Automotive Horn System Market Research, 2033

The global automotive horn system market size was valued at $0.7 billion in 2023, and is projected to reach $1.8 billion by 2033, growing at a CAGR of 9.9% from 2024 to 2033.

Market Introduction and Definition

Automotive horn systems are crucial components of vehicles, designed primarily for safety and communication on the road. These systems consist of an electromechanical device that produces a loud, sharp sound to alert other road users and pedestrians to the vehicle's presence, especially in emergency situations. Modern automotive horn systems typically include a horn switch, relay, and the horn unit itself. When the driver presses the horn switch, an electrical circuit is completed, activating the relay, and allowing current to flow to the horn. This current energizes an electromagnet within the horn unit, causing a diaphragm to vibrate rapidly and produce sound waves.

The intensity and frequency of the sound are engineered to penetrate through ambient noise effectively. Automotive horn system market are of several types, such as electric horns, air horns, and electromagnetic horns, each offering different sound characteristics and power levels. They are strategically placed in vehicles to maximize sound dispersion while ensuring compliance with regulatory standards regarding noise levels. Beyond their functional role, horns are integral to driving etiquette, enabling drivers to signal intentions or express warnings promptly. Overall, automotive horn system industry enhance road safety by facilitating immediate and clear communication between drivers and other road users.

Key Takeaways

The automotive horn system market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period of 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major automotive horn systems industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In May 2024, Uno Minda, a prominent player in the automotive components industry, launched Clarton’s premium C80 trumpet horn to the Indian aftermarket. The C80 trumpet horn is renowned for its superior sound quality, robust build, and reliable performance. Clarton, a reputable European horn manufacturer, has engineered the C80 model to deliver a loud, clear, and distinctive tone that ensures effective communication and safety on the road.

Key Market Dynamics

The rise in global vehicle production and sales is a significantly boosts the demand for automotive horn system market growth. As more vehicles are manufactured and sold worldwide, the need for essential components like horn systems increases proportionally. Automotive horns are critical for safety, enabling drivers to alert others on the road and prevent accidents. With the growing automotive industry, particularly in emerging markets, the demand for reliable and effective horn systems continues to rise. This trend is further supported by the increasing consumer awareness of road safety and stringent government regulations mandating the use of functional horn systems in all vehicles. As a result, the automotive horn systems market experiences substantial growth driven by the expanding vehicle production and sales globally. Furthermore, rise in awareness of road safety, and growth in aftermarket sales have driven the demand for the automotive horn system market size. However, the high cost of advanced horn systems has hampered the growth of the automotive horn system market trends. Advanced horn systems, such as digital and multi-tone horns, offer superior performance and additional features compared to traditional horns. These benefits come with higher manufacturing and development costs, leading to increased prices for consumers. Moreover, competition from low-cost manufacture, and stringent noise regulation are major factors that hamper the growth of the automotive horn system market forecast. On the contrary, the integration of horn systems with Advanced Driver Assistance Systems (ADAS) and other advanced vehicle technologies presents significant opportunities for developing smarter, more efficient horn solutions that enhance overall vehicle safety. By incorporating horn systems into the ADAS framework, vehicles can leverage sensor data and real-time analytics to trigger horns automatically in critical situations, such as imminent collisions or pedestrian crossings. This integration ensures timely alerts, reducing reaction times and potentially preventing accidents.

Vehicle Production and Sales Statistics for the Automotive horn systems Market

In 2023, the global automotive industry witnessed robust vehicle production and sales figures. With approximately 85 million vehicles manufactured worldwide, including passenger cars, light commercial vehicles, and heavy-duty vehicles, the demand for essential components like horn systems saw a significant uptick. Similarly, global vehicle sales reached around 82 million units, indicating a steady demand for automobiles across various markets. Key regions such as China, the U.S., and Europe remained pivotal contributors to both production and sales figures. China, the largest vehicle producer, manufactured over 25 million units, while the U.S. and Europe collectively contributed around 28 million vehicles.

This sustained momentum in vehicle production and sales underscores the growing need for automotive horn systems, emphasizing the market's potential for growth and expansion. As vehicle manufacturers continue to prioritize safety features and regulatory compliance, the demand for reliable and efficient horn systems is expected to remain strong in the coming years, driven by the steady growth of the automotive industry globally.

Market Segmentation

The automotive horn systems market is segmented into product type, vehicle type, horn shape, sales channel, and region. On the basis of product type, the market is classified into air horn, and electric horn. On the basis of vehicle type, the market is divided into passenger cars, and commercial vehicles. As per the horn shape, the market is categorized into flat, spiral, and trumpet. On the basis of sales channel, the market is bifurcated into OEM and aftermarket. By Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America has a large and mature automotive horn system industry with established manufacturers and a significant consumer base. The high standard of living in North America, particularly in countries like the United States and Canada, results in a higher demand for vehicles equipped with advanced safety features, including reliable horn systems. In addition, stringent safety regulations in North America mandate the use of functional horn systems in all vehicles, further driving market growth. These regulations not only ensure compliance but also encourage innovation among manufacturers to develop more efficient and effective horn systems to meet safety standards.

North America's robust aftermarket automotive industry contributes to the region's dominance in the horn system market. With many vehicles on the road, there is a continuous demand for replacement and upgraded parts, including horn systems.

The Asia-Pacific region is experiencing rapid economic development and urbanization, leading to a significant increase in vehicle ownership rates. As more people in countries like China, India, and Southeast Asian nations enter the middle class, there is a surge in demand for automobiles, including passenger cars, commercial vehicles, and two-wheelers, thereby driving the demand for automotive horn systems. In addition, the Asia-Pacific region has emerged as a manufacturing hub for the global automotive industry. Many international automotive manufacturers have established production facilities in countries like China, India, and Thailand to cater to both domestic and export markets. This substantial increase in vehicle production contributes directly to the demand for automotive horn systems.

In May 2024, Uno Minda, a prominent player in the automotive components industry, launched Clarton’s premium C80 trumpet horn to the Indian aftermarket. The C80 trumpet horn is renowned for its superior sound quality, robust build, and reliable performance. Clarton, a reputable European horn manufacturer, has engineered the C80 model to deliver a loud, clear, and distinctive tone that ensures effective communication and safety on the road.

In August 2022, Grupo Antolin has won the prestigious Plastics Recycling Award Europe 2022 in the Automotive, Electrical or Electronic Product of the Year category for its innovative sustainable modular headliner, produced from urban and post-consumer plastic waste and end-of-life tires. This eco-friendly headliner, now used in the Volvo C40 Recharge electric SUV, showcases reduced waste and energy consumption during manufacturing. The project, a collaborative effort with Tier 2 suppliers, aligns with the growing consumer demand for sustainable vehicle interiors.?

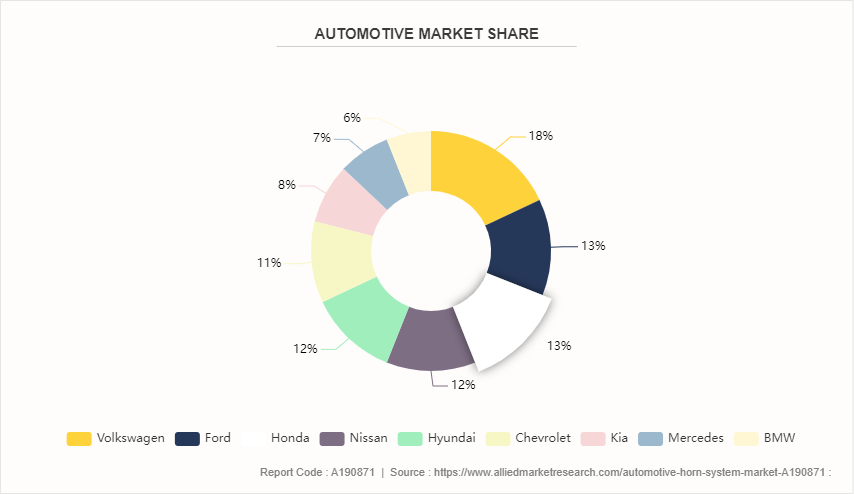

Competitive Landscape

The report analyzes the profiles of key players operating in the automotive horn systems market such as Denso Corporation, Fiamm Componenti Accessori - FCA, Hella GmbH & Co. KGaA, Horns Unlimited, Klaxon Signals Ltd., Minda Industries Ltd., Mitsuba Corporation, Robert Bosch GmbH, Sanfeng Auto Parts Co., Ltd., and UNO Minda Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive horn systems market.

Industry Trends

In December 2022, Valeo Service India launched the PIAA Horn under the co-branding name of PIAA Valeo Horn Set in the electronic and accessories segment. Leveraging their extensive dealer network, the product has reached even the remotest parts of the country and has received a positive response at the ground level due to its high quality and distinct sound. This launch marks Valeo's entry into the electronic and accessories business segment, and it is expected to pave the way for the introduction of additional related PIAA products in the future.

In November 2022, Bosch launched a digital horn, marking a significant innovation in automotive horn technology. Unlike traditional electromechanical horns, Bosch's digital horn leverages advanced electronics to produce sound. This technology offers precise control over the sound characteristics, including tone, volume, and pattern, ensuring a consistent and reliable performance. The digital horn is designed to be more durable and less susceptible to wear and tear since it has fewer mechanical components.

In August 2022, Automotive component supplier Steelbird International partnered with German brand Hella to introduce Hella's range of horns and spark plugs to the Indian market, which will be marketed and distributed by Steelbird. This collaboration signifies Steelbird's expansion in the automotive component sector, following their recent ventures into selling tires, lubricants, bearings, and other products. Steelbird, which already retails safety equipment for two-wheelers.

In June 2021, Maruko Keihoki, as a longstanding technological partner of Japanese carmakers, has played a pivotal role in advancing eco-friendly vehicles. Specializing in compact, lightweight, and cost-effective parts, the company has developed specialized electric car horns that adhere to diverse market regulations regarding size, shape, and performance. With the automotive industry shifting towards electric vehicles (EVs) , Maruko Keihoki recognizes the pivotal role of horn technology in expediting the production of safe, affordable, and sustainable EVs. Leveraging their expertise in electric horn systems, the company aims to contribute to the ongoing evolution of the automotive industry towards a greener and more environmentally conscious future.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the automotive horn systems market segments, current trends, estimations, and dynamics of the automotive horn systems market analysis from 2022 to 2032 to identify the prevailing automotive horn system market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive horn systems market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global automotive horn systems market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional and global automotive horn systems market trends, key players, market segments, application areas, and market growth strategies.

Automotive Horn System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.8 Billion |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 485 |

| By Product Type |

|

| By Vehicle Type |

|

| By Horn Shape |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Minda Industries Ltd., Robert Bosch GmbH, Horns Unlimited, Fiamm Componenti Accessori - FCA, HELLA GmbH & Co. KGaA, Sanfeng Auto Parts Co., Ltd., Klaxon Signals Ltd., UNO Minda Group, Mitsuba Corporation, DENSO CORPORATION |

Upcoming trends in the global automotive horn system market include the adoption of advanced electronic horns for enhanced durability and sound quality, integration of multi-tone and customizable horns, increasing use of lightweight and compact horn designs, and a growing focus on eco-friendly and energy-efficient horn systems. Additionally, advancements in vehicle safety standards and the rise of electric vehicles are driving innovations in automotive horn technologies.

The leading application of the automotive horn system market is in passenger vehicles, where horns are essential for safety, communication, and alerting purposes.

North America is the largest regional market for automotive horn system

$1.8 billion is the estimated industry size of automotive horn system

Adient, Atlas Roofing Corporation, Grupo Antolin, Harodite Industries, Howa-Tramico, International Automotive Components, Group LLC, Industrialesud GmbH, Lear Corporation, Motus Integrated Technologies, and Sage Automotive Interiors are the top companies to hold the market share in automotive horn system

Loading Table Of Content...