Automotive Condenser Market Research, 2032

The global automotive condenser market size was valued at $6.8 billion in 2022, and is projected to reach $10.9 billion by 2032, growing at a CAGR of 5% from 2023 to 2032.

Market Introduction and Definition

Automotive condensers, also called air conditioning condensers, are an essential component of a vehicle air conditioning system. The condenser works to reduce the temperature of the refrigerant during the condensation process. The automobile air conditioner holes also discharge the cold liquid that forms in the condenser when the heated temperature is effectively lowered. Automotive condensers play a pivotal role in producing cool air circulated within the vehicle's cabin and increase comfort inside a vehicle cabin.

Key Takeaways

- The automotive condensers market forecast covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automotive condenser industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

- On July 6, 2023, Marelli Corporation announced its new integrated thermal management module for electric vehicles for efficient thermal management and increasing driving range. The company's new water-cooled condenser has a smart valve arrangement, which can manage up to 6 channel combinations for optimized cooling. The system reduces system complexity and ensures ideal cooling of electric powertrain and cabin.

- In July 2020, MAHLE GmbH announced the launch of its new condenser for faster charging in electric vehicles. The new condenser is specifically designed to increase power density and provide optimum cooling of the battery and cabin without the need for extra installation space. The new condenser model production process is also optimized to provide a lighter-weight product that is less susceptible to corrosion and requires less refrigerant.

Key Market Dynamics

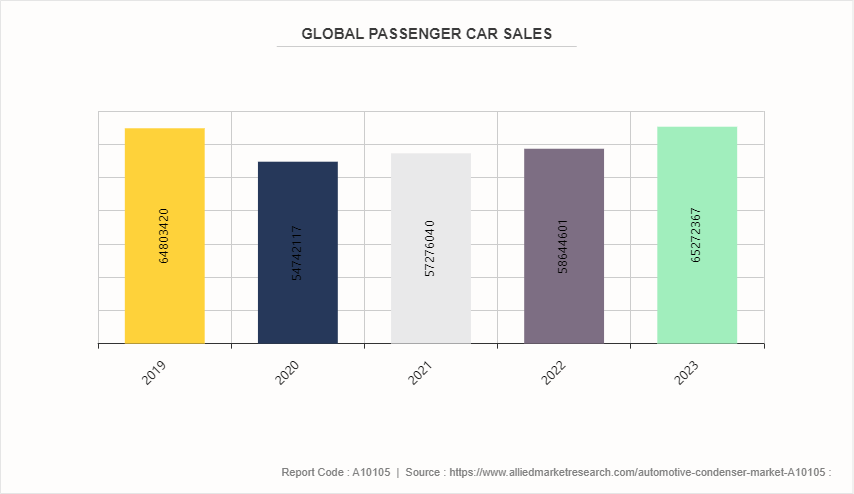

The global automotive condenser market size is growing due to several factors, such as an increase in demand for better driving comfort in automobiles, growth in sales of automobiles, and growth in regulatory standards in the automobile industry. However, high costs and fluctuation in the price of raw materials and perception of risk restrain the development of the market. In addition, growth in sales of electric and hybrid vehicles and integration of advanced cooling technologies and integration of lightweight materials are expected to provide ample opportunities for the automotive condenser market growth during the forecast period.

One of the major driving factors is increase in demand for better driving comfort in automobiles. In recent years, there has been a growing customer preference toward comfort and safety in automobiles. This is due to changes in consumer lifestyles and increased demand for advanced technology features in automobiles. With the growing urbanization and rising temperature levels, there is a growing demand for advanced cooling systems in automobiles to maintain comfortable temperatures inside a vehicle; this has led to automobile manufacturing companies investing more in the development of advanced air-conditioning systems, thus driving the demand for automotive condensers.

Moreover, growth in sales of electric and hybrid vehicles is further escalating the market for automotive condensers. For instance, in a recent article published by ET Auto in 2023, India witnessed a 120% sales growth in the electric vehicle segment; similarly, the country also witnessed a 400% surge in demand for hybrid vehicles. Major countries around the world are also experiencing an increase in demand for hybrid and electric vehicles due to the increase in the price of petroleum and growth in emission regulations on traditional ICE automobiles. The demand for electric and hybrid vehicles is anticipated to continue during the forecast period, creating market expansion opportunities for the companies operating in the market.

However, the high costs associated with the purchase and maintenance of condensers are anticipated to hinder its market growth during the review period. The complex electronics and regular maintenance required for condensers' microchannel tubes, fins, and expensive materials used, such as aluminum, increase the overall cost of condensers. Moreover, automotive condensers work in harsh environments as they are located in the front bumper. They are more prone to dust and debris, which obstruct the flow of air and reduce the air conditioning cooling efficiency. Likewise, the coolant used in condensers requires regular refills and changes from time to time. This increases its overall maintenance cost, thus hindering the automotive condenser market forecast growth.

Market Segmentation

The automotive condenser market share is segmented into type, material, vehicle type, sales channel and region. On the basis of type, the market is segregated into a single flow, tubes and fins, serpentines and parallel flow. By material, the market is analyzed into aluminum and copper. On the basis of vehicle type, the market is segmented into passenger vehicles and commercial vehicles. By sales channel, the market is segmented into OEM and aftermarket. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In Mexico, the growth in sales and production of automobiles has created a lucrative market opportunity for the global automotive condenser manufacturer in the region.

The major factors driving the growth of Mexico's automotive industry are favorable business conditions, strategic location, and established automotive clusters throughout the country; high availability of laborers and a cheap labor force are also helping in growing vehicle production, thus driving the demand for automotive condensers in the region. For instance, according to the International Trade Administration,

Mexico is the world’s 7th largest passenger vehicle manufacturer, manufacturing around 3.5 million vehicles annually. 76% of vehicles manufactured in Mexico are exported in the U.S. The country has a presence of companies such as Audi, BMW, Ford Motor Company, General Motors, Honda, Hyundai, Kia, Mazda, Mercedes Benz, Nissan, Stellantis, Toyota, Volkswagen, and Tesla. The U.S.-Mexico-Canada Agreement (USMCA) , which was enacted in 2020, further helped in the growth of the automotive industry in the country.

On May 7, 2021, Hanon Systems announced completion of its acquisition of the condenser business from Keihin Corporation for certain operations in Europe and North America region. The acquisition will help Hanon System to supply auto manufacturers with condenser technology and further diversify its customer base. The acquisition includes Keihin’s condenser operation in Kladno, Czech Republic, and San Luis Potosi, Mexico region. The acquisition also includes a portion of the condenser business in the U.S. Around 500 employees were transferred to Hanon Systems in this transaction.

Competitive Landscape

The major players operating in the automotive condenser industry include Robert Bosch GmbH, Denso Corporation, MAHLE GmbH, Hanon Systems, Marelli Corporation, Valeo SA, Subros Limited, OSC Automotive Inc, Delphi Technologies, and Koyorad. Co., Ltd. Other players in the automotive condenser market include Air International Thermal Systems, MODINE MANUFACTURING COMPANY, and Reach Cooling Group.

Industry Trends:

- On September 11, 2023, Denso Corporation announced that they had developed a new technology “Everycool’’, a commercial vehicle cooling system for trucks that improves cooling efficiency and reduces environmental impact. The new cooling system can also be used when a truck engine is not running. The technology can achieve the dual objectives of improving driver working conditions during hot summer seasons and reducing environmental impact and promoting efficient energy utilization by lowering fuel consumption.

- In 2022, the Society of Indian Automobile Manufacturers released a data that portrayed passenger sales in India in FY 2022-2023 accounted for 38, 90, 114 units which was around 30, 69, 523 units in 2021-2022. During the same period, the sales of commercial vehicles increased from 7, 16, 566 to 9, 62, 468 units. The country is witnessing an increase in vehicle production and sales of automobiles which is anticipated to provide lucrative growth opportunity for the companies operating in the automotive condenser market.

Parent Market Overview

The automotive industry globally is witnessing a strong growth rate. The growth can be attributed to rise in inclination of customers toward electric and hybrid vehicles, especially in Europe and North America region. Moreover, the growth in disposable income in Asia-Pacific and Africa region has resulted in an increase in sales of automobiles, especially in the passenger cars segment. According to data published by the International Energy Agency (IEA) , by 2030 almost 1 in 3 cars on the roads in China is set to be electric, and almost 1 in 5 cars in both the U.S. and the European Union will be electric or alternative fuel vehicle. The agency also anticipates that global electric car sales will reach around 17 million units by the end of 2024 and will continue to grow steadily till 2030; the share of electric vehicles in commercial vehicle segment is also expected to witness a strong growth in the coming years. Thus, the growing automotive industry is anticipated to present a lucrative automotive condenser market opportunity during the forecast period.

Key Sources Referred

- European Automobile Manufacturers Association

- U.S. Department of Energy

- International Energy Agency

- World Economic Forum

- National Highway Traffic Safety Administration

- International Organization of Motor Vehicle Manufacturers (OICA) :

- U.S. Department of Transportation (DOT)

- Environmental Protection Agency (EPA)

- National Institute of Standards and Technology (NIST)

- European Union Open Data Portal

- Automotive Component Manufacturers Association of India (ACMA)

- Motor & Equipment Manufacturers Association (MEMA)

- Truck and Engine Manufacturers Association (EMA)

- Society of Automotive Engineers (SAE)

- American Trucking Associations (ATA)

- International Road Transport Union (IRU)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the automotive condenser market segments, current trends, estimations, and dynamics of the automotive condenser market analysis from 2023 to 2032 to identify the prevailing automotive condenser market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive condenser market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global automotive condenser market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global automotive condenser market trends, key players, market segments, application areas, and market growth strategies.

Automotive Condenser Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.9 Billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2023 - 2032 |

| Report Pages | 179 |

| By Type |

|

| By Material |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Subros Limited, Delphi Technologies, MAHLE GmbH, Koyorad. Co., Ltd, Marelli Corporation, Valeo SA, DENSO CORPORATION, Robert Bosch GmbH, OSC Automotive Inc, Hanon Systems |

Integration of lightweight materials in the manufacturing of automotive condensers is the upcoming trend in the industry.

Passenger vehicle is the leading application of automotive condenser market.

Asia-Pacific is the largest region for automotive condenser market.

The automotive condenser industry was valued at $6783.43 in 2022.

Robert Bosch GmbH, Denso Corporation, MAHLE GmbH, and Hanon Systems are some of the major companies operating in the market.

Loading Table Of Content...