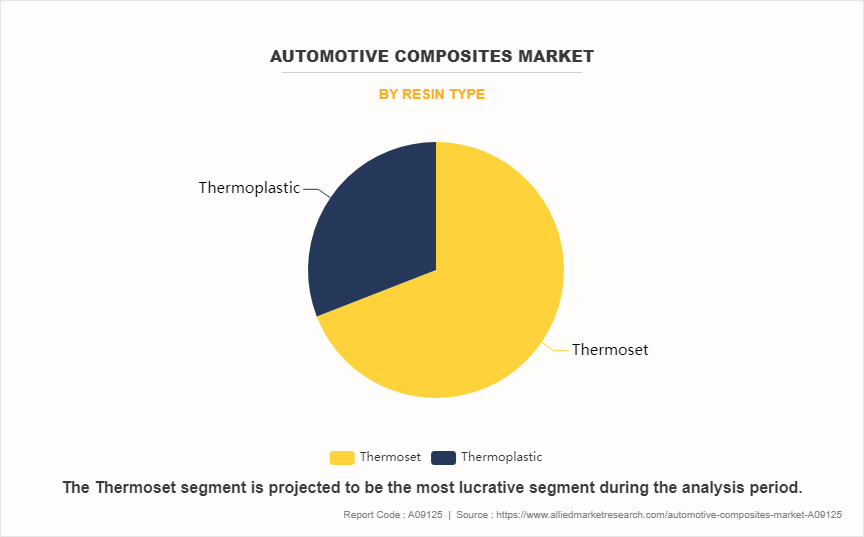

By resin type, the market is classified into thermosets and thermoplastics. The thermoset segment accounted for more than two-thirds of the automotive composites market share in 2023 and is expected to maintain its dominance during the forecast period. Thermoset resins play a crucial role in automotive composites, driven primarily by the automotive industry's growing demand for lightweight materials to enhance fuel efficiency and reduce emissions. As governments worldwide push for stricter emissions regulations, automakers are looking for ways to reduce vehicle weight without compromising safety or performance. Thermoset resins, which provide a high strength-to-weight ratio, have become a preferable solution. Their ability to form durable, lightweight, and complex structures offers automotive manufacturers the means to lower overall vehicle mass while still maintaining structural integrity.

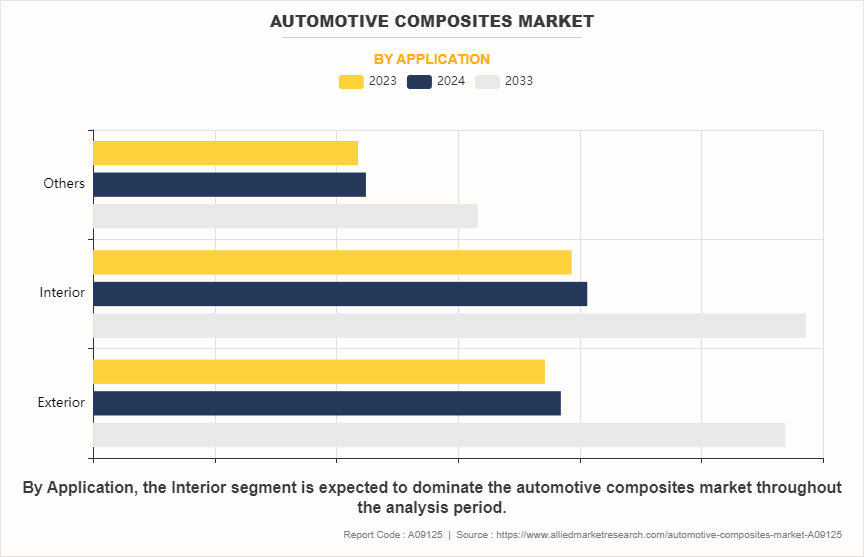

By application, the market is divided into exterior, interior, and others. The interior segment accounted for two-fifths of the automotive composites market share in 2023 and is expected to maintain its dominance during the forecast period. Composites such as carbon fiber, glass fiber, and thermoplastic materials are far lighter than traditional materials such as metal and offer robust structural integrity, which aligns well with stringent fuel economy and sustainability regulations. In addition, electric vehicle (EV) adoption is growing, where weight reduction is essential to extending battery life and driving range. Thus, manufacturers prioritize lightweight composites to optimize energy efficiency while maintaining safety and performance standards.

Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region accounted for less than half of the automotive composites market share in 2023 and is expected to maintain its dominance during the forecast period. The Asia-Pacific region is a major hub for automotive manufacturing, with countries such as China, Japan, South Korea, and India leading the production. As the automotive industry in these countries continues to expand, there is a surge in demand for lightweight materials such as composites to improve fuel efficiency, meet regulatory standards, and enhance vehicle performance. Furthermore, with rise in emphasis on reducing greenhouse gas emissions and transitioning toward electric & hybrid vehicles, there is an increase in demand for lightweight materials that are expected to help extend the range and improve the efficiency of these vehicles. Composites are well-suited for use in electric and hybrid vehicles due to their lightweight properties and design flexibility.

Competitive Analysis

Key players in the automotive composites industry include Toray Industries, Inc., SGL Carbon SE, Teijin Limited, Hexcel Corporation, Owens Corning, Mitsubishi Chemical Holdings Corporation, Gurit Holding AG, Solvay S.A., TenCate Advanced Composites, and Huntsman Corporation.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive composites market analysis from 2023 to 2033 to identify the prevailing automotive composites market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive composites market forecast and segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive composites market trends, key players, market segments, application areas, and market growth strategies.

Automotive Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.7 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 397 |

| By Fiber Type |

|

| By Resin Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | SGL Carbon, TORAY INDUSTRIES, INC., Gurit Services AG, Hexcel Corporation, Plasan, Solvay, Mitsubishi Chemical Group Corporation, Owens Corning, TEIJIN LIMITED., Huntsman Corporation |

Analyst Review

According to the CXOs of leading companies, the automotive industry has witnessed a transformative shift toward lightweight materials to enhance fuel efficiency, reduce emissions, and improve overall performance. Among these materials, automotive composites have emerged as a promising solution. Composites offer a unique combination of lightweight properties, strength, and design flexibility, making them increasingly attractive for manufacturers.

Furthermore, stringent emission regulations and environmental concerns have emerged as primary catalysts for the adoption of automotive composites. As governments worldwide continue to tighten emission standards and implement policies aimed at curbing carbon emissions, automakers are compelled to explore lightweight materials to achieve compliance. The role of composites in reducing vehicle weight and improving fuel efficiency aligns closely with these regulatory imperatives. Going forward, the evolution of emission standards and environmental policies is expected to remain pivotal in driving the demand for automotive composites, with further advancements expected to reinforce their importance in the pursuit of sustainable mobility.

In addition, the rise in demand for enhanced fuel efficiency and superior performance characteristics has been a longstanding priority for automakers. Automotive composites offer a compelling solution by delivering significant weight savings without compromising on strength or durability. This improves fuel economy and enhances acceleration, handling, and driving dynamics. As consumer expectations continue to evolve toward more efficient and technologically advanced vehicles, the demand for composites is expected to intensify.

The automotive composites market was valued at $9.8 billion in 2023, and is estimated to reach $14.7 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033.

Asia-Pacific is the largest regional market for Automotive Composites.

Interior is the leading application of Automotive Composites Market.

Rapid advancements in material science and manufacturing technologies is the the upcoming trends of Automotive Composites Market in the globe.

Key players in the automotive composites market include Toray Industries, Inc., SGL Carbon SE, Teijin Limited, Hexcel Corporation, Owens Corning, Mitsubishi Chemical Holdings Corporation, Gurit Holding AG, Solvay S.A., TenCate Advanced Composites, and Huntsman Corporation.

Loading Table Of Content...

Loading Research Methodology...