Automotive Gears Market Research, 2033

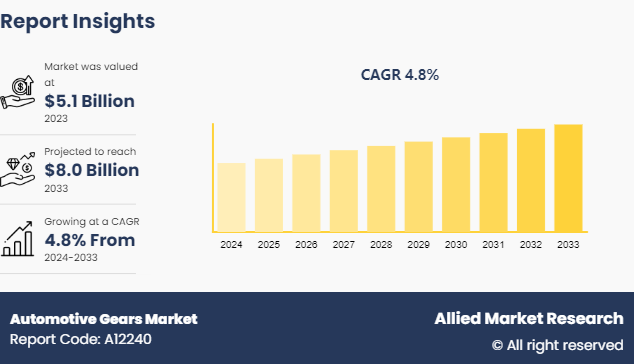

The global automotive gears market size was valued at $5.1 billion in 2023, and is projected to reach $8.0 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Market Introduction and Definition

Automotive gears are critical components of a vehicle's gearbox system. They distribute power from the engine to the wheels, allowing the vehicle to move. A vehicle's gears must be able to resist extreme stress and torque while maintaining precise control over the vehicle's speed and direction. Gears vary in shape and size based on load and usage parameters. From spur or helical gearbox to planetary gears, their use requires less mechanical force and reduces rotation speed.

The quality and longevity of these automobile gears are critical factors influencing a vehicle's overall performance and safety. The engine and gearbox system's high stress and torque require careful consideration of gear design and material. Furthermore, gears must be precisely manufactured and installed to ensure smooth and accurate operation.

Advancements in technology have led to more efficient gears made of lightweight materials and specialised coatings that reduce friction and wear. The vehicle industry's desire for high-quality and dependable gears will continue to drive innovation and growth.

Key Takeaways

- The automotive gears market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major automotive gears industry participants along with authentic industry journals, trade associations releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Developments

- In June 2021, JATCO developed a new continuously variable transmission, "CVT-X, " for medium and large FWD vehicles with improved environmental performance and drivability. CVT-X have achieved more than 90% transmission efficiency, which was considered difficult for a CVT

Key Market Dynamics

Rising wind power installations and the rapid growth of the construction industry in developing countries will boost the global automotive gears market during the forecast period. Wind energy's growing popularity is contributing significantly to the Automotive Gears market, as the Automotive Gearsbox is utilised in a wind turbine to boost the rotational speed from a low-speed rotor to a high-speed electrical generator. Furthermore, the quick emergence of multiple innovative technologies by leading competitors creates a lucrative growth trend in the automotive gears market share. However, technical issues such as as oil leakage and heating restrict market growth, as Automotive Gearsboxes are the most commonly used Automotive Gearsbox equipment in the field of machinery.

With increased vehicle manufacturing in countries such as India and China, as well as manufacturers focus on improving production capacity, demand for Automotive Gears is expected to increase dramatically. For instance, some sources predict that China will sell 80 million internal combustion engines per year in the next years, as these IC vehicles continue to dominate the automotive gears market growth.

Market Segmentation

The automotive Automotive Gearss market is segmented into type, application and material and region. On the basis of type, the market is divided into spur, helical, rack and pinion, worm and others. On the basis of application, the market is segregated into transmission systems,, steering systems, and differential systems. On the basis of material it is classified into metallic and non-metallic. . Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The Automotive Gearss market in North America is thriving, primarily due to the substantial increase in vehicle production, especially in the U.S., which represents around 67% of the region's output. The market is dominated by light commercial vehicles (LCVs) , SUVs, and trucks, reflecting the regional preference for larger vehicles. Automatic transmissions are particularly widespread, driven by consumer demand for convenience and suitability for urban driving.

Europe continues to be a crucial market for automotive Automotive Gearss, driven by strict emission regulations and a strong focus on fuel efficiency. The region is seeing a rising adoption of hybrid and electric vehicles, which boosts the demand for advanced Automotive Gears technologies. Germany remains a leader in this market, fostering innovations and Automotive Gears production. The market benefits from robust manufacturing capabilities and technological advancements from major players like ZF Friedrichshafen AG and Schaeffler AG.

The Asia-Pacific region is the largest market for automotive Automotive Gearss, supported by rapid industrialization, growing vehicle production, and increasing demand for passenger vehicles. China and India are significant contributors, with extensive manufacturing facilities and rising consumer incomes. The region is also a key hub for electric vehicle (EV) production, further enhancing the demand for innovative Automotive Gears solutions. Companies such as Hyundai Transys and JATCO Ltd. are instrumental in driving market expansion.

The automotive market in Latin America is expanding, driven by higher domestic vehicle production and the growing presence of Chinese automakers. Brazil and Mexico are primary markets, with Brazil seeing significant investments in automotive manufacturing. Market dynamics in the region are influenced by the production of electric and hybrid vehicles and the rising adoption of connected car technologies. Growth is supported by local production facilities and competitive pricing from Chinese OEMs.

Competitive Landscape

The major players operating in the market include GKN Plc. Inc., Altra Industrial Motion Corporation, American Axle and Manufacturing Inc., NSK Limited, Univance Corporation, Eaton Corporation, Bharat Gears Limited, Showa Corporation, Linamar Corporation, AmTech International.

Key Players and Market Dynamics

The automotive gears market opportunity involves several major players who are crucial to different stages of the value chain. Companies such as Gleason Corporation, SEW-Eurodrive, and David Brown Santasalo are notable for their contributions to automotive gears design, manufacturing, and distribution. The market is influenced by technological advancements, the demand for energy-efficient solutions, and the adoption of automation in manufacturing processes.

Technological Advancements

The automotive gears industry is witnessing advancements in materials technology, manufacturing processes like additive manufacturing, and the integration of smart technologies for predictive maintenance and enhanced performance.

Challenges and Opportunities

Key challenges include the need for high precision, managing material costs, and meeting environmental regulations. However, opportunities lie in the growing demand for automotive gears market size in emerging markets and the development of new materials and manufacturing techniques.

Value Chain Analysis of Global Automotive Gears Market

Raw Material Sourcing

The initial stage in the automotive gears market value chain involves sourcing raw materials. common materials used in automotive gears manufacturing include:

- metals: steel, cast iron, aluminum, and brass are frequently used due to their durability and strength.

- plastics: for certain applications, automotive gears made from high-performance plastics such as nylon and polycarbonate are used due to their lightweight and resistance to corrosion.

- Alloys: Specialized applications may require alloy materials that provide enhanced properties such as heat resistance or reduced wear.

Material Processing

Once raw materials are sourced, they undergo various processing steps to prepare them for Automotive Gears manufacturing. These steps include:

- Casting and Forging: Raw metals are cast or forged into basic shapes that are easier to machine into Automotive Gearss.

- Heat Treatment: Materials are subjected to heat treatment processes like annealing, tempering, or quenching to enhance their mechanical properties.

- Plastic Molding: In the case of plastic Automotive Gearss, the raw plastic material is melted and molded into Automotive Gears shapes.

Manufacturing

The processed materials are then transformed into Automotive Gearss through several manufacturing techniques:

- Machining: CNC machining, hobbing, and grinding are commonly used to achieve the precise dimensions and surface finishes required for Automotive Gearss.

- Injection Molding: For plastic Automotive Gearss, injection molding is used to produce Automotive Gearss in large volumes with high consistency.

- 3D Printing: Emerging technologies such as 3D printing are also being utilized for prototype and small batch production.

Quality Control and Testing

Quality control is a critical step to ensure Automotive Gearss meet the required specifications and performance standards. This involves:

- Dimensional Inspection: Using tools such as calipers and coordinate measuring machines (CMM) to verify Automotive Gears dimensions.

- Material Testing: Conducting tests to check material properties such as hardness and tensile strength.

- Functional Testing: Ensuring Automotive Gearss operate correctly under load and in their intended application environments.

Distribution and Logistics

After manufacturing, Automotive Gearss are distributed to various industries through:

- OEMs (Original Equipment Manufacturers) : Automotive Gearss are supplied to manufacturers of machinery, automotive, aerospace, and other industries.

- Aftermarket Suppliers: Providing replacement Automotive Gearss and parts for maintenance and repair operations.

- Distributors and Retailers: Selling Automotive Gearss to smaller manufacturers or end-users through wholesale and retail channels.

End-Use Applications

The final stage of the value chain is the application of Automotive Gearss in various end-use sectors, including:

- Automotive: Automotive Gearss are integral to the functioning of transmissions, differentials, and steering systems.

- Industrial Machinery: Used in machines for manufacturing, mining, and construction.

- Aerospace: Critical for the functioning of aircraft engines and control systems.

- Energy: Applied in wind turbines, oil & gas exploration equipment, and other energy-related machinery.

Industry Trends

- Investments in the automotive sector are still rising, with $ 5.2 billion in FDI inflow recorded in 2022, bringing the total FDI received by the sector to $ 34.11 billion between April 2000 and December 2022, accounting for approximately 5.45% of India's total FDI inflow during the same period.

- In September 2023, the central government has allocated US$1.4 billion for electric mobility under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) II scheme, signaling its commitment to EV adoption and in turn creating new avenues for ACM manufacturers.

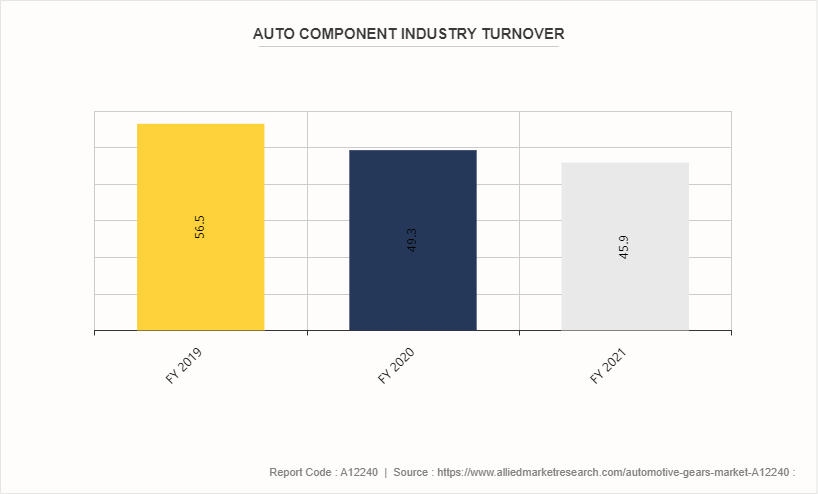

- The auto component industry exported $ 19 billion and imported $ 18.3 billion worth of components in 2021-22, resulting in the highest export surplus of $ 700 million.

- Auto component exports from India is expected to reach $ 30 billion by 2026.

Key Sources Referred

- India Brand Equity Foundation

- National Ocean Industries Association

- Occupational Safety and Health Administration

- ANSI Organisation

- U.S. Department of Transportation

- National Aeronautics and Space Administration

- International Transport Forum

- Maryland Department of Natural Reseources

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive gears market analysis from 2024 to 2033 to identify the prevailing automotive gears market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global automotive gears market forecast statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive gears market trends, key players, market segments, application areas, and market growth strategies.

Automotive Gears Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.0 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 324 |

| By Application |

|

| By Type |

|

| By Material |

|

| By Region |

|

| Key Market Players | Nord Drivesystems, SEW-EURODRIVE, BorgWarner Inc., David Brown Santasalo, HÖFLER Maschinenbau GmbH, Sumitomo Drive Technologies, Gleason Corporation, RENK AG, Klingelnberg GmbH, Bonfiglioli Group |

The differential systems is the leading application of Automotive Gears Market.

The upcoming trends of Automotive Gears Market include rising vehicle production, a growing demand for fuel-efficient and high-performance vehicles.

Asia-Pacific is the largest regional market for automotive gears.

The gears market was valued at $5.1 billion in 2023.

The spur is the leading type of Automotive Gears Market.

Loading Table Of Content...