Automotive Constant Velocity Joint Market Research, 2031

The global automotive constant velocity joint market was valued at $2.9 billion in 2021, and is projected to reach $4.7 billion by 2031, growing at a CAGR of 5.3% from 2022 to 2031.

An automotive constant velocity joint, also known as a CV joint, is a component installed on a drive shaft to allow the drive shaft to transmit power through a variable angle while maintaining a constant rotational speed. It is mostly found in front-wheel drive and all-wheel drive vehicles. The CV joints are required to transfer torque from the transmission to the drive wheels at a constant speed while accommodating the suspension's up-and-down motion. CV joints in front-wheel drive vehicles transfer torque to the front wheels during turns.

Factors such as increase in demand for lightweight constant velocity joints, and increase in demand for commercial vehicles are anticipated to boost the growth of the global automotive constant velocity joint market during the forecast period. However, installation issues with automotive constant velocity joints, and fluctuating prices of raw materials used for manufacturing CV joints are expected to hinder the growth of the global market during the forecast period. Moreover, increase in vehicle production in developing countries, and increase in demand for electric vehicles are expected to create an opportunity for the automotive constant velocity joint industry in near future.

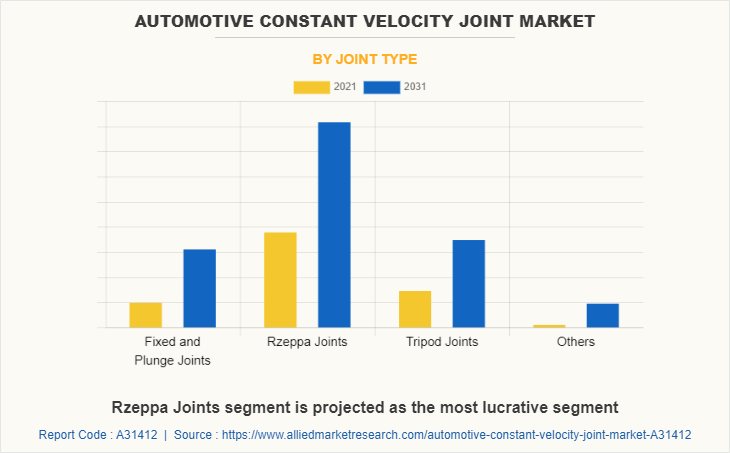

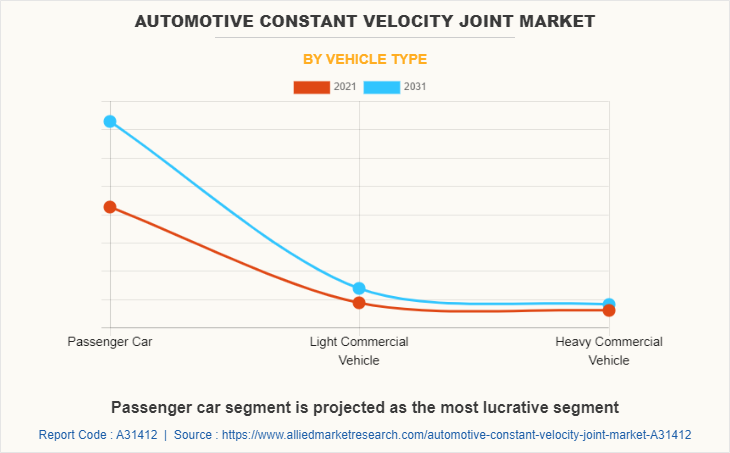

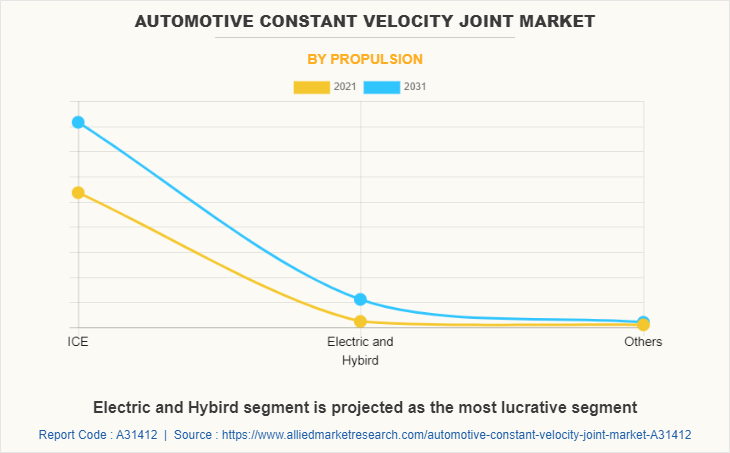

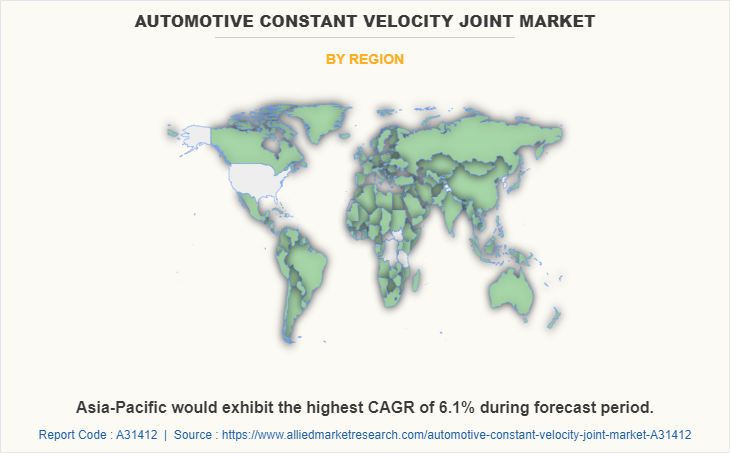

The automotive constant velocity joint market is segmented basis of joint type, vehicle type, propulsion, distribution channel, and region. On the basis of joint type, it is divided into fixed & plunge joints, Rzeppa joints, tripod joints, and others. By vehicle type, it is segmented into passenger car, light commercial vehicle, and heavy commercial vehicle. By propulsion, it is divided into ICE, electric & hybrid, and others. By distribution channel, it is divided into OEM, and aftermarket. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players that operate in this automotive constant velocity joint market are American Axle & Manufacturing, Inc., GKN Automotive Limited, GSP Automotive Group Wenzhou Co. Ltd., Hyundai WIA Corporation, IFA Group, Nanyang Automobile & Cycle Group, Neapco Holdings LLC, Nexteer Automotive, NKN LTD, NTN Corporation, Shandong Carfree Auto Fittings CO., LTD, SKF, Taizhou Hongli Automobile Parts Co., Ltd., Wanxiang Qianchao Co. Ltd., and Zhejiang ODM Transmission Technology Co., Ltd..

Increase in demand for lightweight constant velocity joints

Governments all over the world have enforced the use of fuel-efficient vehicles to reduce pollution and the climatic impact of automobiles. For instance, the European Union (EU) has mandated that average fuel efficiency across manufacturer fleets achieve 57 miles per gallon (mpg) by 2021, up from 41.9 U.S. miles per gallon in 2015, and 92 U.S. miles per gallon by 2030. Increased government measures to improve automobile fuel efficiency have prompted automakers to integrate advance technology into their vehicles to reduce vehicle weight and increase the vehicle efficiency. Modern automobiles require advanced materials to improve fuel efficiency while ensuring safety and performance. Since it takes less energy to accelerate a lighter entity than a heavy one, lightweight materials have the potential to significantly improve the vehicle economy. Regulatory demands on automakers, along with technology advancements in automotive components, have resulted in the development of lightweight constant velocity joints for vehicles. For instance, GKN provides lightweight constant velocity joint (CV joint) systems that enables rear-wheel drive platforms to save more than 4kg of weight. Moreover in May 2021, NTN Corporation developed the “Small and Lightweight CVJ for Rear of Sub-axle,” a constant velocity joints for sub-axles. The newly developed CV joints are small and lightweight for the driven wheels (sub-axles) of 4WD vehicles. Such increase in development from manufacturers' increasing use of lightweight constant velocity joint systems to decrease vehicle emissions and increase the fuel efficiency of the vehicle has fuelled the growth of the automotive constant velocity joint market.

Increase in demand for commercial vehicles

Rise in demand for commercial vehicles in developing nations, owing to urbanization and increased industrial production is anticipated to exhibit remarkable growth in the coming years. For instance, the commercial vehicle segment in the Indian automotive industry experienced an extraordinary growth rate in both light commercial as well as medium & heavy commercial vehicle segments. Commercial vehicles are mostly rear-wheel-drive vehicles, which require high-performance differential assemblies to perform driving operations. For instance, the global commercial vehicles sale was recorded to be 26.9 million units in 2018 and has reached 27 million units in 2019. Emerging players and market leaders operating in different industries namely e-commerce, the food industry, and others, across the developing countries have increased the demand for delivery and transport solutions, thereby further driving the production of heavy commercial vehicles. The commercial vehicle requires durable CV joints which provides enhanced NVH performance high power density, and operates at a wide temperature range. Owing to this the demand for CV joints has increased significantly. In addition, increased production of heavy-duty vehicles considerably boosts the demand for automotive constant velocity joints. Furthermore, the emergence of global potential heavy vehicle manufacturers such as UD Trucks Scania, and Volvo Trucks & Buses, which are focusing on expanding their production capacities in the developing nations through joint ventures with local manufacturers, is expected to present an opportunity for the growth of the automotive constant velocity joints market.

Installation issues with automotive constant velocity joints

The installation of CV joints includes multiple factors including the angle between the input and output shaft, type of transmission and type of drive of the vehicle among others. Installation of an automotive constant velocity joint is a crucial factor in the effective working of vehicle, so if there is any mistake during the installation, it not only makes the automotive constant velocity joint ineffective, but also harms the vehicle transmission. Hence, compatibility of automotive constant velocity joint is an issue that needs serious observation. Moreover, CV joints are subjected to higher wear during the starting phase itself, as lubricant may not be available at the contacting surfaces during the start of the vehicle. Thus, owing to this, constant velocity joint gets easily heated and requires some coolant for its proper working. Most of the vehicles which use CV technology run at very high speeds so any heating related issue could lead the vehicle into dangerous condition. So proper security check and foolproof solution for above conditions is very important for the growth of the automotive constant velocity joint market.

Increase in vehicle production in developing countries

The demand for automobiles in emerging countries is expected to expand dramatically in the future years as a result of urbanization and increased industrial activity. Manufacturers are increasingly building production plants in emerging countries due to rise in demand for automobiles in the region. Developing nations have observed an increase in the production of automobiles owing to factors such as favorable government policies, increase in GDP, and rise in consumer spending. Emerging companies and market leaders in many industries throughout emerging nations, such as e-commerce, the food industry, and others, have boosted demand for delivery and transportation solutions, therefore boosting the production of heavy commercial vehicles even further. Increased manufacturing of heavy-duty vehicles raises demand for automotive constant velocity joint significantly. Furthermore, surge in demand for passenger vehicles in developing countries has considerably increased automobile production in the area. Customers in developing countries such as India, Brazil, and others have shown considerable growth in their adoption of fuel efficient systems, resulting in increased demand for automotive constant velocity joint in the region. Vehicle production in emerging nations is anticipated to increase considerably in the future years, providing an opportunity for the automotive constant velocity joint market to witness growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive constant velocity joint market analysis from 2021 to 2031 to identify the prevailing automotive constant velocity joint market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive constant velocity joint market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive constant velocity joint market trends, key players, market segments, application areas, and market growth strategies.

Automotive Constant Velocity Joint Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.7 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 335 |

| By Joint type |

|

| By Distribution Channel |

|

| By Vehicle Type |

|

| By Propulsion |

|

| By Region |

|

| Key Market Players | Hyundai WIA Corporation, Shandong Huifeng Auto Fittings Co, ZWZ, NKN Co. Ltd., Nexteer Automotive NA, Taizhou Hongli Automobile Parts Co. Ltd, GKN, SKF, American Axle Manufacturing Holdings Inc., Zhejiang ODM Transmission Technology Co. Ltd., Nanyang Automobile & Cycle Group, NTN Corporation, Wanxiang Qianchao Co. Ltd, Neapco Holdings LLC, IFA Rotorion |

Analyst Review

The automotive constant velocity joint market is expected to witness significant growth, due to increase in penetration of front wheel drive, all-wheel drive (AWD) and 4WD vehicles are expected fuel the demand for constant velocity joint market. Moreover, increase demand for fuel efficient vehicles are expected to propel the demand for advanced CV joints which is expected to propel the demand for CV joints market during the forecast period.

Factors such as increase in demand for lightweight constant velocity joints, and increase in demand for commercial vehicles are anticipated to boost the growth of the global automotive constant velocity joint market during the forecast period. However, installation issues with automotive constant velocity joints, and fluctuating prices of raw materials used for manufacturing of CV joints are expected to hinder the growth of the global automotive constant velocity joint market during the forecast period. Moreover, increase in vehicle production in developing countries, and increase in demand for electric vehicles are expected to create an opportunity for the automotive constant velocity joint market in the near future.

To fulfil the changing demand scenarios, market participants are concentrating on product development strategy to expand their product portfolio and meet new business opportunities. For instance, in July 2022, NTN-SNR, the European arm of Japan-based NTN Corporation developed and expanded constant velocity joint range with a further 280 references being added to the range. And planning further increase of the range, this will see a range covering more than 1000 references by 2023. Moreover, in May 2021, NTN Corporation developed the “Small and Lightweight CVJ for Rear of Sub-axle,” a constant velocity joints for sub-axles of rear wheel of FF-based 4WD vehicles. In addition, market participants are continuously focusing on business expansion strategy to improve the product and customer reach. For instance, in March 2021, Nexteer Automotive announced to expand its Driveline portfolio with new Halfshaft technologies that are tailored to meet the unique demands of electric vehicles (EVs). Its driveline technologies include 52 degree CV Joints, high efficiency fixed center 8-ball joint, and crossglide 8-ball plunging joint.

The key players that operate in this market are American Axle & Manufacturing, Inc., GKN Automotive Limited, GSP Automotive Group Wenzhou Co. Ltd., Hyundai WIA Corporation, IFA Group, Nanyang Automobile & Cycle Group, Neapco Holdings LLC, Nexteer Automotive, NKN LTD, NTN Corporation, Shandong Carfree Auto Fittings CO., LTD, SKF, Taizhou Hongli Automobile Parts Co., Ltd., Wanxiang Qianchao Co. Ltd., and Zhejiang ODM Transmission Technology Co., Ltd.

The global automotive constant velocity joint market was valued at $2.86 billion in 2021, and is projected to reach $4.73 billion by 2031, registering a CAGR of 5.3% from 2022 to 2031

Increase in demand for lightweight constant velocity joints is the upcoming trend of automotive constant velocity joint market.

Passenger car is the leading application of automotive constant velocity joint market.

Asia-Pacific the largest regional market for automotive constant velocity joint.

The key players that operate in this automotive constant velocity joint market are American Axle & Manufacturing, Inc., GKN Automotive Limited, GSP Automotive Group Wenzhou Co. Ltd., Hyundai WIA Corporation, IFA Group, Nanyang Automobile & Cycle Group, Neapco Holdings LLC, Nexteer Automotive, NKN LTD, NTN Corporation, Shandong Carfree Auto Fittings CO., LTD, SKF, Taizhou Hongli Automobile Parts Co., Ltd., Wanxiang Qianchao Co. Ltd., and Zhejiang ODM Transmission Technology Co., Ltd.

Loading Table Of Content...