Automotive Head Up display (HUD) Market Insights, 2031

The global automotive head up display market size was valued at USD 1 billion in 2021, and is projected to reach USD 10.4 billion by 2031, growing at a CAGR of 26.7% from 2022 to 2031.The automotive head up display is a clear screen that is mounted so that the driver can maintain their line of sight while driving. The results are displayed on the projector, and it is primarily positioned on the dashboard. Currently, higher-end vehicles use the novel concept of the automotive head-up display. There is a likelihood that it will eventually be utilized in other vehicles owing to its security advantages.

The HUD in a car helps the driver concentrate more on the road by safely displaying speed, warning signals, and other important vehicle & navigational information on the windscreen in the driver's direct line of sight. In addition, the car HUD system is expected to rank among the finest safety systems if it is combined with onboard cameras and adaptive cruise control. A number of automotive HUD systems are now using cameras and GPS to locate the vehicle and project an image on the windscreen. Infrared sensors in the latest HUD systems may identify lines on the road and project their actual location on the screen.

Major growth factors for the global car head up display (HUD) market in the automotive sector include a rise in demand for high-end luxury and mid-size cars with cutting-edge safety features like head-up displays, the introduction of stricter government safety regulations, technological advancements, and an organic increase in vehicle production. Automotive head up display devices also provides the driver with access to a variety of information regarding the status of their vehicle throughout the journey. This is an excellent technique to be proactive about the health of the vehicle so that the owner can get done the necessary maintenance services on time. Furthermore, HUDs may dramatically improve the appearance of the vehicle and make night driving safer. All these are the factors projected to drive the revenue growth of the automotive head up display market share during the forecast period.

The car heads up display industry is likely to be hampered by a lack of familiarity regarding this technology among people in developing countries. Its high costs and availability as a inbuilt feature only in high-end cars are also predicted to hinder the automotive head up display market growth during the forecast period.

The automotive industry is evolving because of technological breakthroughs. In certain economy cars, features like surround-view cameras and driver assistance systems that were previously only available in luxury cars are now standard. With head-up displays (HUD), the same phenomenon is gradually taking place. The top competitors in the automotive head up display market concentrate on R&D initiatives to launch cutting-edge solutions. In addition, these players are working with automakers to introduce HUDs in the midrange car sector. For instance, on January 5, 2023, BMW announced that it will be developing a full windshield augmented reality head up display for Neue Klasse EVs when they go into production in 2025.

The key players profiled in this automotive HUD market report include Continental Valeo, 3M, Hudway, Nippon Seiki Co., Ltd., Denso, Visteon Corporation, Bosch, UniMax, and FIC Group.

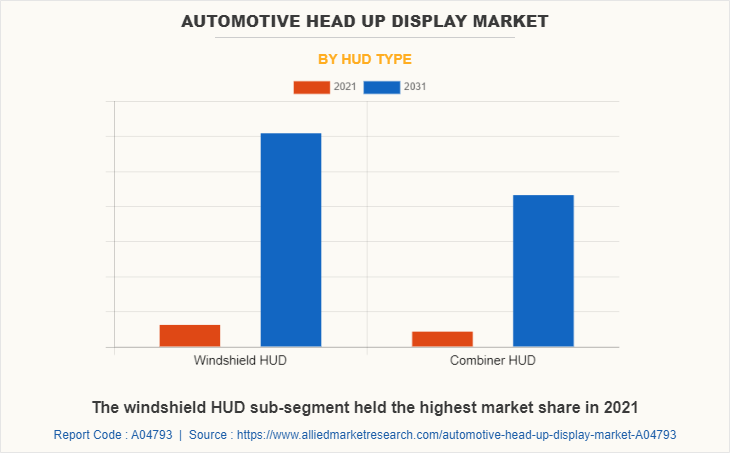

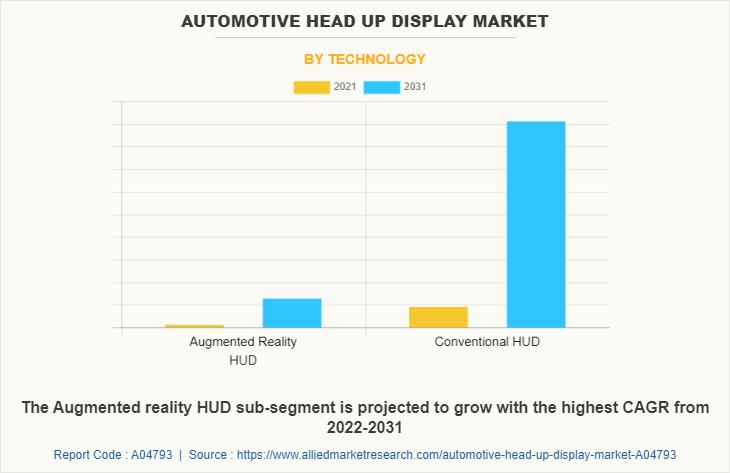

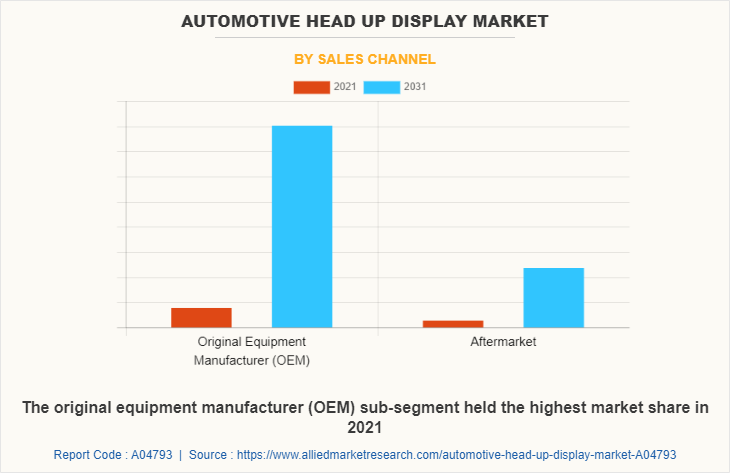

The automotive head up display market is segmented on the basis of HUD type, technology, car type, sales channel, and region. By HUD type, the market has been divided into windshield HUD and combiner HUD. By technology, the market has been divided into augmented reality HUD and conventional HUD. By car type, the market has been divided into high-end cars, mid-segment cars, and economy cars. By sales channel, the market has been divided into original equipment manufacturer (OEM) and aftermarket. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The automotive head up display market is segmented into HUD Type, Technology, Car Type and Sales Channel.

By HUD type, the windshield HUD sub-segment accounted for the largest market share in 2021. The windscreen head-up display (HUD) displays important information directly on the windshield's screen. The driver has all of the information needed while driving right in front of him. In addition, in the event of a special occurrence or a risky circumstance, the driver is notified without being distracted. These factors are expected to drive the sub-segment growth during the forecast period.

By technology, the augmented reality HUD sub-segment is anticipated to be the fastest growing during the forecast period. Head-up displays (HUDs) with augmented reality (AR) are the next step in improving the driving experience. AR HUDs can greatly improve drivers’ situational awareness by placing images in the driver's field of sight that interact with and augment real-world items. A layer of information located directly on the road in front of the car is added to the information on the windscreen HUD in the case of an augmented reality head-up display.

The High-end Cars sub-segment held the highest market share in 2021

By Car Type

By car type, the high-end cars sub-segment accounted for the largest market share in 2021. The high price of the HUD systems, the government's strict road safety rules, along with a growth in the sales of luxury automobiles, have led to an increase in the use of head-up displays (HUD) in high-end cars. This display is considered as a driver and passenger safety system as it displays all the essential information for the driver while driving.

By sales channel, the original equipment manufacturer (OEM) sub-segment accounted for the largest automotive head up display market share in 2021. Original equipment manufacturers (OEMs) can install automotive HUDs into vehicles during vehicle production. Each OEM's HUD varies by dimension type, technology, vehicle, and other factors. All major automakers are developing HUD displays to represent the next generation of automotive infotainment.

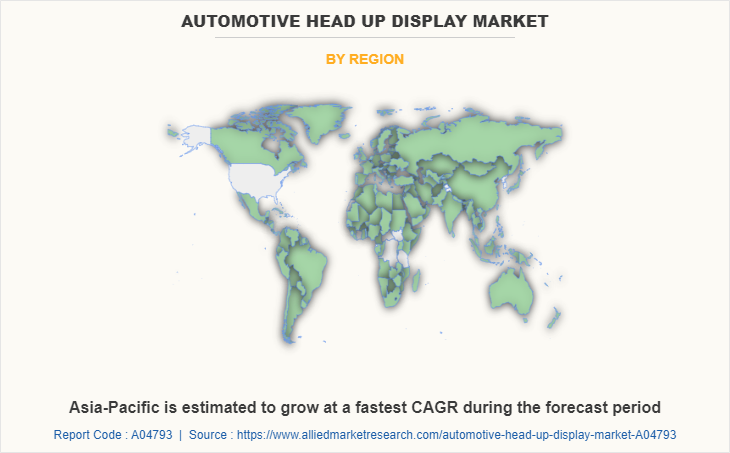

By region, Asia-Pacific is projected to be the fastest growing during the forecast period. The Asia-Pacific automotive industry is undergoing significant digital transformation owing to technological advancements. Furthermore, the region has the largest car sales in the globe due to a large consumer base and rising per capita disposable income. These factors are projected to boost demand for automotive head-up displays in Asia-Pacific and drive the market revenue growth during the forecast period.

Impact of COVID-19 on Global Automotive Head Up Display Industry

- The COVID-19 pandemic negatively impacted the automotive head up display market as several OEMs had to delay or cease production due to manpower shortages, high raw material prices, and supply chain disruption

- Lower sales of vehicles during the pandemic time resulted in the decline in demand for HUDs

- In the post-pandemic period, as the economy began to recover, demand for cars and their production has raised in important countries such as the U.S., China, India, and others

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive head up display market analysis from 2021 to 2031 to identify the prevailing automotive head up display market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive head up display market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global automotive head up display market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the automotive head up display market players.

- The report includes the analysis of the regional as well as global automotive head up display market trends, key players, market segments, application areas, and market growth strategies.

Automotive Head Up display Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 10.4 billion |

| Growth Rate | CAGR of 26.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By HUD Type |

|

| By Technology |

|

| By Car Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | HUDWAY, LLC, UniMax Electronics Inc., FIC Group, Visteon Corporation, Nippon Seiki Co., Ltd., Continental AG, MicroVision, Panasonic Holdings Corporation, DENSO CORPORATION, Valeo |

Analyst Review

Some of the primary factors driving the growth of the automotive head up display market during the forecast period include increasing demand for vehicles with improved safety features, rising awareness about road safety among drivers, and a growing need for a better in-car experience. Automotive head-up displays improve in-car experience and road safety by presenting drivers with essential information such as lane change warnings, maps, ADAS information, traffic warning, speed limit, pedestrian alerts, and others. The high cost of vehicle head-up displays, along with a lack of technological understanding in developing countries, is projected to hinder the market expansion during the forecast period. As the automotive head-up display is a new technology, there is less awareness among the population in many regions. The increase in the use of automotive head-up displays in high-end vehicles is likely to provide attractive prospects for major stakeholders.

Among the analyzed regions, Europe dominated the global market in 2021 and Asia-Pacific is anticipated to witness the fastest growth during the forecast years. Ongoing R&D in head-up display technology, the presence of major manufacturers, and significant sales of premium cars are the key factors responsible for the leading position of Europe and Asia-Pacific in the global automotive head up display market.

The global automotive head up display market size was valued at USD 1 billion in 2021, and is projected to reach USD 10.4 billion by 2031,

The global automotive head up display market is projected to grow at a compound annual growth rate of 26.7% from 2022 to 2031.

Asia-Pacific and drive the market revenue growth during the forecast period.

Increasing demand for automobiles with improved safety features, rising awareness about road safety among drivers, and growing need for a better in-car experience are some of the primary factors driving the growth of the automotive head up display market during the forecast period. The increase in the deployment of automotive head-up displays in high-end vehicles is likely to provide attractive prospects for major stakeholders.

The key players that operate in the automotive head up display market such as DENSO CORPORATION, UniMax Electronics Inc., Visteon Corporation, MicroVision, HUDWAY, LLC, Valeo, FIC Group, Continental AG, Panasonic Holdings Corporation, Nippon Seiki Co., Ltd.

Loading Table Of Content...