Automotive Fastener/Connector Market Research, 2033

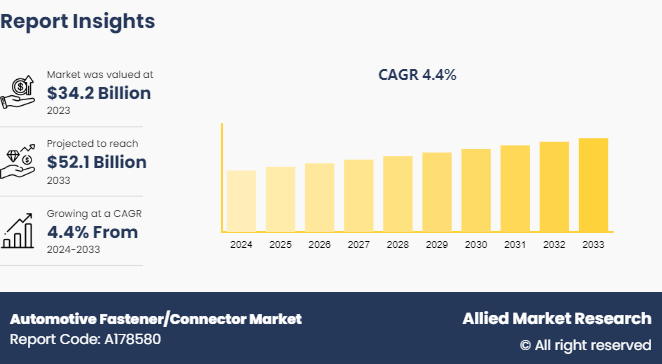

The global autonomous fastener/connector vehicles market was valued at $34.2 Billion in 2023 and is projected to reach $52.1 Billion by 2033, growing at a CAGR of 4.4% from 2024 to 2033.

Market Introduction and Definition

The automotive fastener/connector industry involves the automotive industry sector focused on the development, production, and sale of vehicles and related technologies that reduce environmental impact. The market also includes different types of vehicles and mobility solutions that help in giving importance to sustainability, reduced carbon emissions, and efficiency of energy. There are various components associated with automotive fastener market such as battery electric vehicles, plug-in hybrid electric vehicles, hybrid electric vehicles, hydrogen fuel cell vehicles, alternative fuel vehicles, autonomous vehicles, and shared mobility solutions.

Key Takeaways

The automotive fastener/connector market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1,500 product literature, industry releases, annual reports, and other such documents of major automotive fastener/connector industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Strategies and Developments

Maclean Fogg introduced thread-strong wheel fasteners in February 2022. Direct consumer access to thread-strong wheel fasteners is provided by the www.Threadstrong.use-commerce website and a few other carefully chosen locations. This strategic move was implemented to improve the company's position in the automotive fastener/connector market.

TR Fastenings introduced a novel screw solution in July 2023. The company aimed to increase product life and improve quality by altering how fasteners are utilized in PC screen mounts with this new approach. This strategic move was implemented to improve the company's position in the automotive fasteners market.

The Bollhoff Group introduced QUICKLOC rapid release fasteners in February 2024. The fasteners offer increased security and efficiency. This strategic move will strengthen the Bollhoff Group’s position in the automotive fastener/connector market.

Sundram Fasteners secured a $250 million order contract in the electric car market in January 2023. This strategic move was implemented to strengthen Sundaram Fasteners' position in the automotive fastener/connector market.

Sundaram Fasteners introduced fasteners for ISRO in August 2023. The fasteners were coated with passivation, silver plating, and aluminum ion vapor deposition and were composed of alloy steel, heat-resistant stainless steel, and super alloy. The Chandrayaan 3 was manufactured using the fasteners. This strategic move was implemented to strengthen Sundaram’s position in the fasteners/connectors industry.

Key Market Dynamics

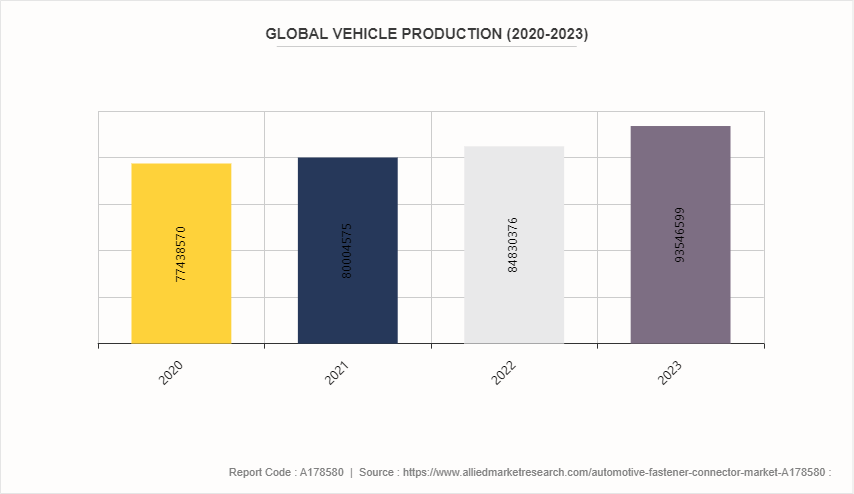

The rise in lightweight vehicle manufacturing and growth in vehicle production are the two main primary factors driving the growth of the automotive fastener/connector market size. Lightweight vehicles incorporate advanced materials such as aluminum, magnesium, and high-strength steel to reduce overall weight without compromising strength and safety. These materials require specialized fasteners that can securely join them together. As vehicle production rises, there is a proportional increase in the demand for automotive fastener/connector market growth. Fasteners are essential components used in the assembly of vehicles, including everything from nuts and bolts to screws and clips. With more vehicles being manufactured, there is a higher requirement for these fastening components.

Furthermore, increasing alternatives for fasteners and rising material costs are two main factors hampering the growth of the automotive fastener/connector market share. The development and use of advanced materials, such as composites and high-strength plastics, often require different joining techniques that do not rely on traditional fasteners. For instance, laser welding and ultrasonic welding are becoming more prevalent in the manufacturing process, which is reducing the need for conventional fasteners. Automotive fasteners are typically made from materials such as steel, aluminum, and specialty alloys. When the prices of these raw materials rise, the production costs for fasteners increase correspondingly. This makes the fasteners more expensive to produce, which can lead to higher prices for consumers and manufacturers. This increased cost can deter buyers, thereby reducing the demand for automotive fastener/connector market size.

Moreover, innovation in manufacturing technology can result in the growth of automotive fastener/connector market opportunity. The development of lightweight materials, such as advanced high-strength steels, aluminum, and composites, helps reduce the overall weight of vehicles. This trend necessitates the use of specialized fasteners that can securely hold these new materials together. Innovations in coatings, such as zinc-aluminum flake coatings and organic coatings, enhance the durability and longevity of fasteners by providing superior corrosion resistance, which is crucial for automotive applications.

Market Segmentation

The automotive fastener/connector market is segmented into product type, characteristics, material type, vehicle type, and region. By product type, the market is bifurcated into threaded and non-threaded. By characteristic, the market is divided into removable fasteners, permanent fasteners, and semi-permanent fasteners. By material type, the market is divided into stainless steel, brass, nickel, aluminum, plastic, iron, and bronze. By vehicle type, the market is bifurcated into passenger cars and commercial vehicles. Region-wise, the automotive fastener/connector market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Region and Country Developments

The U.S. market is presently benefitting from state-of-the-art manufacturing technologies such as additive manufacturing (3D printing) , computer numerical control (CNC) machining, and automated assembly lines. For instance, in May 2023, HP Inc. launched a 3D printing solution named New HP Jet Fusion Automation Solution. In addition, in April 2023, Okuma America Corporation launched the automation business segment that comprises Okuma computer numerical control (CNC) machine tools. These technologies enhance the precision, efficiency, and customization of fastener production.

The increasing adoption of electric vehicles in the U.S. is driving the demand for specialized fasteners that cater to the unique requirements of EVs, such as lightweight materials, corrosion resistance, and thermal management. For instance, in 2023, electric vehicles and hybrids surpassed 16% of the total U.S. light duty vehicle sales. Expansion of electric vehicle (EV) charging infrastructure and battery manufacturing plants in the U.S. also boosts the demand for fasteners designed for these applications.

Canada is home to several major automotive manufacturing plants, including those of General Motors, Ford, and Stellantis. These plants are producing a significant volume of vehicles and are driving demand for a wide range of automotive fasteners. As per Statista, in 2023, the Canadian auto sector produced over 17, 530 heavy trucks, 1, 159, 000 light commercial vehicles, and 377, 000 passenger cars. In total, the manufacturing of motor vehicles in Canada rose by over 26% in 2023. Canada has a strong network of automotive parts suppliers, that are involved in the production of fasteners. This network supports both domestic vehicle production and exports.

China is the world's largest market for electric vehicles, thus driving the demand for specialized fasteners designed for EV components such as battery packs, electric motors, and charging infrastructure. In addition, the Chinese government provides support and incentives to promote the development of the automotive industry, including the fastener sector, through initiatives such as subsidies, tax incentives, and investment in research and development. For instance, in April 2024, China government offered a one-off subsidy of $1, 381 (CNY10, 000) until the end of 2024 for buyers trading in old cars for qualifying new models.

Competitive Analysis

The major players operating in the automotive fastener/connector market include Maclean Fogg, TR Fastenings, Kamax Holding GmbH & Co., Bollhoff Group, Sundaram Fasteners, Meidoh Co. Ltd., Wurth Group, Boltun Corporation, Nipman Fasteners, and SFS Group AG. The following players adopted product launch and contract strategies to increase their market share in the global automotive fastener/connector market.

The other player in the automotive fastener/connector industry includes Berkshire Hathaway Inc., Illinois Tool Works Inc, Sterling Tools Limited, Westfield Fasteners Limited, Shanghai Prime Machinery Company Limited, Kova Fasteners, Private Limited, The Philips Screw Company, Stanley Black & Decker, and Lisi Group.

Industry Trends

The shift towards lightweight vehicles to improve fuel efficiency and reduce emissions is driving the demand for fasteners made from advanced materials such as aluminum, magnesium, and high-strength steel. These materials offer the required strength while contributing to overall weight reduction.

The rise of electric vehicles is creating demand for specialized fasteners designed to meet the unique requirements of electric powertrains, battery systems, and electronic components in the automotive connector market. These fasteners often need to provide superior electrical insulation and resistance to vibration. For instance, as per IEA sources, globally, about 14 million new electric vehicles were registered in 2023, increasing the total number of vehicles on the road to 40 million. This figure roughly matched the sales projection from the Global EV Outlook 2023 (GEVO-2023) . Sales of electric vehicles increased by 3.5 million in 2023 compared to 2022, a 35% annual rise.

The development of advanced coatings that provide superior corrosion resistance is a significant trend. These coatings extend the lifespan of fasteners and enhance their performance in harsh environments. As per an article published by Global Certified Fasteners website source in January 2020, there are various types of advanced coatings available in the industry such as stainless steel, brass, bronze, chrome-plated, nickel-plated, clear zinc, yellow zinc, hot dip galvanized, electro galvanized, grey phosphate, and ceramic coated.

Key Sources Referred

Mclean Fogg

Fast fix technology.com

Bollhoff

Business Standard.com

The Hindu

HP Press Release

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive fastener/connector market analysis from 2024 to 2033 to identify the prevailing automotive fastener/connector market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive fastener/connector market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive fastener/connector market trends, key players, market segments, application areas, and market growth strategies.

Automotive Fastener/Connector Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 52.1 Billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Product Type |

|

| By Characteristics |

|

| By Material |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Kamax Holding GmbH & Co., Boltun Corporation, Sundaram Fasteners, Bollhoff Group, Illinois Tool Works Inc., Sterling Tools Limited, Maclean Fogg, Berkshire Hathaway Inc., Meidoh Co. Ltd., The Philips Screw Company, Shanghai Prime Machinery Company Limited, SFS Group AG, Kova Fasteners, Private Limited, TR Fastenings, Stanley Black & Decker, Westfield Fasteners Limited, Wurth Group, Nipman Fasteners, Lisi Group |

The shift towards lightweight vehicles to improve fuel efficiency and reduce emissions is driving the demand for fastener/connector made from advanced materials such as aluminum, magnesium, and high-strength steel. These materials offer the required strength while contributing to overall weight reduction.

The threaded segment is the leading application of the automotive fastener/connector market. This is due to an increase in automotive sales, technological advancements in the fastener industry to make them lightweight, safe and durable.

Europe is the largest regional market for the automotive fastener/connector market. This is due to European automotive manufacturers being at the forefront of technological innovation, particularly in areas such as electric vehicles (EVs), autonomous driving, and advanced manufacturing techniques. This innovation extends to the development and use of advanced fasteners.

$52.1 billion is the estimated industry size of automotive fastener/connector market.

Maclean Fogg, TR Fastenings, Kamax Holding GmbH & Co., Bollhoff Group, Sundaram Fasteners, Meidoh Co. Ltd., Wurth Group, Boltun Corporation, Nipman Fasteners, SFS Group AG, Berkshire Hathaway Inc., Illinois Tool Works Inc, Sterling Tools Limited, Westfield Fasteners Limited, Shanghai Prime Machinery Company Limited, Kova Fasteners, Private Limited, The Philips Screw Company, Stanley Black & Decker, and Lisi Group.

Loading Table Of Content...