Automotive Hardware-In-The-Loop Market Insights, 2033

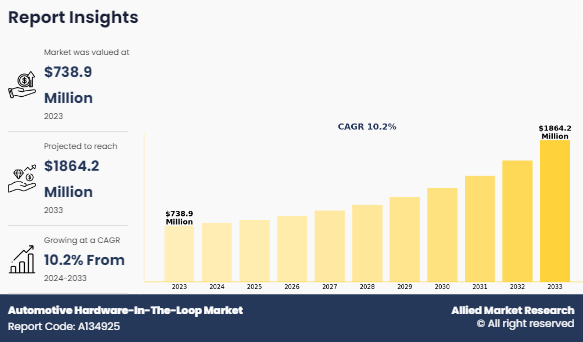

The global Automotive Hardware-In-The-Loop Market Size was valued at USD 738.9 million in 2023, and is projected to reach USD 1864.2 million by 2033, growing at a CAGR of 10.2% from 2024 to 2033.

Market Introduction and Definition

Automotive Hardware-in-the-Loop (HIL) testing is a real-time simulation technique that integrates physical hardware components with virtual environments to validate automotive systems such as Electronic Control Units (ECUs) and safety features. This market exists to address the growing complexity of vehicle electronics, ensuring robust performance and safety through early-stage testing. HIL technology minimizes the need for physical prototypes, reducing development costs and time while improving product reliability. Its adoption is driven by advancements in electric vehicles, autonomous driving technologies, and stringent regulatory standards, enabling manufacturers to meet safety and compliance requirements effectively. HIL systems play a pivotal role in accelerating automotive innovation and enhancing vehicle quality.

The automotive Hardware-in-the-Loop (HIL) market involves advanced testing and simulation technologies used in the Automotive Hardware-In-The-Loop Industry to validate electronic control units and various vehicle components. HIL systems enable real-time simulation of vehicle dynamics, allowing engineers to test powertrains, ADAS, and other critical systems under diverse conditions without relying on physical prototypes. Automotive Hardware-In-The-Loop Market Growth is driven by the rise in complexity of vehicle systems, the rise of electric and autonomous vehicles, and the need for enhanced safety and performance validation processes.

For instance, in, January 2024, dSPACE GmbH partnered with sprint to enhance real-time positioning scenarios for autonomous driving hardware in-the-loop test systems. The partnership aims to provide developers with a turnkey solution by integrating dSPACE's AD-HIL with Spirent's high-fidelity GNSS simulator. This collaboration allowed for comprehensive validation of autonomous driving applications, leveraging real satellite signals to improve safety and precision in vehicle development. furthermore, automotive hardware-in-the-loop allowed for comprehensive validation of autonomous driving applications, leveraging real satellite signals to improve safety and precision in vehicle development.

Furthermore, automotive hardware-in-the-Loop (HIL) systems are pivotal in enhancing vehicle safety, efficiency, and the overall driving experience. By enabling real-time simulation and testing of vehicle components, HIL allows engineers to evaluate the performance and interactions of systems such as powertrains, sensors, and safety features under various conditions without the need for physical prototypes. This accelerates development cycles and minimizes risks associated with real-world testing. Moreover, automotive hardware-in-the-loop helps identify potential issues early in the design process, leading to safer and more reliable vehicles. As the automotive industry continues to innovate, HIL systems are essential for meeting evolving safety and performance standards.

Market Overview

The rising demand for electric and hybrid vehicles is significantly enhancing the automotive hardware-in-the-loop (HIL) market. As manufacturers seek to optimize the performance and safety of these vehicles, HIL systems provide essential tools for testing and validating electric powertrains, battery management systems, and other critical components. This technology enables real-time simulations, ensuring that vehicles meet stringent regulatory standards and consumer expectations for efficiency and safety. Consequently, the growth of the electric vehicle sector directly drives the adoption of HIL solutions across the automotive industry. Furthermore, advancements in ADAS and AV Technologies, and rise in focus on vehicle safety have driven the demand for automotive fuel cell market.

However, the high initial investment required for automotive hardware-in-the-loop (HIL) systems is a significant barrier to market growth. Many manufacturers face budget constraints that limit their ability to adopt advanced testing technologies, hindering innovation and development in the automotive sector. The costs associated with implementing HIL setups such as purchasing specialized hardware, software, and maintenance can deter smaller companies and startups from entering the market. Consequently, this financial obstacle slows down the overall adoption of HIL solutions, despite their potential benefits in enhancing vehicle performance and safety. Moreover, intense competition among HIL solution providers, and shortage of skilled personnel proficient in HIL technology are major factors that hamper the growth of automotive fuel cell market.

The integration of AI and machine learning presents a lucrative opportunity for the automotive hardware-in-the-loop (HIL) market by enhancing the testing and validation processes of vehicle systems. These advanced technologies enable more accurate simulations and predictive analyses, allowing for quicker identification of potential issues and improved system optimization. As automakers increasingly rely on data-driven decision-making and automation, incorporating AI and machine learning into HIL systems can significantly enhance the efficiency and safety of vehicle development, making it an attractive investment for manufacturers looking to stay competitive in the evolving automotive landscape.

The Automotive HIL Market is driven by the rising demand for advanced vehicle testing solutions to reduce development time and cost while improving safety and performance. The increasing adoption of electric and autonomous vehicles is accelerating the need for HIL systems, as these technologies require real-time simulation for software validation. However, high implementation costs and technical complexity pose challenges to market growth. Opportunities lie in the growing use of HIL in developing countries and expanding applications in hybrid vehicle systems. Additionally, government regulations promoting safer automotive systems are boosting demand, while the Automotive Hardware-In-The-Loop Market Trends toward vehicle electrification and software-defined vehicles continues to reshape the market dynamics.

Segment Overview

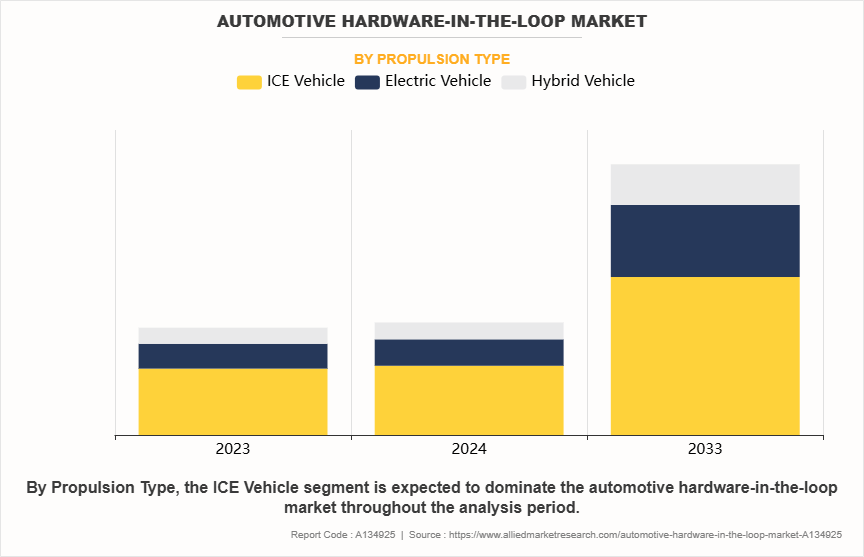

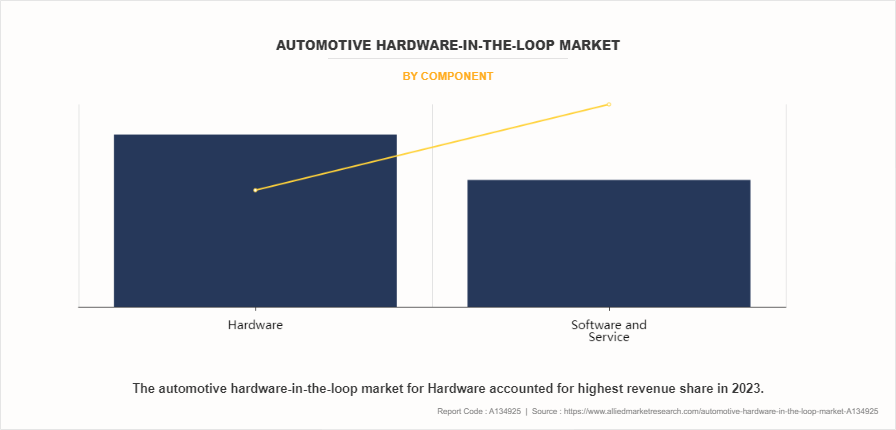

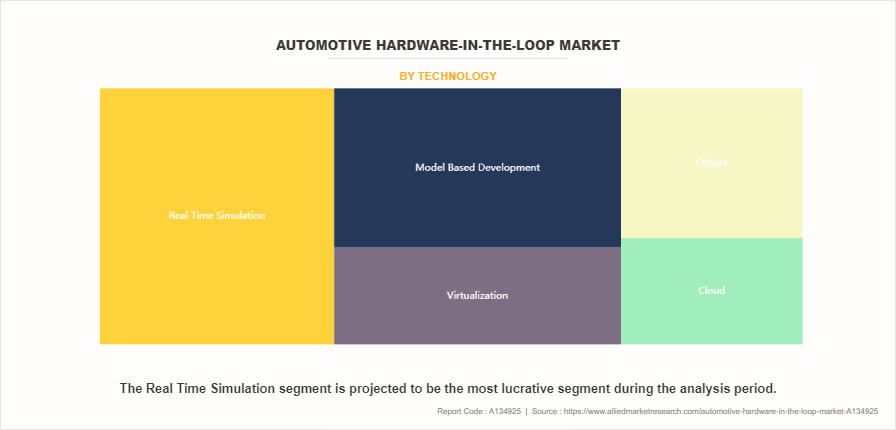

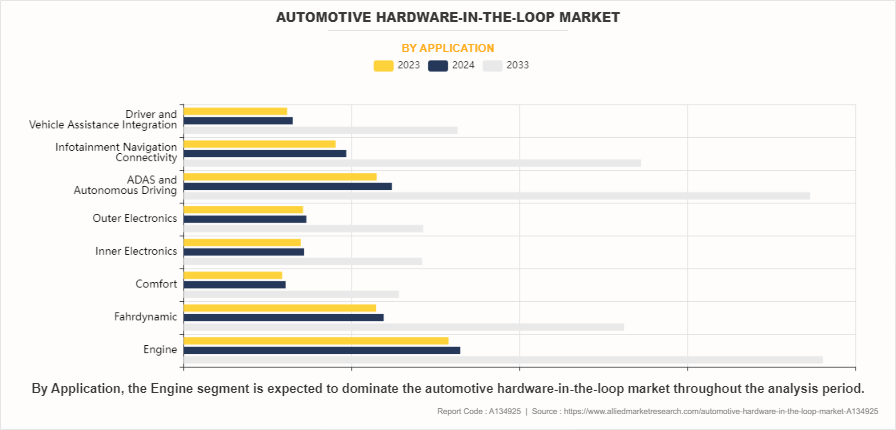

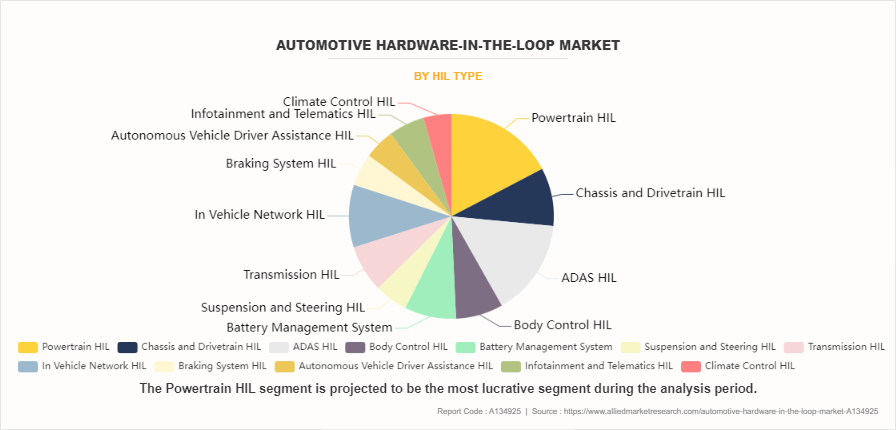

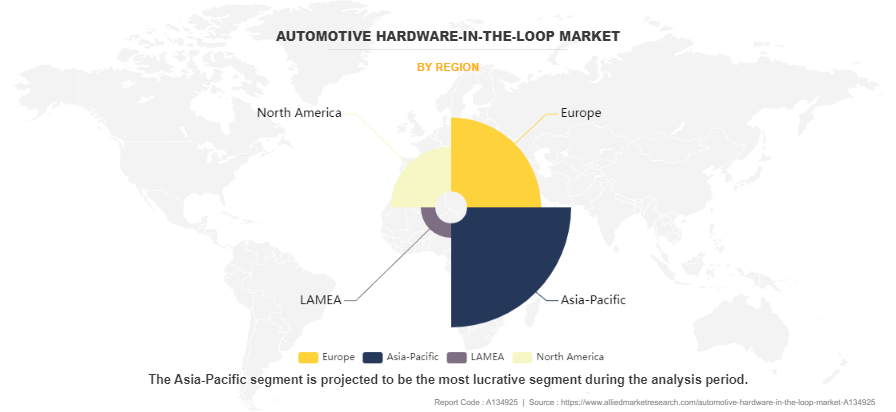

The automotive hardware-in-the-loop market is segmented into component, HIL Type, Technology, Application, Propulsion, and region. On the basis of component, the market is divided into hardware, and Software & Service. As per HIL type, the market is segmented into chassis and drivetrain HIL, ADAS HIL, body control HIL, battery management system, suspension and steering HIL, transmission HIL, In vehicle network HIL, braking system HIL, autonomous vehicle driver assistance HIL, infotainment and telematics HIL, and climate control HIL. Based on technology, the market is divided into real time simulation, model-based development, virtualization, cloud, and other. As per application, the market is segmented into engine, fahrdynamic, comfort, inner electronics, outer electronic, ADAS And Autonomous Driving, infotainment, navigation, connectivity, and driver and vehicle assistance integration. On the basis of propulsion, the market is divided into ICE vehicle, electric vehicle, and hybrid vehicle. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The ICE Vehicle segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the continued demand for internal combustion engine vehicles, especially in developing countries where the transition to electric vehicles is gradual. The strong presence of ICE vehicle production, robust infrastructure, and ongoing advancements in ICE technology also play a significant role in maintaining this segment's dominance.

The Hardware segment dominated the global market in the year 2023 and is likely to remain dominant during the Automotive Hardware-In-The-Loop Market Forecast period. This is attributed to the critical role hardware components play in HIL systems for testing, such as microcontrollers, sensors, and actuators. Hardware is essential for simulating real-world conditions, and manufacturers are increasingly investing in advanced testing hardware to ensure vehicle reliability and performance.

The Real-Time Simulation segment had the dominating Automotive Hardware-In-The-Loop Market Share in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the growing need for accurate, real-time performance testing, which enables engineers to assess vehicle behavior under dynamic conditions. Real-time simulation is crucial for ensuring rapid and precise decision-making during the design and testing phases, reducing development time and cost.

The Engine segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the increasing complexity of modern engines, requiring extensive testing to ensure optimal performance and compliance with stringent emission regulations. Engine testing remains a critical aspect of automotive development, driving demand for HIL testing solutions focused on this application.

The Powertrain HIL segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the rising focus on testing powertrain components like transmissions, drivetrains, and engines together to ensure seamless integration. Powertrain HIL testing is essential for validating energy efficiency and performance, especially as automakers explore hybrid and advanced ICE technologies.

Based on region the Asia-Pacific region dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the region's large automotive manufacturing base, particularly in countries like China, Japan, and South Korea. The increasing investment in automotive R&D, favorable government policies, and rapid technological adoption are also key drivers contributing to the region‐™s market leadership.

The automotive hardware-in-the-loop market analysis includes top companies operating in the market such as Molex Inc., Softing Automotive Electronics GmbH, Magna International Inc., Delphi Automotive PLC, Continental AG, Robert Bosch GmbH, IPG Automotive GmbH, Altech Berlin GmbH, DENSO Corporation, and Aurora Technologies GmbH. These players have adopted various strategies to increase their market penetration and strengthen their position in the Automotive Hardware-In-The-Loop Industry.

Key Takeaways

- The HIL market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literature, Automotive Hardware-In-The-Loop Industry releases, annual reports, and other such documents of major dental industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Automotive HIL Market analysis from 2023 to 2033 to identify the prevailing automotive hardware-in-the-loop market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive hardware-in-the-loop market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive hardware-in-the-loop market trends, key players, market segments, application areas, and market growth strategies.

Automotive Hardware-In-The-Loop Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1864.2 million |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Propulsion Type |

|

| By Component |

|

| By Technology |

|

| By Application |

|

| By HIL Type |

|

| By Region |

|

| Key Market Players | DSpace GmbH, PHINIA Inc. (Delphi Automotive PLC), Robert Bosch GmbH, Continental AG, Typhoon HIL, Inc., Softing Automotive Electronics GmbH, AURORA FLIGHT SCIENCES, ANSYS, Inc., IPG Automotive GmbH, Magna International Inc. |

Analyst Review

The automotive hardware-in-the-loop (HIL) market has witnessed a significant trend toward integrating advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies enhance the accuracy of simulations, enabling engineers to develop more sophisticated models for vehicle functions and sensor systems. AI and ML algorithms facilitate real-time data analysis, improving the efficiency of testing procedures and speeding up the design cycle for advanced driver-assistance systems (ADAS) and autonomous vehicles. As these technologies evolve, their application in HIL testing is expected to expand, driving automotive HIL market growth.

Moreover, collaborations between automotive manufacturers and technology providers are on the rise, further fueling the growth of the HIL market. Automakers access advanced testing solutions and expertise in HIL technology by partnering with specialized companies. These collaborations enhance innovation and enable manufacturers to streamline their testing processes, resulting in improved product quality. The trend of forming strategic partnerships is expected to continue, driving the adoption of HIL systems across the automotive industry.

For instance, in July 2023, FEV, a prominent engineering provider in the automotive sector, partnered with dSPACE, a leader in simulation and validation solutions, to enhance hardware in the loop (HIL) testing capabilities in the industry. Their cooperation agreement focuses on developing customized power hardware-in-the-loop (HIL) test benches that is projected to seamlessly integrate into existing test centers. This partnership aims to deliver tailored solutions that improve the efficiency and effectiveness of automotive testing, ensuring that manufacturers validate their systems more thoroughly and accurately in line with current industry standards. By leveraging each other's strengths, FEV and dSPACE are poised to advance testing methodologies and support the surge in demand for innovative automotive technologies.

Furthermore, continuous advancements in HIL technology propel market growth by offering more sophisticated and efficient testing solutions. Innovations such as real-time simulation, cloud-based HIL testing, and virtualization have enhanced the capabilities of HIL systems, allowing for more comprehensive and accurate testing scenarios. As these technologies evolve, they provide manufacturers with the tools needed to optimize vehicle design and performance, driving further adoption of HIL testing solutions.

The automotive hardware-in-the-loop market was valued at $738,888.9 thousand in 2023 and is estimated to reach $1,864,207.6 thousand by 2033, exhibiting a CAGR of 10.24% from 2024 to 2033.

The Automotive HIL market is product type, and region. 2024-2033 would be the forecast period in the market report.

The ICE Vehicle segment held the largest market share in 2023 and is expected to grow at the fastest rate during the forecast period. The global Automotive HIL market was valued at $738. 9 million in 2023.

The Automotive HIL market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Automotive HIL market report.

The top companies that hold the market share Molex Inc., Softing Automotive Electronics GmbH, Magna International Inc., Delphi Automotive PLC.

Loading Table Of Content...

Loading Research Methodology...