Automotive Leasing Market Research, 2033

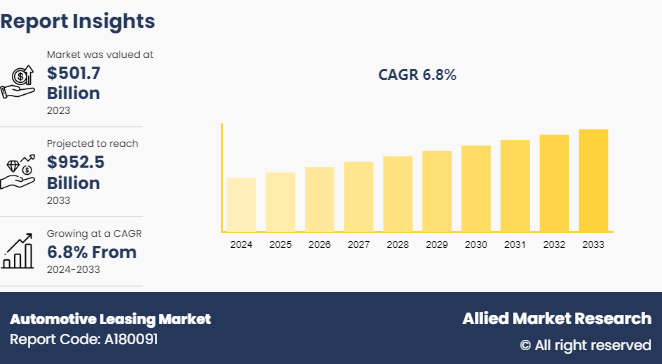

The global automotive leasing market size was valued at $501.7 billion in 2023, and is projected to reach $952.5 billion by 2033, growing at a CAGR of 6.8% from 2024 to 2033.

Market Introduction and Definition

The automotive leasing market includes businesses that provide automotive equipment renting or leasing services, catering to the needs of individuals and organizations seeking access to vehicles without the commitment of ownership. These businesses can be partnerships, sole proprietors, and organizations that run retail outlets with dedicated sections for hiring cars, trucks/vans, recreational vehicles (RVs) , utility trailers without drivers, and others. Customers are able to choose either long-term lease or short-term rental depending on their preferences and requirements.

Furthermore, auto leasing is a sales approach that is becoming common among consumers and businesses. They comprise of low initial costs, wide choice of vehicles, minimized costs of maintenance and repair as well as the possibility to exchange them for new models at the end of a lease period. Besides, car leasing enhances job flexibility in businesses by providing access to a range of vehicles suited for company’s functional needs. In this way, companies adjust themselves rapidly according to changing demand while avoiding the financial burden attributed to car ownership.

Key Findings

The automotive leasing market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major auto leasing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In October 2023, Enterprise Holdings, one of the largest private companies in St. Louis, introduced its new corporate brand name, Enterprise Mobility. Despite this change, the company's individual brands, such as Enterprise Rent-A-Car, are to remain unchanged.

In November 2023, ALD S.A. finalized its acquisition of LeasePlan, a prominent fleet management and mobility company, from a consortium led by TDR Capital, for approximately $5.2 billion (€4.8 billion) . The acquisition was completed through a mix of cash and ALD shares. This significant transaction marks a pivotal moment, propelling the combined entity to the forefront of the global sustainable mobility sector, boasting a total fleet of 3.3 million vehicles managed across the globe.

Key Market Dynamics

The global automotive leasing industry is growing due to several factors such as rise in preference for vehicle usership over ownership, attractive leasing options and flexible terms and cost-effectiveness and tax benefits. However, limited understanding of leasing terms and conditions and restrictions on vehicle customization and modifications hinder the market growth. In addition, expansion of online leasing platforms and digital services and rise in demand for subscription-based mobility solutions are expected to provide ample opportunities for the market development during the forecast period.

Rise in demand for leased cars, especially among urban dwellers and businesses is one of the major drivers of the automotive leasing industry. These days consumer’s mindset has changed a lot, especially in urban areas where ownership is being replaced by usership. This tendency toward usership is influenced by several factors including changing taste for lifestyle, environmental concern and need for flexibility as well as convenience. The increasing shift towards electric vehicles is contributing significantly to the expansion of the automotive leasing market size.

Urban consumers have sought alternative mobility solutions due to the challenges associated with owning personal vehicles such as high maintenance costs, parking difficulties and traffic congestion. Therefore, auto leasing becomes a viable option that enables individuals to enjoy having transport facilities without any long-term financial commitments and obligations that come along with outright ownership.

Furthermore, the popularity of sharing economies and on-demand services has also increased the preference for using rather than owning assets. Particularly among young people, such as millennials and Generation Z, who are more interested in experiencing things than possessing them, they would rather spend money on paying for service provision or experience acquisition. This shift in preference highlights a growing trend towards valuing experiences over material possessions. According to the automotive leasing market forecast, the industry is expected to experience substantial growth in the coming years due to increasing consumer preference for leasing over purchasing vehicles.

More businesses in the sector are discovering the benefits of leasing vehicles for their corporate fleets. Leasing assists companies to better manage cash flow, reduce initial capital expenses, and take advantage of potential tax advantages. Furthermore, it gives organizations an opportunity to benefit from the latest vehicle models and technologies without having to retain ownership thus enabling them fitting changing operational requirements or technological advancements.

These leasing programs often provide advantages such as reduced monthly payments, warranties, and maintenance packages, which make the experience of leasing more appealing and convenient. As urban populations expand and interest in convenient, cost-effective, and environmentally sustainable mobility solutions grows, the auto leasing industry stands to benefit by aligning its offerings with these evolving consumer preferences.

Market Segmentation

The automotive leasing market is segmented into service type, mode, end user, and region. By service type, it segregated passenger car rental, passenger car leasing, and truck, utility trailer, and recreational vehicle rental and leasing. By mode, it is divided into online and offline. By end user, it is divided into industrial divisions and corporate divisions. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The North America region, comprising the U.S. and Canada is a well-established market for auto lease. Strong financial institutions, captive leasing divisions of major manufacturers, and a well-developed automobile rental infrastructure contribute to the automotive leasing market growth in the region. Consumers in North America have a preference for frequently upgrading to newer vehicles, which aligns perfectly with the leasing model.

The automotive leasing industry in Europe is strong and varied. The availability of premium and luxury car brands is a major factor driving this market. These brands often promote leasing as an attractive way for customers to enjoy driving their cars. Furthermore, environmental regulations and incentives for leasing fuel-efficient vehicles have played a pivotal role in shaping the market growth. Corporate fleet leasing for businesses and rental car companies is another significant driver in the Europe automotive leasing market.

Asia-Pacific is home to a fast-growing automotive leasing market led by countries such as China, Japan and India. Rise in middle-class populations and increase in disposable incomes are two main factors driving the demand for personal mobility solutions in the region.

In addition, major Indian auto maker, Maruti Suzuki collaborated with leasing company to further expand its presence in the auto leasing industry. For instance, in February 2023, Maruti Suzuki India announced a partnership with SMAS Auto Leasing India Pvt. Ltd. to bolster its vehicle subscription program. SMAS became the fifth partner to offer a selection of Maruti Suzuki vehicles on white plate subscription, where the vehicle is registered under the user's name and hypothecated to the subscription partner. This expanded service is accessible in cities such as Delhi, Gurugram, Noida, Mumbai, Pune, Bengaluru, Hyderabad, and Chennai.

In November 2023, Mercedes-Benz Mobility launched a fully digital contract signing process for leasing. With this new online leasing system, customers can now handle every aspect of the leasing process independently, without being restricted by service hours. Private customers in Germany can now complete a legally binding leasing contract entirely online through the national subsidiary. Selecting the financing option and finalizing the leasing contract are seamlessly integrated into the Mercedes-Benz online purchasing process. However, if customers have any questions or require assistance, they can still receive personal support through the Mercedes-Benz Customer Contact Center.

In February 2022, XPeng Inc., a prominent Chinese smart electric vehicle (Smart EV) company, revealed that its subsidiary, Guangzhou Xiaopeng Automotive Financial Leasing Co., Ltd., completed the issuance of RMB775 million ($122 million) debut automobile leasing asset-backed securities (ABS) .

Competitive Landscape

The major players operating in the automotive leasing market include Enterprise Holdings, The Hertz Corporation, Avis Budget, GM Financial, Arval, Avis Budget, ALD S.A., Volkswagen Financial Services AG, BMW Group Financial Services, and Mercedes-Benz Financial Services. Other players in automotive leasing market includes Toyota Financial Services, Honda Canada Finance Inc., and others. The growing trend towards eco-friendly vehicles presents a major automotive leasing market opportunity for industry players. Competitive pricing and enhanced service offerings are helping companies boost their automotive leasing market share.

Industry Trends:

In December 2023, France launched a program to make electric vehicles more accessible to low-income individuals. Through a "social leasing" initiative, eligible drivers are capable of now leasing electric cars for approximately as little as $43.60 (€40) per month. Initiated by President Emmanuel Macron, this endeavor seeks to broaden EV accessibility and affordability. Qualified participants, with an annual income not exceedingly approximately $16, 786 (€15, 400) , can benefit from a government-supported lease without any upfront payment, thus making electric vehicle ownership a viable option for those with limited financial resources.

In February 2024, Arval, a prominent vehicle leasing company and an expert in mobility solutions, signed Memorandum of Understanding (MoU) with BYD, a global frontrunner in electric vehicle manufacturing. With the aim of facilitating the transition of its clients' fleets to electric vehicles, Arval integrated BYD vehicles into its leasing portfolio for both corporate and private clients. Beyond the MoU, following previous partnership announcements in Brazil, Arval extended its collaboration with BYD by becoming its leasing partner under a white-label arrangement in Italy, Spain, and Germany.

Key Sources Referred

International Auto Leasing Association (IALA)

National Vehicle Leasing Association (NVLA)

Automotive Leasing Guide (ALG)

Motor Vehicle Leasing Association (MVLA)

Automotive Fleet & Leasing Association (AFLA)

Lease Accounting Software Providers Association (LASPA)

National Independent Automobile Dealers Association (NIADA)

Association of Consumer Vehicle Lessors (ACVL)

International Organization of Motor Vehicle Manufacturers (OICA)

Automotive Lease Guide (ALG)

National Association of Fleet Administrators (NAFA)

Automotive Fleet Leasing Association (AFLA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the automotive leasing market analysis from 2024 to 2033 to identify the prevailing automotive leasing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the automotive leasing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global automotive leasing market trends, key players, market segments, application areas, and market growth strategies.

Automotive Leasing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 952.5 Billion |

| Growth Rate | CAGR of 6.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Service Type |

|

| By Mode |

|

| By End User |

|

| By Region |

|

| Key Market Players | The Hertz Corporation, Europcar Mobility Group, Mercedes-Benz Financial Services, Avis Budget, Volkswagen Financial Services AG, Arval, Enterprise Holdings, BMW Group Financial Services, LeasePlan Corporation N.V., ALD Automotive |

The major players operating in the auto leasing market include Enterprise Holdings, The Hertz Corporation, Avis Budget, GM Financial, Arval, Avis Budget, ALD S.A., Volkswagen Financial Services AG, BMW Group Financial Services, and Mercedes-Benz Financial Services.

The global automotive leasing market was valued at $501.7 billion in 2023, and is projected to reach $952.5 Billion by 2033, growing at a CAGR of 6.8% from 2024 to 2033.

Europe is the largest regional market for Automotive Leasing

Corporate divisions is the leading application of Automotive Leasing Market

Expansion of online leasing platforms and digital services and increasing demand for subscription-based mobility solutions are the upcoming trends of Automotive Leasing Market in the globe

Loading Table Of Content...