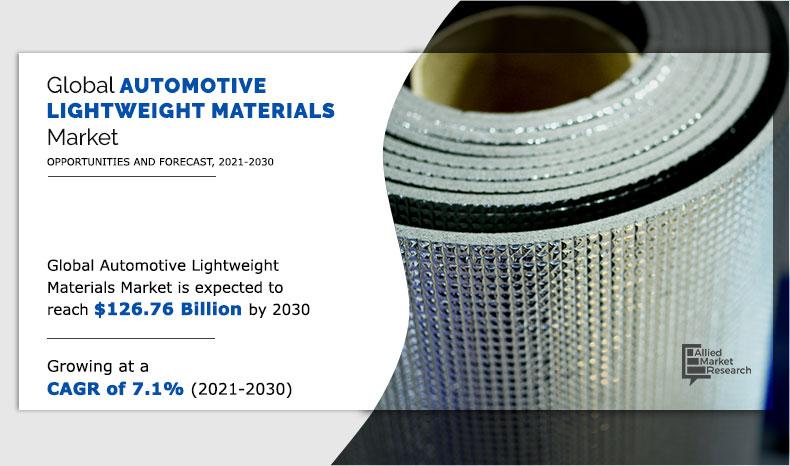

Automotive Lightweight Materials Market Statistics 2021-2030:

The global automotive lightweight material market was valued at $71.65 billion in 2020, and is projected to reach $126.76 billion by 2030, registering a CAGR of 7.1%. Europe was the highest revenue contributor, accounting for $26.15 billion in 2020, and is estimated to reach $50.45 billion by 2030, with a CAGR of 8.0%. Europe and North America collectively accounted for around 64.2% share in 2020, with the former constituting around 36.5% share.

Automotive lightweight material refers to materials that exhibit high strength-to-weight ratio, superior corrosion resistance properties, and substantial design flexibility, thereby finding its application in automotive system and components. In the recent years, requirement for weight minimization & higher fuel efficiency, adhering to environmental regulations, and changing consumer sentiments toward mobility solutions as consumers demand for high-strength materials to attain the high-end operational performance are the major factors anticipated to influence automakers to focus on redesigning of materials. Plastics, polymer composites, steel, magnesium, and aluminum have been used by automotive manufacturers to cater the changing needs of the automotive industry. Composites are gaining traction due to their wide range of applications in automotive development with improved safety and strength.

Factors such as stringent regulations for fuel economy and automotive emission, need for improved safety, and enhanced performance of vehicle are expected to drive the growth of the automotive lightweight materials market. However, high cost of materials and decrease in production and sale of automotive restrain the market growth. On the contrary, entering into agreements and contracts with automotive OEM and increase in trend of vehicle electrification are projected to offer lucrative growth opportunities for the market players.

The global automotive lightweight materials market is segmented into vehicle type, material type, component, and region. Depending on vehicle type, the market is segregated into IC engine powered, electric powered, and others. By material type, it is categorized into metals, composites, plastics, and elastomer. Depending on component, it is fragmented into frame, powertrain, interior systems & components, and exterior systems & components. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Vehicle Type

Electric Powered segment is projected as the most lucrative segments

Leading players and their key business strategies have been analyzed in the report to gain a competitive insight into the market. Key players covered in the automotive lightweight materials market report include Alcoa Corporation, ArcelorMittal, BASF SE, Covestro AG, Hindalco Industries Limited, Lyondellbasell Industries N.V., Owens Corning, Stratasys Ltd., Thyssenkrupp AG, and Toray Industries Inc.

Surge in need for improved safety and enhanced performance of vehicle

Lightweight materials are having characteristics of low weight at a significant level along with high strength as compared to traditional materials, which are crucial factors in the vehicle manufacturing process.

By Material Type

Composites segment is projected as the most lucrative segments

Furthermore, in the current era of advanced mobility solutions, several high-end technology-enabled devices to meet the changing needs of automotive consumers. Systems such as safety devices, advanced emission control systems, and integrated electronic systems uses lightweight materials to improve the operational efficiency along with reduction in overall weight of the vehicles. Thus, use of lightweight materials in the automotive is expected to meet the improved strength and high-end operational efficiency, which, in turn, contributes toward the growth of the global automotive lightweight materials market.

High cost of materials

Increase in need for high-strength and fuel-efficient materials is boosting automotive development, owing to changing automotive design requirements, increasing adoption of connected technologies, and changing mobility outlook across the globe. To attain these changing requirements of automotive manufacturers, composites and carbon fibers are gaining traction in recent years. However, materials such as titanium, magnesium, and carbon fiber-reinforced composites are associated with high cost, which is expected to impact the overall costing of the vehicle. For instance, the pricing of 1 kg of carbon fiber-reinforced polymers for automotive-grade can go up to around 39 times more than normal steel, whereas the price of titanium can go up to around 9 times more than normal steel. Moreover, glass fiber-reinforced plastics cost approximately 4 times expensive than normal steel. Therefore, the use of these materials is merely limited to high-end and luxury vehicles by considering the overall costing. Moreover, the use of cost-effective materials such as aluminum, fiber composites, and magnesium expected to increase considerably. This is attributed to the fact that in majority of the cost-sensitive economies across the globe are highly dependent more on economy passenger cars, which, in turn is likely to boost the demand for conventional materials as compared lightweight materials. Thus, high cost of lightweight materials is projected to hamper the global automotive lightweight materials market growth.

By Component

Exterior systems and components segment is projected as the most lucrative segments

Entering into agreements and contracts with Automotive OEM

Automotive lightweight materials are widely and majorly demanded by automotive manufacturers and component manufacturers for automotive production activities. This material procurement witnesses open contracts and agreements between automotive OEMs and manufacturers of automotive lightweight materials. The commencement of the automotive lightweight materials solution is expected to be carried out through contracts and agreements between end users and developers of automotive lightweight materials. These contracts mention a set of requirements that must be to be met in a certain timeframe. These contracts and agreements are associated with long-term business opportunities with end users. Market participants need to focus on winning the contracts and agreements to gain a competitive advantage and retain long-term business opportunities in the global automotive lightweight materials market.

COVID-19 impact analysis

The spread of the COVID-19 pandemic has negatively impacted the global automotive lightweight materials market, owing to commute restrictions, and is expected to weaken the financial performance of the market players in 2020. It has impacted the overall economy, and contributors such as market participants are formulating strategic cost-saving plans. The major risk factors of the automotive lightweight materials market participants are supply chain execution, regulatory & policy changes, dependency on labor, working capital management, and liquidity & solvency management. Majority of the manufacturing facilities of Automotive lightweight materials has been shut down during the pandemic due to commute restrictions, workforce unavailability, and short supply of raw material due to supply chain disturbance.

By Region

Europe would exhibit the highest CAGR of 8.0% during 2021-2030.

Key Benefits For Stakeholders

- This study presents the analytical depiction of the global automotive lightweight materials market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall automotive lightweight materials market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the market with a detailed impact analysis.

- The current market is quantitatively analyzed from 2021 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Key Market Segments

By Vehicle Type

- IC Engine Powered

- Electric Powered

- Others

By Material Type

- Metals

- Composites

- Plastics

- Elastomer

By Component

- Frame

- Powertrain

- Interior Systems & Components

- Exterior Systems & Components

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- LATAM

- Latin America

- Middle East

- Africa

Key Players

- Alcoa Corporation

- ArcelorMittal

- BASF SE

- Covestro AG

- Hindalco Industries Limited

- Lyondellbasell Industries N.V.

- Owens Corning

- Stratasys Ltd.

- Thyssenkrupp AG

- Toray Industries Inc.

Automotive Lightweight Materials Market Report Highlights

| Aspects | Details |

| By VEHICLE TYPE |

|

| By MATERIAL TYPE |

|

| By COMPONENT |

|

| By Region |

|

| Key Market Players | STRATASYS LTD., HINDALCO INDUSTRIES LIMITED, OWENS CORNING, Covestro AG, ALCOA CORPORATION, LyondellBasell Industries N.V., BASF SE, THYSSENKRUPP AG, ARCELORMITTAL, TORAY INDUSTRIES, INC. |

Analyst Review

The global automotive lightweight materials market is expected to witness significant growth, owing to adoption of automotive lightweight materials in the modern automotive to meet the design requirements and reduction in weight at considerable level to improve the fuel economy. Automotive lightweight materials are gaining high traction in the current era, owing to their operational capability along with cost-effectiveness.

Europe is a leader in the automotive lightweight materials market, owing to the presence of several automotive manufacturers and consistent changes in automotive industry outlook. The global automotive lightweight materials market is a fairly fragmented market in which several market participants are operating in the global market.

Market participants are focused to develop their sales footprints by entering into long-term contracts and agreements with the automotive OEMs and introduce new product lines of automotive lightweight materials to cope up with changing requirement of the end users. Numerous developments have been carried out by top companies, such as Alcoa Corporation, ArcelorMittal, BASF SE, Hindalco Industries Limited, Lyondellbasell industries N.V., and Stratasys Ltd., which have supplemented the growth of the global automotive lightweight materials market. Product development, product launch, and business expansion are the key strategies adopted by the market participants to gain competitive advantage. The impacts of COVID-19 significantly affected the global automotive lightweight materials market in 2020. Furthermore, the market witnessed negative growth or significant downfall in 2020. However, this situation is expected to improve as government has started relaxing norms around the world for resuming business activities.

The global automotive lightweight materials market was valued at $71.65 billion in 2020, and is projected to reach $126.76 billion by 2030, registering a CAGR of 9.4%.

The increased demand for composite based solution owing to its improved starength along with lighweight characteristics

The report sample for global Automotive Lightweight Materials market report can be obtained on demand from the website.

Product Launch product development, and expansion are the top most competitive developments which are adopted by the leading market players in the global Automotive Lightweight Materials market

Automotive component manufacturers and automakers are the key consumers of the automotive lightweight materials

The company profiles of the top players of the market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the industry along with their last three-year revenue, segmental revenue, product offerings, key strategies adopted, and geographical revenue generated

Based on the Automotive Lightweight Materials market analysis, Europe region accounted for the highest revenue contribution in 2020 and is expected to see lucrative business opportunities during the forecast period

COVID-19 health crisis has impacted the market significatly in 2020 owing to supply chain disruption and slow downautomotive production activities

The U.S. and Germany are key matured markets growing in the global Automotive Lightweight Materials market

BASF SE, ThyssenKrupp AG, ArcelorMittal, Covestro AG among others are the top companies hold the market share in automotive lightweight materials

Loading Table Of Content...